"360" in the United States is living the way Chinese internet companies aspire to

![]() 09/03 2024

09/03 2024

![]() 493

493

This article is written based on publicly available information and is intended solely for the purpose of information exchange and does not constitute any investment advice.

It seems that we have found a truly small yet exquisite business model in Life360 (NASDAQ:LIF).

With a clear business direction - safety. Focus on their core competency, acquiring users by continuously enriching features and improving product experience, and generating revenue through value-added products. Stable and effective pricing converts casual users into paying subscribers, without disrupting the lifecycle of paying users through promotional activities. Nor do they arbitrarily add assumed features (I've seen business owners directly interfere with product managers, adding features without justification, leading to deteriorating product performance), leaving users confused.

Focus is the key to Life360's success.

After reviewing Life360's business and data, I want to summarize my thoughts into three progressive conclusions:

1. "Focus" on one business direction;

2. Build your moat around this direction;

3. Continuously expand the depth and horizontal coverage of this direction, with depth being more important than horizontal expansion;

Life360 is an excellent product discovered through our daily market scans.

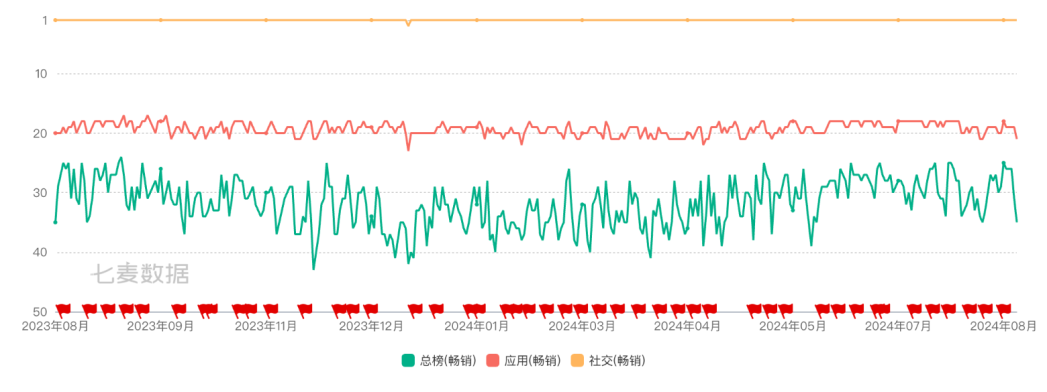

In our daily scans, one product stood out due to its consistently strong ranking on the bestseller list. On the US social app charts, this app consistently ranks No.1 on the "Social Best Sellers" list and around the top 20 on the overall non-game app bestseller list for the past year. Amid the glare of internet product stars, this product seems unremarkable, and due to its misleading name, one of my colleagues even mistook it for a Qihoo 360 overseas product. This product is Life360.

Upon a brief investigation, I was amazed by the uniqueness of this company and its operating model. Such a "narrow" need has somehow supported a publicly listed company with a market value of $4 billion today!

What inspired the founders to discover this need, and how did they persist for over a decade to bring this niche product to the public markets?

01 Founding and Development History

Life360 was founded in 2008 by Chris Hulls and Alex Haro, with headquarters in San Francisco. Its core offering is location-based member tracking and monitoring services.

The company's flagship product is the Life360 app, a mini-social product designed for family members or close relationships. Members can share locations, send notifications, and request emergency assistance.

Despite being a purebred American company, Life360 chose to list on the Australian Securities Exchange in 2019. However, in June 2024, when conditions were ripe, the company returned to its home base on Nasdaq, with a current market value of $4 billion.

Life360's core user need is safety. As a single app cannot fully address safety needs through location sharing, the company has continuously partnered with automakers, enriched features, and made acquisitions to cater to comprehensive safety demands.

1) Infiltrating mobile internet products into real-life scenarios to solidify the user base

In 2013, Life360 partnered with BMW to integrate its location services into BMW's navigation system. Coincidentally, Google shut down a Life360-like product, Google Latitude, in 2013, opening up room for Life360's growth and global positioning support.

In 2016, Life360 added a feature allowing smartphones to detect car accidents and automatically contact emergency response teams.

In January 2018, Life360 collaborated with ADT to launch ADT Go, leveraging ADT's extensive security infrastructure to connect and protect homes outside the house.

As Life360 continues to infiltrate real-life scenarios, it has also acquired companies to enrich and complete the full range of safety application scenarios on the app - member tracking, safety alerts, messaging, and family socializing.

2) Acquisitions to compensate for functional deficiencies in their own products

In February 2016, they acquired "Couple," a private messaging app.

In November 2019, they acquired ZenScreen, an app that helps users and families track and manage screen time habits.

In February 2021, they acquired Tile, a leading company in the lost item tracking space, for $205 million. Tile, founded in 2012, specializes in small hardware devices that can be attached to valuable items like wallets, phones, and suitcases. When an item is lost, the Tile app on the phone uses Bluetooth to locate and make the item beep.

The ZenScreen acquisition helped Life360 complete the core building block of its final product usage loop - family member tracking.

After reviewing Life360's feature development and acquisitions, I sense a distinct operational "rhythm" - methodically enhancing the product experience to retain old users and attract new ones. This unwavering focus on their core competency, unperturbed by market trends, is rare among domestic enterprises.

A good operational rhythm inevitably leads to satisfactory data results. As of Q2 2024, Life360 had 70.6 million monthly active users (MAU) globally, 2 million paying subscribers, revenue of $84.9 million, and adjusted EBITDA of $11 million. With quarterly revenue exceeding RMB 600 million, is the market behind Life360 large enough to sustain it?

To analyze the feasibility of location sharing for safety in China, is this market viable here? Based on my knowledge, there are virtually no similar businesses in China. The question arises, why not? Let's go back to the basics and analyze how Life360 specifically approaches "location sharing and tracking."

02 Life360 Safety Application Scenarios

Life360 primarily provides location-based family tracking and monitoring services. Typical application scenarios include tracking family members' locations while they are out, ensuring safety, and additional location-based services like tracking valuables and personal items like keys, wallets, and phones.

The Life360 app has four main features: Location Share, Circles, Places, and Premium.

1) Location Share

The app's primary function is location sharing, allowing users to view each other's locations.

2) Circles

Circles allow users to create separate groups within the app, similar to WeChat groups in China. Members of a circle can view each other's real-time locations, which are only visible to members of the same circle.

3) Places

Users can create geofences called Places, which trigger alerts when someone enters or leaves a designated area. This feature resembles a protective boundary drawn by Sun Wukong's golden cudgel. It's practical in specific scenarios, like monitoring a child's safety when a parent briefly steps out.

4) Premium

Life360's paying subscribers can access additional features like emergency SOS alerts, sending silent alerts with locations to friends, family, emergency contacts, and rescue services, 24/7 live advisor services, identity theft protection, and roadside assistance.

These scenarios form the user demand basis for Life360's $4 billion market value.

All features stem from the single function of location sharing, gradually expanding into unique products like Circles and Places to fit certain life scenarios. These features then spawn value-added services, generating revenue.

03 Is It Feasible in China?

I believe few domestic internet companies possess the capability to comprehensively expand a business from shallow to deep in this manner.

1) Differences in internet product usage habits exist between users. Domestic users prefer a single app to solve all problems, while Americans tend to use specialized apps for specialized tasks.

Firstly, no domestic company offers a separate app for real-time family member tracking through location sharing. Typically, this function is bundled as an additional feature in a super app, like WeChat's location sharing or hardware like Xiaotiancai smartwatches. Even if there are standalone location-sharing apps, they often add a host of online social features, like Zenly-like LBS socializing. In China, parents prioritize their children's safety but may not realize the need for a dedicated app. They usually follow their children wherever they go.

When browsing Life360's app store reviews, a typical scenario emerged: parents monitoring their children's locations during college or high school orientation or parties to ensure their safe return. It's evident that children dislike such apps, and negative reviews often stem from resentment towards parental monitoring. However, positive reviews highlight how the app addresses parents' core need to ensure their children's safety.

Parents' concern for their children's safety is a strong need in any country. However, parents in different countries approach this concern differently. Chinese parents tend to "call and ask where you are and what you're doing," while American parents prefer to "open the app and see where you are, ensuring you're not in danger or somewhere you shouldn't be."

2) A startup struggling to profit and go public for years would find it hard to survive in China

Life360 took 11 years to go public in Australia. A crucial factor was that the company's revenue in 2019 fell short of Nasdaq's listing threshold. Additionally, an early investor from Australia helped facilitate the listing through connections at the stock exchange.

During the 11 years between founding and listing, the company relied on its own cash flow and investor funding. This lengthy and arduous process tested not only the founders but also investors' patience and confidence.

Fortunately, both the founders and investors persevered. This is the American market; American capital may not be as patient with domestic enterprises. Domestic capital is similarly impatient with domestic enterprises.

04 Are They Really Making Money?

Returning to the Life360 story, a focused narrative is inspiring, but profitability validates the focus. Let's examine Life360's operational data from a financial perspective.

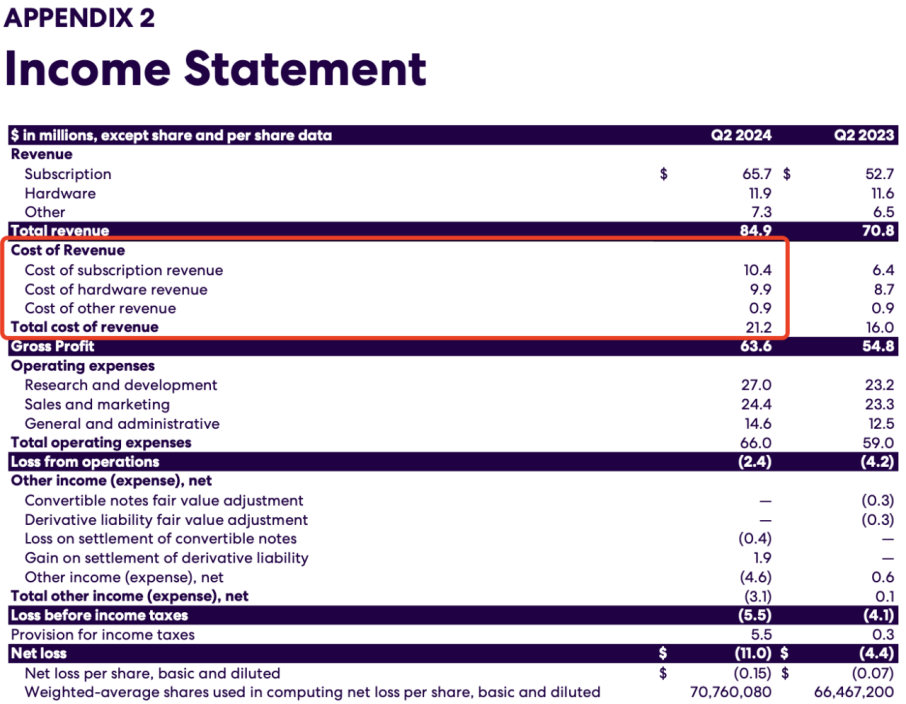

Life360's revenue comes from three main sources: subscription services, hardware sales, and others. According to Q2 2024 financials, revenues were $65.7 million, $11.9 million, and $7.3 million, respectively, accounting for 77%, 14%, and 9% of quarterly revenue. Subscription services are the primary revenue contributor, with a gross margin of 80% compared to 20% for hardware sales.

Hardware sales revenue comes from Tile's Bluetooth trackers;

Subscription revenue stems from value-added features and member subscriptions.

Hardware sales losses directly contribute to Life360's operational losses, not only failing to contribute profits but also declining for several consecutive quarters. The historical burden of acquiring Tile needs time to be digested.

Fortunately, subscription revenue has become Life360's core income source. According to Q2 financials,

1. Total revenue for Q2 2024 was $84.9 million, a 20% YoY increase, with subscription revenue at $65.7 million, a 25% YoY increase, and core subscription revenue at $60.2 million, also a 25% YoY increase.

2. Net loss for Q2 2024 was $11 million, including $5.8 million in IPO-related transaction costs and a $5.2 million increase in income tax provisions compared to Q2 2023. We estimate 2024's income tax expense to be between $2 and $4 million.

3. Adjusted EBITDA was positive at $11 million, compared to a negative EBITDA1 of $5.6 million. Adjusted EBITDA was $5.7 million in Q2 2023, with a negative EBITDA of $2 million. Q2 2024's EBITDA loss includes $5.8 million in IPO-related transaction costs.

4. Operating cash flow was positive at $3.3 million, including the impact of $5.8 million in IPO-related transaction costs.

Business operation metrics show impressive user engagement and subscription conversion rates, driven by product reputation and global expansion.

1. Global MAU increased by 4.3 million net in Q2 2024, a 31% YoY growth to approximately 70.6 million. Management revealed that 70% of new users came from word-of-mouth referrals.

2. Global core subscriptions increased by 132,000 net in Q2 2024, a Q2 record and 25% YoY growth, bringing total subscriptions to 2 million, thanks to improved conversion and retention rates.

3. Average revenue per paying customer (ARPPC) increased by nearly 6% YoY, mainly due to price hikes for existing Life360 Android subscribers at the end of 2023 and the introduction of a three-tier membership in the UK and ANZ in October 2023 and April 2024, respectively.

Recent quarterly revenue data indicates that subscription revenue is growing rapidly. After years of hardware and software integration, Life360 is poised for profitability, perhaps as early as this winter.