Smart projectors are not selling well, is poor image quality to blame?

![]() 09/02 2024

09/02 2024

![]() 583

583

Recently, AVC released the latest report on the online market for smart home projectors in China. Following the half-year report, the consumer smart projector market has rebounded once again.

In July, the online market achieved double-digit growth in both retail sales volume and retail sales value, with the former growing by 16% year-on-year and the latter by a whopping 42% year-on-year.

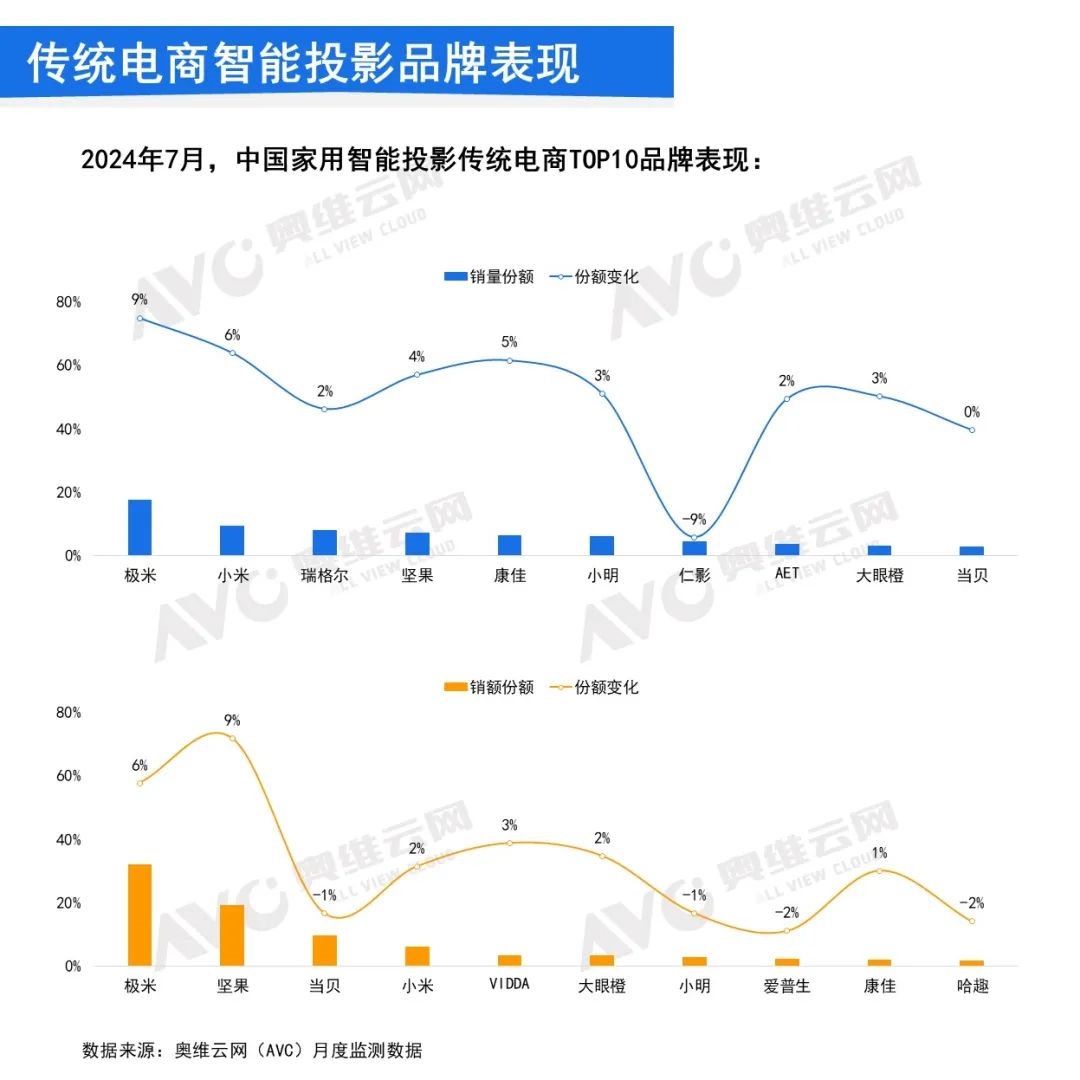

The report further revealed the specific performance of different sales channels. While the retail sales volume of smart home projectors on traditional online e-commerce platforms decreased by 8% year-on-year, the average price of products surged by 26.6% year-on-year, driving a 17% year-on-year increase in the monitored scale of retail sales value.

Image source: AVC

In terms of brands, XGIMI, Xiaomi, and Rigal occupied the top three spots in retail sales volume, with their market shares all increasing year-on-year. In terms of retail sales value, XGIMI continued to lead, followed by JMGO and DBPOWER, who together accounted for 61% of the market share, followed by Xiaomi, Vidda, and other brands. XGIMI, which topped both categories, continues to solidify its leading position in the smart home projector market.

Purchased but rarely used: "Low-frequency users" account for more than half

Beneath the seemingly robust data of smart projectors lies an industry crisis. The domestic smart projector market has been growing rapidly since 2017, with the market size surging from an average of around 1 million units per year to 6.178 million units in 2022. It's worth noting that in 2022, many industries were in a recession, yet smart projectors continued to show strong growth momentum, leading many to believe that smart projectors would eventually replace smart TVs as the new center of the home.

In reality, many people initially purchase projectors for their larger screens and more immersive viewing experiences. Coupled with improvements in smart systems and usability by domestic smart projector manufacturers, smart projectors became the first "large-screen TV" for many young people, driving continuous growth in the market.

Image source: XGIMI

However, once the novelty wears off and users truly focus on the image quality experience, smart projectors fail to withstand the test of time. In 2023, the domestic smart projector market entered a consolidation period for the first time and has yet to reverse its downward trend. Despite the sales growth in the first half of 2024, the overall performance remains in a downward channel.

AVC consumer survey data shows that in 2020, 27% of smart projector purchases were driven by novelty, but by 2024, this figure had dropped to just 12%. The bad news is that 54% of consumers use smart projectors infrequently.

This means that if manufacturers fail to improve the actual user experience, especially by providing better image quality, they will eventually be abandoned by the market.

Debates over technical routes, but image quality lags far behind TVs

Remember last year's spat between XGIMI and JMGO, two leading smart projector brands? From social media feuds to live debate sessions, to JMGO's "Public Showdown of Projection Quality: A Blind Test Vote by 16 City Residents," the main point of contention was the choice of technical route.

Image source: JMGO

In May last year, XGIMI discussed the issue of tri-color laser light source technology at its press conference, arguing that while tri-color laser offers exceptional brightness and color, it suffers from poor viewing comfort, prompting the company to abandon this technology. However, this also exposed the overall limitations of projectors.

Long-term, the projector industry has primarily adopted three technical routes: LCD, DLP, and the combined LCOS. DLP stands for Digital Light Processing, which involves digitally processing image signals before projecting the light. LCD, on the other hand, is a combination of liquid crystal display technology and projection technology. There is no perfect technical route, as each has its strengths and limitations.

In reality, the display effects of the three technical routes are similar, and it is difficult for users to perceive differences with the naked eye. Therefore, there is no definitive answer as to which technical route is the correct choice for smart projectors.

Although the display effects are similar, there are differences in cost, leading to significant price disparities. Top brands like XGIMI, JMGO, and DBPOWER mostly adopt the DLP route, which is more expensive, with products priced between 2,000 and 3,000 yuan, and some exceeding 5,000 yuan. 1LCD (low-end LCD products) are generally priced below 1,000 yuan and are suitable for entry-level home entertainment scenarios, becoming the main source of growth in the domestic smart projector market.

In 2024, LCD products further squeezed the market share of DLP products, and the entire industry seems to be caught in a vicious cycle of low-end competition.

According to Runto's online monitoring data, in the first half of 2024, the sales share of products priced below 2,000 yuan accounted for nearly 80% of the online market, a significant increase of 12.1 percentage points year-on-year. Sales of all price segments below 2,000 yuan increased year-on-year, with growth rates of 22%, 31%, and 16% for the 499 yuan, 500-999 yuan, and 1,000-1,999 yuan price segments, respectively. Sales of price segments above 2,000 yuan decreased year-on-year.

Top brands like XGIMI, JMGO, and DBPOWER face the same challenge: how to increase sales of high-end products, i.e., profit-generating models, after industry growth declines. Competing with countless small or OEM brands in the low-end market is clearly unprofitable. The first half of this year saw smart projector sales increase while prices declined, highlighting the problem of intense competition in the low-end market, making it difficult for everyone to make a profit.

Image source: DBPOWER

Consumers don't want fancy technology; they want a good viewing experience that offers better value than TVs. Smart projectors already offer large screens, but they lag significantly in image quality aspects such as brightness, color, and contrast compared to similarly priced LCD TVs. For example, while 4K resolution is nearly ubiquitous in LCD TVs, smart projectors sold through traditional e-commerce channels are still dominated by 1080P resolution, with 4K resolution accounting for just 7% of retail sales, concentrated in the high-end market above 10,000 yuan.

Moreover, resolution is just one parameter determining image quality. Factors like color, brightness, contrast, reflectivity, viewing angle, dynamic effects, and fine details all contribute to overall image quality. TV manufacturers are aggressively pursuing advancements in image quality technology.

From OLED to MiniLED to MicroLED, different large-screen manufacturers are exploring display technologies for better image quality. Building on sub-segments like MiniLED, manufacturers have developed iterative technologies such as TCL's QD-MiniLED and Hisense's ULED-X. To further enhance image quality, companies like Hisense have even begun developing their image quality chips.

In summary, the image quality of large-screen TVs continues to improve, widening the gap with smart projectors. Compared to the latest TVs on the market, the current image quality of smart projectors can only be described as "barely acceptable."

When users seek larger screens, they ultimately desire better image quality, which smart projectors fall far short of delivering.

Smart projectors face an awkward situation where "high-end models can't compete, and low-end models can't generate profits." Mid-to-high-end models can't match the display quality of similarly priced smart TVs, while low-end models sell well but don't generate significant profits.

Smart projectors can't replace TVs: Portability is their biggest advantage?

From a brand perspective, smart projectors cleverly combine TV boxes with projectors, which were once only used during meetings. In terms of interactivity, smart projectors are highly comparable to smart TVs. In terms of experience, smart projectors perfectly cater to domestic users' demand for large screens, though they still suffer from limitations like image distortion, light leakage, and insufficient brightness.

Indeed, almost all reputable smart projector brands are striving to improve projection brightness, whether by enhancing the brightness of projection light sources or adopting short-throw laser projection technology. However, the inferior brightness compared to mainstream TVs remains a weakness that all projector brands struggle to overcome.

Looking back at the development of related products, we must admit that in certain scenarios, such as dedicated home theaters and outdoor settings, high-end flagship smart projectors do have the potential to challenge traditional display products.

At last year's UDE (Universal Display Expo), many projector brands chose outdoor camping as their promotional scenario, even setting up a tent canopy within the exhibition hall to demonstrate smart projector usage outdoors. From a product perspective, smart projectors align perfectly with the outdoor concept of camping, both in form and usage.

Image source: Leitech

Portability is a significant advantage of smart projectors. In outdoor settings, carrying a TV is impractical. While some brands have introduced portable TVs and monitors with built-in wheels for mobility, akin to large "buddy machines," previous reviews by Leitech found them lacking in experience.

Smart projectors, on the other hand, only require a screen or a suitable background to set up a quick outdoor projection system. The only challenge comes from natural sunlight, as smart projectors need to wait for sunset to deliver optimal display results.

Moreover, the integrated nature of smart projectors allows them to replace Bluetooth speakers and large portable chargers, offering more options for outdoor scenarios. Outdoor displays may be a crucial area for projector brands to consider, as this new customer base could breathe new life into the struggling projector industry.

Beyond outdoor scenarios, we're also seeing new attempts like in-car projectors and HUDs. While these may not fundamentally address growth concerns, they do provide some relief for manufacturers.

Projectors have been around for decades, primarily in commercial and educational settings. Technological advancements have been gradual, with no revolutionary breakthroughs. However, the rise in consumer demand during the intelligent era has significantly improved projector image quality and user experience, giving rise to laser projectors, outdoor projectors, and more.

The current challenges faced by smart projectors essentially stem from shifting consumer demands. The previous shift drove the rise of the smart projector market, while this shift reflects a decline in appeal due to technological bottlenecks—a universal law that every home appliance industry must confront.

It now seems unlikely that the golden age of projector growth will return, and the dream of completely replacing TVs may remain just that—a dream.

Source: Leitech