QTech's profit growth forecast lowered, a case of 'form over substance' in the mobile phone industry?

![]() 08/21 2024

08/21 2024

![]() 636

636

Has the mobile phone industry successfully traversed this 'dark blue light zone'?

From a results-oriented perspective, the recovery of the mobile phone industry has once again been confirmed. Following the recovery in performance in 2023H2, in late July this year, Sunny Optical, a leading supplier of mobile phone camera lenses, once again released an earnings forecast for the first half of 2024 that exceeded expectations. On August 12th, camera and fingerprint sensor manufacturer QTech also announced significant increases in both revenue and profit.

However, surprisingly, after the earnings release, investment institutions such as UOB Kay Hian and CMB International, which had previously given QTech higher valuation expectations, maintained their buy ratings at the current price while slightly lowering their valuation expectations. The reason given was that they believed the visibility of QTech's business prospects was limited. So what exactly is going on here?

Collective surge in profits for mobile phone suppliers, sending share prices soaring

This round of adjustment continued until the third quarter of 2023. With the arrival of the replacement cycle and the return of Huawei mobile phones, the domestic mobile phone consumption market finally ended this long recession of over three years, and the performance of suppliers such as QTech also showed a tangible turnaround.

The financial report shows that QTech, a supplier of camera modules and fingerprint sensors, reversed its declining performance trend in the second half of 2023 for the first time and achieved significant performance recovery in the first half of 2024.

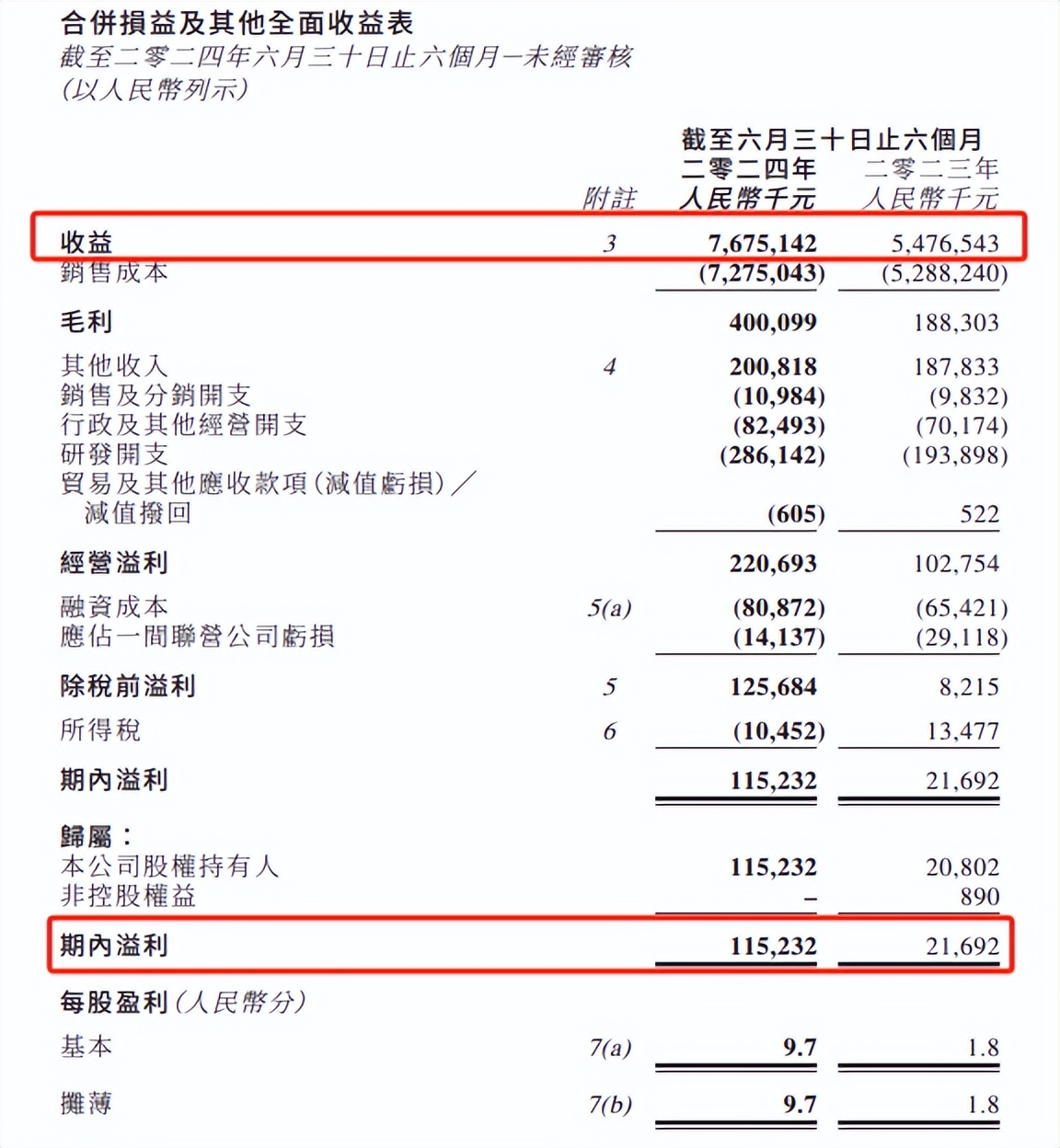

In 2024H1, QTech's unaudited revenue increased by approximately 40.1% year-on-year to RMB 7.675 billion, while net profit increased by over 4.5 times year-on-year to RMB 115 million. Both key operating metrics recovered to the same level as in the same period in 2022. The company attributed this to the lower base in the same period last year and the robust recovery in shipments and profit margins of camera modules and fingerprint sensor modules.

Notably, its net profit recovery elasticity is significantly stronger than its total revenue. The reason for this, apart from the scale effect brought about by high production rates, may also be closely related to the shift in supply and demand trends in the consumer market.

In the third quarter of 2023, the return of Huawei mobile phones opened up a gap in the mid-to-high-end mobile phone market, which had been dominated by Apple. At this time, domestic brands such as Vivo and Xiaomi, which had been accelerating their layouts in areas such as ultra-thin foldable screens and sophisticated photography and videography, accelerated their attacks on this price segment market.

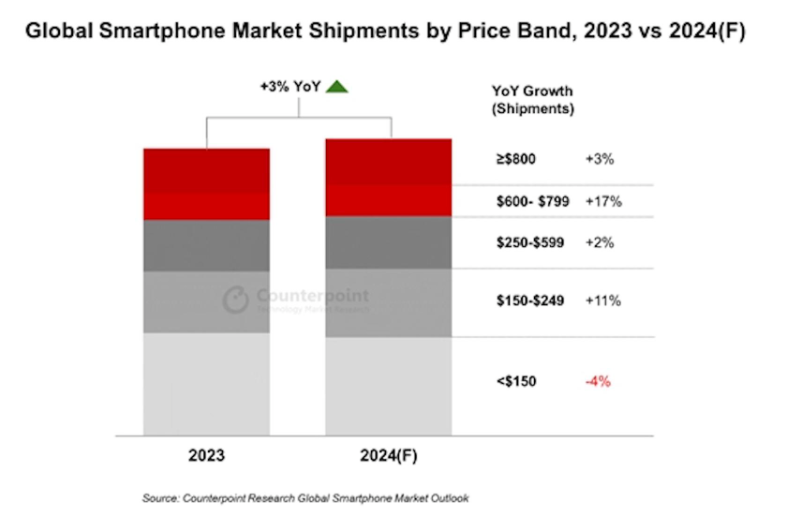

According to Counterpoint's report, shipments in the mid-to-high-end smartphone market, priced between USD 600 and USD 799, increased by 17% in 2024. With the support of innovative technologies, consumers' willingness to purchase mid-to-high-end models will continue to increase.

High-end models naturally mean higher profitability. Therefore, QTech is not the only one to see a surge in profits and a significant recovery in gross margin. Other suppliers in the industrial chain, including Sunny Optical and GoerTek, have also recently released earnings reports or forecasts showing surges in profits.

In the first half of the year, QTech's gross margin was approximately RMB 400 million, or about 5.2%, an increase of 1.8 percentage points year-on-year. Over the same period, GoerTek's net profit increased by 190.44% year-on-year, with its gross margin rising from 7.29% in 2023H1 to 11.51%. Sunny Optical Technology is expected to record a year-on-year increase of 140% to 150% in net profit attributable to shareholders in the first half of 2024.

Driven by these positive factors, the share prices of consumer electronics stocks such as QTech, Sunny Optical, and GoerTek have risen sharply in the secondary market in recent days. After disclosing its latest earnings on August 12th, QTech's share price had risen by more than 25% cumulatively by the time of writing on the 19th.

Uncertainties in growth: QTech's profit expectations lowered

However, just as the market widely expected the adjustment period in the mobile phone industry to be ending, institutions such as UOB Kay Hian and CMB International, which had previously given QTech higher valuation expectations, slightly lowered their valuation expectations, with target prices lowered to HKD 6 and HKD 6.43, respectively. They believed that the visibility of QTech's business prospects was not high.

So, what are the 'blind spots' in QTech's future performance?

From a business structure perspective, QTech's mobile phone camera module and fingerprint sensor module businesses account for more than 90% of its total revenue, driving its performance fluctuations. However, since camera and fingerprint sensor module businesses are essentially low-tech manufacturing businesses with limited innovation, the manufacturers in this segment have limited say in the entire industrial chain, and their performance fluctuations are more influenced by cyclical fluctuations.

Currently, although domestic mobile phone and smartphone shipments reached a three-year high in the first half of the year, indicating the industry is entering a recovery phase, the growth rate is expected to slow down in the second half in terms of year-on-year growth in smartphone shipments.

Firstly, Huawei and Apple both plan to launch AI-powered mobile phones in the second half of the year, which is bound to raise consumer awareness of 'AI mobile phones' and stimulate a wave of replacement demand.

However, in the second half of 2024, considering the high base effect of replacement demand stimulated by Huawei's new phone launches in the second half of 2023, the overall growth rate of the domestic market is expected to slow down compared to the first half. Android smartphones, in particular, face further competition from new flagship models from brands such as Huawei and Apple.

At the same time, it is reported that the production target for Apple's AI-powered iPhone 16, which will be produced starting in August, is 89 million units for the second half of the year, compared to 88 million units for the iPhone 15 over the same period last year. This means that there has been little year-over-year growth in parts preparation for the iPhone 16. For supplier QTech, even taking into account the bullwhip effect in the supply chain, the incremental performance contribution from the 'Apple supply chain' in the second half of the year will be limited, as much of the capacity is actually being reserved for inventory for next year, when demand is still uncertain.

At this point, while QTech is an important supplier to Android brands such as Xiaomi, OPPO, and vivo, and also supplies to Apple and Huawei, considering the changes in demand from multiple sources, its growth rate in the second half of the year may remain stable, with the possibility of slowing down sequentially.

Secondly, there are also significant uncertainties on the demand side. The main factor is the expected interest rate cuts overseas, coupled with the US presidential election, which is expected to maintain a high level of the US dollar index in the short term, exposing emerging markets to exchange rate fluctuations. Since mobile phones are durable goods, consumer demand is significantly affected by price changes.

From multiple perspectives, the certainty of QTech's performance growth in the second half of the year, which earns 'hard-earned' money from manufacturing, is actually high, but the visibility of growth rate is low, mainly due to structural uncertainties in the industry.

In fact, although both research institutions slightly lowered their valuation expectations for QTech, they are still at a relatively high valuation level compared to other institutions. And even the adjusted earnings forecast still maintains a high-speed recovery trend.

According to the report from UOB Kay Hian, it lowered its earnings forecasts for QTech by 10.6%, 4.3%, and 4.8% for 2024-2026, respectively, to RMB 265 million, RMB 362 million, and RMB 436 million, but the year-on-year growth rates were still as high as 227%, 37%, and 20%, respectively. It can be seen that QTech, which relies on the industrial cycle, will continue to be in a performance recovery period in the future, which also largely reflects the current situation that the mobile phone industry is accelerating out of the 'dark blue light zone'.

To accelerate out of the 'dark blue light zone', we need both new products and new markets

As a manufacturing plant with low technical barriers, QTech's continuous performance recovery largely reflects the fact that the mobile phone industry is accelerating out of the 'dark blue light zone'.

However, it should be noted that there is still a long way to go for the global mobile phone market to truly emerge from the 'dark blue light zone'. This is mainly because the entire industry and market are pinning their hopes on the replacement cycle brought about by AI technology for the turnaround of the mobile phone industry.

On the one hand, the introduction of AI features through system upgrades provides customized solutions for specific usage scenarios, and the higher-performance user experience stimulates users' motivation to replace their phones. On the other hand, as AI functions are further extended to the mid-range market, hardware such as SoCs, batteries, and storage will all receive new AI experiences, further extending the replacement cycle brought about by AI technology.

However, from the perspective of behavioral economics, in a relatively 'conservative' consumption environment, consumer behavior will inevitably become more rational. Therefore, after the launch of AI-powered mobile phones in the second half of the year, consumers will gradually develop their own cognitive judgments about the 'AI' attributes of mobile phones. At this point, whether this model can generate truly disruptive applications between large models and hardware will determine the length of the AI replacement cycle.

Although all of this can only be judged after product launches, based on current data, expectations for 'disruptive' AI products led by Apple's iPhone 16 are declining.

Therefore, during this period, it is still necessary for other mobile phone brand manufacturers to seek incremental space in existing markets. As shown in the chart above, the global smartphone market exhibits a 'dumbbell-shaped' growth pattern when segmented by price range.

The high-end market segment needs no further elaboration, as it is showing a clear growth trend. It is expected that the year-on-year growth rate of this market segment will reach 17% in 2024.

However, the growth in demand for mid-to-low-end market segments should not be overlooked, especially the strong demand for mid-to-low-end mobile phones in emerging markets such as Africa and Latin America, which are in the transition from 4G to 5G networks, providing vast market opportunities for mobile phone brands. It is estimated that the demand growth rate for mid-to-low-end mobile phones globally will be 11% in 2024.

It can be seen that for more manufacturers that are slightly lagging behind in AI technology, laying out conventional mid-to-high-end products and overseas untapped markets is still essential. The same logic applies to 'low-cost' manufacturing plants like QTech, which are highly dependent on the prosperity of the mobile phone industry.

According to UOB Kay Hian's forecast, QTech will continue to recover its performance over the next three years following the new AI-driven replacement cycle, but the recovered net profit will still be nearly half the high point in 2021. Therefore, for QTech, how to optimize operating profits through internal drivers will be another consideration for its business performance going forward.

Currently, one of QTech's options is to lay out in the automotive market, which offers higher gross margins on products. However, the incremental performance contribution from this business is still relatively small, and it will take more time to see its growth potential and ability to resist cyclical risks.

Source: Hong Kong Stocks Research Community