Surprising surge, but a 'new' Unity is promising

![]() 08/12 2024

08/12 2024

![]() 638

638

Hello everyone, I'm Dolphin!

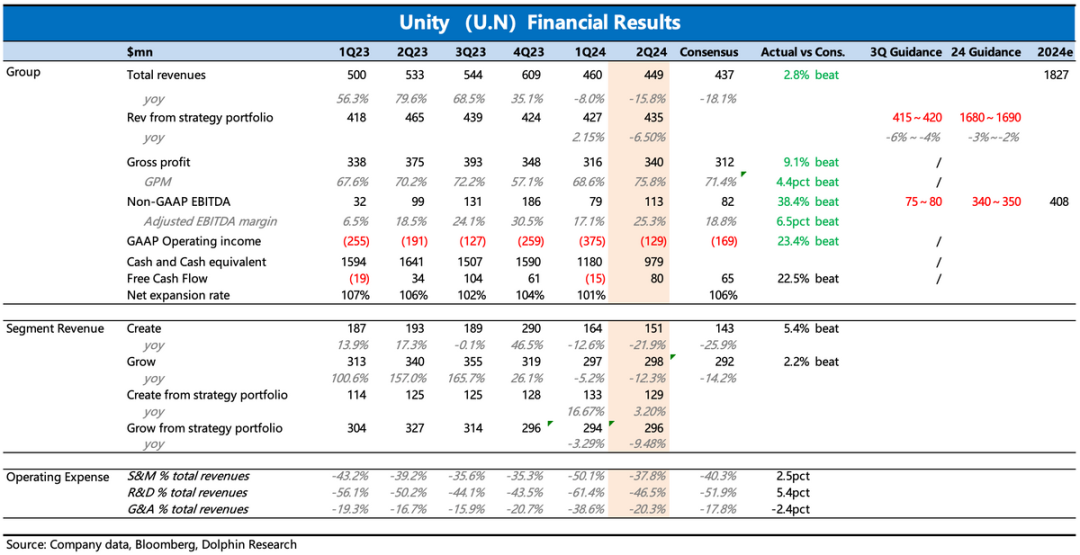

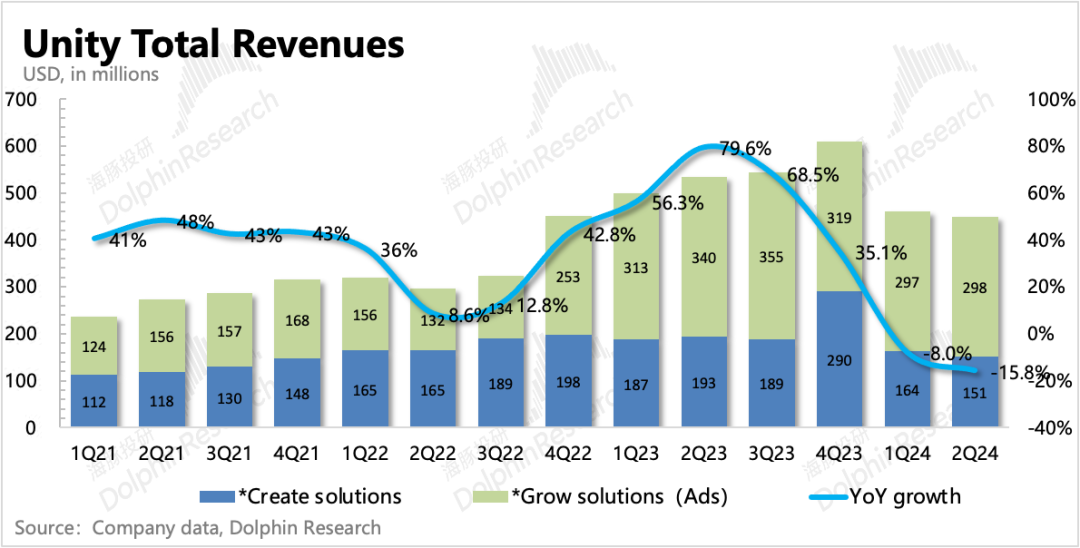

After the US market closed on August 8th (EST), Unity, the leading game engine company, released its Q2 2024 financial results. Overall, Q2 performance exceeded expectations, but Q3 guidance missed estimates, and full-year guidance was further revised downwards.

Theoretically, downward guidance is a highly negative signal, so why was the market response so positive? Unity closed up 8% yesterday. Was it due to the end of restructuring and the market's anticipation of a fresh start for Unity, or simply market volatility? What subtle changes in the company's operations does the Q2 financial report reflect?

As most financial indicators lag behind strategic and operational changes during critical inflection points, and operational information is mainly discussed during earnings calls, Dolphin will share my detailed analysis of this financial report after thoroughly reviewing the shareholder letter and earnings call.

Let's start by reviewing the key financial indicators:

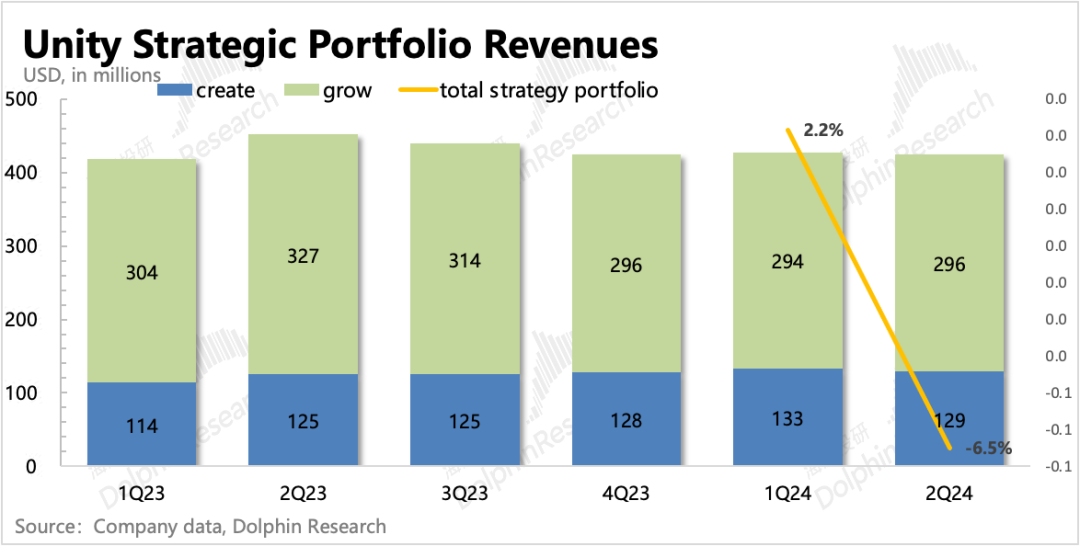

1. Engine Business Recovers Lost Customers Effectively? In the Strategy portfolio disclosure, the slowdown in Create revenue growth is attributed to strategic partnerships and professional services, which are being proactively scaled back. The engine subscription revenue, which comprises the majority, remains at a healthy 13% growth rate.

The company attributes this to both price increases and an upgrade in user subscriptions from lower-priced plans to premium plans, coupled with an increase in the number of subscribing users.

Dolphin is more focused on the latter aspect—the increase in the number of subscribing customers. Not only is acquiring customers crucial for the high-retention Tob business, but after announcing Runtime-based charging in September last year, customer dissatisfaction and even churn ensued. Therefore, the primary task for the new CEO has been to win back lost gaming customers.

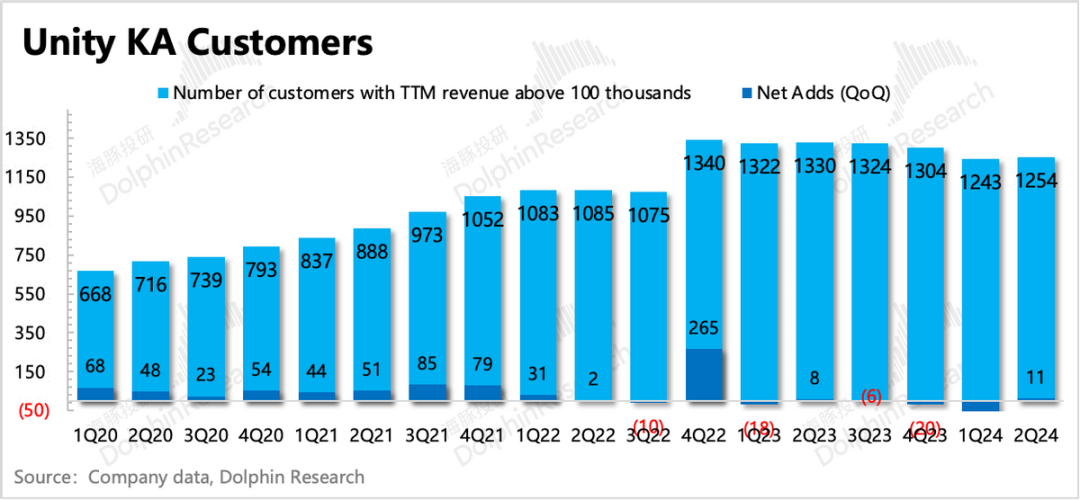

Although management reported an increase in subscribing customers in Q1 and Q2, it was not evident in the actual Q1 figures. In Q2, there was a net increase of 11 large customers quarter-over-quarter, which, while modest, aligns with management's description of customers returning.

Unity 6 will be released in the next quarter, officially launching the new Runtime-based pricing model. Therefore, subscribers who continue their subscriptions at this time can be seen as accepting this pricing change to some extent. Management is confident that this generation of the engine will drive future growth.

2. Advertising Continues to Decline: However, we all know that the engine business is Unity's core competency. The real reason the company has been under pressure for so long is issues within the advertising-focused Grow business.

In Q2, Grow revenue in the Strategy portfolio declined by 9.5% year-over-year, accelerating further from the previous quarter. While industry factors (such as AppLovin missing revenue estimates) played a role, Unity's weaker-than-peer growth indicates a further erosion of its market share.

Currently, Unity has brought in two experts to revamp its advertising business, including Jim Payne, co-founder of mobile advertising platform MoPub and later founder of Max advertising systems, a seasoned expert in mobile marketing.

However, management acknowledges that the advertising recovery will take time. Due to the uncertainty surrounding the pace of the advertising business adjustment, management prudently revised its full-year revenue guidance downwards.

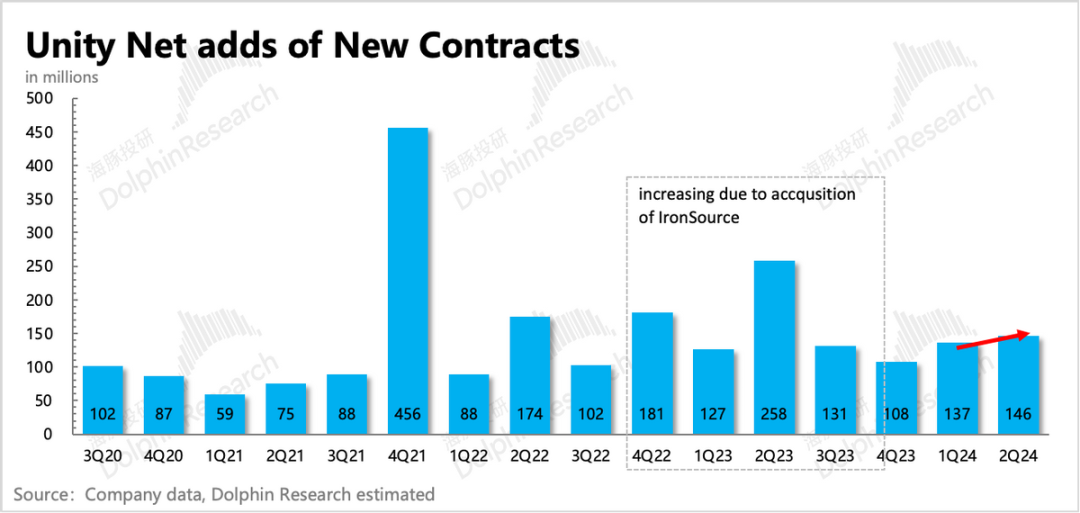

3. More 'Hope' Revealed in Operational Quantifiable Indicators: In the previous quarter, Dolphin noted positive signs in forward-looking operational indicators, particularly the quarter-over-quarter growth in new contracts, which were not affected by restructuring and thus seen as a glimmer of hope.

In Q2, there appear to be more signs of hope in operational indicators: (1) continued quarter-over-quarter growth in new contracts; (2) net increase in the number of large customers; (3) net increase in deferred revenue quarter-over-quarter; (4) while the remaining non-cancelable contract balance (including deferred and unpaid backlog) is still declining quarter-over-quarter, the rate of decline has narrowed further;

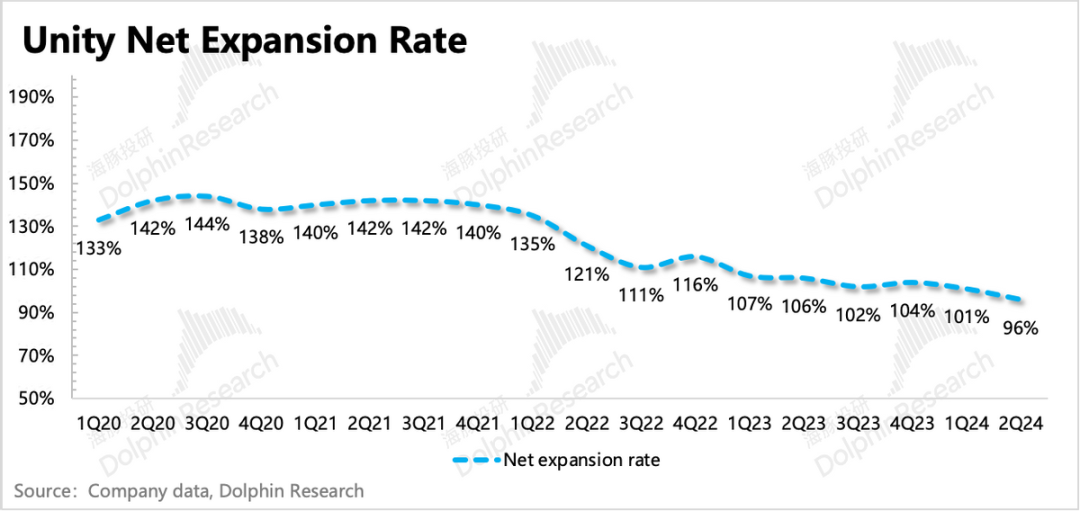

The only disappointment is that (5) the net expansion rate worsened, falling to 96% in Q2. This means that existing customers paid less compared to the previous year. This could be due to customer churn, account reductions or downgrades by existing customers, or Unity's proactive closure of certain businesses. Given the layoffs at many game companies earlier this year, Dolphin believes the latter two factors are more likely.

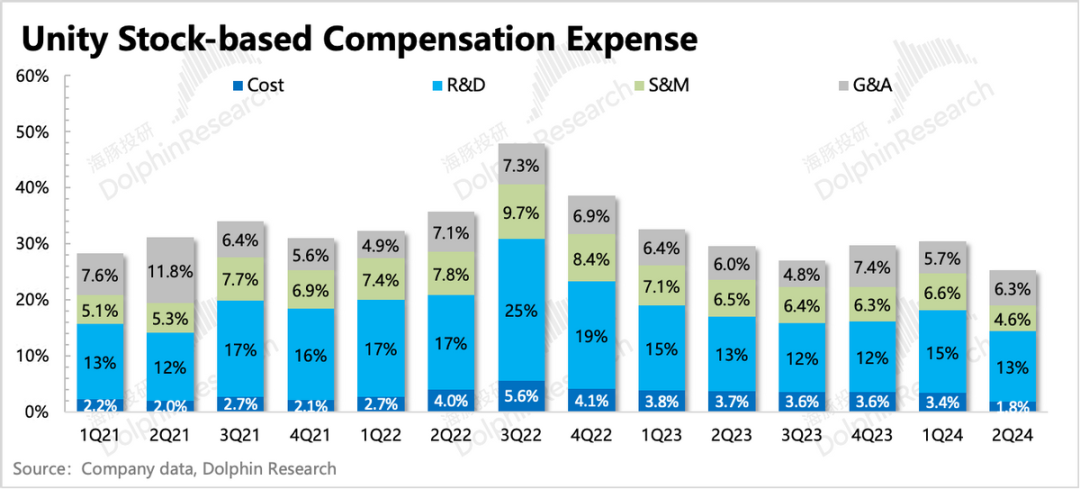

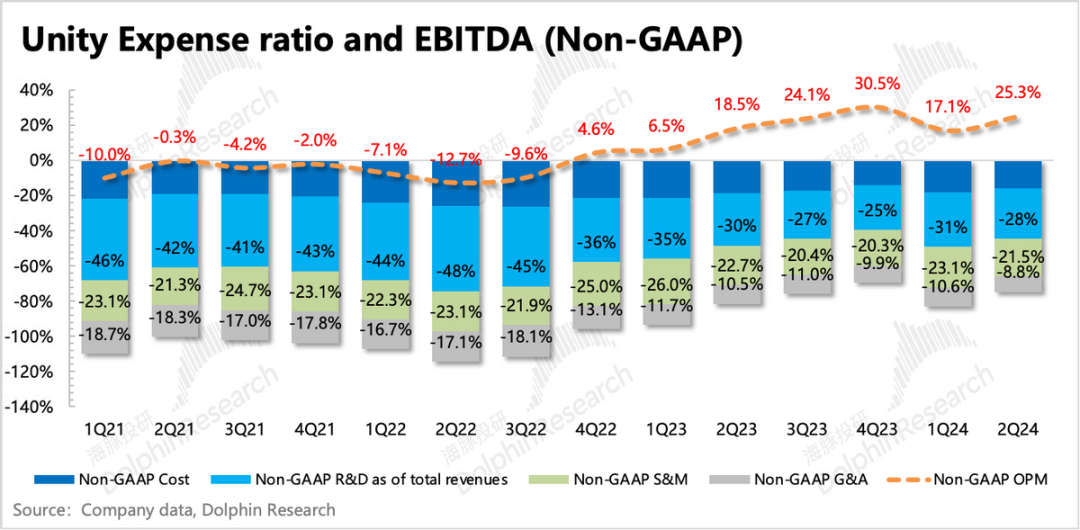

4. Cost-cutting and Efficiency Improvements: The anticipated large layoffs at Unity finally materialized in Q2, with operating expenses declining by 17% year-over-year, primarily due to reductions in R&D and sales expenses, as well as a 28% year-over-year decline in share-based compensation (SBC) expenses. Gross margin rebounded to 76% due to portfolio adjustments, eliminating low-margin professional services and Weta collaborations. As a result, operating losses narrowed to $129 million, a 32% year-over-year decline, and adjusted EBITDA reached $114 million, exceeding guidance and expectations.

Despite Q2 earnings exceeding expectations, the company revised its Q3 and full-year earnings guidance downwards, with a larger reduction than revenue guidance. This suggests that the current round of cost-cutting measures is nearing completion, and moderate new investments are on the horizon.

This was partially confirmed during the earnings call, where management noted the need to build more infrastructure to enhance advertising competitiveness, leading to future investments in machine learning, data stacks, etc.

5. Summary of Financial Results

Dolphin's Perspective

The biggest controversy surrounding Q2 results lies in the revised guidance. At first glance, it seems like a negative signal. However, upon reviewing the financial report, shareholder letter, and earnings call, Dolphin believes that the revised guidance is likely due to "prudent and conservative considerations," as management stated, to provide more room for trial and error for the newly formed team.

With the departure of the former CFO and the introduction of two industry veterans to revamp the advertising business, the new Unity team appears poised for a fresh start. While financial indicators may not reflect these changes immediately, Dolphin believes the turning point in financial performance could arrive by year-end, based on factors such as the release of Unity 6 in the fall, the end of the restructuring cycle, and the recovery of the gaming industry.

While Q2 results did not completely overturn Dolphin's expectations (forward-looking indicators suggest continued improvement in Create, and non-gaming market revenue maintained high growth at nearly 60% in Q2), it must be acknowledged that the advertising business has encountered short-term challenges, with Q4 likely still struggling based on current guidance. The key to advertising recovery lies in Unity's ability to win back customers from competitors like AppLovin.

Management provided some directional guidance, including talent acquisition, infrastructure improvements, faster product innovation, and leveraging existing ecosystem advantages to drive business recovery and expansion.

These efforts will not yield immediate results but represent the right direction for the new team—focusing on product enhancement and competitiveness rather than relying on commercial tactics that may alienate customers.

Therefore, while Unity remains in an adjustment phase in the short term, with revised guidance and declining advertising market share seen as negative signals by many investors, Dolphin remains cautiously optimistic about Unity's ability to return to growth in the medium to long term with a simpler and purer focus.

Looking back at yesterday's unexpected surge, some investors may have gambled on the new team or anticipated the operational turning point. However, Dolphin believes this was primarily driven by trading dynamics, as the fundamentals do not support such a significant rally in the short term. Sustained and meaningful value recovery will likely occur only when there are clear signs of a resolution to the advertising issues.

Detailed Analysis

I. Basic Introduction to Unity's Business

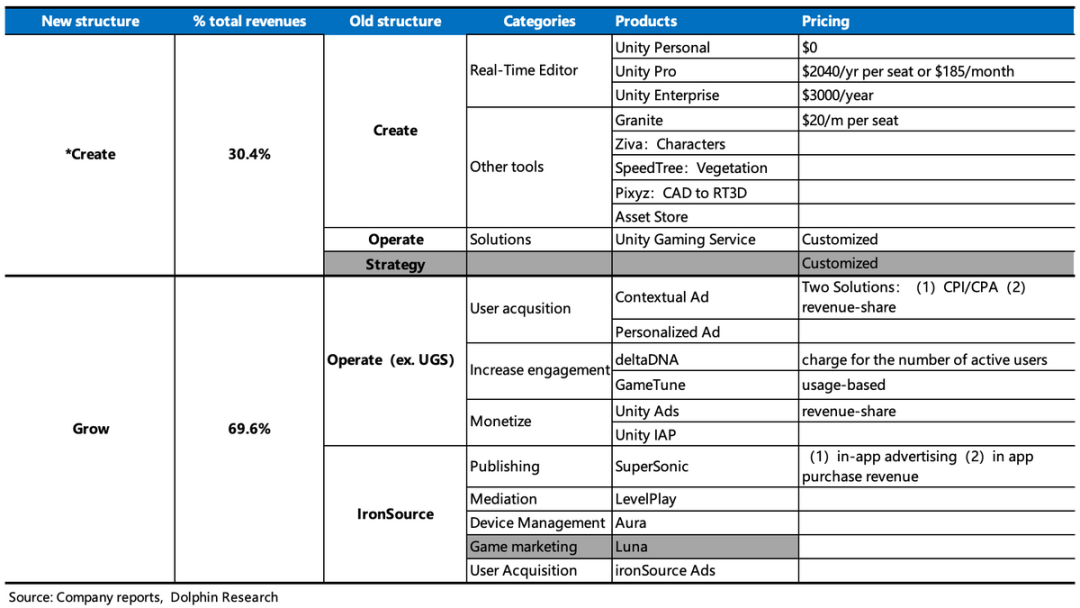

In Q1 2023, Unity merged IronSource's operations and adjusted its segment reporting structure. The new structure consolidates three previous segments (Create, Operate, and Strategy) into two (Create and Grow). The new Create segment includes the game engine, UGS revenue (Unity Game Service, a full-chain solution for game companies), and Strategy revenue, with the gradual phasing out of Professional Service and Weta.

The Grow segment comprises the advertising business from Operate, as well as IronSource's marketing (primarily Aura, with Luna closing in Q1 2024) and game publishing services (Supersonic). Revenue contributions come from seat subscription fees for the game engine, ad platform fees, and game publishing revenue.

II. Create Shows Stable Growth, While Grow Faces Challenges

Unity's Q2 total revenue was $450 million, down 15.8% year-over-year but slightly above guidance and market expectations. Excluding restructuring impacts, revenue from the Strategy Portfolio declined 6.5% year-over-year. On one hand, strategic partnerships and professional services within Create were proactively scaled back, while engine subscription revenue grew 13% year-over-year, similar to Q1's stable performance. On the other hand, Grow continued to suffer from market share losses in mobile in-app advertising to competitors.

From a forward-looking perspective, Q2 showed continued improvement across key operational indicators: (1) Net Expansion Rate continued to decline to 96% in Q2, indicating a year-over-year decline in combined revenue from existing customers over the past 12 months. This could be due to Unity's proactive closure of certain businesses, customers reducing or downgrading accounts, or customer churn. Given layoffs at many game companies earlier this year, Dolphin believes the first two factors are more likely.

(2) Large Customer Count: Affected by restructuring, large customer numbers can also fluctuate. However, the 11 net additions in Q2 is a positive sign Worth continuous attention .

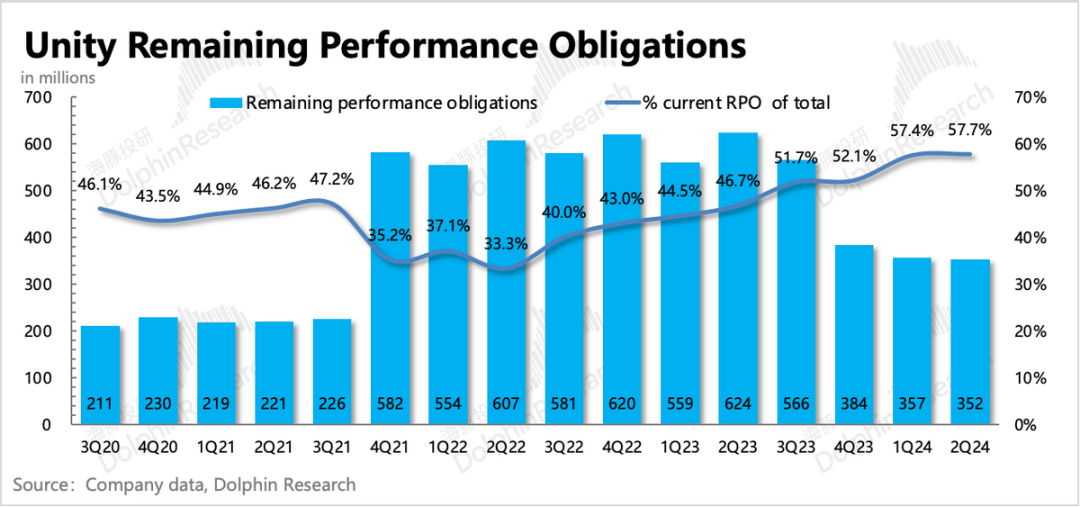

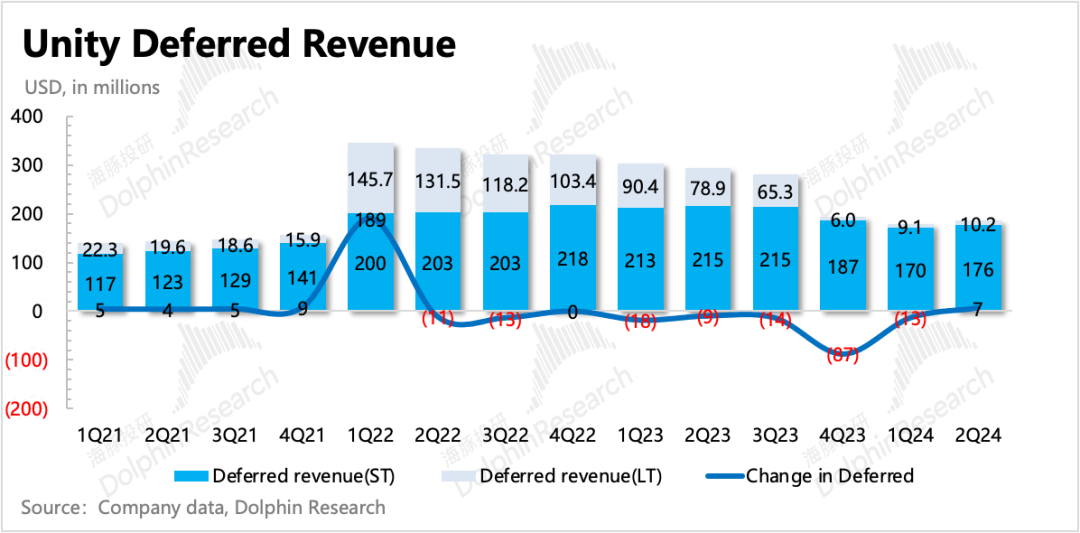

(3) Remaining Backlog & Deferred Revenue: While the remaining backlog continued to decline 1.4% quarter-over-quarter in Q2, the rate of decline slowed compared to Q1. Similarly, deferred revenue, which reflects similar operational trends, emerged from the restructuring impact, increasing net by $680 million quarter-over-quarter instead of declining.

(4) New Contract Value: Dolphin's recalculated new contract value metric was the only positive indicator in Q1 and continued to show improvement in Q2 alongside other forward-looking indicators. The marginal increase in new contracts often reflects changes in customers' attitudes towards Unity, further indicating that the company's retention efforts following last year's challenges have eased customer relationships, aligning with management's statements on the earnings call.

While the above forward-looking indicators (1)-(3) were affected by business closures and difficult to isolate within the Strategy Portfolio, they generally show a sustained recovery trend. (4) is more of a marginal indicator, better reflecting the latest operational trends and confirming that operations have not deteriorated. Financial indicators often lag behind operational changes, and due to prudence regarding the advertising business, management slightly revised downwards its Q3 and full-year revenue guidance. According to the company's guidance, Q3 Strategy Portfolio revenue is expected to be between $415 million and $420 million, representing a 4%-6% year-over-year decline, slightly better than Q2 and with the midpoint of the range below market expectations. Additionally, management expects full-year 2024 Strategy Portfolio revenue to be between $1.68 billion and $1.69 billion, down 2%-3% year-over-year, a downward revision from the previous quarter but still implying a revenue recovery in Q4. With Unity 6 set to release this fall, we should see management's assessment of customer feedback on Unity 6 in Q3. As long as the advertising business does not experience further disruptions, the year-end performance inflection point remains relatively clear.

II. Why hasn't Unity benefited from the industry's recovery?

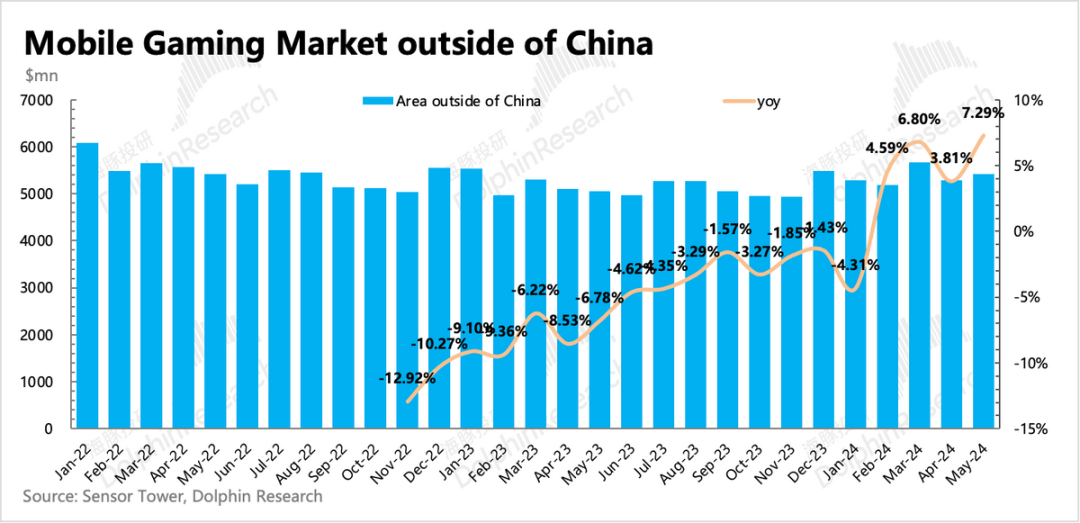

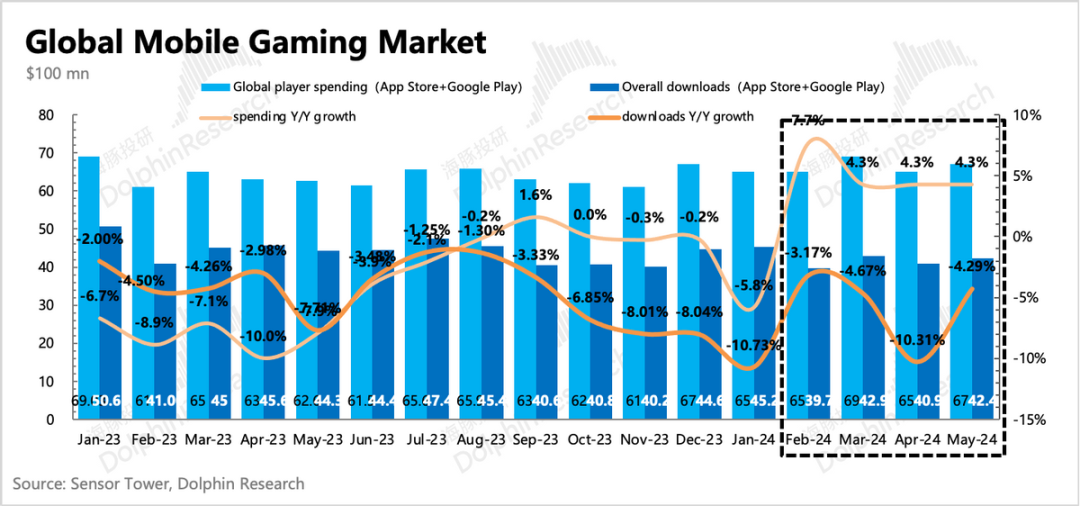

Although Unity's growth and valuation potential are primarily focused on non-gaming industrial scenarios, the gaming market still accounts for the majority of the company's overall engine subscription revenue. Therefore, it is essential to consider the state of the gaming industry. According to Sensor Tower data, global gaming revenue rebounded significantly in the second quarter, and based on the trend of the base period, the second half of the year is expected to continue this recovery. Logically, Unity should also see a recovery, so why has advertising revenue decreased instead of increased?

Dolphin Insights believes that, first and foremost, it is undeniable that Unity has lost market share in the mobile marketing space. On the one hand, the paid Runtime feature has angered users, leading to the cancellation of marketing cooperation. On the other hand, this may be due to the ineffective integration of IS, as well as Unity's failure to promptly optimize its advertising tracking technology under Apple's privacy policies. However, Dolphin Insights has also found that Sensor Tower's industry data is based on actual consumer spending but excludes casual games, which primarily monetize through in-app advertising. Additionally, while global paid gaming revenue has increased, game downloads have not rebounded simultaneously, indicating that the increase in gaming revenue is primarily derived from existing games rather than new ones benefiting from the industry's recovery. These two factors mean that the situation of casual games, closely related to Unity's advertising revenue, is not reflected. In fact, after several years of high growth during the pandemic, casual games are currently experiencing a period of stability. Moreover, with limited new game supply overall, Unity's promotion revenue is unlikely to experience significant growth.

III. Layoffs for efficiency, but investments will resume

Unity's mass layoffs mentioned at the beginning of the year finally materialized in Q2, with operating expenses declining by 17% year-on-year, primarily due to reductions in R&D and sales expenses, which account for a significant portion of costs. The decrease in SBC (Stock-Based Compensation) also indicates that the decline in expenses is primarily driven by reduced team costs.

Furthermore, due to adjustments in the product mix, the gross margin has returned to a high level of 76% by discontinuing low-margin professional services and the Weta partnership. As a result, the operating loss was reduced to $129 million, a year-over-year decrease of 32%, with adjusted EBITDA reaching $114 million and a profit margin of 25.3%, exceeding guidance and expectations.

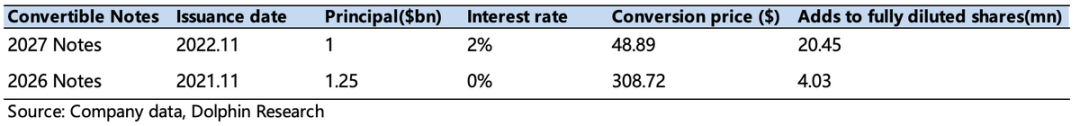

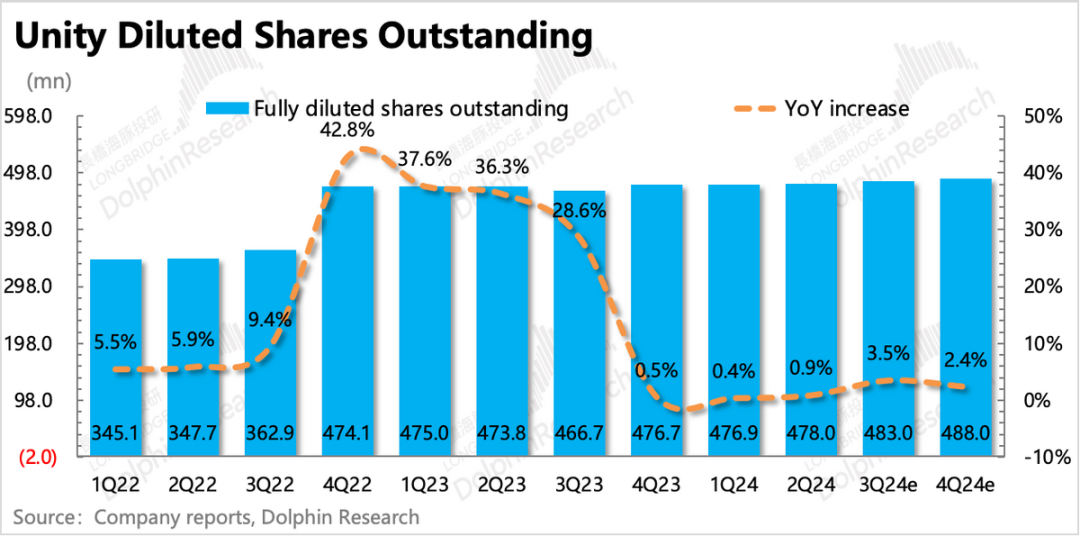

Despite exceeding profit expectations in Q2, the company lowered its profit guidance for Q3 and the full year due to the revenue downgrade, with the adjustment exceeding the revenue reduction. This suggests that the current round of cost-cutting and efficiency improvements is nearing its end, and moderate new investments will soon follow. Management expects adjusted EBITDA for Q3 to range between $75 and $80 million, and full-year guidance is set at $340 to $350 million, representing a 15% reduction from the previous guidance of $400 to $425 million and falling below market expectations. This was partially confirmed during the earnings call. Management noted that to enhance the competitiveness of its advertising business, it needs to build more infrastructure and will start investing in areas such as machine learning and data stacks. Regarding the impact of SBC on equity dilution, which has been a persistent criticism of Unity, there has been significant relief since Q4 last year. Although future R&D investments will increase, the company's guidance for the end of 2024 anticipates a total share count of 488 million, including potential dilution, down from the previous guidance of 492 million shares, implying an annual equity dilution rate of only 2%.

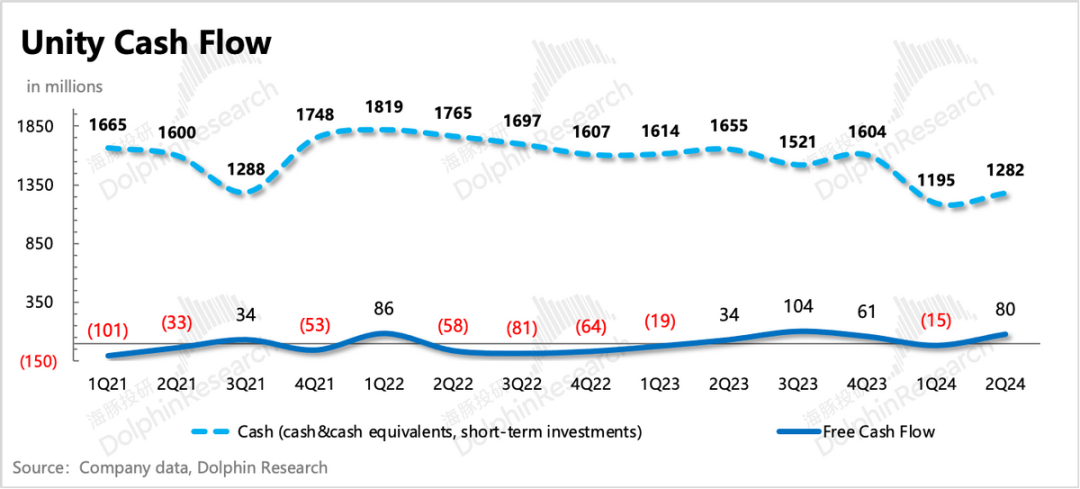

IV. Cash Flow: Return to Positive Free Cash Flow

There are currently no significant issues with cash flow changes in the second quarter. As of the end of Q2, the company had $1.28 billion in cash on its balance sheet, an increase of $100 million from the previous quarter, primarily due to improved operating performance and maintained low capital expenditures.

The company has no interest-bearing debt and relies on direct equity issuance or convertible bond offerings for financing. As of the end of Q2, the combined face value of these instruments totaled $2.2 billion, with no redemptions or new issues during the quarter.