Tesla Insurance screens good drivers

![]() 08/12 2024

08/12 2024

![]() 554

554

Tesla's insurance, which can save Tesla owners at least 30% on car insurance overseas, was re-registered in China this August.

This move suggests that Tesla's in-house insurance plan may be cheaper than the current insurance options available to Tesla owners through third-party insurance companies. Note that it's possible that it could be cheaper, but the magnitude of the discount, based on overseas markets, is roughly 30% at most. Taking the first-year insurance cost of a new Tesla Model 3, around RMB 7,500, a 30% discount would translate to a savings of approximately RMB 2,000.

However, it's important to note that not all Tesla owners are likely to enjoy a 30% reduction in insurance costs. Tesla's insurance assessment model differs from that of BYD (which also operates its own property insurance business, but with regional restrictions). Tesla may factor in owners' driving habits, potentially leveraging intelligent technologies for assessment.

Some Tesla owners may see their insurance premiums increase over time, while others may save money.

How does in-house insurance save money?

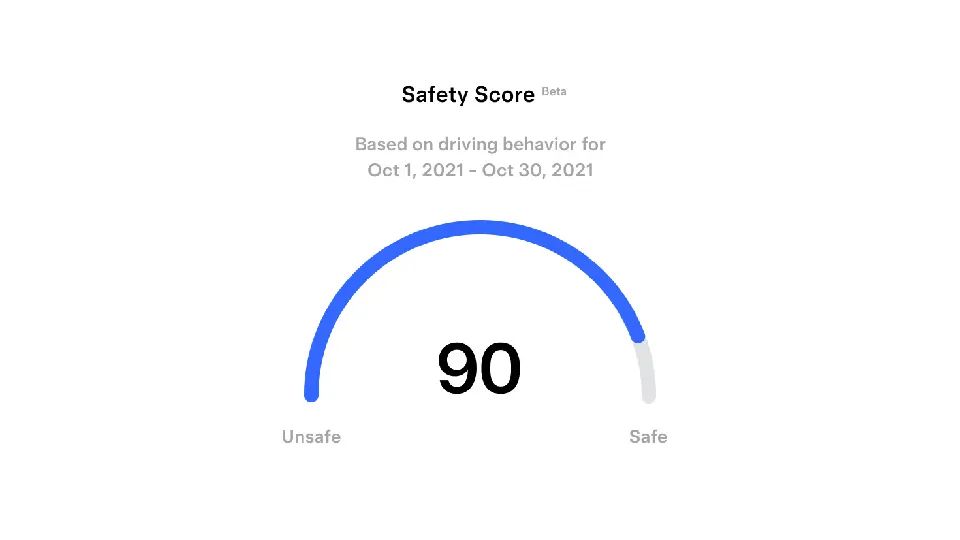

Tesla's in-house insurance has its own assessment system, with monthly evaluations (if paid monthly, prices are dynamically adjusted). Based on feedback from overseas owners who have purchased this insurance, if they drive according to the assessment criteria, they indeed save money, with discounts of roughly 30%.

It does help owners save money. Considering the current insurance prices for some Tesla Model 3 variants, the standard range version's first-year premium is approximately RMB 8,950, and the performance version's is RMB 10,800. With a 30% reduction, the annual premiums would be RMB 6,265 and RMB 7,560, respectively.

Rather than simply stating that this in-house insurance saves money, it's more accurate to describe it as a personalized car insurance service. This is because it incorporates an assessment system tied to intelligent driving capabilities.

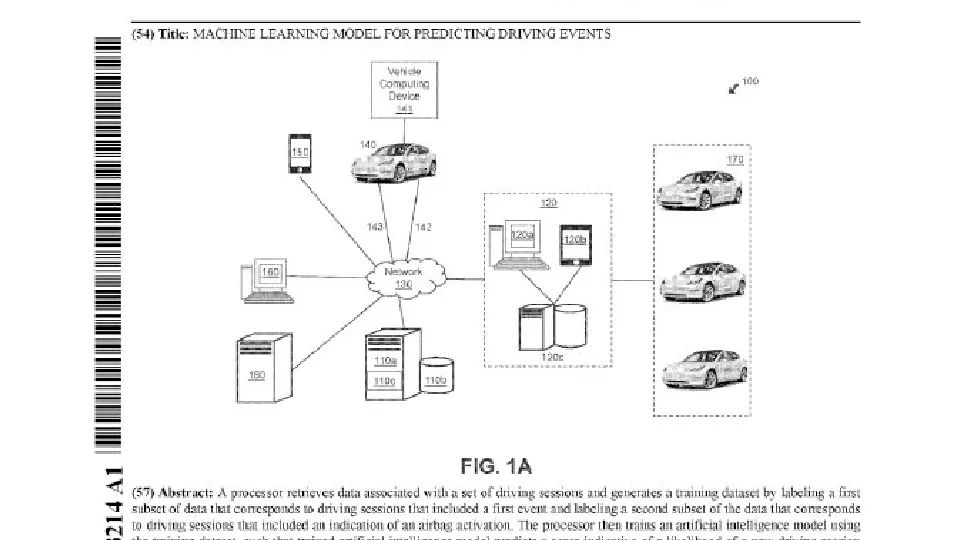

Underlying Relationships:1. It's a learning model for driving events.2. It correlates with Autopilot and FSD intelligent driving functions, sharing driving data.3. It collects real-time risk data, which is fed back to the neural network for training.4. The collected driving data is highly accurate, sourced directly from primary driving information.

Essentially, this is a derivative product developed using neural networks, focused on data collection. In China, it is expected that this model will continue, but it's unclear whether a monthly payment option will be available, which offers greater flexibility and monthly premium adjustments.

Given the current Model 3's integrated casting and CTC battery technology, its insurance prices are quite competitive. Let's consider two counterpoints: the older Model 3 lacks integrated casting and CTC battery, and its intelligent driving components are outdated; while the current Model Y has integrated casting and CTC battery, but some variants have outdated intelligent driving hardware.

Could premiums for the above models decrease?

Understanding Tesla's model (which is also a manifestation of technology) reveals a logic centered on intelligent driving decisions (a series of assessments) and manufacturing/maintenance factors.

Therefore, good driving habits can lead to lower premiums, regardless of the use of high-maintenance technologies like CTC batteries and integrated casting. Some 2019 Tesla Model 3 owners have reported premium reductions of around 50%, equivalent to roughly RMB 3,500 annually in China.

Regarding premium reductions, having FSD does not necessarily lead to cheaper insurance.

Tesla screens drivers

Tesla's insurance clearly incorporates customization, with both premium reductions and increases possible. Poor driving can lead to premium hikes of 40%-70%. Feedback from overseas owners suggests accurate data collection and swift adjustments.

Tesla's assessment system continuously considers intelligent driving configurations. Core safety factors play a significant role, including collision warnings, emergency braking incidents, sharp turns, close following, speeding, night driving, and distractions, all of which can drive up premiums.

The underlying logic is that the driver's every move is recorded by sensing devices, with data transmitted to the backend. There's even a strict grading system for turning speeds, though not explicitly tied to intelligent driving, except for inattentiveness detected by an in-car camera during autonomous driving.

In summary, Tesla's in-house insurance may require you to adjust your driving habits, as its logic essentially aims to make human driving mirror that of intelligent driving systems—avoiding excessive speed, close following, and sharp turns. This could also be an effort to boost FSD adoption.

Is this system applicable in China?

Considering the proximity assessment, relying on millimeter-wave radar, in China's busy urban traffic, premiums could easily double with a single commute. If Tesla introduces this insurance model in China, it's likely to do so gradually, city by city.

Regarding premium increases after claims using Tesla's in-house insurance, a reference point is the current insurance cost for a new Tesla Model 3 in China, roughly RMB 7,000. After a claim, the second-year premium jumps by approximately RMB 2,800, nearing RMB 10,000, a roughly 30% increase.

With Tesla's in-house insurance, the second-year premium after a first-year claim would increase by roughly 46.8%, potentially reaching a 70% increase with subsequent claims. This translates to an insurance cost of approximately RMB 11,900 for the Tesla Model 3 in China.

Is this model replicable?

While less complex than intelligent driving systems, this insurance model is tied to neural networks, involving data collection and feedback. The data annotation process, now automated by AI algorithms, was implemented years ago. In the Chinese automotive landscape, such highly customized insurance models are not easily replicated.

In reality, the points or criteria mentioned in the article are only part of Tesla's insurance system. Its comprehensive assessment system considers factors like occupation, age, driving locations (city, home, work), among others, to determine premiums. Overseas, premiums can vary significantly based on city and driver age, even for the same vehicle model. Therefore, while driving habits play a role, safer, slower driving indeed leads to cheaper insurance, aligning with the system's core goal of promoting safer driving.