"Roll pricing" is a dead end, so why does 1688 value user logic in its anti-internal competition strategy?

![]() 08/29 2024

08/29 2024

![]() 659

659

Author: Zeng Xianyong

Publisher: Atong Observation Yongli Business Review

This afternoon, I wrote the following in my WeChat Moments with care:

"I just listened to a fascinating sharing from a second-generation rich kid, a second-generation factory owner, and a Master of Data Science from Stanford University.

Born in 1993, he spent ten years in the US before returning to China three years ago. He worked at a unicorn company before choosing to take over his father's business and become the general manager of the family enterprise.

He knows how to use AI to design product packaging in minutes, manage customers meticulously with SCRM systems, and promote the family brand into international markets to compete with foreigners..."

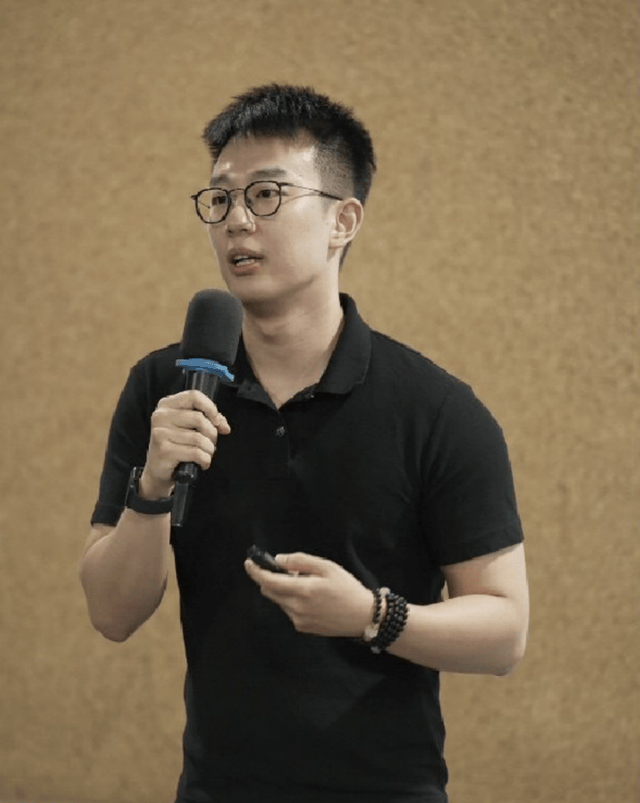

The 'second-generation rich kid' I mentioned in my WeChat Moments is Dong Fanming.

After graduating from high school in the US and eventually earning a Master's degree in Data Science from Stanford University, Dong Fanming did not choose to stay overseas like many other young people, working permanently for a tech giant with a high-tech aura.

After completing his graduate studies at Stanford, Dong Fanming joined an American AI unicorn company. However, he eventually gave up the already listed unicorn company to return to China and take over his father's mooncake factory, becoming the general manager of Shanghai Xinmai Food Industry Co., Ltd., responsible for OEM business for well-known brands such as LV, Gucci, Dior, etc.

"I still hope to combine my expertise and view how AI and traditional industries can better integrate from a higher perspective. I thought about this for a long time," Dong Fanming said after much deliberation, deciding to take over his father's business and become a 'post-90s general manager.'

The Trouble with Internal Competition

Ambitious Dong Fanming wears three hats – strategic planner, business manager, and sales director.

He aims to establish a comprehensive strategic system. However, transitioning from a relatively flat internet company to a hierarchical family business took some getting used to. He knew he had to make changes.

Moreover, when Dong Fanming first returned to China, he was even unsure about seating arrangements and toasting rituals during business meals with Chinese clients...

However, these are not the core issues. Since becoming a member of 1688's Super Factory program, Dong Fanming has been pondering not only his company's brand positioning but also how to combat internal competition.

Dong Fanming, General Manager, Shanghai Xinmai Food Industry Co., Ltd.

"I position my company as the 'source factory for the world's top luxury brands,'" Dong Fanming said. "We joined 1688 around 2021, and our mooncake sales were quite good in the first year. However, our prices are actually higher than 90% of other factories. One of our positioning concepts is that high cost-performance does not equal low prices."

Dong Fanming was puzzled to find that some competitors sold the same products much cheaper. For example, while Shanghai Xinmai's mooncakes sold for five yuan, some competitors offered them for just one yuan. They were amazed – how could anyone produce a mooncake for just one yuan when the cost alone exceeded that? Yet, they were indeed selling them, and Dong Fanming bought one to try – it was indeed a mooncake, not some gimmick.

He Yudi, General Manager, Dongyang Shangdao Fishing Tackle Co., Ltd.

As a peer, He Yudi, General Manager of Dongyang Shangdao Fishing Tackle Co., Ltd., encountered similar oddities in the fishing line industry. Suddenly, many merchants offering five-yuan fishing lines with free shipping emerged, which is unprofitable in the industry.

He Yudi wondered how these competitors could offer five-yuan fishing lines with free shipping and still make a profit. Later, he learned that many merchants included promotional game cards from game companies in their packages, subsidizing losses on fishing lines through advertising revenue...

"Many people say the market is highly competitive. Why? I think it's because there's too little differentiation among competitors. The less differentiation, the more intense the competition. For us, it's about creating differentiated experiences and widening the brand gap," Dong Fanming believes. The focus should be on enhancing the customer experience, not just on price competition. Brands must find suitable channels to enter suitable markets and sell suitable products.

"As the market pie gets smaller, business becomes increasingly challenging. It's crucial to find new angles and create new things. But for now, let's focus on quality and cost-performance – these principles remain unchanged. I engage in a daily 'three rolls' ritual – rolling on prices, services, and advertising," Dong Fanming humorously remarked about the frustration of internal competition.

"From the perspective of change, heaven and earth cannot remain constant for even a moment," Dong Fanming quoted a line from Su Shi to express his anti-internal competition strategy. He hopes to focus on what remains unchanged amidst change, enhancing his products, services, and customer retention – the keys to breaking free from internal competition.

How Does 1688 Combat Internal Competition?

In 2024, e-commerce competition has intensified, with merchants complaining about business difficulties. Many merchants face three major challenges: operational difficulties, high costs, and low profits. Some even resort to loss-making tactics like price wars and refund scams, further complicating their business.

On August 12, 1688 introduced a series of anti-internal competition measures, launching a 'Productivity and Revenue Enhancement' plan for source manufacturers in industrial belts and a free 'AI Business Assistant' to bring more certainty and simplicity to merchants' businesses.

To help merchants break free from internal competition, 1688 simplified its platform's business model into two categories: self-operated and supply modes.

The platform's new measures offer clear benefits for merchants. On average, every yuan invested on 1688 generates 43 yuan in online transactions and attracts at least 200 repeat customers per year.

To sell well, merchants can join the Buyer Experience Improvement Program, providing better services to gain more traffic, new customer conversions, and repeat purchases.

To sell explosively, merchants can opt for the platform's 'Help Sell' service or participate in the supply mode, leveraging 1688's digital supply chain to sell globally.

China's three largest industrial hubs are Yiwu Small Commodity Market, Canton Fair, and 1688. These sourcing centers represent the pinnacle of Chinese manufacturing. Canton Fair showcases China's manufacturing prowess over time, Yiwu Small Commodity Market represents its geographical concentration, and 1688 embodies its digital transformation.

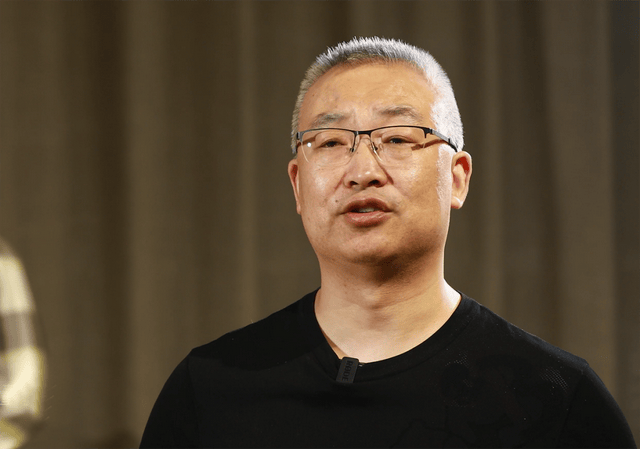

"Many merchants sell at a loss online because they can't attract traffic without extreme low prices. This is a distorted business mindset," said Ma Shuzhong, Dean of the China Institute of Digital Trade, Zhejiang University. "The best scenario is for more merchants to start competing on service on e-commerce platforms."

Ma Shuzhong, Dean, China Institute of Digital Trade, Zhejiang University

To enhance service quality, 1688 offers merchants a free 'AI Business Assistant,' equivalent to equipping them with a digital workforce. The AI Business Assistant comes in various roles, including AI Store Manager, AI Content Operation, AI Marketing, and AI Customer Management. For buyers, 1688 is using AI to enhance the procurement experience, quickly matching high-quality supplies based on buyer needs.

Dong Fanming has much to say about AI.

In his three years at the helm of Shanghai Xinmai, Dong Fanming has explored supply chain intelligence, including AI vision and digital twins. AI replaces repetitive tasks, and simple tasks are the easiest to automate. He used AI to automate color sorting on the production line, replacing a person who previously worked 16 hours straight on the task. "For me, the industry is very specialized, while AI technology is more transversal. I aim to become the person who understands technology best in manufacturing and manufacturing best in AI," Dong Fanming said.

For many OEM companies, many requirements are set by customers, who directly specify product specifications and selling points. Therefore, many OEM factories don't know why they do what they do, focusing only on production and deadlines.

Interestingly, as an OEM company supplying products to customers, Dong Fanming established a product department within the factory, with in-house product managers responsible for product design and other tasks.

"I aim to gain precise insights into end-user needs," Dong Fanming said. In his view, everything disseminated by his company is a 'product.' "Ultimately, a store is also a 'product.' Your avatar is your 'product' when chatting with someone on Wangwang. I want to perfect this entire suite of 'products.'"

Differentiated Competition Calls for 'Rolling on Service'

"Doing business on 1688 has fundamentally changed merchants' underlying logic. To make money on the platform, merchants must shift from a traffic logic to a user logic," said a responsible person from 1688's Merchant Development Center.

In his view, under the traffic logic, merchants interact and compete with the platform. Under the user logic, merchants interact and compete with buyers.

In the traffic model, merchants view users as traffic, often providing subpar service. They respond quickly to big clients but often neglect small buyers. In the user logic, buyers are individuals with needs and emotions.

Therefore, 1688's platform traffic tilts towards merchants that provide excellent service to buyers.

"A decade ago, starting a factory meant grabbing the red carpet because China was the world's factory. In recent years, everyone realizes that business isn't harder today; it was too easy before. The fiercely competitive market in the future may be the norm," said Lu Hongwei, Chairman of Nantong Dongdi Textile Co., Ltd.

Lu Hongwei, Chairman, Nantong Dongdi Textile Co., Ltd.

He believes that to avoid price wars, product innovation is crucial. Otherwise, internal competition is inevitable. Companies that try to compete on price by cutting corners or compromising quality are headed down a dead-end street. In price competition, there's no bottom; only lower prices.

In the view of the aforementioned 1688 representative, this year's AI revolution represents the second information revolution after the 1995 internet revolution. The 1995 internet revolution lowered the marginal cost of information acquisition to near zero. Similarly, if AI significantly reduces the marginal cost of social production, it can be considered a true production revolution.

He believes the essence of internal competition lies in significantly improved production efficiency but rapidly declining transaction costs, leading to excess supply over demand in the market.

For Chinese merchants, differentiation is crucial. Whether it's market differentiation, channel differentiation, user differentiation, marketing strategy differentiation, or service differentiation, differentiation – including product differentiation – is a must. Secondly, focus on certainty. Most industries have entered a game of Stock game with limited growth opportunities. When planning, merchants should choose directions with greater certainty. (Written by Zeng Xianyong)