Tesla loses to Chinese cars in Japanese car market

![]() 08/08 2024

08/08 2024

![]() 645

645

Introduction

Introduction

In terms of localized production in the Thai market, Tesla has once again lost to Chinese automakers such as SAIC Motor and BYD. However, in the face of Tesla's sales momentum, Chinese new energy automakers cannot afford to be complacent.

"Tesla Abandons Plans to Build a Factory in Thailand!"

"Tesla Model Y Becomes Thailand's Second Best-selling Electric Vehicle, Second Only to BYD Yuan Plus!"

Two vastly different pieces of news suddenly emerged. On the one hand, Tesla suffered a major setback in its plans to build a factory in Thailand, ultimately abandoning the construction of local production capacity. On the other hand, China is making significant inroads into Southeast Asia, particularly Thailand, which has traditionally been a stronghold for Japanese automakers, and Tesla is not letting this piece of the pie slip away.

In July alone, BYD and GAC Aion's Thai factories began operations, and Geely Radar also established a Thai subsidiary, marking a significant investment by Chinese automakers in Thailand.

However, the Thai consumer's penchant for trying new things and the polarization of spending power has allowed Tesla to gradually find its footing in the local market.

As Thailand becomes a hotbed for Chinese automakers, how should we view Tesla's simultaneous decision to abandon factory construction and aggressively pursue market share?

Tesla's Thai Factory Dreams Dashed

"In addition to China, the United States, and Germany, Tesla has shelved all plans to invest in new factory construction projects, including those in Asian countries such as Thailand, Malaysia, and Indonesia, as well as the Mexican Gigafactory project."

This news was a shock to many governments hoping to attract foreign investment.

It is understood that this decision stems from Tesla's consideration of global economic uncertainty and the optimal allocation of its own resources. With the global economy in a downturn and various regional conflicts, many companies, including Tesla, have adopted a more conservative investment strategy.

In fact, the prospect of a "Tesla factory" had filled the Thai government with hope for several months. After Tesla expressed interest in building a factory, the Thai government engaged in multiple rounds of negotiations with the company. A few months ago, Thai Prime Minister Prayut Chan-o-cha personally visited Tesla's headquarters in the United States and invited Tesla executives to participate in the Loy Krathong Festival celebrations in Thailand.

According to the original plan, Tesla was set to invest $5 billion in a factory in Thailand covering approximately 320 hectares of land. Site selection had entered a substantive stage, with three potential locations (primarily in Bangkok, Rayong, and Chonburi, based on Thailand's automotive industry distribution), and a final decision was expected in early 2024.

This stands in stark contrast to the aggressive factory construction efforts of Chinese automakers in Thailand.

The most established Chinese automaker in Thailand is SAIC Motor, whose entire lineup of brands is sold under the MG brand in the country. From its joint venture with the Charoen Pokphand Group in Rayong in 2012 to the establishment of its own factory in Chonburi in 2019, SAIC has invested over 10 billion Thai baht and plans to produce 100,000 vehicles annually.

Next in line is Great Wall Motors, which acquired General Motors' Thai factory for 22 billion Thai baht to establish a 100,000-vehicle production base. The first Haval H6 HEV rolled off the line on June 9, 2021. NIOZ Automobile partnered with PNA Auto Alliance (PNA Group) to invest 3.5 billion Thai baht in a 20,000-unit electric vehicle production capacity, becoming the first Chinese new energy automaker to have a local factory in Thailand. Production of new vehicles began at the factory in November 2023.

Starting in July of this year, a wave of Chinese automakers began entering the Thai market.

On July 4, BYD's Rayong factory opened with an annual production capacity of 150,000 vehicles.

On July 9, Geely Radar announced the official establishment of its first overseas subsidiary in Thailand, with the Thai market set to become its first independent overseas market.

On July 17, GAC Aion's Thai smart factory was officially completed with a total investment of 2.3 billion Thai baht and an initial annual production capacity of 50,000 vehicles, with plans to expand to 100,000 in the future.

Soon, Changan Automobile's factory will be completed by the end of 2024, with operations set to commence in the first quarter of 2025. Similarly, Chery Automobile's factory is expected to become operational around 2025.

"Seven to eight Chinese electric vehicle brands will commence production in the next two years, with a total investment of up to 200 billion Thai baht," according to data from the Electric Vehicle Association of Thailand and other organizations, equivalent to approximately 40 billion yuan in Chinese currency. In terms of investment amounts, Tesla's original plans were ambitious, with a single factory investment of approximately 30 billion yuan.

Did Tesla Lose? Or Did It Stay Grounded?

In fact, the Thai and broader Southeast Asian markets, traditionally seen as the "backyard" of Japanese automakers, are also being abandoned by some of these companies.

At the end of May, Subaru announced that its Bangkok factory would shut down by the end of 2024.

On June 7, Suzuki officially announced the closure of its Rayong factory in Thailand, with operations set to cease by the end of 2025.

Of course, the lag in Japanese automakers' new energy technology and Thailand's push for EV 3.0 to 3.5 policies are heading in opposite directions. According to the Thai government's plan, electric vehicles will account for 30% of the Thai automotive market by 2030.

Tesla's decision to abandon plans to build a factory in Thailand appears similar to the closure of Japanese factories in the country, suggesting a significant decline in Thailand's status as a major automotive hub, comparable to Mexico in the Americas.

However, considering Tesla's stance on the Mexican Gigafactory project, it is clear that the company is beginning to scale back its global operations.

The Mexican Gigafactory was originally scheduled to commence operations in early 2025, but due to political turmoil in the United States (particularly election changes), tariff policy changes, and the impact of the global economy, Tesla decided to postpone the project. This ripple effect forced various fixed point suppliers to adjust their plans to manage potential delays.

After achieving a record profit of $792.8 million in the fourth quarter of 2023, Tesla found itself in a predicament. The company led a price war in the Chinese market, only to suffer significant backlash and a significant decline in profits. In other global markets, Tesla's progress has been relatively stagnant.

This led to Tesla's profits in the first and second quarters of 2024 being only in the tens of millions of dollars. Affected by the price war, Tesla's gross vehicle margin declined from a peak of 20-30% to the teens, failing to differentiate itself from companies like NIO and Zeekr.

Nevertheless, Thailand still holds out hope for Tesla and wishes to collaborate with the company in areas such as charging infrastructure.

Thailand's automotive market is increasing its support for new energy vehicles on an industrial level.

On a macro level, Thailand's economy is tending towards stagnation, and aging is intensifying, causing bottlenecks in various industries. However, new energy vehicles can bring new opportunities to the Thai economy by driving product renewal, infrastructure development, and upstream and downstream industrial linkages.

From 2018 to 2023, Thailand's per capita GDP remained largely stagnant at around $7,000. Considering a slight decline in the Thai baht's exchange rate against the US dollar, the domestic economy experienced only a slight increase. However, as a country with a relatively low base, this growth trend is clearly insufficient to satisfy the Thai government's aspirations.

Therefore, in addition to being a major automotive consumer market, Thailand also attaches great importance to building a localized automotive industry to stimulate economic growth.

In terms of vehicle sales alone, Thailand maintained annual sales of around 1 million vehicles until 2019, but the pandemic subsequently hit the Thai market, causing sales to slide to around 700,000 to 800,000 vehicles. Currently, among ASEAN countries, Thailand's automotive sales are lower than Indonesia (just over 1 million) and roughly on par with Malaysia.

If automakers merely sell vehicles in Thailand without bringing technology and supply chains into the country, as Chinese automakers have done, the level of support and integration with the local market will be significantly lower, putting pressure on Tesla and Chinese automakers in subsequent competition.

Aggressive Sales Momentum

"Thai people attach great importance to their lifestyles, and unlike the Chinese, real estate is not their biggest household expense. Therefore, the proportion of automotive expenses is quite high," said a local source during a June survey by Automobile Society in Thailand.

This has led to significantly higher automotive prices in the Thai market compared to China. For example, the list price of the Camry at local dealerships reaches 1.47 million Thai baht, close to 300,000 yuan, which is 70% higher than in China. The price of the BYD ATTO 3 (Yuan Plus) is also around 180,000 yuan, 50% higher than in China.

This pricing advantage is now shifting from conventional vehicles to new energy vehicles.

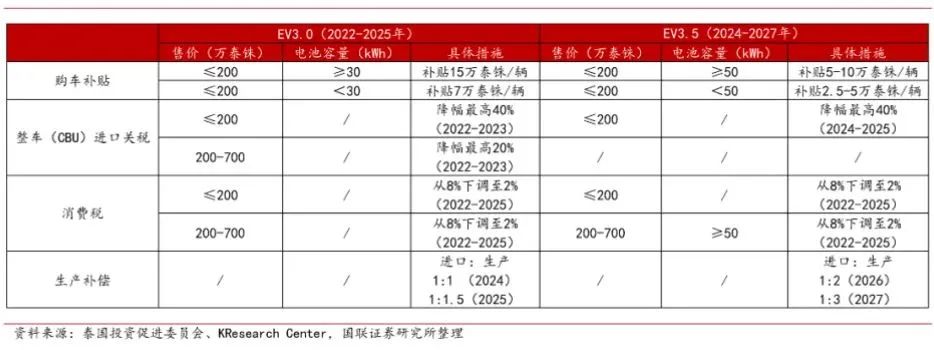

Since 2022, Thailand has continuously introduced policies to encourage new energy vehicles. The EV 3.0 phase runs from 2022 to 2025, followed by the EV 3.5 phase from 2024 to 2027. Models that meet certain sales price and battery capacity criteria can receive subsidies of up to 150,000 Thai baht (30,000 yuan), with excise taxes reduced from 8% to 2%. Additionally, there are import subsidies and production incentives.

Both Chinese new energy vehicles and Tesla have benefited significantly from these policies.

In Tesla's case, it entered the Thai market in December 2023, beginning online sales of the Model Y and Model 3 with starting prices of 1.96 million Thai baht (approximately 390,000 yuan) and 1.76 million Thai baht (approximately 340,000 yuan), respectively. These prices are relatively expensive compared to Chinese new energy vehicles in the 1 million Thai baht (200,000 yuan) range.

In March 2024, Tesla made significant progress in Thai sales, with the Model Y selling 1,034 units, accounting for 17% of the local electric vehicle market share and ranking second only to the BYD ATTO 3 in electric vehicle sales.

In contrast, the ATTO 3's local starting price is approximately 180,000 yuan. The Dolphin has significantly reduced its price to capture the market for smaller vehicles.

In June, the price of the Dolphin in Thailand was significantly reduced, with the 44.9 kWh standard range version dropping from 699,900 Thai baht to 559,900 Thai baht, equivalent to a price reduction of approximately 27,700 yuan. The 60.5 kWh long-range version dropped from 859,900 to 699,900 Thai baht, a price reduction of approximately 32,000 yuan. This brings the starting price of the Dolphin in Thailand to just over 110,000 yuan, almost in line with domestic prices.

Therefore, in terms of price range, Tesla has an advantage over Chinese new energy vehicles. However, as higher-end Chinese new energy vehicles such as Changan Avitar, Zeekr, and NIO continue to enter the Thai market, Tesla will soon face another "Chinese car beatdown."