Comparison of automobile production among provinces and cities: How does Guangdong remain the 'number one province in production'?

![]() 08/16 2024

08/16 2024

![]() 620

620

According to the Huoshi Industrial Data Center, China's automobile production reached 13.96 million vehicles in the first half of 2024, an increase of 5.7% year-on-year. Among them, new energy vehicle production was 4.903 million vehicles, up 34.3% year-on-year, with a market penetration rate of 35%. By vehicle type, 4.958 million sedans and 5.681 million SUVs were produced, with growth rates of 1.0% and 10.4%, respectively.

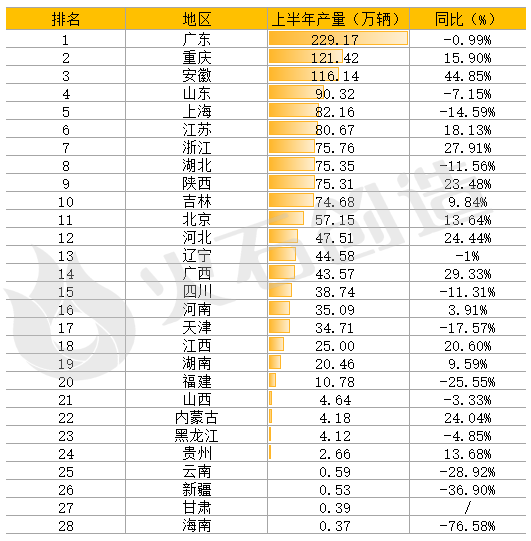

Based on the Huoshi Industrial Data Center, there are 28 provinces, municipalities, and autonomous regions (excluding Hong Kong, Macao, and Taiwan) in China with complete vehicle manufacturing capabilities. The ranking of automobile production in these 28 regions in the first half of the year is as follows:

In the first half of 2024, competition in China's automobile industry intensified, resulting in a diversified automotive landscape. Guangdong Province led the nation with a production volume of 2.2917 million vehicles, while Chongqing regained its position as the country's leading automobile city with 1.214 million vehicles produced. Anhui surpassed Shanghai and Shandong to enter the top three. Hubei, Tianjin, and other traditional automotive hubs experienced varying degrees of decline in rankings.

This article examines the fundamentals of Guangdong Province, the leading producer of automobiles in China, based on the Huoshi Industrial Data Center, aiming to provide insights for regional industrial layout planning.

Guangdong's Automotive Industry Fundamentals

In the first half of this year, Guangdong produced 2.292 million automobiles and 1.304 million new energy vehicles, both ranking first nationwide and significantly outpacing the second and third places. According to the Huoshi Industrial Data Center, Guangdong produced 5.1919 million automobiles in 2023, up 16.9% year-on-year, 7.6 percentage points higher than the national average, maintaining its top position nationwide for seven consecutive years. Among them, 2.5318 million new energy vehicles were produced, up 83.3% year-on-year.

Guangdong is one of the major automobile production bases in China. In 2022, the province's automobile manufacturing industry achieved an industrial added value of 244.227 billion yuan and operating revenue of 1.198744 trillion yuan, exceeding one trillion yuan for the first time and becoming Guangdong's eighth trillion-yuan industrial cluster.

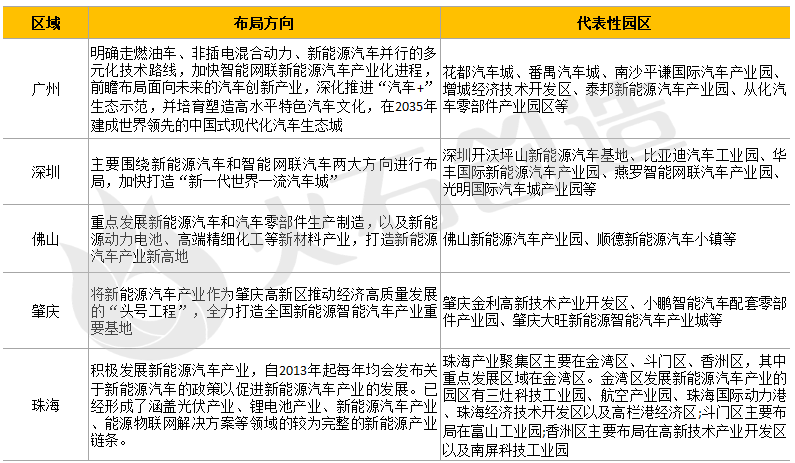

In terms of industrial layout, Guangdong follows the principles of "regional agglomeration, centralized entities, and integrated whole-part collaboration" to coordinate industrial layouts across the province and guide differentiated and coordinated development among regions. Guangzhou, Shenzhen, Foshan, and Zhaoqing collaborate to leverage the leading role of automakers and enhance the concentration and local supporting capabilities of the automotive industry. Cities such as Zhuhai, Shantou, Shaoguan, Meizhou, Huizhou, Dongguan, Zhongshan, Jiangmen, Yangjiang, Zhanjiang, Maoming, and Qingyuan are making concerted efforts to create differentiated automotive parts clusters.

Key Automotive Industrial Bases in Guangdong Province

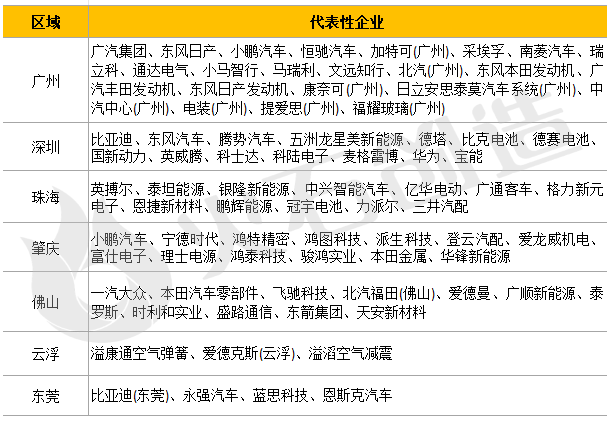

In terms of enterprise agglomeration, Guangdong boasts a robust automotive industry chain, encompassing complete vehicle manufacturing, parts research and development, design, production, and sales. According to the Huoshi Industrial Data Center, there are over 1,000 above-scale automobile and parts enterprises in Guangdong.

Concentration of Key Enterprises in Guangdong Province

With the growth and expansion of domestic brands such as BYD and GAC Motor, and the gradual development of new energy automakers like GAC Aion and XPeng, Guangdong has formed a diversified automotive industry landscape encompassing Japanese, European, and domestic brands.

The industrial chain in Guangdong has gradually improved, and the cluster effect has continued to strengthen. Guangdong has established a comprehensive industrial chain centered on complete vehicle manufacturing. To accelerate the high-quality and innovative development of the automotive industry cluster, Guangdong released the "Guangdong Province Strategic Pillar Industry Cluster Action Plan for Automotive Development (2023-2025)" in early 2024, which proposes achieving notable progress in cultivating a world-class automotive industry cluster by 2025, with operating revenue exceeding 1.35 trillion yuan, automobile production exceeding 5.3 million vehicles, and new energy vehicle production exceeding 3 million vehicles.

Guangdong is transitioning from a "world factory" to a manufacturing powerhouse. Leveraging China's large domestic market and Guangdong's robust industrial base and superior business environment, a globally competitive automotive industry cluster is emerging.

Huoshi Industry Data

Focusing on nine strategic emerging industrial chains, Huoshi provides massive and multi-dimensional data on key cities' industrial chain maps, supply chain maps, and industrial park information, facilitating precise implementation of urban industrial investment strategies.

Huoshi Enterprise Map and Business Score

Based on non-public financial data from enterprises nationwide, this tool is used to accurately assess business performance, industry trends, and screen potential enterprises based on customer entry criteria.

Huoshi Park Data enables users to precisely locate parks, enterprises within parks, and other derivative information according to their needs. Huoshi Invoice Data and Analysis Reports provide comprehensive financial and tax credit information such as basic enterprise information, financial invoice analysis, tax risk assessment, and comprehensive fiscal and tax risk assessment, enabling users to quickly understand an enterprise's financial and tax status and inform credit transaction decisions. The Biomedical Industry Data correlates data from various dimensions to each node of the industrial chain map, providing comprehensive data on the biomedical field to assist financial institutions, market analysts, researchers, and investors in gaining insights into industry trends, selecting high-quality enterprises, and making informed decisions. Other industrial data services include Huoshi Tendering and Bidding Data, Huoshi Industry Research Reports, Huoshi Risk Big Data, and Huoshi Enterprise Reach Data.