Google gives Baidu a temporary relief.

![]() 09/03 2024

09/03 2024

![]() 543

543

Written by Hao Xin | Edited by Wu Xianzhi

On August 22, Baidu released its Q2 2024 financial report. While total revenue remained largely flat compared to last year, advertising revenue declined, but growth in its intelligent cloud business helped fill the revenue gap, barely maintaining growth in Baidu's core revenue. The growth in cloud business driven by large models is becoming increasingly evident.

The financial report showed that Baidu's Q2 revenue was 33.9 billion yuan, a decrease of 0.4% year-on-year. Baidu's core revenue was 26.7 billion yuan, an increase of 1% year-on-year. Net profit attributable to Baidu was 5.5 billion yuan, an increase of 5% year-on-year. Among them, Baidu's online marketing revenue was 19.2 billion yuan, a decrease of 2% year-on-year. Non-online marketing revenue was 7.5 billion yuan, an increase of 10% year-on-year, mainly driven by the intelligent cloud business.

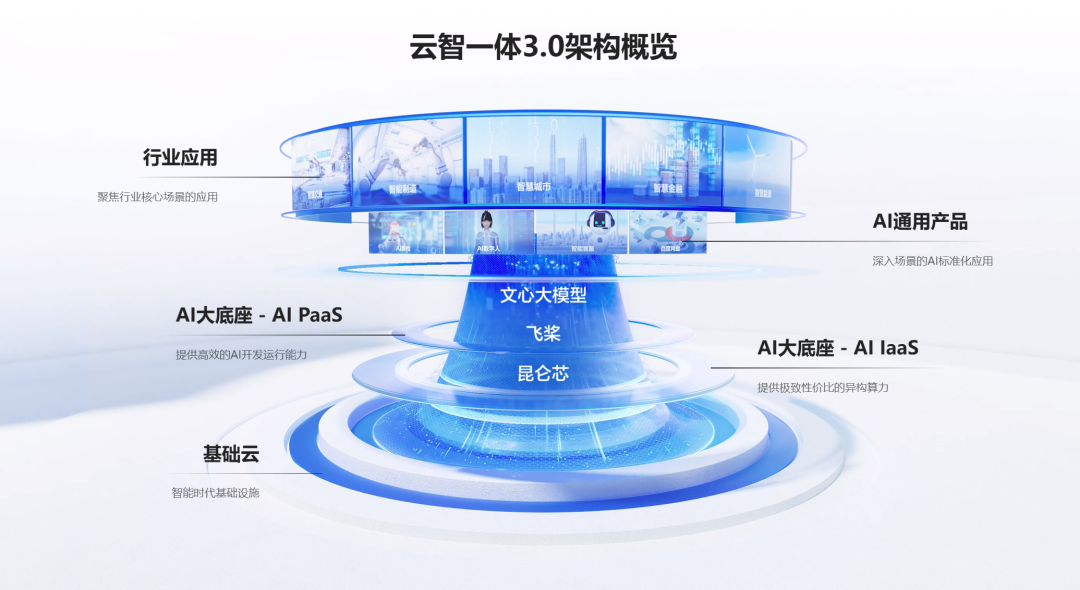

From a business perspective, if we look for a frame of reference for Baidu, it is likely to be Google. Both rely on advertising revenue as their cash cow and have adopted an end-to-end approach for Gen AI, from "chip-framework-large model-industry application." Both are also "old money" companies catching up with the AI trend.

Google's Q2 2024 financial report showed that while YouTube advertising revenue weakened, Google Search significantly exceeded expectations, generating revenue of 48.5 billion yuan, an increase of 13.8% year-on-year. During Google's earnings call, it was stated that "AI has expanded search types, such as visual search." Functions like AI Overview and Circle to Search have enhanced user-side search, subsequently increasing search usage and satisfaction.

Instead of disrupting Google, AI has strengthened its search business, which may also provide Baidu with temporary relief. After all, AI search has become a consensus, and whenever a new company emerges in the market, it immediately claims to "compete with Google and topple Baidu.""

Like Google, Baidu is particularly cautious about matters related to "money." By conducting localized tests of AI search functions and launching new apps, both veteran companies are exploring the boundaries between new technologies, old businesses, commercialization, and user experience.

For Baidu, the decline in online marketing revenue may be a temporary phenomenon, and the pull of AI on search and advertising businesses has yet to be evident. Fortunately, AI search companies like Perplexity are still struggling to increase monthly active users, while Google and Baidu are already among advertisers.

Large Models Promote, Cloud Earns Money

"Currently, the daily call volume of the Wenxin large model exceeds 600 million times, with an average daily usage of about 1 trillion tokens. As of June, the number of developers in the PaddlePaddle Wenxin community has reached 14.65 million."

During the conference call, Robin Li, as usual, focused on the large model. However, at this stage, the large model is more like a "loss-making advertisement," ultimately relying on the cloud for profitability. Currently, there are two ways to earn money from the cloud globally: one is through "cloud vendors + large model vendors," represented by Google, Microsoft, and Baidu, providing MaaS services through the cloud; the other is AI Infra companies packaging GPUs, computing power, model inference, cloud, and software together and charging service fees.

Against the backdrop of "bone-breaking price reductions" for large models, the fees solely from API calls of large models are negligible to Baidu's revenue. Especially when the large model market is still in its early stages, in order to win over ecological partners and establish benchmarks in industry-specific large models, companies like Baidu have chosen to actively forgo profits. According to Photon Planet, Baidu has offered a "several hundred thousand yuan per year" price to a partner company operating across the country in a specific sector.

The same applies to To B, where winning bids for large model projects range from millions to tens of millions, far lower than cloud computing contracts. For state-owned enterprises, there is a tendency to procure a complete solution, with cloud, large models, and applications often packaged together. Due to path dependence, they may continue to adopt a cloud vendor's large model products if they are already using that vendor's cloud services, giving cloud vendors a natural advantage at this stage.

According to a report by F&E Research, the domestic large model sector secured 207 winning bids in the first half of 2024. Among mainstream large model vendors, Baidu secured the most winning bids, covering the most industries, with a total winning bid amount exceeding 64 million yuan. Earlier, Shen Dou, President of Baidu Intelligent Cloud Business Group, revealed that "more than half of the 98 centrally administered state-owned enterprises in China use Baidu's large model platform or services," many of which have been accumulated since the cloud computing era.

Ultimately, the gains brought by large models are reflected in the cloud business. During Baidu's conference call, it was revealed that cloud revenue in Q2 2024 was 5.1 billion yuan, an increase of 14% year-on-year, higher than the previous quarter's 12%. AI revenue accounted for 9% of total revenue, also higher than the previous quarter's 6.9%.

Baidu Intelligent Cloud started late and has a relatively low market share, making it difficult to compete with the well-established Alibaba Cloud and Tencent Cloud. However, with the advent of the Gen AI wave, both companies have seen hope for overtaking the competition on curved roads, with Microsoft abroad and Baidu domestically.

The highly anticipated intelligent cloud business became Baidu's fastest-growing segment in 2022 and achieved its first profit in eight years in Q1 2023. Maintaining double-digit growth for consecutive quarters undoubtedly gave Baidu's intelligent cloud business a boost.

Ever-flowing AI Search, Ironclad Baidu

AI search has become the hottest track at present. Perplexity, an AI search company that neither builds base models nor engages in technological competition, is currently valued at approximately one month's worth of dark money, which is quite impressive.

Carving up the search business is nothing new. From product search on Taobao, lifestyle search on Xiaohongshu, video content search on Douyin, to various AI assistants in this round, they are essentially all within-frame searches. Compared to the generalized ChatGPT, AI search is more focused, with more targeted engineering optimizations in terms of timeliness, information source capturing, and understanding and generating answers.

Judging from the overall trend, users are highly enthusiastic about AI search, leading to unusually high growth rates. Data shows that in July, 360 AI search visits increased by 82.48% year-on-year. Perplexity's search engine answered approximately 250 million questions, compared to 500 million queries throughout 2023, already surpassing half of last year's KPI in just one month.

Although users are willing to actively try AI search applications, the overall search market is still in the hands of Google, Microsoft, and Baidu. Moreover, it has been proven that the AI transformation of established search engines is also gaining momentum. According to the AI Product Ranking aicpb.com, Microsoft New Bing had 178 million visits in July, an increase of 31.49% year-on-year, while Baidu Search, embedded with AI functions, had 392 million visits, an increase of 61.22% year-on-year.

Unlike startups, large companies are less aggressive in search transformation, with the disadvantage of not being natively AI-driven, giving them a "half-internet, half-AI" vibe. Google is a prime example, releasing demos and then disappearing, with new features taking more than half a year to launch due to extensive negotiations with advertisers. However, this gradual transformation also leaves room for AI search commercialization.

During Baidu's earnings call, it was disclosed that the proportion of AI-generated search results in Q2 increased to 18%, a 7% increase from Q1.

"After trying all AIs, I still have to search on Baidu," which may be a common scenario for users at present.

From a technical perspective, model processing is not yet intelligent enough. The current issue is "authorization." To improve search accuracy, reference sources must be introduced. Ideally, the more comprehensive and high-quality the reference materials, the higher the quality of the final answers. However, these channels are controlled by large companies, with Baidu having Baijiahao and its search engine, Tencent having WeChat and video numbers, and ByteDance having Douyin. This means that if a search information source is not authorized to a particular company's AI and is not within the aforementioned distribution channels, it will lack this reference source.

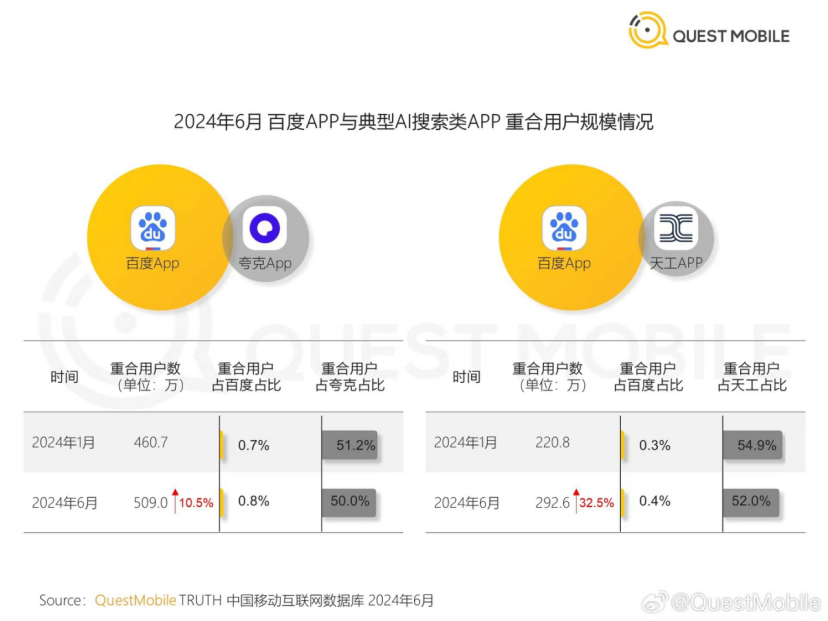

There is also an interesting phenomenon. According to Quest Mobile data, there is a high overlap between users of new AI search apps and those of Baidu apps. Taking Tiangong App as an example, the number of overlapping users between the two in January was 2.208 million, which increased by 32.5% to 2.926 million in June. However, there was a "scissors difference" in the proportion of overlapping users, with the proportion of overlapping users in Baidu increasing while decreasing in Tiangong.

This indirectly indicates that while the number of Baidu app users is still increasing, the growth rate of AI search users has slowed down. According to Baidu's latest Q2 financial report, in June 2024, Baidu App had 703 million monthly active users, an increase of 4% year-on-year.

Search is not yet easily disrupted by AI

Traditional search does not seem to be easily disrupted just yet.

During its earnings call, Google stated that "AI has expanded the types of search." The AI Overview in Lens has led to an increase in overall visual search usage, and ads appearing above or below AI Overview can still attract businesses.

Robin Li has repeatedly emphasized the importance of intelligent agents in public and has now introduced them into search. This not only solves the problem of users not knowing how to search or ask questions but also meets their personalized search needs. Search is no longer just an input-output window but a way to find intelligent agents that can solve practical problems.

According to Baidu's earnings call, the distribution volume of intelligent agents in Baidu's ecosystem has increased significantly, with an average daily distribution of over 8 million times in July, double that in May.

It sounds like the next "pay-per-click" mechanism for intelligent agents. First, Baidu has the right to decide whether to distribute content to Baidu Search, and within the search ecosystem, it can determine the search order. There is also a correlation between users' prompts and different intelligent agents, and its monetization seems to mirror the logic of advertising bidding.

There is no definitive answer to how AI can reconstruct search. Both transformation and starting anew are merely means, but the advertising business model is once again becoming a consensus.

Perplexity, a pioneer in AI search, initially pursued "direct answers without ads," with its primary revenue coming from paid subscriptions from both C-end users and B-end enterprises. However, its founder, Aravind Srinivas, recently stated unequivocally in an interview: "Regardless of how much we criticize Google, the greatest business model of the past 50 years has been click-based advertising. It's a fantastic business model with a profit margin as high as 80%."

When asked, "What will be Perplexity's primary profit engine in the next five years?" Aravind Srinivas confidently replied, "Advertising." Not long ago, Perplexity removed its "not driven by advertising" statement from its official website and announced the introduction of advertising by the end of next month.

Perplexity has single-handedly verified that, at least in terms of business models, AI search cannot completely disrupt traditional search, and the shadows of giants like Google and Baidu will continue to linger overhead.

Can AI keep Google and Baidu strong in the short term, despite their current resilience to disruption?