The second half of live streaming e-commerce: Top streamers 'forge ahead bravely', while emerging forces continue to hype

![]() 09/06 2024

09/06 2024

![]() 540

540

Since the launch of Taobao Live in 2016, the live streaming industry has undergone rapid development over the past five years. During this period, the unprecedented enthusiasm of consumers for shopping has given birth to one top streamer after another, vividly embodying the "80/20 rule" among them.

However, while contributing a significant portion of GMV to the platform, they are often accompanied by various controversies. Especially as the growth of the live streaming e-commerce market becomes more subdued, their every move is magnified.

What's happening to the top streamers?

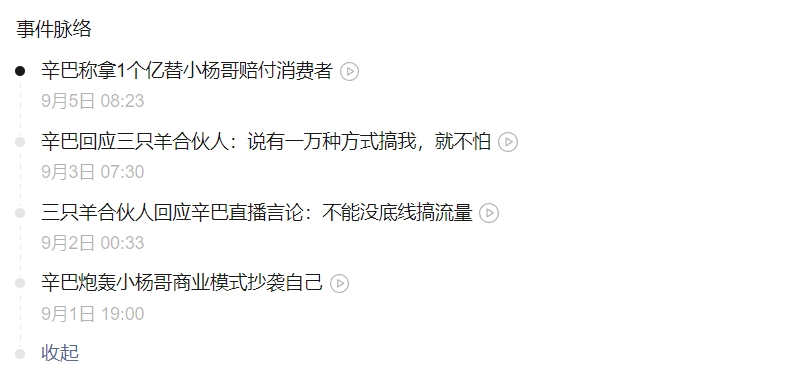

Recently, top streamers on Kuaishou and Douyin, Xinba and Fengkuangxiaoyangge (Three Sheep), got into a dispute over the sale of crab gift cards from the same brand. From initial accusations to mutual revelations of secrets, it eventually escalated into the so-called "Lion vs. Sheep War." Xinba even claimed he would spend 100 million yuan to compensate consumers on behalf of Xiaoyangge.

Image source: WeChat Search

In fact, it's clear to anyone with discerning eyes that all disputes between the two sides stem from their own interests. As the matter is still ongoing, all we can do is grab a seat and watch the show unfold.

Similarly, two other top streamers, Dong Yuhui and Luo Yonghao, have recently found themselves in the midst of public scrutiny.

In the month after Dong Yuhui's departure from EastBuy, both his fan base and live streaming sales figures have remained strong. His personal Douyin account gained nearly 520,000 new followers, while his "Walk with Hui" account gained over 1.6 million. With a monthly GMV of 739 million yuan, equivalent to an average daily GMV of over 23 million yuan, this far surpasses EastBuy's monthly GMV of 248 million yuan.

Despite the impressive sales growth, Dong Yuhui's interviews have been plagued by mishaps, possibly due to the transition from employee to boss, making it difficult for audiences to empathize with him as they once did. As a result, public opinion has shifted, and his reputation is showing signs of decline.

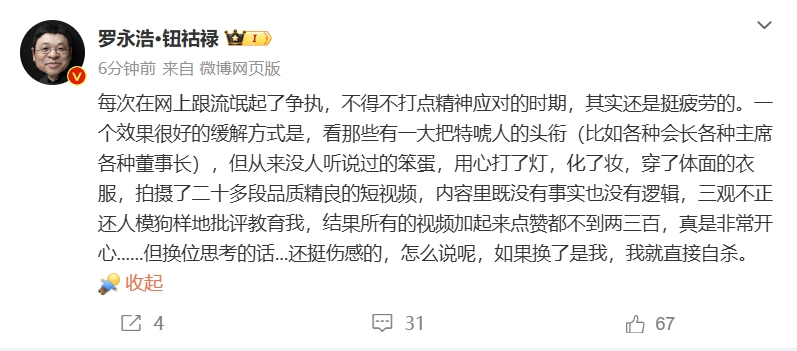

On the other hand, Luo Yonghao and Zheng Gang, an early investor in Smartisan Technology, have been embroiled in a heated debt dispute. Their arguments on social media have focused on capital repayment and reputation. We may never know the truth, but they have already changed their Weibo usernames to "Luo Yonghao, Niu Huru" and "Zheng Gang, Guo Junwang," respectively, as if to add drama to the situation. The "real repayment drama" has only just begun.

Image source: Weibo

Having discussed the current status of many top streamers, some of you may be wondering if anyone was left out. Indeed, Taobao's top streamer Li Jiaqi has been busy "forging ahead bravely" in his crossover endeavors, taking a brief hiatus from live streaming.

However, this has not prevented him from trending on social media, with the hashtag "#Should Li Jiaqi, who earns 2.2 billion yuan annually, still forge ahead bravely?#" once topping the trending list. To date, Li Jiaqi remains in the game, and his crossover journey continues.

Amid heated debates and controversies, live streaming e-commerce faces a shake-up

As we can see, the current situation of big streamers is surprisingly consistent, with controversies arising whether they are selling products on live streams or engaging in crossover performances. In fact, their every move can reflect the current state of the live streaming e-commerce industry to some extent.

The past year has been a complex one for live streaming e-commerce.

On the one hand, the market size is still growing, with a stable user base, albeit at a significantly slower pace.

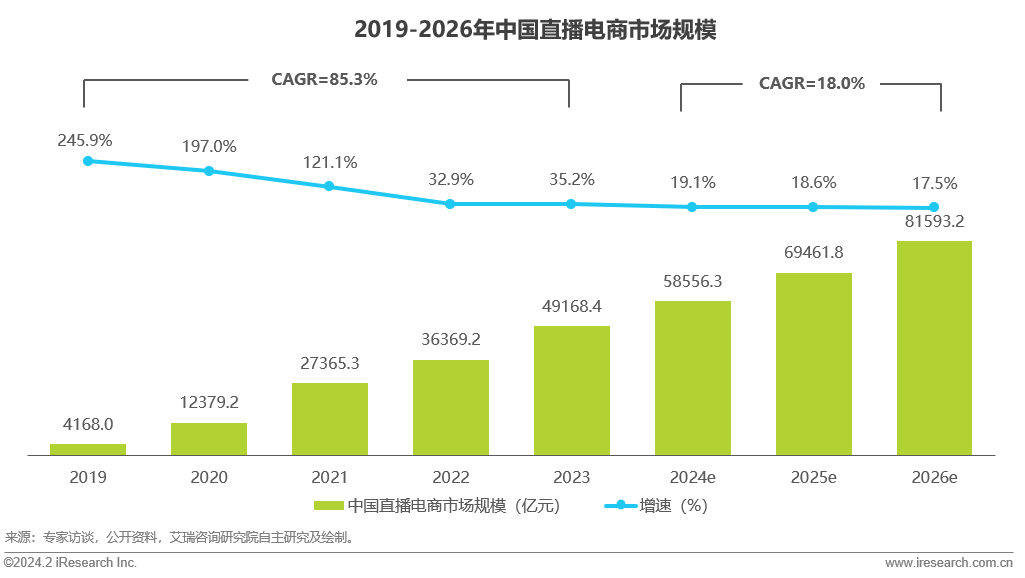

According to iResearch's "China Live Streaming E-commerce Industry Research Report 2023," the market size of China's live streaming e-commerce reached 4.9 trillion yuan in 2023, with a year-on-year growth rate of 35.2%. In the first half of the year, live streaming e-commerce GMV was approximately 1.99 trillion yuan. Relying on major promotional events like Singles' Day in the second half of the year, the annual growth rate was maintained above 35%.

Image source: iResearch

In contrast, the year-on-year growth rates for the previous four years were 227.7%, 189.57%, 83.77%, and 48.21%, respectively, indicating a clear slowdown. However, considering that the penetration rate of live streaming e-commerce is still increasing, with a user base of 540 million, the slowdown in growth is understandable given the large user base.

iResearch predicts that the compound annual growth rate (CAGR) of China's live streaming e-commerce market size will be 18.0% from 2024 to 2026, indicating a steady growth trend and a move towards refined development in the industry.

From the perspective of annual discussion heat, the traffic advantage of live streaming e-commerce has not diminished. It remains a frequent topic on trending lists and headlines across various media outlets. The various incidents mentioned earlier are all among the hottest topics in the e-commerce industry this year, and there are many similar incidents.

On the other hand, there are increasing controversies in the industry, and the resistance to upward breakthroughs is also growing.

The disputes between Dong Yuhui and EastBuy's "separation," as well as the "crab card" spat between Xinba and Xiaoyangge, can essentially be attributed to conflicts over profit distribution. Li Jiaqi's crossover into the entertainment industry, on the other hand, implies that big streamers are seeking potential growth points outside of the live streaming industry.

Image source: UNsplash

Uneven profit distribution and the "either-or" dilemma are hardly new topics. However, as the wild growth period of the live streaming industry has passed, making money is no longer as easy as before, and all parties have become more sensitive. This has led to even greater controversies and more attention.

Overall, live streaming e-commerce remains a profitable business, with no shortage of users, heat, or resources. However, after years of exponential growth, encountering a bottleneck is normal. Driven by growth anxiety, platforms, streamers, and MCN agencies are engaging in internal friction, indirectly creating a breeding ground for the aforementioned chaos.

It can be said that the live streaming e-commerce industry has reached a crossroads, and a new round of reshuffling is inevitable.

E-commerce platforms compete for traffic, while emerging forces in live streaming e-commerce bide their time

The live streaming e-commerce industry does not follow the rule that the strong will always remain strong. At least that's what new forces in live streaming e-commerce like JD.com, WeChat Video, and Xiaohongshu believe. They are determined to carve out a share of the market currently dominated by Taobao, Douyin, and Kuaishou.

Since tasting success during last year's Singles' Day, JD.com has placed increasing importance on live streaming. It has Tilted resources towards live streaming at least three times this year, with the latest investment adding 1 billion yuan in cash and traffic resources.

In March this year, JD.com identified "content ecosystem," "open ecosystem," and "instant retail" as its three key directions for 2024. The content ecosystem includes live streaming and short videos within JD.com, reflecting the company's emphasis on content-based e-commerce.

With the investment of resources, results have followed. According to official data, JD.com's live streaming orders during 618 this year increased by over 200% year-on-year. Chasing the AI trend, digital humans were launched in over 5,000 brand live rooms, with a cumulative broadcast time of over 400,000 hours and over 100 million viewers.

Image source: Leitech

Judging from current developments, JD.com's live streaming e-commerce is likely to adopt an aggressive strategy in the new year, focusing resources on building top live rooms and super streamers. This is precisely why JD.com was rumored to have attempted to poach Dong Yuhui.

However, JD.com is not without its share of top streamers. When Luo Yonghao joined JD.com, he also set a series of records, but the heat dissipated quickly. Therefore, in addition to building top live rooms, JD.com may also need to consider how to maintain the heat through its content ecosystem and cultivate users' habit of watching live streams on JD.com.

Turning to WeChat Video, Tencent CEO Pony Ma singled out WeChat Video for praise at Tencent's annual meeting in January this year and proposed to fully develop WeChat Video e-commerce in 2024.

According to LatePost, WeChat Video's gross merchandise volume (GMV) in 2023 was approximately 100 billion yuan, still lagging behind Douyin E-commerce's 2 trillion yuan GMV. However, in terms of scale growth and conversion efficiency, WeChat Video E-commerce shows considerable potential. According to data from the "2024 WeChat Open Class," the number of suppliers on WeChat Video increased by over 300% year-on-year, orders increased by over 244%, and the order volume increased by over 244 times, with a GPM (gross merchandise value per thousand viewers) exceeding 900 yuan.

Image source: WeChat

WeChat Video's advantages and disadvantages in live streaming e-commerce are clear. The advantage is that it has no shortage of traffic, leveraging WeChat's social network to quickly reach a vast user base through acquaintance-based communication channels, achieving deeper and more efficient penetration than JD.com. The disadvantage is that it started late, and its supporting facilities are not yet perfect, requiring improvement in terms of product and merchant scale, streamer resources, transaction rules, and after-sales guarantees.

Therefore, WeChat Video Live has been making adjustments, such as modifying live streaming categories and changing transaction outlets, upgrading WeChat Video Stores to WeChat Shops. Currently, the difference between WeChat Video Live and platforms like Douyin and Kuaishou lies in the fact that WeChat Video does not consider live streaming as a separate business line but fully integrates it into the WeChat ecosystem.

In addition to WeChat Video and JD.com, platforms like Xiaohongshu and Bilibili are also potential challengers capable of changing the landscape. Whether live streaming e-commerce will evolve from a tripartite standoff to a flourishing landscape remains to be seen, depending on whether these up-and-comers can muster the momentum to catch up.

Final Thoughts

Returning to the highly popular streamers, they are more like a double-edged sword for platforms – capable of defeating enemies but also potentially harming themselves.

Streamers have always occupied a central position in live streaming e-commerce, connecting platforms, users, merchants, and other resources, and holding the most traffic. On the one hand, platforms rely on streamers to generate more GMV, and the past few years have proven how crucial top streamers are to platforms.

On the other hand, when resources are excessively concentrated on one individual, it can easily lead to uneven distribution of platform resources and excessive individual inflation, thereby weakening the profits of platforms and merchants. Therefore, no platform or merchant wants to see a monopoly situation. Platforms can support more mid-level and top streamers to weaken the influence of a single streamer, while merchants can focus on store broadcasts to reduce their reliance on big streamers.

Of course, top streamers are not going away in the live streaming industry. All parties need such a role. The key is to explore a mutually satisfactory cooperation and profit distribution model. In the coming years, the live streaming industry is bound to face turmoil, and it remains to be seen who will rise to the occasion, but the process promises to be exciting.

Source: Leitech