Minieye's Stock Rockets 15% on Lock-up Expiry, Zhejiang Shibao Hits Record Peak!

![]() 12/30 2025

12/30 2025

![]() 552

552

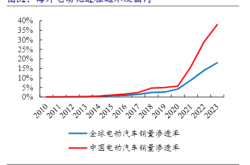

On December 29 (Beijing time), Zhejiang Shibao, a rising star in the intelligent driving sector, continued its upward trajectory, surging by 4.03% to close at a record high of 24.28 yuan.

Buoyed by the persistent rally in A-shares, Zhejiang Shibao's H-shares also posted a robust 12.70% gain today. After all, during the two-and-a-half-day Christmas break when the Hong Kong stock market was closed, Zhejiang Shibao's A-shares had achieved two-and-a-half consecutive daily limit-ups.

However, the biggest winner among H-share intelligent driving-related stocks today was not Zhejiang Shibao's H-shares, but Minieye, whose lock-up period expired today, leading to a 15.45% surge!

Surprised? Baffled? Contrary to the common expectation of a price drop upon lock-up expiry, Minieye's stock soared. Other stocks that experienced significant gains include UFACTORY, whose lock-up period ended two days ago, and UBTECH, which announced a 1.7 billion yuan acquisition of a controlling stake in A-share listed company Fenglong Shares.

Let's first examine Zhejiang Shibao's performance today.

It opened at 23 yuan, down 1.46%. After a brief spike, it quickly retreated and oscillated downward, reaching a maximum drop of over 6%. Just before the morning session closed, it staged a sudden rally, turning positive shortly after the afternoon session opened. It then oscillated upward and surged again before the close, reaching a high of 24.35 yuan and breaking its all-time high. It closed at 24.28 yuan, nearly at the day's peak, with a market capitalization approaching 20 billion yuan.

Since the implementation of the L3 policy on December 15, Zhejiang Shibao's A-shares have skyrocketed by 103.18%.

In contrast, Zhejiang Shibao's H-shares have performed far less impressively, with an interval gain of only 36.48%.

However, the Hong Kong stock market, which lacks price limits, operates on its own set of principles.

Today's standout performer in the Hong Kong stock market was Minieye, whose lock-up period expired. It opened 2% higher in the pre-market auction, then continued to climb, reaching an intraday gain of over 18%, and finally closed up 15.45%. Its full-day turnover rate was 5.56%, with a trading volume of 259 million Hong Kong dollars and a closing market capitalization of 6.067 billion Hong Kong dollars.

This performance on the lock-up expiry day was outstanding. Besides the recent boost from the L3 policy, its inclusion in the "Hang Seng HK Stock Connect Electronic Theme Index" and its focus on unmanned logistics vehicles, which have driven business growth, have prompted investors to re-evaluate its value.

However, its performance may also be linked to its stock price being below the issue price. Perhaps early investors are reluctant to sell at this level, exerting downward pressure on the stock price. Moving forward, we need to observe whether this rally is sustainable, as early investors still face pressure from fund redemptions to return money to limited partners (LPs), especially at year-end!

Nevertheless, looking at UFACTORY, a recently lock-up-expired IPO, it continued to soar today, reaching an intraday gain of over 13% and closing up 7.21%.

UBTECH, which announced a 1.7 billion yuan acquisition of a controlling stake in A-share listed company Fenglong Shares, also experienced a significant surge, reaching an intraday gain of over 13% and closing up 9.13%, with a closing market capitalization of 60.156 billion Hong Kong dollars. Meanwhile, Fenglong Shares achieved three consecutive daily limit-ups, with a trading volume of only 6.5607 million yuan. The limit-up streak may persist.

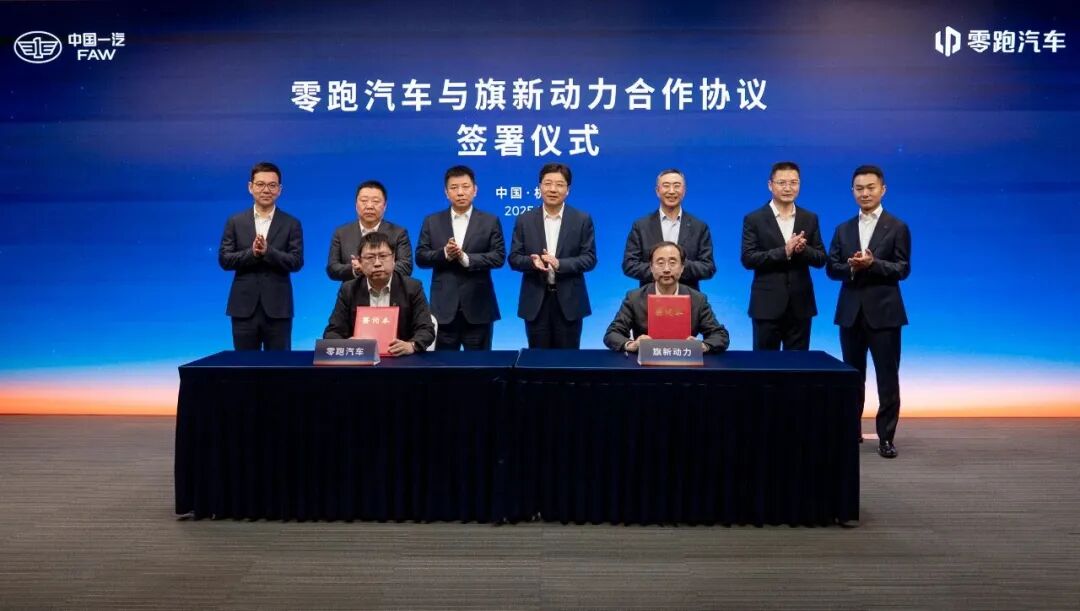

Today's major news in the automotive sector also includes FAW's acquisition of a 5% stake in Leapmotor, making it a major shareholder. The transaction price was over an 11% premium to the previous closing price, with a transaction volume exceeding 3.744 billion yuan. Influenced by this news, Leapmotor gapped up at the open, reaching an intraday gain of over 7%, but then oscillated downward, closing up 0.92%.

Leapmotor's Zhu Jiangming stated that the founding team maintained control of the company, and both sides would collaborate on electric vehicle R&D and overseas market expansion.

This marks FAW's second major investment in a new energy vehicle startup, following its investment in Byton. However, Byton's team had a professional manager mindset and ultimately failed.

This time, how much can Leapmotor cater to FAW's needs?

Notably, FAW's approach to intelligent driving cooperation takes an unconventional path. Instead of partnering with Huawei like Chang'an, Dongfeng, SAIC, GAC, and BAIC, it invested over 3.6 billion yuan in Zhuoyu, a spin-off from DJI, holding a 35.8% stake.

Another piece of news is NIO's announcement of delivering the 40,000th ES8 within 100 days of its launch, a remarkable feat for a 400,000 yuan-level new energy vehicle.

In terms of stock performance, NIO's H-shares closed up 4.89% today, reaching an intraday gain of over 7%.

Overall, NIO's latest closing price is 40.32 Hong Kong dollars, midway between the low of 23.70 Hong Kong dollars and the high of 61.75 Hong Kong dollars after the launch of the LeDao L90.

For NIO, orders for the L90 have bottomed out, while orders for the ES8 have accumulated significantly. The ES8 is currently the only model among all NIO models that requires a waiting period, and it's over three months. This is quite unusual.

What NIO needs to do now, besides ensuring ES8 orders, is to swiftly update previous flagship models like the ES6 and ET5(T) to the latest platform, while avoiding cannibalizing ES8 orders. This requires NIO to demonstrate higher product definition skills. As for the LeDao L90 and L60, they seem to have not found the most suitable price range to penetrate the market. The Firefly, however, was a pleasant surprise.

William Li vowed to turn profitable in Q4, but this may be more about financial engineering. We'll gauge this from indicators like accounts payable, cash reserves, free cash flow, and debt.