Game giants venture into VC, mass-incubating XR unicorns

![]() 08/27 2024

08/27 2024

![]() 606

606

Written by VR Gyroscope Ran Qixing

Game giants are venturing into VC, playing a new "game".

Looking at the investment and financing data of the XR industry over the past five years, hundreds of participating institutions have emerged, including leading financial institutions, industrial capital, internet giants, and state-owned assets. Among them, 37 Interactive Entertainment, an internet enterprise that started with games and successfully went public, can be considered the most unique presence in the "XR investment camp." Although it may not seem directly related to "hard tech" attributes, it has been a driving force behind the implementation of many cutting-edge technologies.

According to the financial report for the first half of 2024 released by 37 Interactive Entertainment on August 26, the company achieved operating revenue of 9.232 billion yuan, an increase of 18.96% year-on-year; net profit attributable to shareholders after deducting non-recurring gains and losses was 1.275 billion yuan, an increase of 14.27% year-on-year. The steadily rising financial data of the group has also laid a solid foundation for its investment in the hard tech industry.

The financial report also noted that the company gradually established a complete industrial chain layout of "computing power infrastructure - large model algorithms - AI applications" through technology investment, including direct or indirect investments in multiple high-quality enterprises such as Zhipu Huazhang, Baichuan AI, Moon's Dark Side, Guixin Technology, Shenyan Technology, Yahaha, Xinghe Visual Effects, Chenjing Technology, Cixin Technology, Tingyu Technology, Huixi Intelligence, Huayi Quantum, and Yizhi Electronics.

To further understand the investment logic behind 37 Interactive Entertainment, VR Gyroscope recently had the opportunity to interview Liu Yu, Vice President of Investment at 37 Interactive Entertainment, for an in-depth exchange on topics such as "37 Interactive Entertainment's investment strategy, XR and spatial computing, and the best carrier for AGI."

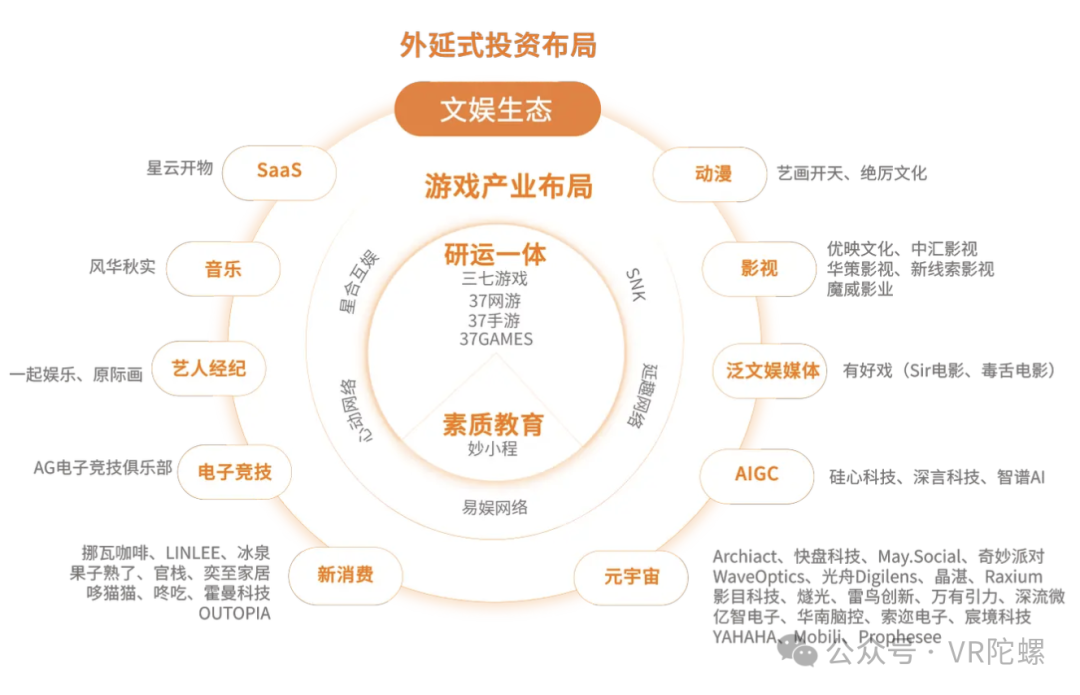

37 Interactive Entertainment's Investment Landscape

From "Culture and Entertainment" to "Hard Tech": The Evolution and Continuity of 37 Interactive Entertainment's VC Strategy

Taking 2018 as a watershed, 37 Interactive Entertainment's investments can be roughly divided into two stages.

Liu Yu told VR Gyroscope, "In the initial stage, which we call the 1.0 stage, our investments mainly focused on cultural and entertainment content, with games occupying a dominant position and being the main source of income. Apart from games, we also ventured into music, artist management, film and television, animation, and various other cultural and entertainment content-related projects."

"Taking 2018 as a watershed, 37 Interactive Entertainment's investments entered the 2.0 stage, with our focus shifting to 'tech.' We hope that the technology projects we invest in can serve the interaction of cultural and entertainment content, at least play a role in this field, and overall, it is still a To C logic."",The change in 37 Interactive Entertainment's investment logic has transformed the company from one focused on games and pan-entertainment content investments to one that places greater emphasis on technology-driven and future-oriented investments, with a focus on long-term development and strategic layout.

This change may stem from the market and environment at the time. In 2018, due to the suspension of game license approvals, the growth rate of China's game industry in overall revenue slowed down significantly, and transformation was imminent. Additionally, technological modernization is a long-term strategy in China, and the trend of technological development is irreversible. 37 Interactive Entertainment urgently needed new business growth.

What has changed is what is invested in, but what remains unchanged is the underlying investment logic. Compared with traditional VC institutions, 37 Interactive Entertainment also has its own "personality" preferences in investments. 37 Interactive Entertainment pays more attention to integration with its own product lines and the possibility of online interaction, whether through business cooperation or from the perspective of upstream and downstream industrial chains, involving new cultural entertainment, new consumption, or hard tech.

Liu Yu said, "Since the same user scenarios can be infiltrated through different platforms, we usually establish close ties between the invested enterprises and our ecosystem. Games are undoubtedly one of the most interactive fields, whether it's co-customizing products with our R&D team or globally distributing games."

Some of 37 Interactive Entertainment's Invested R&D Companies

"In terms of internationalization, compared with traditional VC institutions, we have a more global perspective. We have always had a presence overseas, and all our investments still revolve around the two core dimensions mentioned earlier: content and technology."","For the domestic market, we adopt two investment methods: direct investment and investment through funds. The fund's investment strategy mainly focuses on 'investing early, investing small, investing in technology,' with an emphasis on early-stage, small- and medium-sized technology-oriented projects. This is where we differ from most VC institutions – we have a broader global perspective and can leverage our industry background to bridge the entire ecosystem, empowering the companies we invest in as much as possible."",As a representative industry in 37 Interactive Entertainment's investment 2.0 stage, since 2018, 37 Interactive Entertainment has invested in over 20 XR-related projects, forming a nearly complete "spatial computing" industrial chain in terms of project attributes.

XR, smart cockpits may become the next-generation hardware interfaces for information interaction, and mixed reality, spatial computing is the next anticipated form of interaction.

According to public data from 37 Interactive Entertainment, its investment layout in the XR industry is extensive, covering computing chips, human-computer interaction, optics, display and materials, software tool engines, applications, and complete machine projects.

According to Liu Yu, the core members of XR chip manufacturer Wanyouyinli come from Apple's chip design team. The company mainly focuses on sensor chips in the early stages and can also cover computing chips. Its first-generation chip is mainly comparable to Apple's Vision Pro coprocessor R1.

It is reported that R1 is primarily responsible for processing data signals from 12 cameras, 5 other types of sensors, and 6 microphones, accelerating the processing of sensor data and reducing latency. For MR headsets with VST paths, this coprocessor is crucial, significantly reducing the dizziness caused by latency. Meanwhile, the Android XR camp is also in urgent need of such a coprocessor, and Wanyouyinli is one of the most anticipated Chinese players in this field.

In terms of complete machine investments, Liu Yu said, "In terms of complete machines, we participated in the angel round investment of INMO in 2021 and invested in PICO in 2023. Based on current market data, they have achieved industry-leading positions in AR all-in-one devices and Birdbath viewing products, and they have basically realized a global business strategy."",According to the China 2023 VR/AR Shipment Report released by IDC, in 2023, China shipped 725,000 AR/VR headsets (sales-in basis), a year-on-year decline of 39.8%. Among them, 262,000 were AR shipments, up 154.4% year-on-year. The top five AR shipments in China in 2023 were XREAL, PICO, Rokid, INMO, and Huawei.

In addition to chips and optics, 37 Interactive Entertainment has also invested in upstream material companies such as GaN (Jinzhan Semiconductor), which can be used in power, radio frequency, and new displays. Liu Yu believes that as an upstream material company, GaN technology can deliver materials and epitaxial wafers at different development nodes and application scenarios across various industries, possessing long-term revenue-generating capabilities and investment value.",In this regard, from XR chips, displays, and materials, XR optics, human-computer interaction, XR complete machines to applications, 37 Interactive Entertainment's investments in hard tech have nearly formed a complete "spatial computing" industrial chain.

Pursuing Long-term XR Investment and Focusing on Excellent XR Targets

In 2023, Apple officially launched the Vision Pro, a new spatial computing concept that deeply binds XR technology with the next-generation computing platform. At the same time, XR-related investment and financing projects began to recover.

However, practical factors such as the ultra-high price of $3,499, the heavy headset usage method, and limited application scenarios for the product have inhibited its explosion, and multiple market research institutions expect Vision Pro sales to remain at 500,000 to 600,000 units in 2024.

Regarding this, Liu Yu said, "In fact, 37 Interactive Entertainment proposed the strategy of investing in XR in 2021, and even now, we have not allowed changes in product sales or trends to affect the overall strategy's direction."","We believe that this may simply be due to some differences in development trajectories among categories, fluctuations and variations caused by different stages, which are cyclical issues. We will not formulate investment strategies based on a single hot topic."",37 Interactive Entertainment invested in XR enterprises such as AR waveguide manufacturer WaveOptics, Guangzhou Guangzhou Semiconductor, XR chip manufacturer Wanyouyinli, and VR content manufacturer Archiact before the launch of Vision Pro.

As we all know, compared with many unicorn projects, XR will not generate significant returns in the foreseeable short-term future, and the commercial investment cycle is relatively long.

In Liu Yu's view, some XR projects indeed have a long commercialization cycle, and it is difficult to scale up in the short term. She said, "As early investors, we can choose to exit at any time in subsequent funding rounds for some projects. Not all investments need to be held long-term. We also have long-term confidence in the development of the XR/spatial computing industry. Meanwhile, among the projects invested by 37 Interactive Entertainment, we prefer some human-computer interaction technologies that are closer to the underlying supply chain. They usually have more landing scenarios and commercial cash-in capabilities, with potentially higher returns."",Finally, Liu Yu revealed that 37 Interactive Entertainment is still highly focused on the XR industry and recently looked at a material project aimed at reducing the weight of AR glasses and further optimizing product wear design.

In Closing

Talented horses are common, but good judges are rare.

In fact, it's not uncommon for game companies to venture into VC. The profitability of the gaming industry is usually strong, and many game companies can generate stable cash flows, providing them with ample funds to support venture capital projects.

At the same time, stable cash flows enable game companies to take on higher risks and support startup projects that may take longer to become profitable. Overseas giants such as Nintendo, Epic Games, and Activision Blizzard also have related strategic investment divisions. However, among the investments of many internet giants, 37 Interactive Entertainment, which is deeply invested in XR, stands alone.

Although the essence of venture capital is to pursue equity appreciation and achieve higher returns, from a more macro perspective, it also plays a crucial role in driving product innovation and technological development.

Looking ahead for a long time in the future, it is foreseeable that XR will still be a niche market. From technology breakthrough to market breakthrough, it still needs more "37 Interactive Entertainments".