Chengdu Auto Show Observation: BYD Shines Brightly, While Fuel Vehicles Get Colder

![]() 09/01 2024

09/01 2024

![]() 557

557

Although the Chengdu Auto Show is considered one of China's four major A-class auto shows, in previous years, its "promotional" nature was quite apparent – there were few product technology launches, and most of the new releases were focused on additional models rather than groundbreaking innovations.

This is not necessarily a mistake, as selling cars is the primary purpose of auto shows.

However, this year's Chengdu Auto Show differs significantly from previous ones. In the past, it was "comprehensive yet unremarkable," with almost all mainstream automakers offering discounts during the show. This year, while not as comprehensive, it is significantly larger in scale, with some brands like Nissan and Kia absent. Nonetheless, many participating automakers brought larger lineups of new vehicles than in previous years.

Therefore, this year's Chengdu Auto Show does offer some notable highlights and can arguably be considered the hottest show in its history.

Domestic Brands: Mainstream New Vehicles Launched in Clusters

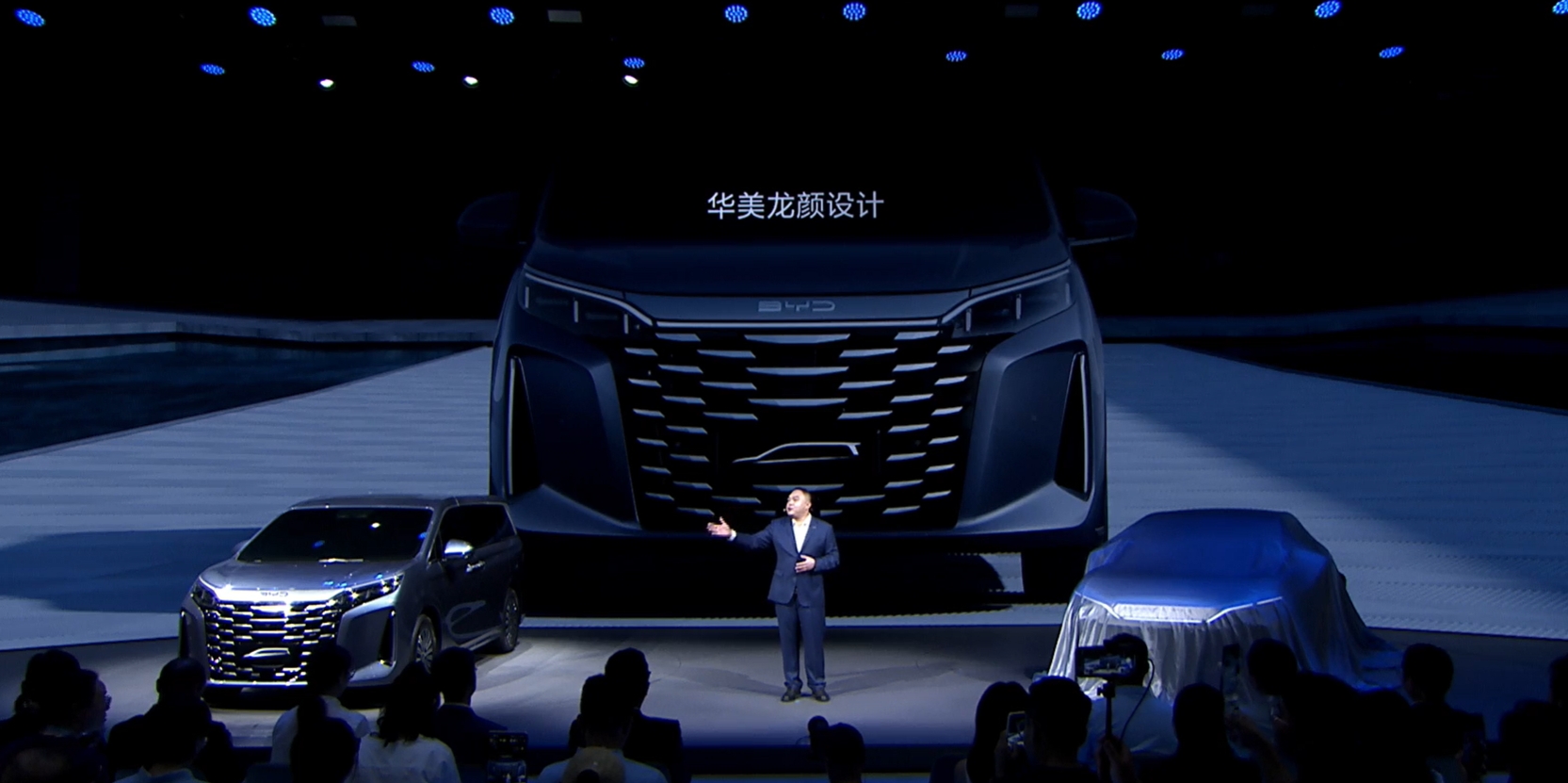

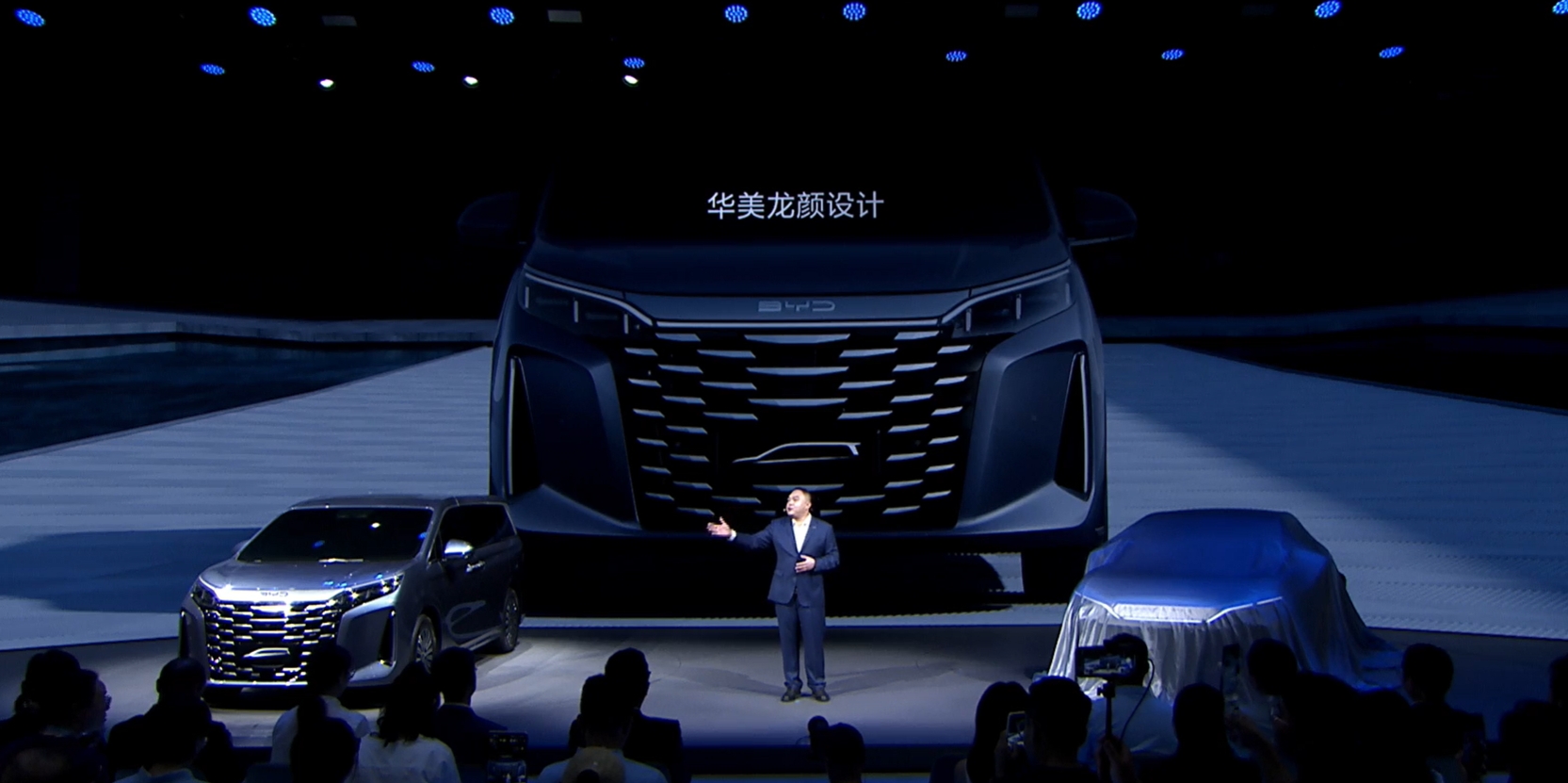

Undoubtedly, BYD, the leader in new energy vehicles, boasts the largest presence among domestic brands. In summary, BYD Group unveiled the all-new IP of the Dynasty family – Xia, revealed the exterior designs of the new flagship MPV Xia and Denza Z9, as well as the black interior of Yangwang U8. At the same time, the new Song L EV and Denza N7 Lieying Edition were launched, and the Dolphin 06GT officially started pre-sales.

This lineup of new vehicles would not be out of place even at the year-end Guangzhou Auto Show. Closer inspection of BYD's new vehicles reveals that models like the MPV Xia, pure electric hatchback Dolphin 06GT, and Denza Z9 are not mass-market oriented.

Generally speaking, to achieve better sales figures during the "golden September and silver October," most automakers release their high-volume models at the Chengdu Auto Show. BYD could have easily equipped its existing models with the latest fifth-generation DM technology and attracted customers during the show. However, few brands dare to take the niche route like BYD.

In my opinion, BYD currently has no sales concerns in the mainstream family car market. Still, to achieve higher sales targets, it naturally aims to "shore up its weaknesses" by expanding into more areas to broaden its automotive footprint.

At this stage, the Dynasty family comprises six major IPs, while the Ocean Network boasts the "three brothers" of Dolphin, Seagull, and Walrus, which are responsible for high sales volumes. Going forward, in addition to equipping its mainstream models with the latest technologies, BYD will likely focus more on Denza, FANGXIAOBAO, and Yangwang.

Other brands also unveiled numerous new vehicles, but if we focus solely on all-new models rather than refreshed or special edition vehicles, the following six can be considered the most significant.

ARCFOX's S05 and L07, as well as Chery Fengyun E05, made their real-car debuts. Meanwhile, three pure electric mid-size SUVs – VOYAH Free, Zeekr 7X, and AITO 07 – made their public debut for the first time and simultaneously opened for pre-sales or reservations.

Clearly, these new vehicles are targeted at the mainstream market. In terms of quantity, there were indeed fewer new vehicles launched at the show. However, from the audience's perspective, there were far more new vehicles on display than just those that premiered at the show. The reason is that most high-profile new vehicles chose to be released before the Chengdu Auto Show.

Domestic new energy vehicles like Wuling Xingguang, XPeng MONA M03, the new AITO M7 Pro, WEY Blue Mountain Intelligent Driving Edition, Jiyue 07, the new VOYAH Dreamer, Zhijie R7, and the updated AITO M7 Pro all chose to be released just before the Chengdu Auto Show and made their public debut there for the first time. Automakers could have easily held press conferences during the show, leveraging its platform to achieve similar promotional effects at a lower cost.

Yet, they chose not to. In my opinion, this is one manifestation of the intensifying "internal competition" in China's new energy vehicle market.

On the one hand, consumers need more time to understand a product's technological foundation and market competitiveness. The few minutes of a product launch during the auto show cannot leave a lasting impression. Of course, automakers could spend more time on the stand to announce more detailed information, but this would compromise sales time. On the other hand, automakers need to launch their products before the "golden September and silver October" to achieve better sales figures during the traditional peak sales season.

Therefore, automakers prefer to avoid the traffic peak of the Chengdu Auto Show by announcing their new vehicles before the show. This allows genuine buyers to directly visit the stands for more information, achieving a "two birds with one stone" effect.

Foreign Brands: Focusing on Fuel Vehicles and Special Editions

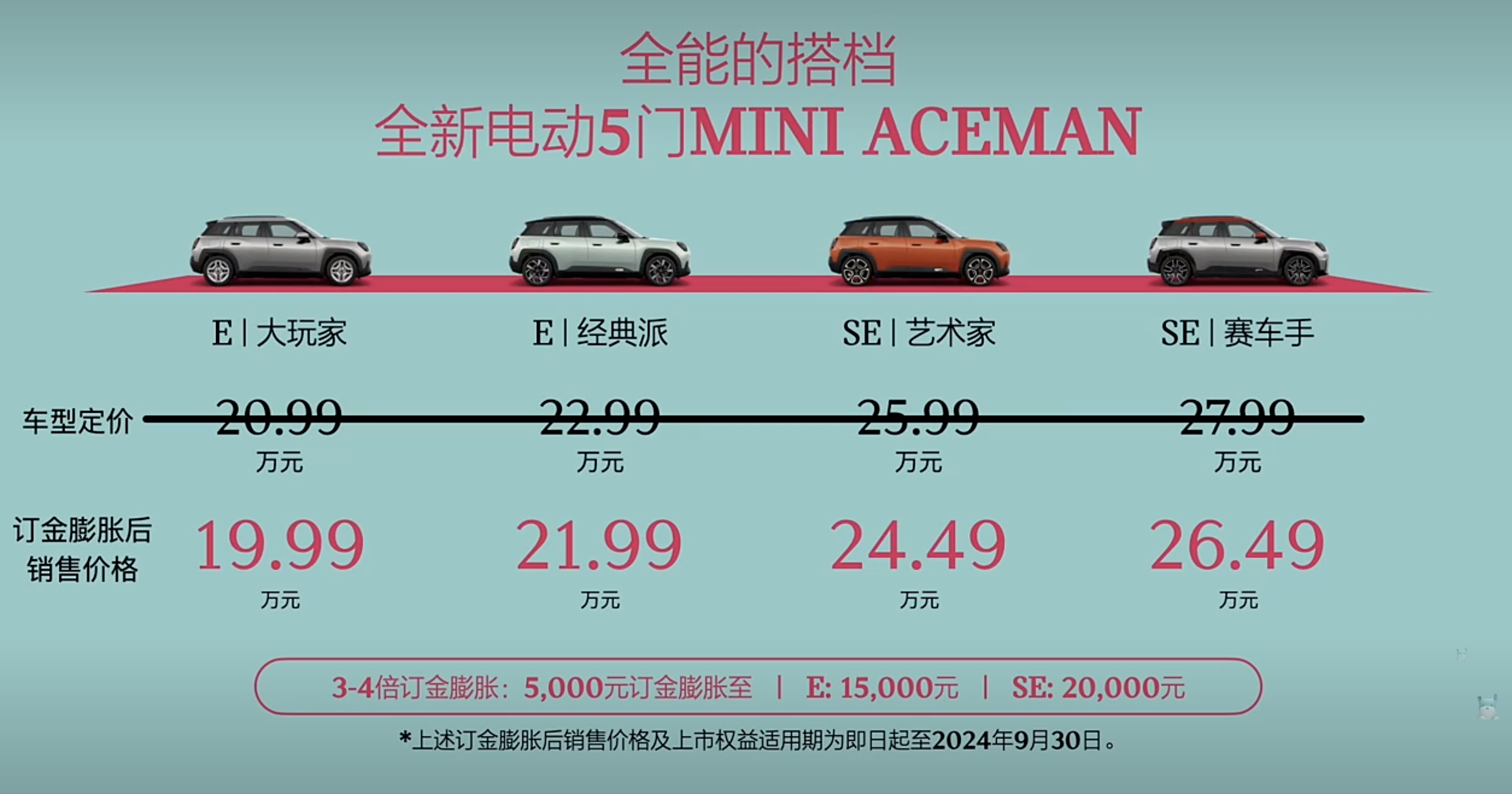

After looking at domestic brands, let's turn to the luxury brands that audiences often enjoy watching. Among them, BMW and Mercedes-Benz likely had the largest presences. BMW unveiled the new-generation BMW X3 Long Wheelbase, the new BMW 3 Series family, and the new BMW M5. Additionally, the BMW M240i Coupe, the new BMW M3, and the new BMW M2 officially went on sale. The only new energy vehicle in their lineup was the all-new electric MINI ACEMAN, which went on sale just before the auto show.

It cannot be denied that BMW's sales in China are primarily driven by models like the BMW X3 and BMW X5. The electric MINI still needs time to expand its influence, and since the brand exited the "price war," the price of the BMW i3 has rebounded, with consumers continuing to focus on fuel vehicles.

Mercedes-Benz also unveiled several new energy vehicles, including the debut of the GLC plug-in hybrid SUV and the new C 350 e L plug-in hybrid sports sedan. The AMG EQE 4MATIC+ pure electric SUV also went on sale.

Plug-in hybrids from luxury brands have not been very popular in the domestic market. However, I noticed that to cater to domestic consumers, Mercedes-Benz added configurations favored by local users to the all-new GLC 350 e L 4MATIC, such as soft pillows inspired by Maybach and a luxurious rear center armrest. Additionally, it introduced the Qualcomm Snapdragon 8295 automotive chip, the first of its kind in this segment, alongside the new C-Class family.

Luxury brands have long been present in the plug-in hybrid market, leveraging low energy consumption to attract customers. However, domestic consumers have developed negative stereotypes about "oil-to-electric" conversions. Coupled with the fact that many consumers do not have a strong demand for fuel economy, even relatively popular luxury brands like BMW and Mercedes-Benz struggle to gain significant market share in the plug-in hybrid segment, let alone other brands.

Perhaps recognizing the "promotional" nature of the Chengdu Auto Show, other luxury brands did not make significant moves during the event. Cadillac unveiled the new XT5, Volvo showcased its new energy lineup, and Lincoln and Land Rover each introduced new models, but these offerings failed to bring much freshness.

Joint Venture Brands: Never Giving Up on the Transition to New Energy

Similarly, joint venture brands have concentrated almost all their resources on fuel vehicles. Examples include the SAIC Volkswagen Tharu XR priced at 79,900 yuan and the all-new Volkswagen Passat PRO, as well as the launch of the fifth-generation Hyundai Santa Fe.

Among joint venture brands still "struggling" in the new energy sector is Changan Mazda, which unveiled the Mazda EZ-6. As Changan Mazda's first new energy vehicle based on a pure electric digital platform, it is expected to officially go on sale in September.

While there were not many spectators surrounding the new vehicle, I noticed several highlights. For instance, it is equipped with an 8155 chip and offers both an extended-range version and a pure electric version. Judging from its power parameters, the Changan Mazda EZ-6 bears some similarities to the ARCFOX SL03, and its dynamic performance is expected to prioritize comfort and low energy consumption.

However, considering the brand factor, the Changan Mazda EZ-6 may be more expensive than the similarly positioned ARCFOX SL03. While this pricing strategy is reasonable, from a consumer perspective, the Changan Mazda EZ-6 may not be very attractive, making it difficult to help the brand transition to electrification. The brand needs to further strengthen the unique features and configurations of its products to better attract audiences.

Apart from Changan Mazda, GAC Toyota unveiled its latest pure electric vehicle, the Bozhi 3X, and showcased the brand's latest achievements in intelligence. As Toyota's first end-to-end intelligent driving product, the Bozhi 3X is scheduled for launch early next year. The brand has also stated that, along with XPeng MONA M03, it will bring high-level intelligent driving versions into the 1-era (i.e., priced below 200,000 yuan).

Analyzing its hardware performance, the Bozhi 3X utilizes an intelligent driving solution jointly developed by GAC Toyota and Momenta. The vehicle is equipped with 29 sensors, including a 126-line LiDAR, providing 360° all-round perception and strong computing power. It also incorporates Momenta's most advanced algorithm, the 5.0 end-to-end intelligent driving big model. According to the brand, the Bozhi 3X can achieve full-scenario mapless NDA piloting, "on par with what new forces offer."

At the end of July, ARCFOX launched the "only Huawei intelligent driving vehicle under 200,000 yuan" – the ARCFOX S07. However, this vehicle still does not support high-level intelligent driving on urban roads. From a technological perspective, equal rights to intelligent driving will inevitably lead to its popularization. If GAC Toyota can take the lead in launching a model equipped with a high-level intelligent driving version priced below 200,000 yuan, it will become a leading joint venture brand in the era of smart cars.

Regardless of its intelligent driving performance, if the Bozhi 3X truly becomes a model equipped with a high-level intelligent driving version priced below 200,000 yuan, I am concerned about the interior configurations and materials used. After all, the development of hardware such as 126-line LiDAR, sensors, and software algorithms requires costs.

Furthermore, GAC Toyota is not without competition. ARCFOX has consistently advocated for equal rights to intelligent driving, and the new AION V Tyrannosaurus Rex, which debuted at this year's Chengdu Auto Show, is equipped with LiDAR and a high-level assisted driving system. The brand claims to have achieved scenario coverage under all weather and road conditions, with a starting price of just 169,800 yuan. It is evident that the "price war" in intelligent driving has already begun. Even Toyota, known as a "cost-control madman" who was an early adopter of the key strategy of intelligent equality, will face increasing competition in the future.

Reflections on the Chengdu Auto Show: Few New Vehicles, Colder Fuel Vehicles

In summary, brands with new vehicle plans are primarily concentrated among a few well-known automakers. For those who only attend the Chengdu Auto Show to see new vehicles, they may feel that the "ticket price is not worth it." Facing a "promotional auto show," most automakers prefer to maximize their returns, leaning towards using show subsidies and limited-time discounts to attract customers to place orders rather than relying on new vehicle launches to generate buzz.

New energy vehicles remain a must-win battleground for all mainstream brands. However, from the traffic at the auto show, it is clear that domestic brands' new energy vehicles are more popular among consumers, and the number of new energy vehicles launched at "promotional auto shows" is also significantly higher than that of luxury and joint venture brands.

At the same time, there seem to be more spectators focusing on new energy vehicles than on fuel vehicles. The number of spectators stopping by joint venture brands like Honda and Toyota was not as large as in previous Chengdu Auto Shows.

"Rome wasn't built in a day." Xiaotong believes that due to the continuous investment of domestic brands in the new energy field in recent years, more users have come to believe in the advantages of new energy vehicles in terms of quality and energy consumption, leading to the current situation, especially for joint venture brands that once occupied a prominent position in the traditional gasoline passenger car market, the impact is the greatest.

Although the Chengdu Auto Show is known as a "promotional auto show", these changes also indicate that the survival space for joint venture brands in the domestic market is gradually narrowing. There may be two paths before joint venture brands: one is to follow the example of SAIC Volkswagen and launch the Tharu XR starting at 79,900 yuan for a limited time, attracting customers with cost-effectiveness; the other is to follow the lead of GAC Toyota and open up a new development path focused on smart equity.

Both paths come with their own benefits and risks, and the wheel of the automotive market is rolling forward relentlessly. No one can accurately predict which path holds the most promise, but one thing is certain: automakers must make timely changes to cope with the turbulence in the domestic automotive market.

Source: Leitech