"Xiaoxiong U-Rent's DaaS doesn't seem to be as impressive as expected."

![]() 09/02 2024

09/02 2024

![]() 578

578

This article is the 838th original work of Shenqian Atom

Despite the multi-billion market potential of the DaaS industry, Xiaoxiong U-Rent struggles with commercialization

Meng Fanliao | Author

Shenqian Atom Studio | Editor

For both individuals and companies, failure is often easier than success.

In 2004, starting from selling computers in Huaqiang North, Hu Zuoxiong expanded his business with Lingxiong Technology (the parent company of Xiaoxiong U-Rent). In 2013, he extended the business to leasing IT office equipment such as computers to corporate clients. In 2017, he ventured into the recycling business, joined the digital wave in 2019, and successfully listed on the Hong Kong Stock Exchange on November 24, 2022, becoming the first DaaS industry stock.

On August 23, 2024, Lingxiong Technology released its interim financial report. In the first half of the year, Lingxiong Technology achieved revenue of RMB 943 million, an increase of 14.62% year-on-year; however, it suffered a loss of RMB 39.79 million, an increase of 6.06% year-on-year. After briefly turning a profit in 2022, Lingxiong Technology has been unable to shake off its losing streak.

Perhaps due to a lack of confidence in Xiaoxiong U-Rent's prospects, Lingxiong Technology has underperformed in the capital market since its listing. The issue price of Lingxiong Technology, the parent company of Xiaoxiong U-Rent, was HK$7.6 per share on the Hong Kong Stock Exchange. By the close on August 30, 2024, the share price had fallen to HK$4.52 per share.

Why has Xiaoxiong U-Rent, which took 18 years to reach its peak, fallen into difficulties within just two years?

Once a darling, research and development flaws prevent adaptation to market changes

In Lingxiong Technology's financial reports, there is an interesting statement: maintaining its position as the industry leader. The question arises: can revenue of RMB 942 million sustain this leadership position in such a narrow market segment?

First, let's look at the main business of Xiaoxiong U-Rent. Since its establishment in 2004, Xiaoxiong U-Rent has been dedicated to solving the challenges faced by small and medium-sized enterprises in IT device management. It has gradually developed into a full-stack DaaS service solution provider covering the entire lifecycle management of devices, offering one-stop services including device leasing, recycling, IT technical services, and SaaS-based asset management.

Globally, the DaaS service market is enormous, expected to exceed RMB 100 billion by 2025. However, this market segment has struggled to gain traction in China, with a penetration rate of only around 5%, indicating limited influence on both enterprises and individuals.

Nonetheless, this market segment has still enabled Xiaoxiong U-Rent's success. According to Tianyancha data, Lingxiong Technology listed on the Hong Kong Stock Exchange on November 24, 2022, and raised HK$405 million in financing. Prior to this, it completed eight rounds of financing, including investments from renowned institutions such as JD.com Group, Tencent Investments, Lenovo Capital, Shenzhen Hi-Tech Venture Capital, and China Capital Management, all of which occurred after 2018.

Undoubtedly, Lingxiong Technology's continued recognition by the capital market after 14 years of establishment is attributable not only to the novelty of DaaS services but also to the prosperity of the sharing economy.

Around 2018, the sharing economy flourished, with shared businesses gaining widespread recognition from the capital market, particularly bike-sharing and battery-sharing services. In 2018, when Hu Weiwei sold Mobike to Meituan for US$2.7 billion, the sharing economy thrived. As an IT leasing company, Xiaoxiong U-Rent undoubtedly capitalized on this trend.

As a shared product alone, Xiaoxiong U-Rent's advantage is not particularly pronounced. Unlike other shared products, Xiaoxiong U-Rent also caught the wave of intelligence. In 2021, after completing financing, He Zhiqiang, Senior Vice President of Lenovo Group and President of Lenovo Capital, expressed high hopes for Xiaoxiong U-Rent, noting Lenovo's recognition of its closed-loop ecological service solution for office scenario intelligence, which is highly synergistic with Lenovo Group's DaaS services. In the future, the two parties will complement each other's strengths to create more new value for SMEs.

Although Xiaoxiong U-Rent has stated that it is committed to solving practical business problems through digital DaaS service solutions, creating an asset-light innovation and entrepreneurship service ecosystem. From 2019 to 2023, Lingxiong Technology's R&D investments were RMB 12.03 million, RMB 13.65 million, RMB 18.28 million, RMB 27.49 million, and RMB 25.49 million, respectively, seemingly reducing R&D investments consciously after incurring losses in 2023. Without R&D investments, how can continuous user needs be addressed?

Lingxiong Technology, which originated from selling and leasing computers, does not seem to possess a strong R&D gene. In the first half of 2024, R&D expenses amounted to RMB 12.7 million, an increase of 14.2% year-on-year. However, this increase was driven by the pursuit of the AI trend, similar to the previous pursuit of the sharing economy trend, with limited actual service delivery.

Even during the pandemic, Xiaoxiong U-Rent continued to operate unhindered, successfully listing on the Hong Kong Stock Exchange. However, as time progressed, facing challenges such as slowing industry growth, high customer concentration, business model challenges, fierce market competition, low market awareness, and the absence of industry standards, Xiaoxiong U-Rent failed to provide viable solutions, resulting in its inability to meet previous expectations.

Persistent losses have led shareholders to turn bearish

In fact, since 2018, the number of leasing companies and the balance of leasing assets have declined. As of the end of 2023, the total number of registered and operational leasing companies nationwide was approximately 9,170, a decrease of 6.81% from the end of 2022. The contract balance of leasing companies was RMB 5.76 trillion, a decrease of 1.61% from the beginning of the year.

Amidst the market downturn, Lingxiong Technology, as a leading enterprise in the industry, still managed to significantly increase its customer base for device subscription services by 35.8% year-on-year, reaching 22,726 customers, with a total device subscription volume of approximately 3.112 million units, a noteworthy achievement. This is largely attributed to the advantage of DaaS services, which can help enterprises reduce their initial investment by 97.4%, enabling Xiaoxiong U-Rent to quickly gain market share from competitors in the short term.

Despite Xiaoxiong U-Rent's large and rapidly growing customer base, its heavy reliance on major clients may be attributed to the limited scale of this model in China. In 2023, Lingxiong Technology's largest client contributed 22.6% of total revenue, while its top five clients contributed 31.1% of revenue.

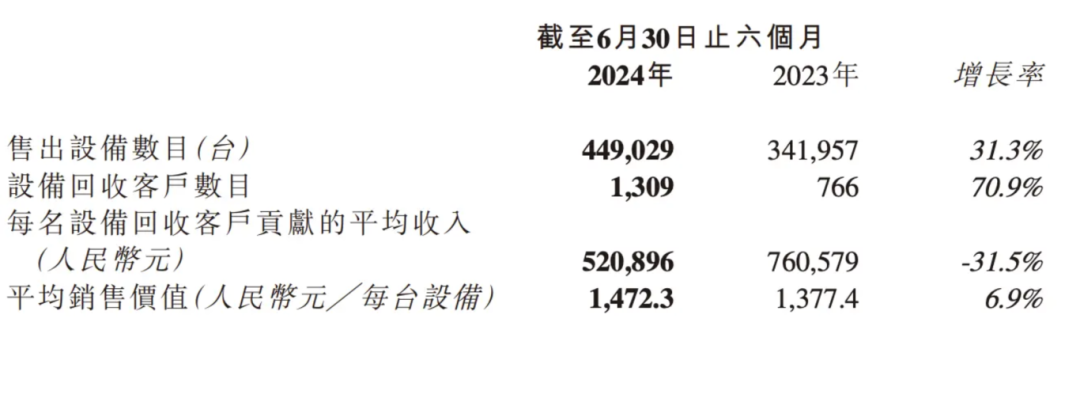

As one of the company's main businesses, the device recycling service contributes significantly to revenue. In the first half of 2024, Lingxiong Technology sold 449,029 devices at an average price of RMB 1,472.3 per device, representing increases of 31.3% and 6.9%, respectively, and generating RMB 660 million in revenue for Lingxiong Technology, accounting for over 70% of total revenue.

Recently, an independent security tester discovered and recovered a significant amount of confidential data from used devices previously used and discarded by Apple or related organizations sourced from the global second-hand market. This has reignited concerns about the information and privacy security of used second-hand products. In 2023, Xiaoxiong U-Rent refurbished 1.3 million devices. Although these devices are priced lower than new ones, ensuring their quality and data security will be a long-term challenge.

Another issue lies in the low gross profit margin of the recycling business. According to financial reports, the gross profit of the device recycling business was approximately RMB 7.7 million, while the gross loss for the same period in 2023 was approximately RMB 11.2 million. The gross profit margin for the device recycling business during this period was approximately 1.1%, compared to a gross loss margin of approximately 1.9% as of June 30, 2023.

To increase revenue, Lingxiong Technology increased its sales and marketing expenses. In the first half of 2024, Lingxiong Technology expanded its sales and marketing team, with distribution and sales expenses reaching RMB 77.3 million, an increase of 48.2% year-on-year.

With increased investments and a decline in the gross profit margin of its core business, how can Lingxiong Technology achieve profitability? In the first half of the year, the loss of RMB 39.79 million was narrower than the RMB 42.36 million in the same period last year; adjusted EBITDA was RMB 140 million, an increase of 4.48% year-on-year.

Of course, to enhance its financial performance, Lingxiong Technology reduced investments in other areas, with administrative expenses totaling RMB 49.3 million, a decrease of 4.5% year-on-year. This may be related to layoffs, as of June 30, 2024, Lingxiong Technology had 1,052 full-time employees, nearly 100 fewer than at the end of 2023. Employee compensation was RMB 93.8 million, a slight decrease from the same period last year.

It is worth noting that on June 28, 2024, Hu Zuoxiong, speaking at an event, expressed optimism about the future of China's DaaS industry, predicting a 32% compound annual growth rate and a market size exceeding RMB 100 billion by 2025. However, many investors may have already lost confidence in Xiaoxiong U-Rent's future, as evidenced by the withdrawal of several shareholders, including Shenzhen Tencent Venture Capital Co., Ltd., Jiangsu JD.com Bangneng Investment Management Co., Ltd., and Lenovo (Beijing) Co., Ltd., in February 2022.

Leasing has revolutionized consumer behavior, but in traditional Chinese culture, leasing is often seen as inferior to purchasing. This may explain why Xiaoxiong U-Rent has struggled to grow as rapidly as other shared products.

Early IT leasing models merely provided device leasing, whereas modern IT leasing also encompasses device installation, after-sales technical support, management systems, customized system development, and more. This is reminiscent of cloud services, where competition is fierce due to the rapid development of cloud computing, leaving Xiaoxiong U-Rent at a disadvantage.

In 2024, with the establishment of the first national resource integration and innovation service platform for China's DaaS industry by the China Association of Small and Medium Enterprises' DaaS Service Professional Committee, can Xiaoxiong U-Rent seize this opportunity for a turnaround?