Betting 11.5 billion on Huawei subsidiary: AVATR wants to 'fight to the last'

![]() 08/27 2024

08/27 2024

![]() 571

571

Written by Lu Qianying

Edited by Chen Feng

AVATR is still seeking a breakthrough.

Recently, AVATR invested 11.5 billion yuan in Huawei subsidiary Shenzhen Yingwang Intelligent Technology Co., Ltd. (hereinafter referred to as Yingwang), acquiring a 10% stake.

Yingwang spun off from Huawei's BU (Business Unit) for vehicles and was registered in January this year. Huawei spun off its BU for vehicles with the aim of establishing a more open cooperation platform and forming equity partnerships with automakers to allay their concerns about "losing their souls" and thereby enhance Huawei's market influence in the new energy vehicle sector.

Currently, Yingwang's main products include intelligent driving, intelligent cockpit, intelligent vehicle control, intelligent vehicle digital platforms, and intelligent vehicle cloud services.

AVATR's early bet on Yingwang has a clear purpose: to leverage Huawei's influence to further enhance its autonomous driving capabilities and boost sales.

Image source: AVATR's official Weibo account

Behind this, despite being backed by Chang'an Automobile, Huawei, and CATL, AVATR is currently in a difficult situation.

In the past two years, AVATR has successively launched two models, but sales have remained sluggish. In 2023, AVATR's average monthly sales were only about 2,000 units; moreover, the company is still suffering from huge losses. According to Chang'an Automobile's financial report, AVATR's net loss last year reached 3.693 billion yuan, an increase of 83.22% year-on-year.

To boost sales, AVATR has been active in recent years, introducing a series of measures such as internal management reforms and sales model transformations.

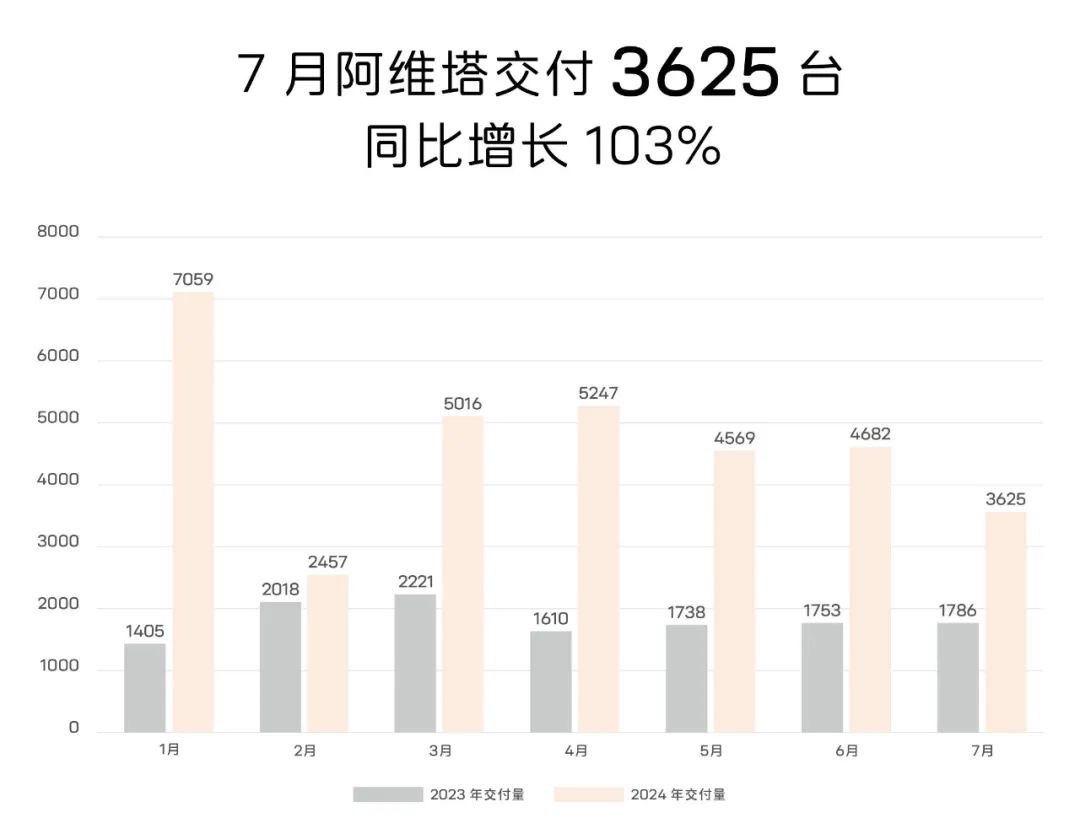

These changes have indeed yielded some results. From January to July this year, AVATR's average monthly new car deliveries were 4,665 units, compared to 1,820 units in the same period last year, representing a growth rate of approximately 156.29%.

However, from an industry perspective, AVATR's high growth rate is attributable to its low base in previous years, and it has yet to establish a certain advantage among independent high-end electric vehicle brands.

In the fiercely competitive new energy vehicle market, AVATR's move reveals both its determination to fight to the last and its desperation in facing a difficult situation.

Therefore, this tie-up with Huawei is, to some extent, a high-stakes gamble for AVATR.

1. What does AVATR hope to achieve by becoming the first automaker to invest in Yingwang?

Actually, AVATR's connection with Huawei goes back a long way.

Huawei has three modes of cooperation with automakers: vertical component supply mode, HI (Huawei Inside) mode, and HarmonyOS Intelligent Driving mode. Among these three modes, Huawei's involvement gradually deepens.

In the HI cooperation mode, Huawei provides automakers with full-stack automotive solutions, including software, hardware, and other technologies.

Since its establishment, AVATR has launched two models in collaboration with Huawei using the HI mode.

Specifically, the AVATR 11 comes standard with Huawei's full-stack intelligent vehicle solutions, including Huawei's intelligent cockpit, A0S intelligent driving operating system, and Huawei Kunpeng ADS 3.0. Meanwhile, the AVATR 12 comes standard with Huawei's ADS 2.0 advanced intelligent driving system, equipped with HarmonyOS 4 intelligent cockpit and LiDAR fusion GOD neural network.

However, among Huawei's three modes, only the Smart Selection mode has been market-verified.

Currently, only Beiqi ARCFOX and AVATR cooperate with Huawei using the HI mode, while the Smart Selection mode is more mainstream. In November last year, Huawei upgraded this mode to HarmonyOS Intelligent Driving, further elevating its strategic position.

It is worth noting that AVATR's investment in Yingwang has brought about new changes in its cooperation mode with Huawei.

Image source: AVATR's official Weibo account

"With AVATR's investment in Huawei subsidiary Yingwang, AVATR's original 'HI mode' has been upgraded to the new 'HI PLUS' mode," said Zhu Huarong, Chairman of Chang'an Automobile, on August 21. He added that AVATR and Huawei have entered into a capital partnership, and Huawei will empower AVATR in areas such as product definition, joint brand marketing, design, core technology, and user services.

It is not difficult to see that with the deepening of the partnership, AVATR will not only receive assistance from Huawei in terms of intelligent driving technology but also have the opportunity to leverage Huawei's advantages in brand marketing and user services to accelerate market capture under the new cooperation mode.

In fact, this is why many automakers are currently considering cooperating with Yingwang.

For example, on August 23, Seres also signed a share transfer agreement with Huawei and plans to invest 11.5 billion yuan in Yingwang, acquiring a 10% stake.

Before that, Huawei had also invited Qirui, Beijing Automotive Group, JAC Motor, and other automakers to invest in it and hoped that China FAW Group would join.

Huawei's previous successful cooperation with AITO has, to some extent, boosted the confidence of automakers.

Image source: AITO Automobile's official Weibo account

AITO is the first brand to collaborate with Huawei and is currently the most successful one. In the first half of this year, AITO almost single-handedly supported Huawei HarmonyOS Intelligent Driving's sales of 194,000 vehicles, helping it top the sales rankings among new force brands in China, with a strong growth momentum.

However, not all automakers' collaborations with Huawei have been successful.

For example, under the Smart Selection mode, among the nearly 200,000 vehicles sold by Huawei HarmonyOS Intelligent Driving in the first half of the year, only about 15,000 were the AITO M7, which AITO co-developed with Huawei.

In other words, even with closer cooperation with Huawei, AVATR's future market trajectory remains uncertain.

2. Is 11.5 billion yuan a burden for AVATR?

According to Chang'an Automobile's previous announcement, the funds for this investment come from AVATR's own capital. According to the agreement, AVATR will pay the 11.5 billion yuan in three installments.

For AVATR, 11.5 billion yuan is not a small amount.

According to Chang'an Automobile's financial report, AVATR's losses have continued to widen in recent years, with cumulative losses reaching 6.068 billion yuan from 2020 to 2023. In 2023, AVATR's total revenue was 5.6 billion yuan. In other words, this investment is roughly equivalent to twice AVATR's revenue last year.

However, backed by Chang'an Automobile and CATL, AVATR may not have to worry too much about funding issues. Qichacha shows that Chang'an Automobile holds a 40.99% stake in AVATR, while CATL holds a 14.1% stake.

AVATR's greater pressure lies in how to quickly boost sales, gain more market share, improve its operating performance, and strengthen its brand influence in the high-end new energy vehicle market.

In terms of sales, AVATR's current performance is unremarkable.

Image source: AVATR's official Weibo account, AVATR's delivery data from January to July 2024

Last year, AVATR's sales target was 100,000 vehicles, but it ultimately sold only 27,600 vehicles. In 2024, AVATR adjusted its sales target to 90,000 vehicles. However, from January to July this year, AVATR sold about 32,000 vehicles, failing to reach half of its target.

This is partly related to AVATR's positioning in the high-end pure electric vehicle market. Currently, the starting prices of AVATR's two models are around 300,000 yuan, which is not cost-effective. Moreover, compared with other lower-priced new energy vehicles, AVATR's product advantages are not prominent, and its brand advantage has not yet been established.

Facing sluggish sales, AVATR is seeking various ways to adjust and make breakthroughs.

On the one hand, AVATR has bid farewell to its past single product line layout of pure electric vehicles and started to walk on "two legs" with both pure electric and extended-range models.

A few days ago, AVATR unveiled its Kunlun extended-range technology and announced that it would be equipped on the extended-range hybrid product AVATR 07, which will be launched in the fourth quarter of this year. In addition, AVATR plans to launch multiple new models, including extended-range and dual-power models, to further lower the threshold for car purchases.

This aligns with the mainstream trend in China's new energy vehicle market. According to the China Association of Automobile Manufacturers, in the first seven months of this year, the sales growth rate of pure electric vehicles in China was 10.1%, while that of plug-in hybrid vehicles (including extended-range vehicles) was as high as 84.5%.

On the other hand, in addition to product updates, AVATR is also accelerating channel reforms.

Image source: AVATR's official Weibo account

Starting in April 2024, AVATR transitioned from a self-operated store model to a franchisee model, retaining only city experience centers. In addition, during the 2024 Beijing Auto Show in April, Chen Zhuo, President of AVATR Technology, stated that AVATR would expand by 120 stores this year, bringing the total to approximately 470-500 stores by the end of the year. This means that most of the newly expanded stores will be dealer stores.

In terms of personnel changes, in December 2023, Zhu Huarong, Chairman of Chang'an Automobile, succeeded Tan Benhong as Chairman of AVATR Technology. Shortly thereafter, the former Senior Executive Vice President of AVATR, Chen Zhuo, was promoted to President, taking overall responsibility for AVATR's operations and management.

In addition, AVATR has initiated a salary reform within the management. At the beginning of this year, AVATR linked the monthly income of managers above the director level directly to sales to stimulate their enthusiasm.

Currently, the effects of these measures are beginning to emerge, but they are far from sufficient.

In the first half of this year, AVATR sold 29,030 vehicles, an increase of 170% year-on-year. While this represents a significant increase, there is still a large gap compared to its annual sales target.

Long-term poor sales performance can easily trigger a chain reaction for AVATR, putting considerable pressure on its revenue and profits.

It is worth noting that to alleviate operational pressures, AVATR is also seeking external financing. This year, Chen Zhuo, Senior Executive Vice President of AVATR Technology, revealed that AVATR would initiate its Series C funding round in the second half of 2024 and strive for an IPO.

From this perspective, while AVATR's investment in Yingwang represents a potential growth opportunity, it still faces significant uncertainties. In today's fiercely competitive and rapidly evolving technology landscape, AVATR faces immense pressure.

Whether it can improve sales and achieve self-breakthrough remains to be seen.

(The featured image of this article is sourced from AVATR's official Weibo account.)