Will impulsive car purchases die out with the rise of extended-range EVs and major model updates in 2024?

![]() 08/15 2024

08/15 2024

![]() 626

626

You will never buy the cheapest Tesla, nor the latest ZEEKR.

This joke has been circulating among early ZEEKR owners before the launch of the 2025 ZEEKR models. The so-called disruption of the times, in the automotive market of 2024, seems like a dream, beyond traditional cognitive patterns. First, the WENJIE M7 underwent a major update after just eight months. Then, more and more vehicles experienced significant price drops without warning. And now, ZEEKR has unveiled two major updates in less than eight months.

Anxiety is inevitable, fueled first by the 18-month-long automotive price war and now by the rapid pace of model refreshes and new technology applications. Observing the weekly sales rankings posted by LIXIANG, the sales of WENJIE suddenly plummeted from nearly 10,000 to under 4,000. Witnessing this unexplained decline and hearing the latest feedback from BMW dealers, "Continuous price cuts have deterred many from placing orders. Only when prices stabilize, customers' anxiety begins to subside," it seems clear that anxiety may have put a pause on impulsive car purchases for many.

The new market rhythm is one of annual model updates or major price drops that hurt early adopters, while the new technology trend is the increasing prevalence of extended-range EVs. Together, these factors are stifling impulsive purchases, with the silver lining being that consumers are gradually becoming more rational.

Who will HUAWEI and ZEEKR's frequent updates deter from impulsive purchases?

As Yu Chengdong revealed at the AITO S9 launch event that the WENJIE M7 Pro would debut at the Chengdu Auto Show, those familiar with HUAWEI noticed a boomerang effect, once again causing cognitive dissonance among consumers. The prerequisite is that Yu Chengdong has repeatedly emphasized HUAWEI's focus on intelligence, where high quality comes at a cost, making new vehicles priced below 300,000 RMB unprofitable.

However, the upcoming WENJIE M7 Pro will feature HUAWEI's Kunpeng ADS Pro intelligent driving system without a LiDAR. Considering the lackluster sales of the AITO S7, the number of models priced below 300,000 RMB has increased from two to three after the second launch. In other words, HUAWEI's Hongmeng Intelligent System is not only targeting the 300,000 RMB market but also making new attempts in the 200,000-250,000 RMB segment.

Nonetheless, the rapid update of the WENJIE M7's phone mode has led to many owners receiving their vehicles only to find them outdated four months later. The decline in weekly sales figures is unclear whether it's due to high temperatures, excessive prices after the update, or mere market observation. This answer will only be revealed in the monthly sales rankings on September 1.

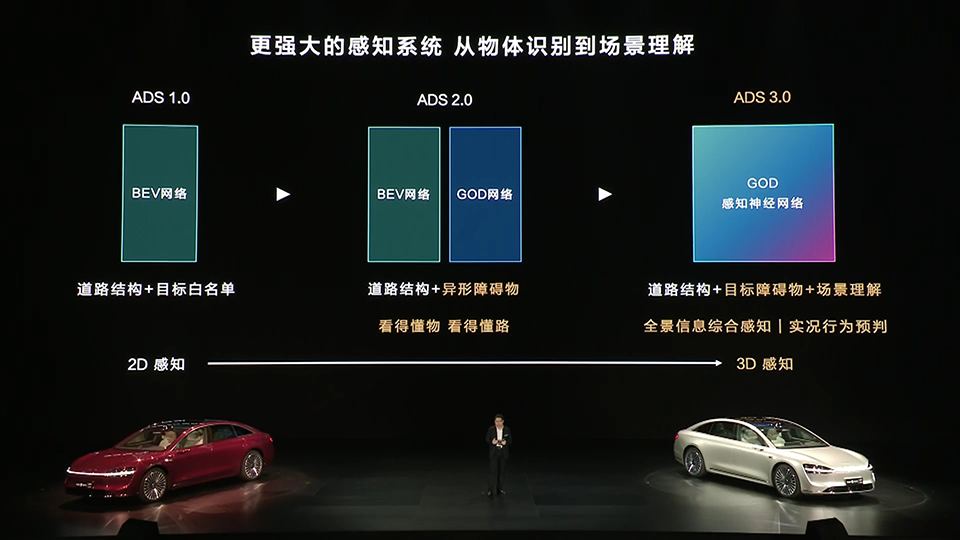

The same can be said for ZEEKR. In the 2025 ZEEKR 001 and ZEEKR 007, it's evident that An Conghui's choice is "intelligent driving is crucial, and we must quickly catch up." Despite ZEEKR's unique advantages in mechanical quality, vertical integration, tuning, EV technology, and cost reduction, it doesn't want to rely solely on one strength but aims to be a well-rounded player.

The core message conveyed during the entire launch event was that the 2025 ZEEKR 001 and ZEEKR 007 would address their shortcomings in urban NOA intelligent driving and further enhance their smart cockpits, keeping pace with the latest trends and incorporating AI-powered proactive services. While the second-generation Golden Brick battery, faster charging speeds, and software algorithms that improve the 0-100 km/h acceleration times by 0.1 and 0.4 seconds, respectively, are also important, they are not the main focus.

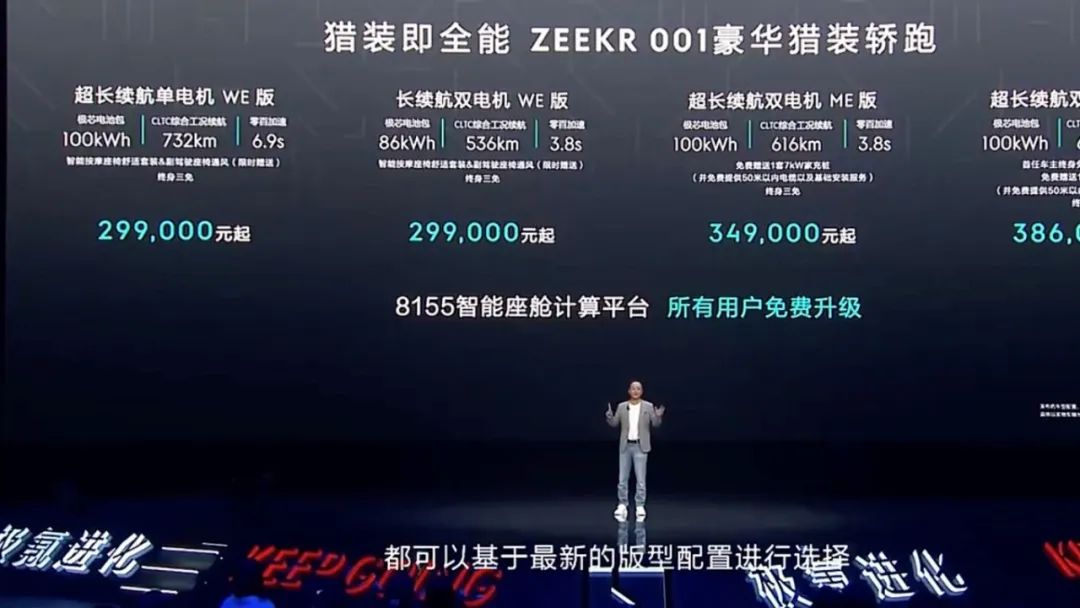

In summary, it's undeniable that the 2025 ZEEKR 001 and ZEEKR 007 offer impressive product capabilities. The ZEEKR 001 adds LiDAR, dual Orin-X chips, and urban NZP with minimal price increases, while the ZEEKR 007 offers price reductions and upgrades, with prices generally dropping by 20,000-30,000 RMB, faster acceleration, elimination of non-intelligent driving variants, and quicker charging.

However, the faster and more significant improvements in product capabilities inevitably stir up emotions among early adopters. After all, it's only been six months, and the same price now offers nearly transformative performance, requiring time for consumers' psyches to adjust.

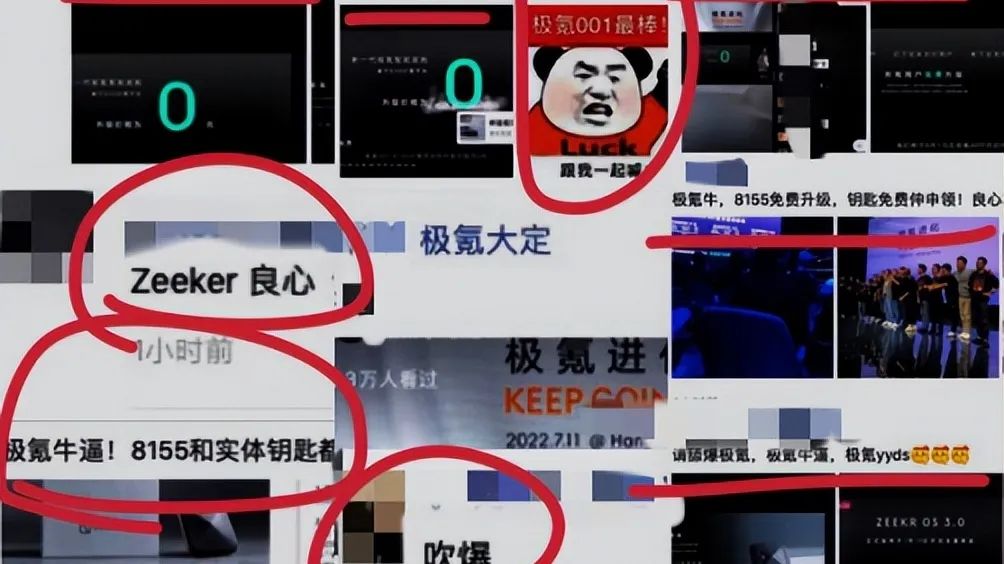

Nevertheless, given ZEEKR's previous marketing efforts, there's still room for redemption. In July 2022, ZEEKR addressed early criticisms about its infotainment system by offering free upgrades to the 8155 chip for ZEEKR 001 owners. This instantly turned public opinion and boosted the brand's reputation. By spending 300 million RMB to resolve an old issue, ZEEKR not only created a significant advertising opportunity but also established itself as an industry benchmark overnight.

Similarly, the current situation has a solution, provided that ZEEKR can quickly complete the technical loop for mapless NZP and offer it to early adopters, democratizing this capability.

Therefore, both HUAWEI and ZEEKR are gradually setting a rapid pace for market competition, with highly competitive subsequent products that challenge traditional consumer perceptions. For example, although the 2025 ZEEKR 001 has already been launched, rumors of a mid-cycle refresh with comprehensive exterior, interior, and technological upgrades for 2025 have already circulated among owners.

As for who will be deterred from impulsive purchases due to this accelerated pace, the answer undoubtedly lies with those seeking stability. According to two sets of data released in July, the National Bureau of Statistics reported that in the first half of the year, the per capita disposable income of Chinese residents was 20,733 RMB, a nominal increase of 5.4% year-on-year, and a real increase of 5.3% after adjusting for price factors.

Another set of data comes from the People's Bank of China, which reported that as of the end of June this year, the total balance of domestic and foreign currency deposits was 301.68 trillion RMB, an increase of 6% year-on-year, with RMB deposits increasing by 11.46 trillion RMB in the first half of the year.

With income growing by 5.4% and deposits by 6% year-on-year, despite differences in calculation methods, it is clear that Chinese people are increasingly saving money and seeking relatively stable asset preservation, a trend that is here to stay.

Whether automakers will adapt to this trend in the future will be an important observation point. They can continue this rapid pace, but if they can Preview new car launches in advance, similar to NIO, Mercedes-Benz, and BMW, rather than surprising consumers, it may stimulate more impulsive purchases.

Extended-range EVs: A cure or poison for novice drivers?

In addition to the unpredictable acceleration of major model updates, consumers are also observing the influx of new technologies, particularly as extended-range EVs gain popularity and attract more players.

Over the past decade, consumer behavior in the Chinese automotive market has remained consistent, with following the crowd as a dominant trend. However, previously, gasoline-powered vehicles dominated, so after the explosion of domestically produced SUVs in 2014, sedans suffered while all domestic automakers profited.

But a decade later, the dynamics have changed. As extended-range EVs gain popularity, some vehicles unsuitable for this technology are still "forcing" their way in.

Statistically, extended-range EVs represent the largest growth opportunity in sales, attracting more players to the market, but issues have also arisen.

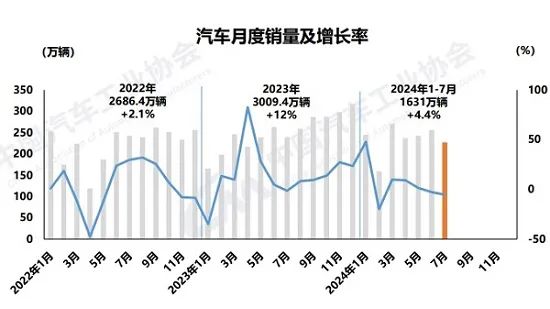

In July, total automotive sales reached 2.262 million units, down 11.4% month-on-month and 5.2% year-on-year. The decline was mainly driven by a significant contraction in gasoline-powered vehicle sales, which totaled only 742,000 units in July, compared to 853,000 new energy passenger vehicles, resulting in a penetration rate of 53.5%. Among these figures, pure electric vehicle sales growth has remained below 10% for an extended period, while plug-in hybrids (including extended-range EVs) with over 50% growth have become the savior of the automotive and new energy markets.

According to statistics, in June 2024, pure electric vehicles accounted for 57% of new energy vehicle sales, narrow-definition plug-in hybrids for 31%, and extended-range EVs for 12%. In 2023, the figures were 69% for pure electric, 32% for narrow-definition plug-ins, and 8% for extended-range. In short, as pure electric vehicles become harder to sell, extended-range EVs are stealing customers with range anxiety.

Currently, there are fewer than 30 extended-range EV models on the market. However, by the end of this year, this number is expected to exceed 50. Automakers are constantly seeking bluer oceans in their internal competition, and extended-range EVs offer a low-tech-threshold, low-cost option, making them an attractive choice.

However, extended-range technology is not suitable for all models. At the end of July, it was revealed that the V23 model from the icar brand of Chery Automobile had temporary mufflers and exhaust pipes added to its test vehicles, even though it had previously been showcased as a pure electric vehicle in public.

Some netizens commented that Chery had succumbed to the popularity of extended-range technology. However, discussions within the automotive industry suggest otherwise. Firstly, using a small battery for extended range can lead to reduced power at low battery states of charge (SOC) and high fuel consumption due to sustained high loads on the range extender, which cannot exceed physical limits. Secondly, due to the inherent high cost of large batteries, the bill of materials (BOM) for vehicles is difficult to reduce, explaining why few extended-range models are priced below 150,000 RMB. Thirdly, the inherent conflict between low pricing and high costs directly squeezes automakers' profits, potentially leading to a vicious cycle of selling cars at a loss.

Currently, extended-range models that achieve monthly sales of over 5,000 units have a CLTC pure electric range of over 200 km, with the WENJIE M7 offering 210-240 km, the LIXIANG L6 offering 212 km, and the Leapmotor C10 offering 210 km. In terms of pricing, a few models are priced below 150,000 RMB, but they typically serve to lower the starting price. For example, the eπ007 200Air version is priced at 131,600 RMB, but the volume model, after discounts, is only 8,000 RMB more expensive.

The recent two new range-extended vehicles in the industry, the test car of Chery iCar V23 and the range-extended version of Wuling Hong Guang, are representative examples of forced implementations. A good range extender requires a large battery with a pure electric range of around 200 kilometers, which necessitates a large size, making current range-extended models at least mid-sized SUVs/sedans. However, the iCar V23 falls short in both aspects, positioning itself as a compact SUV and unable to accommodate a large battery. With an estimated price below 130,000 yuan, it cannot support the BOM costs. Therefore, when netizens advise caution, it implies that Chery iCar can only use a small battery, which leads to higher fuel consumption, significantly higher than that of new energy vehicles. Similarly, news about the range-extended Wuling Hong Guang also indicates a pure electric range of only 43 kilometers upon its declaration, meeting the purchase tax threshold but falling short of the 50-kilometer requirement for new energy vehicle licensing. As a trade-off, it sacrifices horsepower for torque, giving up power and transforming into a specialized vehicle catering primarily to urban logistics needs.

Range extension technology can indeed leverage its advantages in larger vehicles, offering the flexibility of being used as both an EV and an ICEV, eliminating range anxiety, and supporting advanced intelligence. However, its inability to adapt to lower-priced, smaller vehicles that cannot accommodate large batteries is an inherent drawback.

As sales of range-extended vehicles continue to soar, they are also confronted with traditional issues faced by internal combustion engines, such as carbon deposits and oil burning. This combination of popularity and unresolved issues has led to increasing caution among potential buyers.

Closing Remarks

In short, as technology rapidly advances and competition intensifies, many things are being phased out. While price wars persist, automakers like BMW, Mercedes-Benz, and others are striving to stabilize pricing and pace, offering more humanistic considerations to reshape consumer perceptions. This rationale also applies to the introduction of new vehicles and technologies like range extension.

Despite opposition from numerous automakers and executives, Lixiang ONE continues to release weekly sales reports. Despite public opinion pressures, the pace of new vehicle and technology launches remains unchanged. The Chinese automotive market is dominated by traffic and attention, but the inherent positions of consumers and enterprises maintain a stalemate where one side attacks while the other defends.

Today's growing preference for saving money, coupled with declining luxury consumption in 2024 and even the declining price of Moutai liquor, all point to the emergence of an anti-consumerist foundation.