"Diving" China Duty Free: A Bleaker Picture Than E-commerce, Even in Tax-Free Sales

![]() 09/02 2024

09/02 2024

![]() 541

541

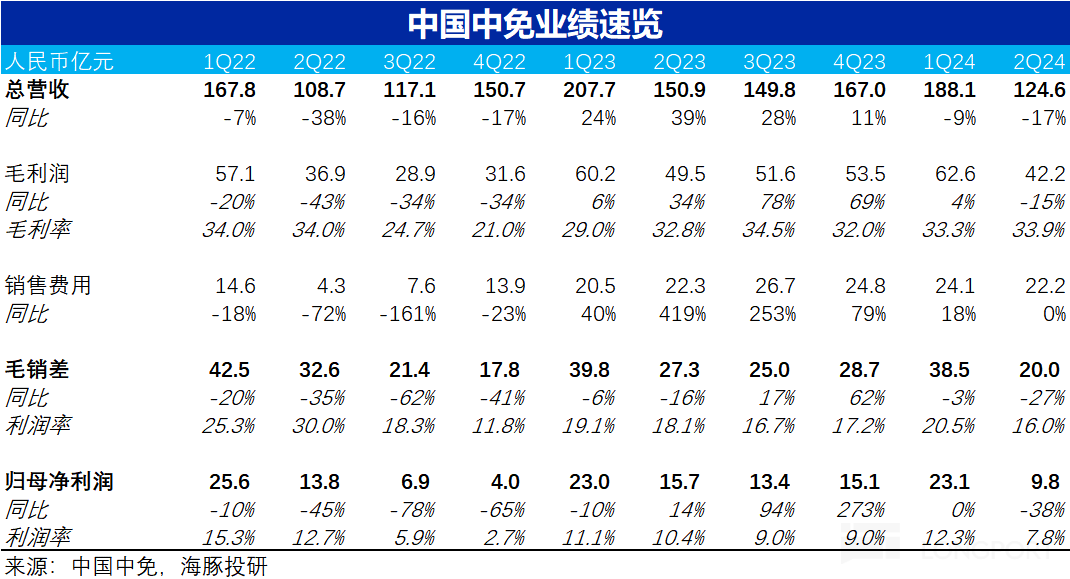

On the evening of August 30, China Duty Free Group released its mid-year report for 2024. While key financial data had already been disclosed in earlier flash reports, we will still examine the detailed disclosures in the mid-year report to understand the reasons behind the company's seemingly endless decline in performance. The main points are as follows:

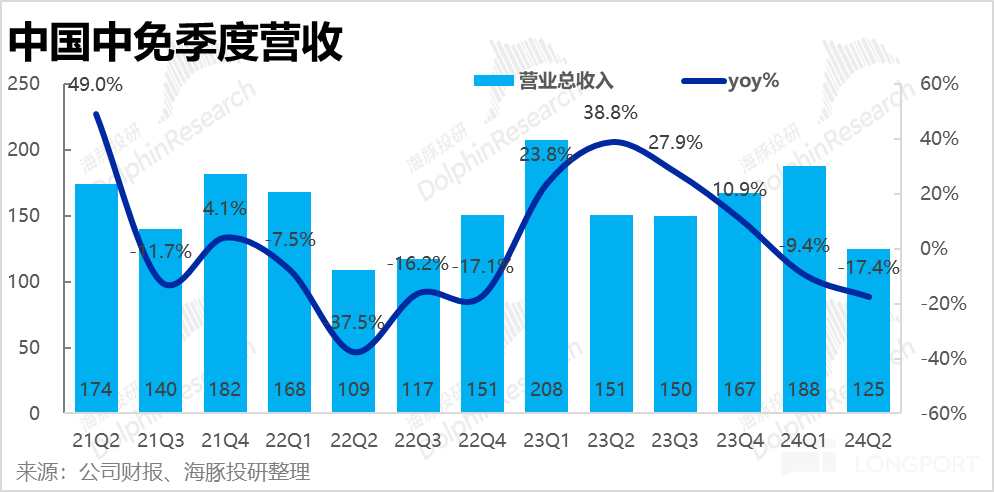

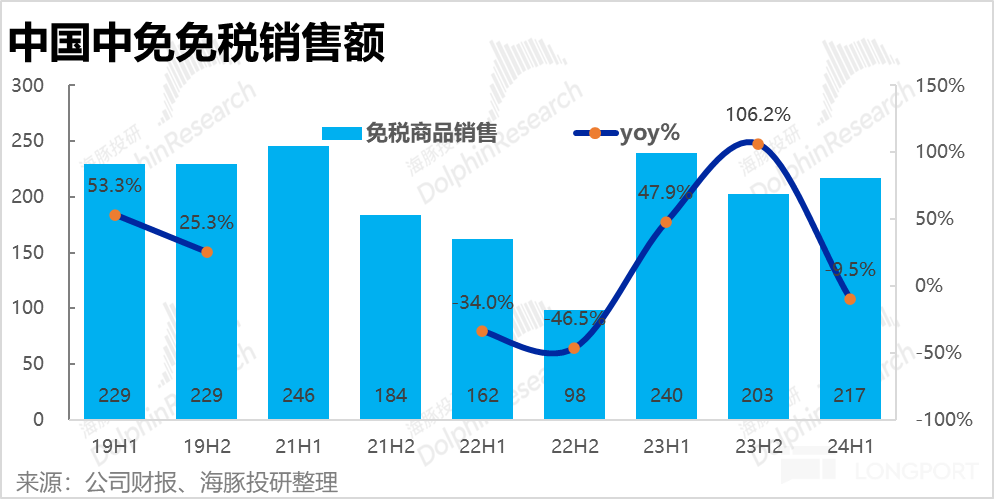

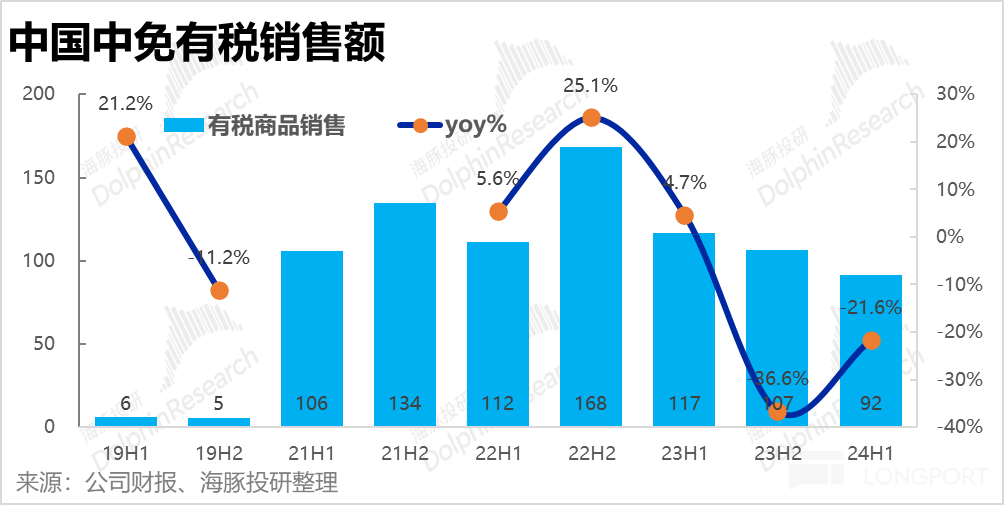

1. Revenue Growth Continues to Decline: In terms of revenue, China Duty Free Group reported RMB 12.5 billion in revenue for the second quarter, a year-on-year decline of 17.4%, with the decline widening further. By sales type, tax-free sales revenue amounted to RMB 21.7 billion in the first half of the year, down nearly 10% year-on-year, while taxable sales revenue fell even more steeply by 21.6% year-on-year. The relatively smaller decline in tax-free sales provided some solace amidst the gloom. As international travel gradually resumes, the company has reduced its reliance on taxable sales and returned to its core business of tax-free retail, a strategic choice made by the company.

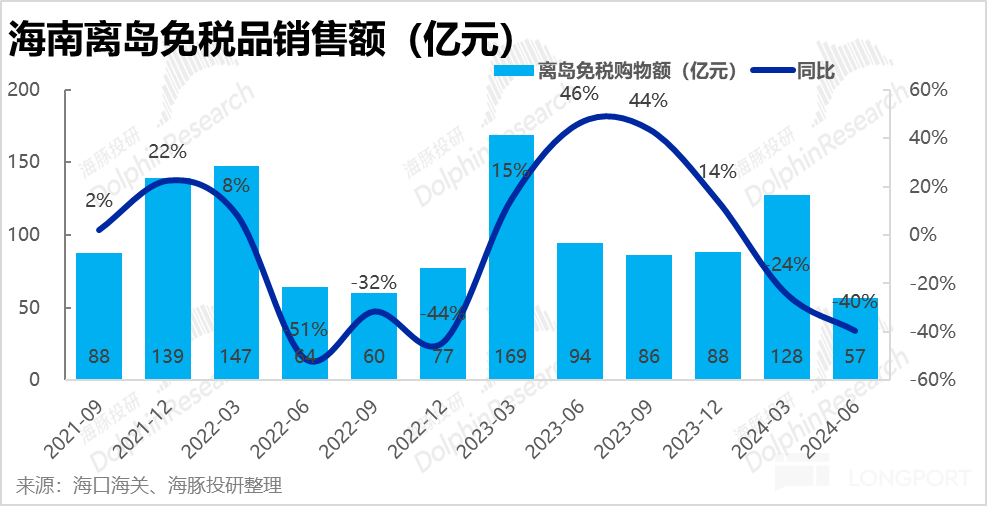

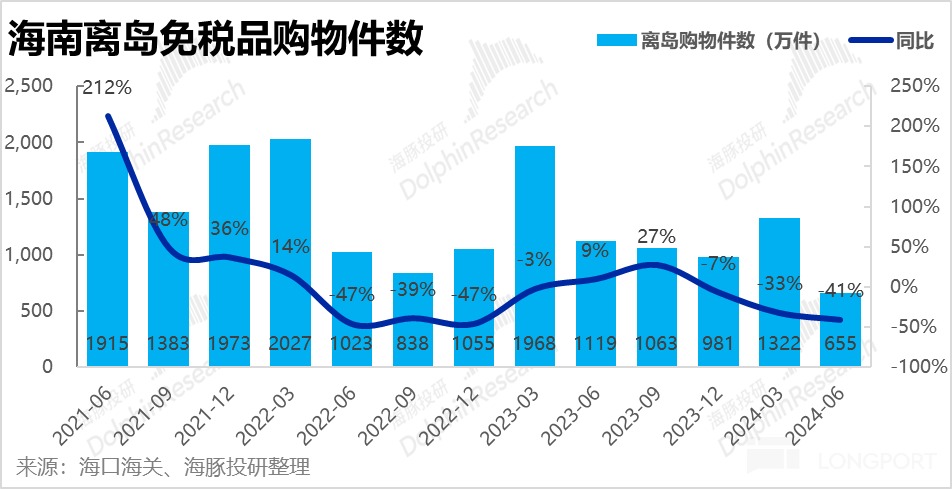

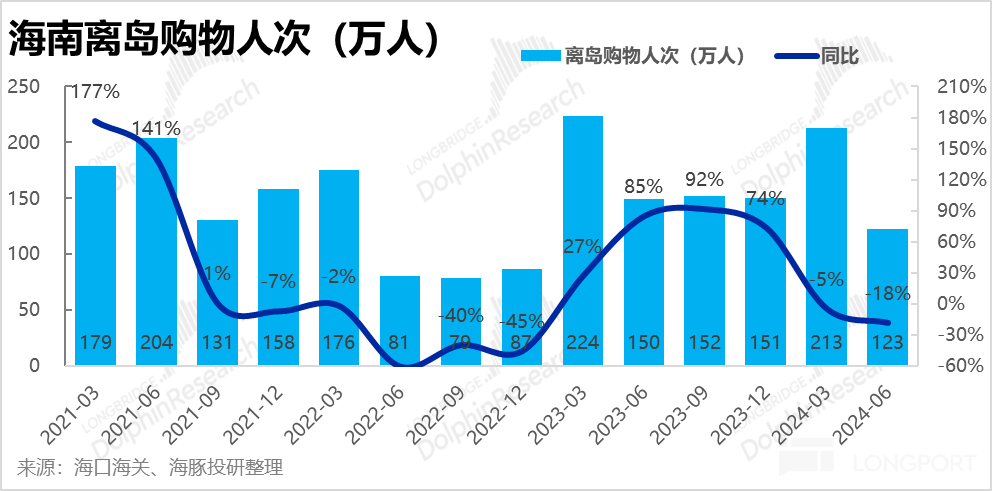

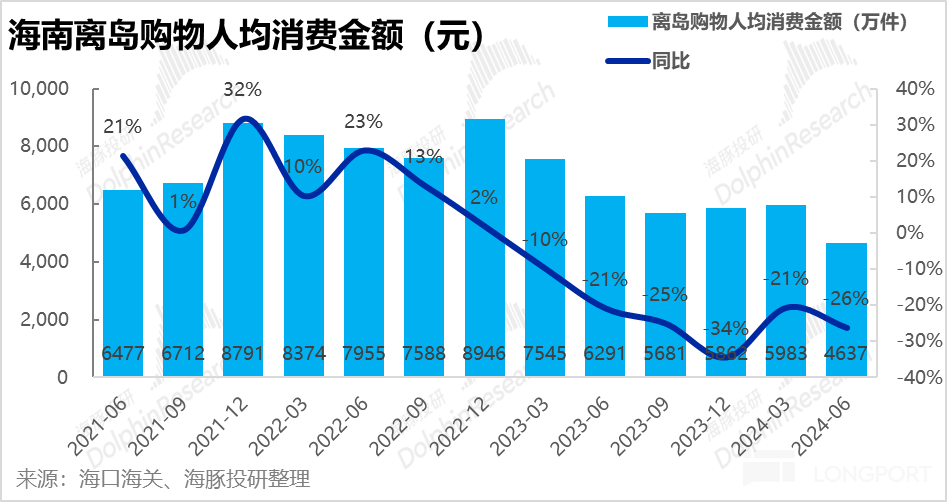

2. Divergent Trends in Offshore Island and Outbound Travel: At the industry level, the overall sales performance of Hainan's offshore island tax-free retail has deteriorated significantly, with overall retail sales falling by 40% year-on-year in the second quarter. In terms of drivers, the number of tax-free sales transactions fell by an even steeper 41% year-on-year. In other words, the average transaction value per customer increased slightly year-on-year, indicating that the decline was primarily due to insufficient demand rather than pricing factors. A closer look reveals that the number of tax-free shoppers in Hainan fell by 18% year-on-year, while the average spending per person declined by 26%. The decline in purchase frequency was more pronounced than the decline in shopper numbers. Calculations show that the average number of items purchased per person in this quarter was only 5.3, a sharp drop from the peak of over 10 items per person in 2021-2022. However, the clearance of bulk buyers like daigou (personal shoppers) also dragged down the average purchase indicators.

Additionally, China Duty Free Group's overall revenue decline was significantly smaller than that of offshore island tax-free sales, reflecting the recovery of domestic international travel, the erosion of offshore island tax-free sales, and the company's revenue growth in other channels like airports, which to some extent offset the decline in offshore island tax-free sales.

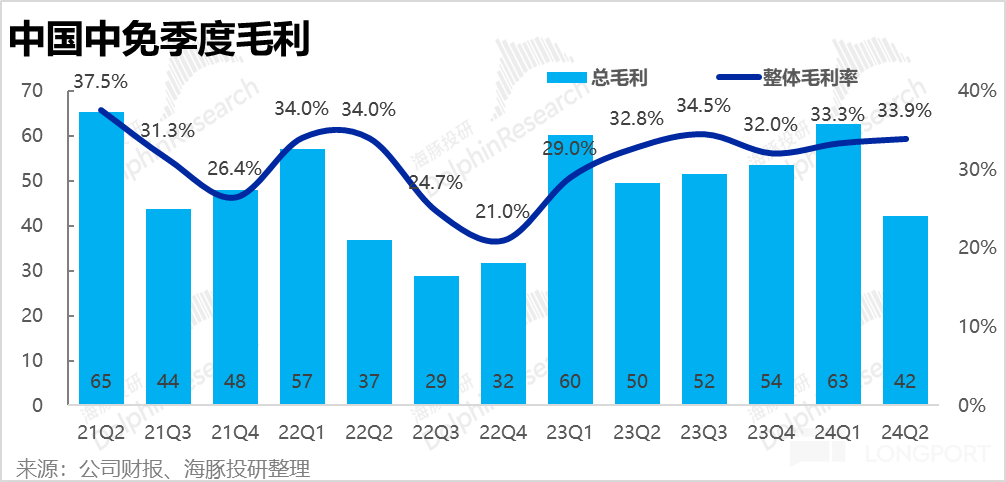

3. Gross Margin Improvement, but Increased Marketing Expenses: Despite the decline in revenue, China Duty Free Group's gross margin for the second quarter was 33.9%, an increase both year-on-year and quarter-on-quarter. Considering that the average transaction value per customer in offshore island tax-free sales increased slightly year-on-year, and the proportion of high-margin tax-free sales in revenue structure also increased, the improvement in gross margin is understandable.

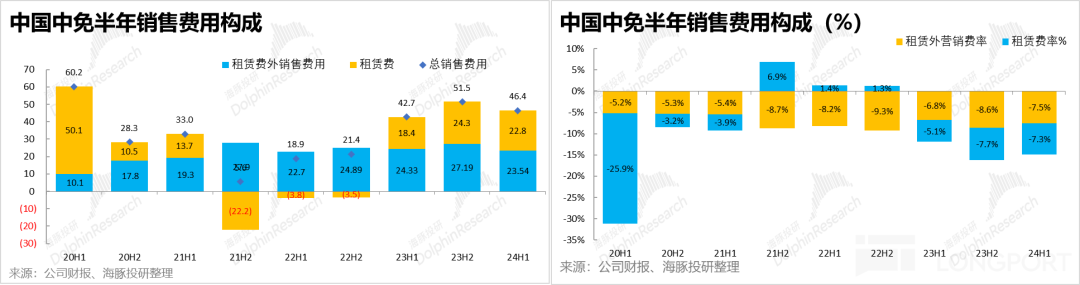

However, due to the recovery of passenger flow and tax-free sales at airports and other ports, the company's lease expense ratio for the first half of the year increased by 2.2 percentage points year-on-year, and other marketing expense ratios also increased by 0.7 percentage points year-on-year. As a result, the company's gross margin minus selling expenses as a percentage of revenue decreased by 2.1 percentage points year-on-year due to the increase in marketing expenses.

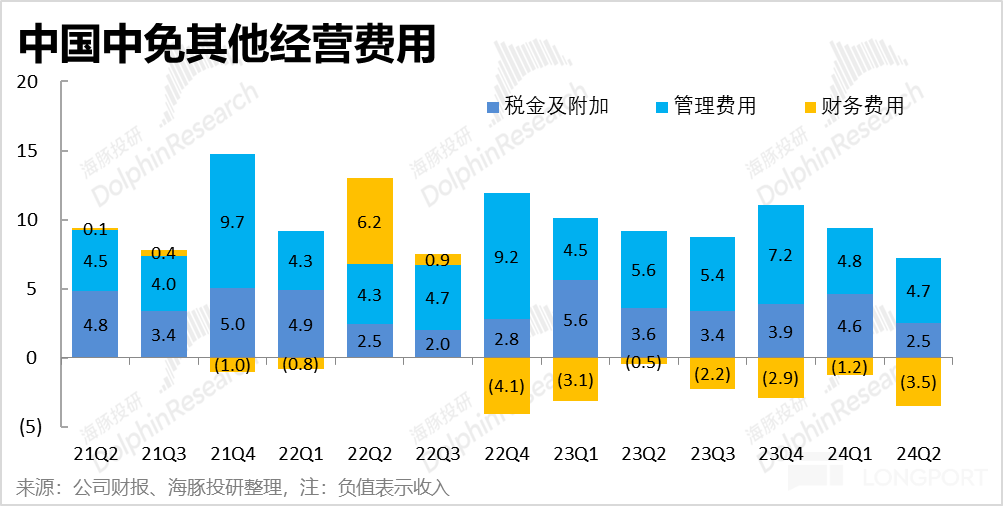

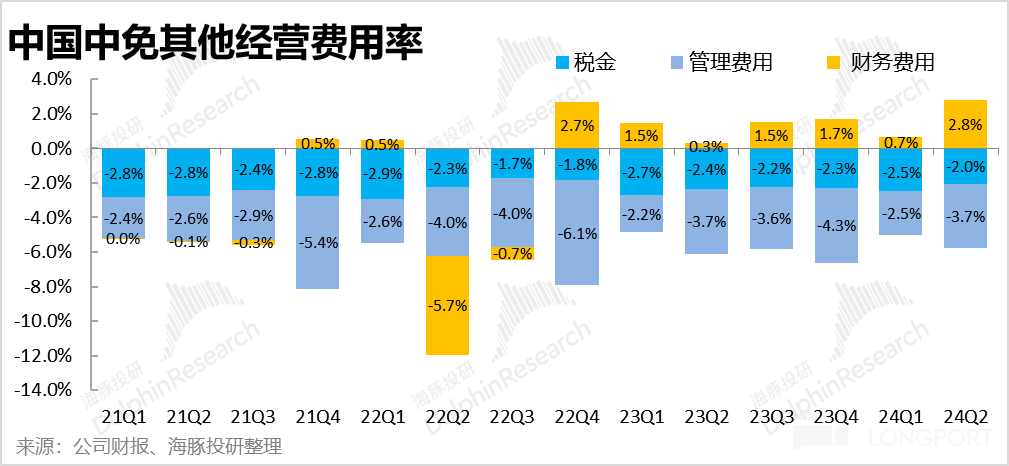

4. Rigid Expenses and Plummeting Profits: In terms of other expenses, although administrative expenses and tax expenses decreased both year-on-year and quarter-on-quarter, and net financial income was confirmed at RMB 350 million due to the increase in interest income, reflecting some efforts in cost control, state-owned enterprises are still slow in controlling expenses. The decline in expenses was not enough to offset the decline in revenue, resulting in a passive expansion of expense ratios.

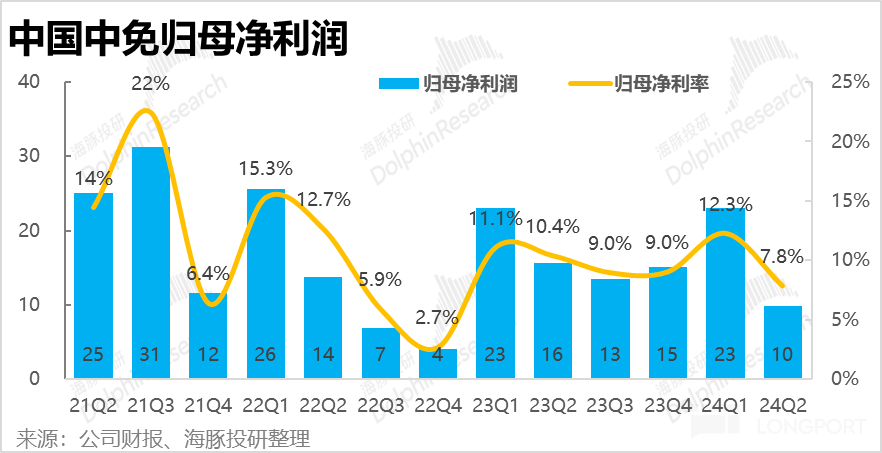

Ultimately, despite the improvement in gross margin, the significant increase in marketing expenses and the passive expansion of other expenses led to a year-on-year decrease of nearly 1.2 percentage points in the net profit margin attributable to shareholders. Coupled with a nearly 18% decline in revenue, the net profit attributable to shareholders in the second quarter was only RMB 980 million, a year-on-year decline of nearly 38%.

Dolphin Investment Research Insights

Based on this mid-year report, Dolphin Investment Research believes that the following insights into the industry and the company's business and development trends can be drawn:

First, at the macro or industry level, the weak consumer sentiment is most evident in tax-free retail, a type of discretionary spending. While the company has indeed improved the "health" of this business and maintained its gross margin by reducing discounts, clearing out daigou (personal shoppers), and other measures, no one can escape the headwinds of the overall economic environment, regardless of how well the company performs.

At the structural level, as outbound and inbound passenger flow gradually recovers in the second quarter, we can clearly see the shifting trends between Hainan's offshore island tax-free retail and tax-free retail at inbound and outbound ports. However, these two trends are not fully offsetting each other, as the lost tax-free purchasing power that has shifted overseas cannot be compensated for by China Duty Free Group.

Another impact of the changing revenue structure is that the decline in higher-margin offshore island sales and the growth in relatively lower-margin airport channel sales have led not only to a decline in total revenue but also to a deterioration in profit margins.

Despite the continuous decline in the company's market value and valuation in recent years, China Duty Free Group's profits have also "fallen and fallen again." The continuous decline in the numerator (profits) makes it impossible for the company's valuation to ever reach a truly "cheap" level.

Recently, long-rumored city-based tax-free shopping has finally been implemented, which is expected to bring incremental channels and revenue. However, the restriction of only allowing pick-up at outbound ports leads Dolphin Investment Research to believe that city-based tax-free shopping is currently only a supplement to airport channels, and its potential revenue scale is unlikely to significantly exceed that of airport channels. Whether this incremental market can offset the headwinds facing the overall market remains to be seen.

Detailed Contents

I. From One Low Point to an Even Lower One

In terms of growth indicators, China Duty Free Group achieved revenue of RMB 12.5 billion in the second quarter, a year-on-year decline of 17.4%, with the decline widening further. This is only RMB 1.6 billion higher than the low point in the same period of 2022, when Hainan's stores were temporarily closed.

By sales type, the company's tax-free sales revenue amounted to RMB 21.7 billion in the first half of the year, down nearly 10% year-on-year, while taxable sales revenue fell even more steeply by 21.6% year-on-year. Structurally, the decline was primarily driven by taxable sales, while the relatively smaller decline in tax-free sales provided some solace amidst the gloom.

On the one hand, taxable sales have lower gross margins and have a relatively smaller impact on profits. On the other hand, as international travel gradually resumes, the company has reduced its reliance on taxable sales and returned to its core business of tax-free retail, which is a strategic choice made by the company to some extent.

Compared to the company's performance, the overall sales performance of Hainan's offshore island tax-free retail has deteriorated even more severely, with overall retail sales falling by 40% year-on-year in the second quarter. In terms of drivers, the number of tax-free sales transactions fell by an even steeper 41% year-on-year. In other words, the average transaction value per customer increased slightly, indicating that the weakness in sales was not due to pricing factors but rather due to insufficient demand.

A closer look reveals that the number of tax-free shoppers in Hainan fell by 18% year-on-year, while the average spending per person declined by 26%. The decline in sales volume was due to both a decrease in the number of shoppers (with a relatively minor impact) and a decrease in the number of items purchased per person (with a greater impact). According to Dolphin Investment Research's calculations, the average number of items purchased per person in this quarter was only 5.3, a sharp drop from over 10 items per person during the peak period from 2021 to 2022. This clearly reflects the weakening of domestic tax-free spending power, although the industry's clearance of bulk buyers like daigou (personal shoppers) has also dragged down the average number of items purchased per person.

The significant decline in Hainan's tax-free sales was obviously also affected by the gradual recovery of domestic international travel. This is evident from the fact that China Duty Free Group's revenue decline was significantly smaller than that of offshore island tax-free sales. The company's revenue growth in other channels such as airports to some extent offset the decline in offshore island tax-free sales.

II. Slight Improvement in Gross Margin, but Rising Airport Rents Lead to Declining Profits

Despite the decline in revenue, China Duty Free Group's gross margin for the second quarter was 33.9%, an increase both year-on-year and quarter-on-quarter. As mentioned earlier, the average transaction value per customer in offshore island tax-free sales increased slightly year-on-year, and the proportion of high-margin tax-free sales in revenue structure also increased, both of which contributed to the improvement in gross margin.

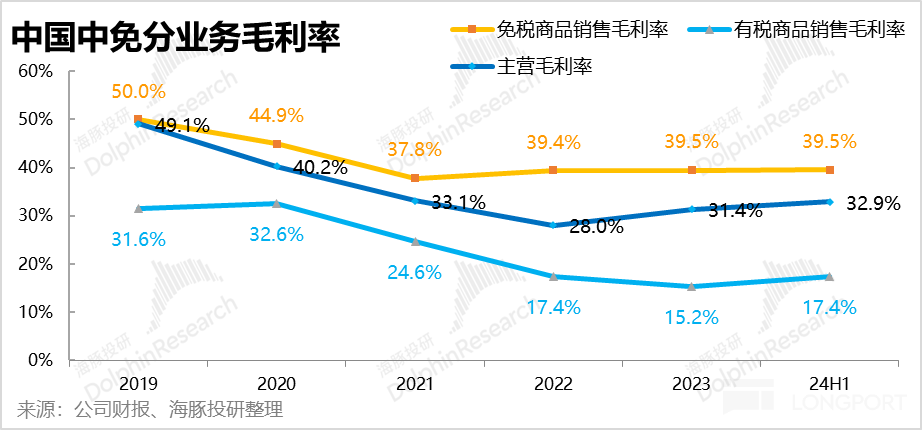

In terms of gross margin by sales type, tax-free sales had a gross margin of 39.5% in the first half of 2024, roughly unchanged from the full year of 2023. Additionally, the gross margin for taxable sales returned to 17.4% from 15% in the full year of 2023. This indicates that after stabilizing average transaction values and reducing discounts, the company's sales gross margin has stabilized and rebounded. However, the decline in demand is to some extent beyond the company's control.

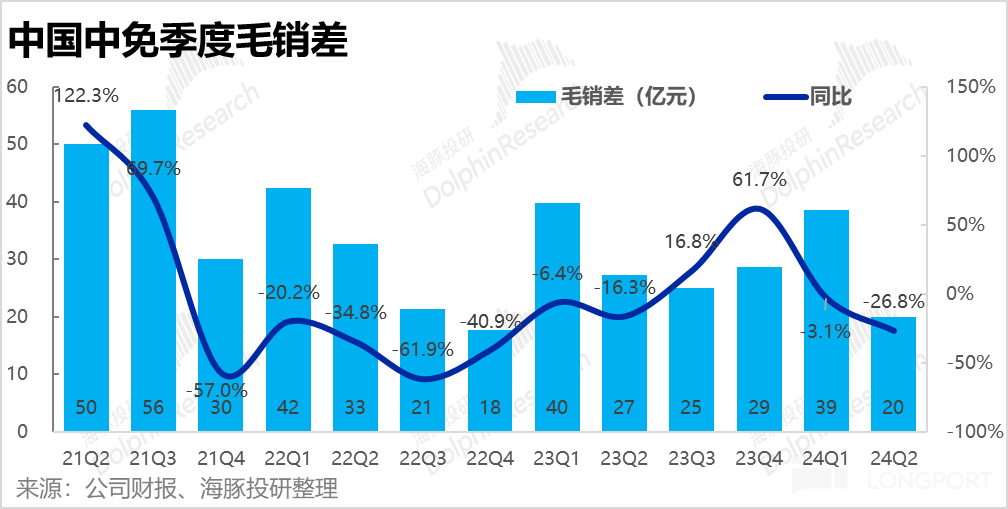

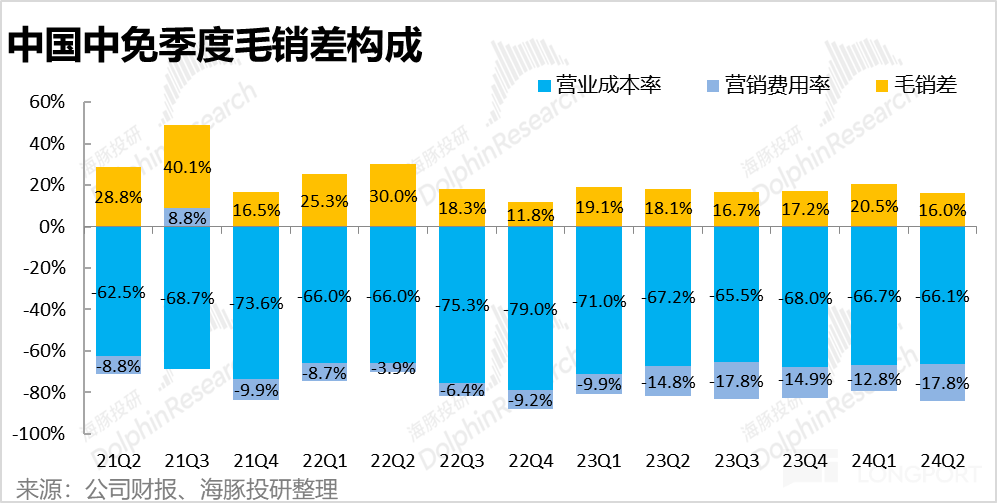

Despite the slight improvement in gross margin, China Duty Free Group's selling expense ratio reached 17.8% in the second quarter, up 3 percentage points year-on-year. Due to the significant increase in marketing expenses, the company's gross margin minus selling expenses profit margin still decreased by 2.1 percentage points year-on-year in this quarter.

According to the sales expense composition disclosed on a semi-annual basis, the lease expense ratio for the first half of the year increased by 2.2 percentage points year-on-year, and other marketing expense ratios also increased by 0.7 percentage points year-on-year. However, as international travel gradually resumes, it is reasonable that the company's commission payments to airports would increase along with the growth in revenue contributed by airport ports. Nevertheless, China Duty Free Group has renegotiated and reduced lease fees with major airports such as Beijing and Shanghai, so the expense levels will not return to the high levels seen in 2020.

III. Rigid Expenses Lead to "Passive Growth" and a Plunging Net Profit

In addition to the significant increase in marketing expenses, China Duty Free Group has been relatively frugal in other expenses, with both administrative expenses and tax expenses decreasing both year-on-year and quarter-on-quarter. Due to the increase in interest income, the company actually recorded a net financial income of RMB 350 million. However, due to the inflexibility of expense adjustments in state-owned enterprises and the larger decline in revenue, expense ratios have still increased passively.

Overall, despite the improvement in gross margin, the significant increase in marketing expenses and the passive expansion of other expenses due to revenue declines led to a year-on-year decrease of nearly 1.2 percentage points in the net profit margin attributable to shareholders. Coupled with a nearly 18% decline in revenue, the net profit attributable to shareholders in the second quarter was only RMB 980 million, a year-on-year decline of nearly 38%.

- END -

// Reprint Authorization This article is an original creation of Dolphin Investment Research. If you wish to reprint it, please obtain authorization.