Focus Media, defying macroeconomic growth?

![]() 08/19 2024

08/19 2024

![]() 635

635

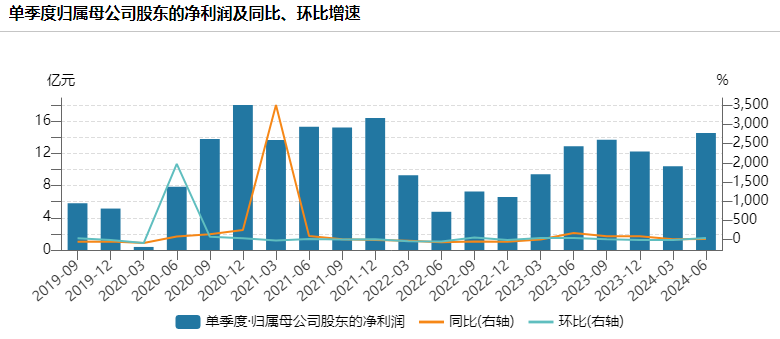

Recently, Focus Media released its mid-year report. In the first half of the year, Focus Media generated revenue of 5.97 billion yuan, up 8.2% year-on-year; net profit was 2.49 billion yuan, up 11.7% year-on-year.

Everyone knows that the advertising industry is significantly influenced by the cyclical nature of the macroeconomy. When the economy is doing well, people not only have money to spend on advertising, but also compete to advertise; when the economy is weak, advertising budgets become tight.

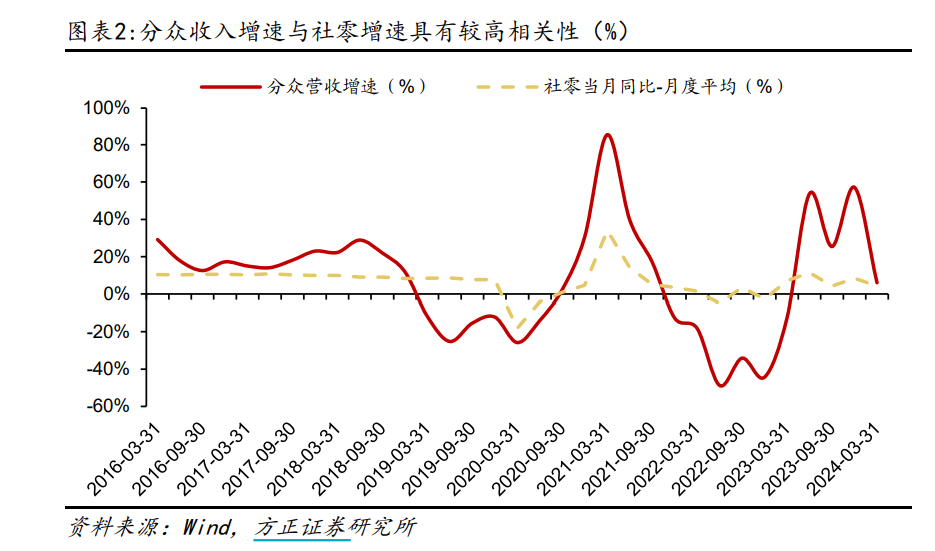

Companies like Focus Media are typical pro-cyclical enterprises. In past years with a poor macroeconomic environment, Focus Media experienced significant negative growth. When comparing the monthly average growth rate of China's total retail sales of consumer goods with Focus Media's past revenue growth rates, a strong positive correlation can be observed over a longer time horizon. Meanwhile, the fluctuations in Focus Media's revenue are even more pronounced.

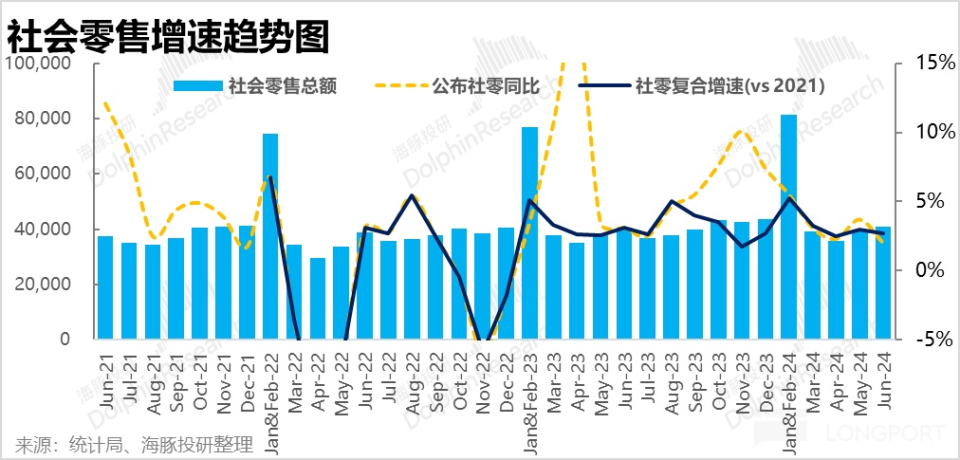

There's no need to elaborate on the current macroeconomic environment. Since April, the compound growth rate of social retail sales has hovered below 3%, indicating a notable slowdown in domestic consumption since April.

Despite the current macroeconomic downturn, Focus Media is defying the trend and growing?

I. Elevator Media Leader

Focus Media's business is straightforward, primarily selling elevator advertisements and cinema advertisements.

Elevator advertisements account for over 90% of its business, and it pioneered the "building elevator" advertising scenario.

Building elevators are an essential urban infrastructure, and this scenario is unique. Advertisements placed in this enclosed, mandatory space are hard to ignore.

The daily life scenario of building elevators represents four key words: mainstream crowd, inevitable, high frequency, and low interference. In other words, Focus Media's business directly targets a high-quality audience and ensures a high reach rate by making advertisements impossible to avoid.

What does Focus Media need to invest?

An advertising board or screen, plus rental costs and salaries for maintenance personnel, comprise the primary costs.

This is a highly profitable and straightforward business model. Focus Media's mid-year report shows a gross profit margin of 65.13% and a net profit margin of 41.1%, which are rare in the market.

While profits attract competition and potential price wars, leading to declining profit margins, why does Focus Media maintain such high profitability despite its seemingly low barrier to entry?

This business model, though simple, confers significant first-mover advantages. The core lies in securing premium resources. Only a limited number of elevators exist in prime locations, and once contracts are signed, competitors must settle for less desirable spots.

Advertisements in high-tier cities reach high-spending audiences, and the dense placement of advertisements in these cities is a key competitive advantage for elevator media. Companies with more premium spots can offer advertisers broader and deeper coverage, achieving better advertising effects and reaching a higher-quality audience, thereby increasing their value.

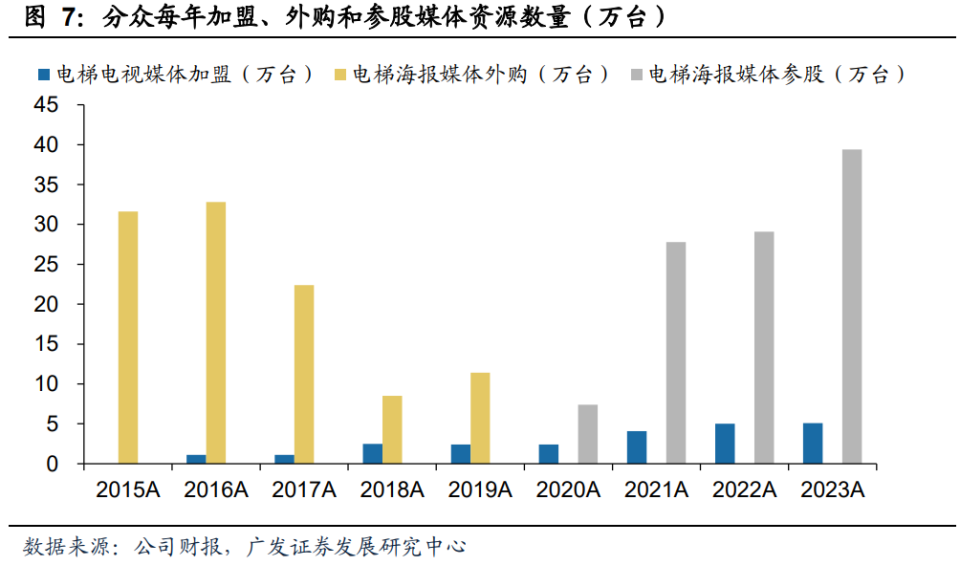

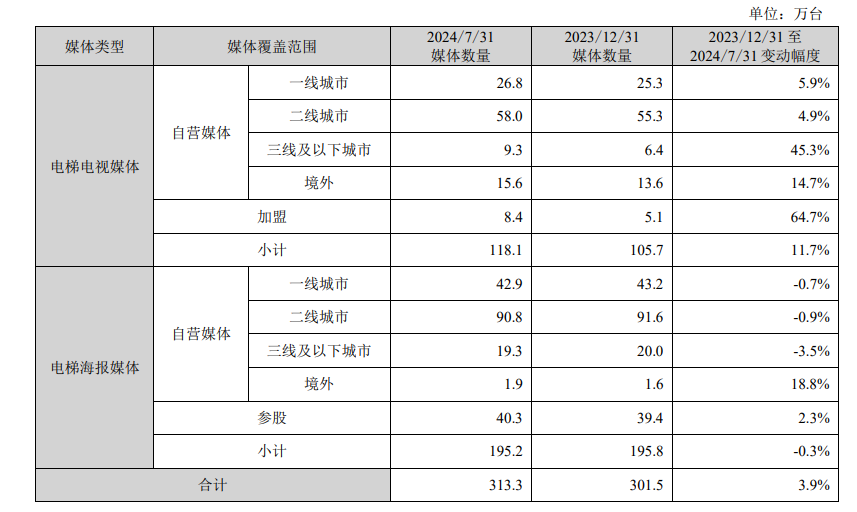

As a pioneer in the elevator media industry, Focus Media expanded rapidly through new placements and financing/mergers and acquisitions early in its development, steadily increasing its market share and consolidating its industry-leading position. Focus Media holds a large number of premium spots and continues to densify its presence in high-tier cities. In lower-tier markets, Focus Media supplements its spots through franchising, outsourcing, and equity participation. As of July 31, 2024, the company's franchised elevator TV media equipment numbered approximately 84,000 units, covering approximately 130 cities in China, and equity-participated elevator poster media equipment numbered approximately 403,000 units, covering approximately 70 cities in China.

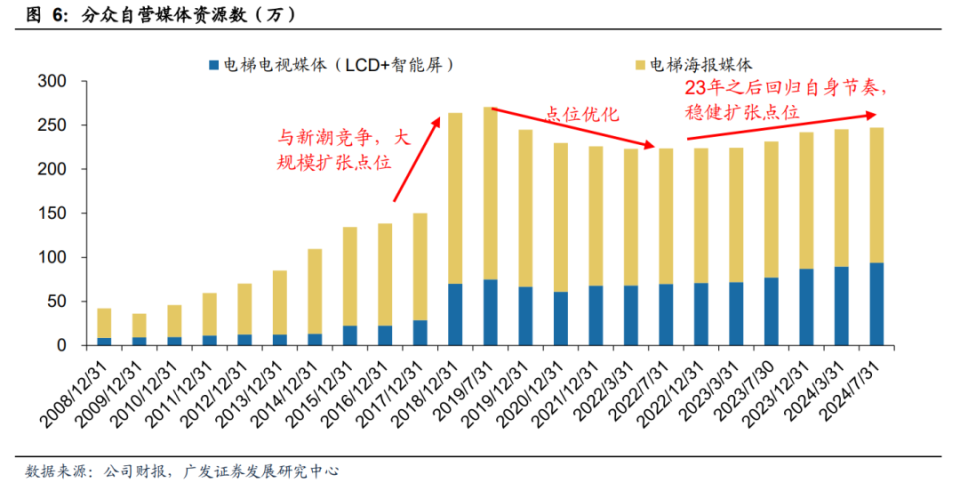

The competition with NewTrend Media at one point intensified investments, but NewTrend Media burned billions of yuan and ultimately failed to shake Focus Media's position. Focus Media has gradually returned to its original pace, and as the number of its spots steadily increases, its competitive advantage is further strengthened. Currently, Focus Media owns approximately 1.097 million self-operated elevator TV media devices and 1.549 million self-operated elevator poster media devices.

Simultaneously, Focus Media has replicated its model in other densely populated Asian cities and countries. As of July 31, 2024, Focus Media's Living Circle Media Network covers approximately 300 cities in China, the Hong Kong Special Administrative Region, and approximately 100 major cities in countries such as South Korea, Thailand, Singapore, Indonesia, Malaysia, Vietnam, India, and Japan. Currently, overseas revenue accounts for 7% to 9% of total revenue.

Amidst a challenging macroeconomic environment, small and medium-sized elevator media companies are experiencing a shakeout. On June 24, 2024, Huayu Media announced the cessation of operations, citing increasing economic pressures and intensified market competition. This has improved the competitive landscape for market leaders like Focus Media. In previous years, Focus Media's financial reports would include a risk statement mentioning that "some media outlets may compete for market share by continuously lowering prices." However, this statement is absent from this year's report, suggesting that the company may perceive an improving competitive landscape.

II. Accelerating Penetration into Lower-Tier Markets

Focus Media has a strong business model, but the market perceives its biggest challenge as a lack of apparent growth, making it less appealing. While there is some overseas expansion, the scale is still relatively small.

Nevertheless, Focus Media performed well in the second quarter of this year. In 2024Q2, it generated revenue of 3.238 billion yuan, up 10.05% year-on-year and 18.62% quarter-on-quarter; net profit attributable to shareholders was 1.453 billion yuan, up 12.65% year-on-year and 39.74% quarter-on-quarter.

Focus Media's revenue grew by 10% in Q2, significantly exceeding market expectations of 4%. However, as mentioned earlier, the growth rate of social retail sales in Q2 was notably lower than that in Q1. While Q1 provided a low base for comparison, Q2 had a higher base. Given the pessimistic outlook for social retail sales growth, a linear extrapolation would suggest that Focus Media's Q2 performance, while not pessimistic, would be average at best.

However, the results exceeded expectations. So where did this growth come from?

Actually, the advertising market performed reasonably well in the first half of the year.

According to CTR data, domestic advertising spending in the first half of 2024 increased by 2.7% year-on-year based on rate card prices. Specifically, elevator LCD and elevator poster advertising grew by 22.9% and 16.8%, respectively. From an industry perspective, the elevator media advertising market grew impressively, even outperforming Focus Media's financial results.

The divergence between advertising market data and macroeconomic conditions is unusual. Is the macroeconomic outlook more optimistic than expected, or is the advertising sector more pessimistic?

Firstly, the second quarter was significantly influenced by the 618 shopping festival. This year's 618 started earlier and ended later, extending the overall promotional period and increasing advertising spending by brands.

Secondly, the remarkable performance of the elevator media industry is likely due to price hikes by Focus Media from July 2023 to the present, resulting in a significant increase in the elevator media market as calculated by CTR. However, Focus Media's financial results did not reflect such a significant growth, suggesting that discounts were likely applied to the increased prices.

Additionally, the advertising industry often lags behind macroeconomic trends, and without the boost of the Olympics in Q3, expectations may decline.

Of course, Focus Media's mid-year report also highlights its own business performance.

Focus Media has intensified its efforts in elevator TV media. As of July 31, its elevator TV media spots had increased by 11% compared to the end of the previous year, with growth across all regions.

In particular, the lower-tier markets in China and overseas media spots continue to densify. There are now 93,000 elevator TVs in third-tier and lower-tier cities, a 45.30% increase from the end of 2023. As consumption downgrades, the previously overlooked lower-tier markets must also be addressed.

Due to the relatively low value of spots in lower-tier markets, the industry has traditionally relied on franchising. Many of Focus Media's lower-tier spots are also franchised, resulting in rapid growth in franchised spots. Additionally, the company's partnership with Meituan for low-tier cities may spark new opportunities.

Overseas, as of the end of July 2024, there were a total of 175,000 screens (a 15.13% increase from the end of 2023), including 156,000 elevator TVs (a 14.70% increase) and 19,000 elevator posters (an 18.80% increase). In terms of overseas asset returns, outdoor advertising in Hong Kong and elevator TVs in Singapore achieved positive profits in 2024H1. Southeast Asian regions such as Thailand, Malaysia, and Indonesia grew rapidly, while Japan's market expansion was slower but cost-controlled. The company plans to further expand into markets such as Brazil and Mexico in the future.

Overall, the macroeconomic environment remains challenging, but various factors within the elevator media sector, combined with Focus Media's own expansion efforts, contributed to its strong Q2 performance.

From a business structure perspective, we can gain some insights by focusing on the core building media segment.

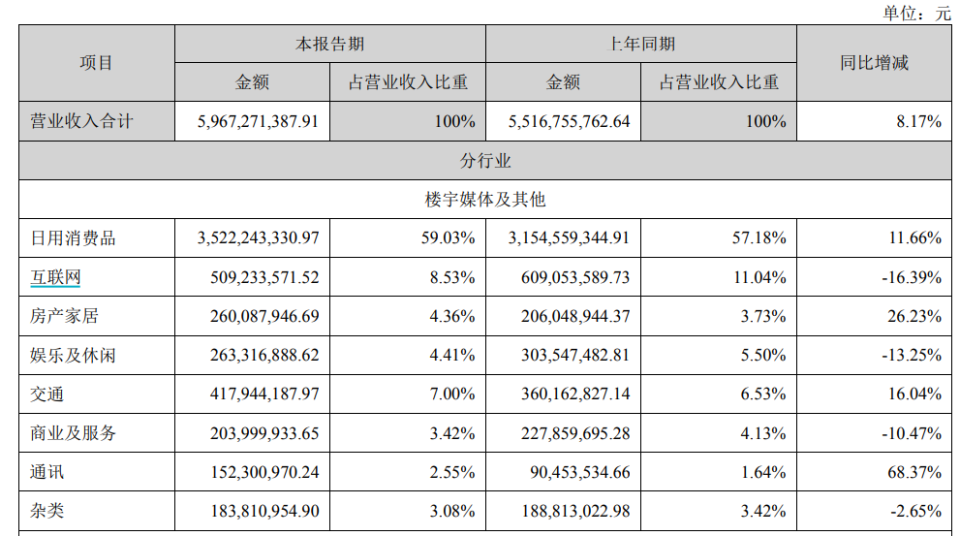

The largest share of business revenue comes from consumer goods, accounting for 59% and growing by 11.66% year-on-year, driven by both price increases and the sector's resilience to economic cycles. In 2021, consumer goods accounted for 35.4% of revenue, while the internet sector accounted for 30%; today, the internet sector's share has dropped significantly to 8.53%, contributing to the rise in consumer goods' share.

From a broader perspective, the sharp decline in internet advertising spending is understandable.

Apart from the internet, advertising revenue in the entertainment, leisure, and business services sectors declined by double digits year-on-year, reflecting the lack of confidence among discretionary consumption companies and general business enterprises. In contrast, industries such as real estate, home furnishing, transportation, and communications, which are more necessity-driven, recorded double-digit revenue growth.

Currently relying primarily on spots in first- and second-tier cities, Focus Media remains closely tied to the broader economic environment. Looking ahead, with the approaching global interest rate cut cycle and more room for domestic policy maneuvers, the macroeconomic outlook may change.

Conclusion

In the past, the market had many concerns about Focus Media, including competition from NewTrend Media and the rise of Douyin (TikTok). Douyin's algorithm-based recommendation system and strong ad conversion capabilities, coupled with elevator signal availability, raised concerns that people may spend their time scrolling through their phones in elevators instead of paying attention to advertisements.

However, over time, it has become apparent that companies seeking to establish their brands in consumers' minds will continue to advertise on Focus Media, while those aiming for quick conversions may prefer short video advertising. This gradual differentiation in advertising strategies complements each other.

Therefore, within its niche, Focus Media remains a relative monopolist, and the competitive landscape is improving. The highly profitable Focus Media has also arranged for cash dividends of no less than 80% of its net profit attributable to shareholders over the next three years, making it a high-yield stock with growth potential.