Mysterious Sichuan tycoon delivers express, sending out 35 billion in the first half of the year

![]() 08/23 2024

08/23 2024

![]() 579

579

Written by Zero Degrees

On October 27, 2023, J&T Express, which spent eight years capturing the Southeast Asian express market, finally went public. On the day of its listing, J&T Express had a market value of approximately HK$106 billion, making it the company with the highest market value among Hong Kong-listed companies that year.

Recently, J&T Express released its first half-year report after going public, revealing that in H1 2024, its revenue reached $4.86 billion (approximately RMB 34.7 billion). More notably, its operations in the Chinese market successfully turned around from losses to profits.

Founded in 2015, J&T Express did not enter the Chinese market until 2019, when the market landscape was already highly consolidated. Many investors were skeptical about J&T Express's chances, but to their surprise, within just four or five years, J&T Express not only survived but also achieved overtaking success. Today, even SF Express, the leader in the express industry, cannot underestimate this "rabbit" from Indonesia that runs extremely fast.

01 Domestic Business

Finally Making Money in the Chinese Market?

In the Chinese market, J&T Express handled 8.836 billion parcels in the first half of the year, an increase of 37.1% year-on-year. With this increase in parcel volume, J&T Express achieved an adjusted EBIT of $60 million, marking its first-ever profitability.

J&T Express finally turned around from losses.

In just four years, J&T Express achieved a remarkable triple jump in the highly competitive express industry by starting out, rising to the first tier, and becoming profitable, a true miracle in the industry.

In fact, J&T Express's previous losses were primarily due to the long-standing price war in the domestic express market. The vicious price war in the express industry can be traced back to 2017, with renewed skirmishes in some regions last year, further intensifying competition.

To compete in the domestic market, J&T Express resorted to a price war by offering nationwide delivery for just 80 cents, resulting in years of losses.

However, this year, J&T Express achieved profitability primarily by reducing the cost per parcel while maintaining revenue per parcel.

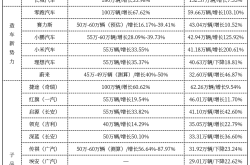

According to July briefings from various express companies, SF Express's revenue per parcel in July was RMB 15.76, down 5.80% year-on-year; STO Express's revenue per parcel was RMB 2.00, down 6.98% year-on-year; YTO Express's revenue per parcel was RMB 2.24, down 3.69% year-on-year; and Yunda Express's revenue per parcel was RMB 1.98, down 10.00% year-on-year.

While the revenue per parcel of other competitors declined, J&T Express maintained its revenue per parcel at $0.34 (approximately RMB 2.43), unchanged from the same period last year, and reduced its cost per parcel by 6% to $0.32 (approximately RMB 2.28).

So, how did J&T Express reduce its cost per parcel?

This is related to the company's operational mechanism. At the end of 2023, J&T Express underwent adjustments in its organizational structure and personnel appointments, separating the management of the group and Chinese operations. The Chinese region also welcomed its first CEO, Liu Wei, a founding team member of J&T Express and former Director of the Group's Marketing Department. This made J&T Express's system more complete and its Chinese operations more flexible.

A typical operational mechanism is price adjustment. In fact, the express industry experiences seasonal fluctuations. During peak seasons, express prices rise accordingly, and vice versa. During the earnings call, J&T Express executives stated that the recent increase in spot business, including improvements in the structure of e-commerce customers, provided some support for J&T Express's pricing in China, while another important response was the reduction in operating costs.

Thanks to continuous refinement and operational optimization in various aspects in China in the first half of the year, J&T Express completely overcame its previous dilemma of "losing money on every delivery."

J&T Express finally made money in the Chinese market.

02 International Business

Can It Maintain Its Position as the Leader in Southeast Asia?

In March of this year, J&T Express's founder Li Jie delegated his authority, no longer personally overseeing the Chinese market, and instead focused more on international operations. J&T Express's international operations are thriving.

First, let's look at Southeast Asia, where J&T Express originated in Indonesia and other Southeast Asian countries. This stronghold is of immense importance to J&T Express.

The financial report reveals that J&T Express has maintained the top market share in the Southeast Asian market for four consecutive years. However, the company in second place has a market share of 24.3%, narrowing the gap with J&T Express. To better stabilize the Southeast Asian market, J&T Express has been continuously expanding its major customers in the past year, such as partnering with cross-border e-commerce giants like Shopee, AliExpress, SHEIN, Temu, TikTok, and continuously expanding its logistics presence.

In the first half of this year, J&T Express's parcel volume in Southeast Asia increased by 42% year-on-year, and its market share increased by 2 percentage points to 27.4% compared to the whole of 2023.

At the same time, J&T Express's revenue in the Southeast Asian market increased by 22% year-on-year to $1.52 billion, with adjusted EBITDA of $210 million, up approximately 13% year-on-year, and adjusted EBIT of $130 million, up approximately 46% year-on-year.

In addition to the Southeast Asian market, J&T Express achieved its best-ever performance in new markets, with revenue reaching $290 million in the first half of the year, an increase of nearly 120% year-on-year.

This growth momentum was primarily driven by a robust 64% year-on-year increase in parcel volume in new markets. During the reporting period, J&T Express also achieved a turnaround from losses to profits in new markets, recording a gross profit of $35.022 million, and adjusted EBITDA losses of $7.84 million, a significant narrowing compared to the same period last year.

During the earnings call, J&T Express management stated that the reduction in losses in the new market segment was very noticeable in the first half of this year, as J&T Express insisted on expanding into new markets, including all countries, to establish a nationwide express network that not only serves cross-border business for international e-commerce platforms but also serves local e-commerce platforms and individual customers in each country.

Thanks to the development of international e-commerce business and the diverse customer base, J&T Express has been highly profitable in overseas markets.

03 Learning from Duan Yongping

Can It Rely on Low-Price Strategies to Capture the Market?

To the market, J&T Express's founder Li Jie is a mysterious figure. He was even absent from the listing ceremony of J&T Express.

Li Jie, 49, was born in Sichuan. Early in his career, he worked as a salesperson for a BBK (OPPO's parent company) agent and frequently won sales championships due to his excellent eloquence and interpersonal skills, attracting the attention of BBK's founder Duan Yongping. He became the fifth "Duan disciple" after Jin Zhijiang (founder of Little Genius), Chen Mingyong (founder of OPPO), Shen Wei (founder of VIVO), and Huang Zheng (founder of Pinduoduo).

In 2015, Li Jie decided to start his own business. Leveraging the strength of OPPO and VIVO's extensive offline distribution networks, J&T Express quickly gained a foothold in the Indonesian market.

According to early employees of J&T Express, during its initial stages, the company struggled to secure external orders due to its lack of brand recognition and relied on contracting OPPO's delivery services in Indonesia to survive. Although this allowed it to operate decently, it paled in comparison to the daily business volume of 400,000 parcels handled by local leading express companies.

Afterward, J&T Express capitalized on the booming e-commerce market in Indonesia and entered an acceleration mode. When J&T Express entered China in 2019, it was labeled an "outsider" in the market. To quickly establish a presence, J&T Express burned through RMB 20 billion in just 10 months. At the time, domestic express delivery prices were generally around RMB 2 per parcel, but J&T Express slashed them to just RMB 0.8 with its RMB 20 billion subsidy, halving the price and causing significant distress to competitors like STO Express, YTO Express, ZTO Express, and Yunda Express.

It was precisely through its low prices that J&T Express quickly gained recognition in the Chinese market. Looking back, Li Jie's approach bears striking similarities to that of Huang Zheng, the founder of Pinduoduo, who first used low prices to rapidly capture the market and then continuously refined management and reduced operating costs. This could be the secret to J&T Express's turnaround from losses to profits in such a short time in the Chinese market.