Car owners complain, insurance companies suffer, why is new energy vehicle insurance so vulnerable?

![]() 09/03 2024

09/03 2024

![]() 460

460

With the increase in sales of new energy vehicles, the price of new energy vehicle insurance in China has become a hot topic.

On the Internet, there are endless news about new energy vehicle owners reflecting on vehicle insurance premiums. Some have even stated that vehicle premiums have risen nearly three-fold. According to data from the National Monitoring and Management Platform for New Energy Vehicles, the total premium for new energy vehicles in 2022 was approximately RMB 65 billion, with an average premium of RMB 4,139 for new energy vehicle insurance, which is 81% higher than the average premium for fuel vehicles.

According to incomplete statistics, of the 55 insurance companies that have disclosed vehicle average premium data for the second quarter of 2024, 44 companies saw a significant increase in their average vehicle premiums compared to the first quarter, accounting for nearly 90% of the total.

Regarding the general increase in average vehicle premiums, industry insiders generally believe that this is directly related to factors such as the increase in the number of commercial vehicles operated in the second quarter, the higher commercial insurance coverage rate, and the increased liability limits for third-party liability insurance. Notably, the rise in new energy vehicle insurance premiums is a major contributing factor.

This increase is also reflected in the fact that premiums have risen rather than fallen this year, even for vehicles that had no claims last year, which is in stark contrast to fuel vehicles. Some insurance companies have even refused to offer commercial insurance due to the high risk involved.

This has led to a bizarre scenario where car owners complain about the high cost and difficulty of obtaining new energy vehicle insurance, while insurance companies also lament their predicament.

Consumers feel aggrieved

In 2023, China's new energy vehicle production and sales reached 9.587 million and 9.495 million units, respectively, up 35.8% and 37.9% year-on-year. The premiums for new energy vehicles have also risen, primarily in two ways. First, the premiums for new energy vehicle insurance in 2023 increased by 3.7% compared to 2022, accounting for 11.5% of overall vehicle insurance premiums. Second, the premiums for new energy vehicles are significantly higher than those for fuel vehicles. According to the "New Energy Vehicle Insurance Market Analysis Report" released by the China Banking and Insurance Regulatory Commission, the average premium for new energy vehicles in 2023 was approximately 21% higher than that for fuel vehicles, with pure electric vehicles costing an average of RMB 1,687 more per year than fuel vehicles, roughly 1.8 times the cost of fuel vehicles.

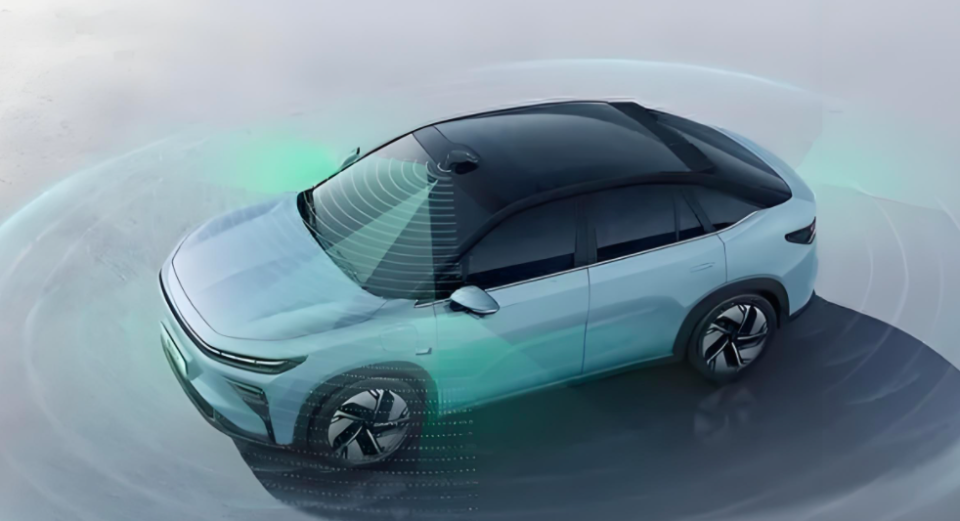

The reason for the rise in new energy vehicle insurance premiums lies in the product-level innovations of new energy vehicles, such as their relatively complex intelligence and autonomous driving capabilities, which can result in greater losses if they malfunction. Additionally, the driving characteristics of new energy vehicles differ from those of fuel vehicles, with faster acceleration that some drivers may not be accustomed to, leading to a higher likelihood of accidents. Therefore, new energy vehicles face challenges such as difficulty in pricing premiums and high maintenance costs.

This poses significant challenges for consumers, as the decreasing prices of new energy vehicles have lowered the threshold for purchasing them, resulting in increased sales. Moreover, the improved energy efficiency of new energy vehicles has reduced vehicle operating costs, broadening the consumer base. However, the rise in insurance costs has left many consumers feeling cheated, as the insurance bills far exceed those for fuel vehicles, leading to psychological imbalances.

Taking Xiaomi SU7 as an example, according to public information, Xiaomi's official platform currently offers two insurance plans: Basic and Premium. The Basic plan costs RMB 6,638.29 and includes compulsory traffic insurance (RMB 950), commercial insurance (RMB 5,500.29), and driver and passenger accident insurance (RMB 188). The Premium plan costs RMB 7,035.95, with the main difference being that the third-party liability insurance coverage increases from RMB 2 million to RMB 3 million. Of course, there may be regional differences in premiums, but they generally range from around RMB 6,000 to RMB 9,000.

To be honest, this is close to the premiums for fuel vehicles costing over RMB 500,000, so the price is not cheap.

These are just the initial insurance costs. Other new energy vehicle brands also face challenges when it comes to renewing insurance policies. On social media, many new energy vehicle owners have reported not only increases in their insurance premiums upon renewal but also being denied insurance coverage altogether by some insurance companies.

Note that being denied insurance coverage here refers to being unable to purchase commercial insurance.

Insurance companies struggle

Some industry insiders believe that as a new category, new energy vehicles have not been around for long, and a mature risk assessment system has yet to be established. This results in higher overall costs for insurance companies, which are then passed on to consumers in the form of higher insurance premiums.

For example, the bumper, which is one of the most prone to damage, has a relatively simple structure in traditional fuel vehicles, primarily consisting of a plastic bumper and a few radar devices. In contrast, the bumper of a new energy vehicle is much more complex, integrating various electronic devices such as lidar, millimeter-wave radar, and cameras. While these features enhance the driving experience, they are also highly susceptible to damage in accidents, increasing maintenance costs.

Another factor is battery costs. In 2023, the average zero-to-whole-vehicle ratio for domestic new energy batteries was approximately 48.5% to 50%. This means that if the battery fails, the repair cost could reach half the vehicle's price. Moreover, since new energy vehicle batteries are typically located under the vehicle, they are more vulnerable to scratches and bumps. This is not a concern for fuel vehicles. All of these factors undoubtedly increase the insurance company's compensation costs.

According to previous data from Pacific Insurance, the claim rate for new energy vehicles is twice that of fuel vehicles. Taking vehicle damage insurance as an example, the claim rate for private passenger cars, which account for the largest proportion of new energy vehicles, is as high as 30%, significantly higher than the 19% for fuel vehicles.

The average compensation rate for new energy vehicle insurance is close to 85%, which is roughly 10 percentage points higher than that for fuel vehicle insurance across the industry.

Most insurance companies are operating their new energy vehicle insurance business on the verge of profitability, facing significant pressure to cover losses. This is an unsustainable burden for insurance companies. In 2023, the combined cost ratio of new policies for new energy vehicle insurance basically exceeded 100%, with some companies even reaching a combined cost ratio of 130%.

The top three insurance companies in the new energy vehicle insurance business are currently operating at a loss. Overall, People's Insurance Company of China (PICC), Ping An Property & Casualty Insurance, and China Pacific Property Insurance (CPIC) account for 68.6% of the vehicle insurance market, firmly establishing themselves as market leaders.

While we do not have specific data on this, we can infer from the comments made by Gu Yue, Chairman of CPIC Property & Casualty Insurance, at the 2023 annual results press conference that "our new energy vehicle insurance combined cost ratio is still in a loss-making state." In the first half of 2023, the combined cost ratio for CPIC's vehicle insurance underwriting reached 98%.

Currently, new energy vehicle manufacturers are also entering the insurance market to compete for a share. Companies such as BYD, XPeng, NIO, and Lixiang have established their insurance brokerages, aiming to reduce intermediate links and lower the prices of new energy vehicle insurance.

Elon Musk previously stated that insurance will become one of Tesla's main products, and the value of this self-operated insurance business is expected to account for 30% to 40% of the total vehicle value in the future.

Car Review by the Public

Objectively speaking, the current situation of high prices and widespread complaints regarding new energy vehicle insurance can only be considered temporary. The most direct reason is that new energy vehicles have not been around for long, and issues have arisen not only in vehicle insurance but also in areas such as charging infrastructure, parity between fuel and electric vehicles, and owner rights protection during model transitions.

However, these issues do not negate the fact that new energy vehicles represent the future direction of development. Based on this premise, the chaos in the new energy vehicle insurance market is bound to undergo a brutal market baptism before returning to order.