"Starry Sky Project" Lands at CES: Is Cross-Industry Car Manufacturing Making a Comeback?

![]() 12/31 2025

12/31 2025

![]() 351

351

Lead-in

Introduction

Just a few months after Dreame officially announced its foray into car manufacturing, stepping onto any stage is merely the first step for this newcomer to prove itself in the automotive industry.

Since Xiaomi and Huawei successively entered the automotive market, each sparking a major upheaval across the industry with their respective strengths, everyone has been convinced that after several rounds of market eliminations, no new entrant would dare to venture into car manufacturing. Coupled with the dual impacts of price wars and public opinion battles, the idea that someone would still consider cross-industry entry to grab a share of the pie now seems utterly absurd.

Imagine this: when nearly all Chinese automakers are at the mercy of Huawei's influence and also show deference to Xiaomi's automotive endeavors, which cross-industry player could truly establish a foothold in such a market environment?

On August 28, 2025, Dreame Technology, a company widely recognized for its robotic vacuum cleaners, officially announced its entry into the new energy vehicle industry. It boldly claimed to create a super luxury pure electric vehicle brand, with its first model positioned as a super luxury pure electric sports car, scheduled to debut in 2027, directly competing with million-dollar supercars like the Bugatti Veyron, aiming to become the 'fastest car in the world.'

Upon hearing this news, while not everyone may dismiss Dreame's announcement as a joke, for most in the industry, with so many precedents of failure staring them in the face, the sight of a tech company daring to enter the new energy market at this juncture is truly astonishing.

Now, just a few short months later, one might have expected the topic of 'Dreame's car manufacturing' to gradually fade amidst the hustle and bustle of the Chinese automotive market. Yet, surprisingly, 'Starry Sky Project Automotive,' the vehicle through which Dreame plans to make its mark, recently announced that the 2026 CES (International Consumer Electronics Show) would serve as the debut stage for Dreame's automotive endeavors. According to the information, the new car to be unveiled at the show could indeed be a supercar.

'What path will Dreame take in car manufacturing?' This is undoubtedly the question on everyone's mind. Over the past decade, hundreds of new entrants have tried their hand at car manufacturing, yet none have chosen sports cars as their anchor point to compete in the market. Even the quirky NIO EP9 was, at best, a product aimed at establishing brand image. So, what exactly is Dreame's game plan?

01 Dreame's Growing Resolve in Car Manufacturing

Looking back at 2025, without even mentioning how traditional automakers have been actively showcasing future development trends to the industry, when the remaining 'Wei Xiaoli Ling' (NIO, XPeng, Li Auto, Leapmotor) among the new entrants have prioritized survival above all else, launching cost-effective models to the market, we should recognize that any flashy yet impractical products have been eliminated from automakers' lineups. This not only signifies a shift in consumer trends but also foreshadows the path China's automotive industry should take moving forward.

Of course, given the current market landscape, perhaps it's due to the less-than-optimistic economic environment that Chinese automakers are leaning heavily towards cost-effectiveness. But with the future uncertain, who can break free from this survival logic?

Previously, as Dreame itself acknowledged, amidst the accelerating trends of high-end and globalization in the new energy vehicle sector, truly recognizable Chinese luxury brands on the international stage remain scarce. Therefore, during this rare window of opportunity, Dreame believes it can leverage its technological prowess, global channels, and brand recognition accumulated in the smart hardware sector to achieve a strategic leap from 'smart home appliances' to 'super luxury electric vehicles.'

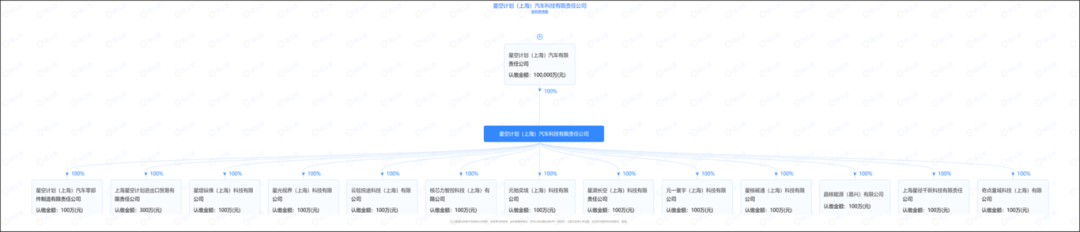

With the Starry Sky Project establishing numerous new companies between December 23rd and 25th. According to investigations, Starry Sky Project (Shanghai) Automotive Technology Co., Ltd. established 11 new companies in Baoshan District, Shanghai, and Jiaxing City, Zhejiang Province, over the aforementioned three-day period. These companies belong to industries such as scientific research and technical services, wholesale and retail, with a 100% stake held in each.

It seems these signs increasingly prove to the outside world that this tech company, suddenly venturing into the automotive industry, possesses ample confidence to shake up the current stagnant automotive market.

Is this the audacity of the ignorant? Back around 2020, we could certainly view it that way. However, considering the market upheavals of the past three years, with companies ranging from HiPhi, Zeekr, and Evergrande Auto at the top to Neta, Seres, and Levdeo at the bottom, none have managed to maintain basic viability. To be honest, it's truly hard to fathom what Dreame is pursuing.

Like every year, the 2026 CES stage always gathers high-tech enterprises from around the globe. When these companies flock together, gaining exposure without genuine capabilities is out of the question.

In other words, for the Starry Sky Project, daring to debut with a supercar at its first appearance inevitably leads people to believe that, unlike other Chinese new entrants, its technological strength is truly formidable.

Indeed, founded in 2017, Dreame initially served as a member of Xiaomi's ecosystem and gained recognition for its smart home devices like robotic vacuum cleaners. Based on its early planning, Dreame's core technologies lie in high-speed digital motors, intelligent algorithms, and robot sensing and control. Once applied to automotive electric drive systems, smart cockpits, and advanced driving assistance systems, could their effects be immediately apparent?

Furthermore, as of May 2025, with Dreame having accumulated over 6,300 patent applications globally, 45% of which are invention patents covering core areas of intelligent vehicles such as sensor fusion and motor control, does this also indicate that replicating Xiaomi's success in the Starry Sky Project's car manufacturing logic is not entirely impossible?

In terms of technological reserves, it can be said that Dreame is not entering the automotive market blindly like past opportunists, armed merely with PowerPoint presentations. Regarding relevant industry personnel, the talent left adrift due to the closure of new entrants in recent years is sufficient for Dreame to assemble a car manufacturing team. However, standing at the crossroads of 2025, amidst ongoing disputes and a market gradually returning to order, the future for newcomers seems to await further exploration.

02 The Chinese Automotive Market Knows No Mercy, Only Reality

Throughout the year, since Neta sounded the final death knell for new entrants, information regarding new entrant car manufacturing has ceased to dominate the internet as it once did. At most, Jia Yueting and his lingering FF occasionally emerge to amuse everyone.

When everyone is resolving their survival through price wars and relying on subsidy policies to Crazy shipment (go all out in shipping products), for today's consumers, buying a car has little to do with the emotional value a brand can offer. Perhaps compared to the vibrant era of the past, such a Chinese automotive market seems overly bland. However, from another perspective, this market status quo, purely oriented towards price, clearly establishes a set of survival rules for everyone.

The Chinese automotive market is vast, and regardless of what a new automaker previously did, there is undoubtedly space for its survival. The key lies in whether the company can truly align with the rhythm of future development, rather than acting on a whim based on the founder's will.

In the past two years, following the exit of numerous new entrants, the Chinese automotive market has welcomed some formidable cross-industry players. Leveraging their traffic (online presence) and Mass foundation (popular support), understanding what Chinese consumers truly need, and launching products that cater to the times, achieving 'explosive sales' doesn't seem that difficult.

Of course, regardless of how inclusive the Chinese automotive market may be, given the current consumer outlook and economic environment, relying on sports cars to achieve primitive accumulation is absurd. Years ago, when everyone's fortunes were on the rise, HiPhi couldn't survive with a sports car priced at over 600,000 yuan. Today, with a market that venerates cost-effectiveness above all else, I remain unconvinced that things would be any different.

In recent years, how pragmatic have Chinese consumers become? Countless stories prove this point. Regardless of the automaker, car manufacturing no longer adheres to strict hierarchical divisions. Overnight, it seems, B-class and even C-class cars are priced like A-class cars, mid-to-large SUVs directly enter the 200,000 yuan price range, and intelligent driving and cockpit features come standard in cars priced at 100,000 yuan... All have become the default development rules.

Among the surviving new entrants in car manufacturing, NIO is lowering prices while introducing the Leapmotor L60/L90 and Firefly; to further attract users, XPeng is massively launching extended-range models; and the 'dark horse' Leapmotor, with its 'half-price Li Auto' approach, solely shoulders the dual responsibilities of reputation and sales, even catching the attention of FAW Group, which directly enlisted it as a technology supplier.

It's said that Chinese consumers' preferences are hard to predict. Their demands of 'wanting everything' are indeed challenging to satisfy. However, the existence of these companies now proves to us that even without a brand halo, taking the path of 'from the people, for the people' can always be applicable.

With a deep foothold in the smart home appliance sector, Dreame's reputation among the masses is evident. Sometimes, its technological attributes inherited from Xiaomi can also evoke strong empathy. Perhaps it was precisely witnessing the senior (predecessors') immediate success upon entry that made Dreime's plan to enter the Chinese automotive market seem so resolute. Debuting at CES 2026 was always a must-do in its established plans.

However, regardless, the Starry Sky Project's appearance at CES is merely the first step in Dreime's long journey in car manufacturing. Positioning itself in the super luxury market, Dreime to some extent avoids the fierce competition in the mass market. Founder Yu Hao's determination is no less fierce than that of his predecessors. Yet, in today's context where China's automotive industry is transforming from a 'follower' to a 'leader,' the success of Dreime's cross-industry attempt depends not only on product strength but also continues to test the market's tolerance for emerging brands.

Editor-in-Chief: Cao Jiadong, Editor: He Zengrong

THE END