Behind the relaunch of ride-sharing is Amap's unconcealed ‘ambition’

![]() 09/09 2024

09/09 2024

![]() 494

494

Drawing lessons from history, we can often see the wisdom of the ancients and the progress of the times in today's events. As the Han dynasty scholar Heng Kuan once said, "The wise adapt to the times, and the knowledgeable act according to circumstances."

Source: Amap official

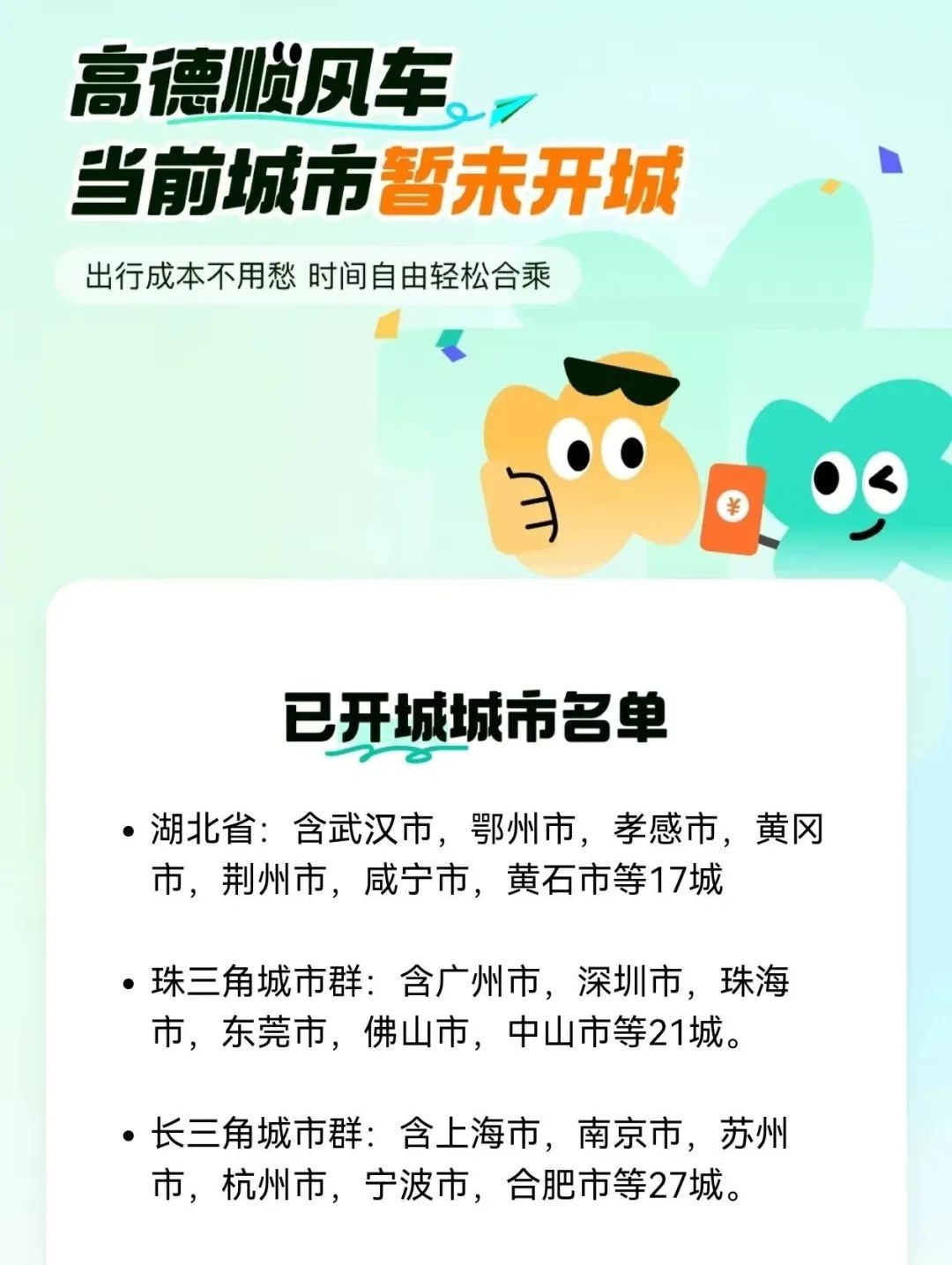

Recently, Amap has demonstrated such wisdom. As the ride-hailing market becomes saturated, Amap, sizing up the situation, announced the relaunch of its ride-sharing service and embarked on a large-scale rollout nationwide, initially covering 65 cities including the Pearl River Delta, Yangtze River Delta, and Wuhan, Hubei Province, marking another important layout in the travel service sector.

Ride-sharing relaunch: Seizing opportunities in the incremental market

Looking back, at the end of 2017, the embryonic form of Amap's ride-hailing service took shape. Unlike Didi, Amap, which entered the ride-hailing market later, chose a different path and adopted an aggregation model. Then, in 2018, due to Didi's ride-sharing controversy, Amap briefly relaunched its ride-sharing service before quickly taking it offline.

Recently, T3 entered the ride-sharing market, and Amap also relaunched its ride-sharing service. Much of this is attributed to the saturation of the ride-hailing market and the inherent potential and advantages of the ride-sharing market itself.

In June this year, Dida successfully listed on the Hong Kong Stock Exchange, becoming the "first Chinese shared mobility stock." According to the prospectus, Dida's adjusted net profits from 2021 to 2023 were RMB 238 million, RMB 84.71 million, and RMB 226 million, respectively; in the first half of 2024, Dida's adjusted net profit reached RMB 130 million, a year-on-year increase of 51.3%.

Meanwhile, for shared mobility platforms that went public in Hong Kong during the same period, Tianyancha data shows that Caocao Mobility lost RMB 1.92 billion in 2023, while Ruqi Mobility lost RMB 690 million. In comparison, Dida stands out as one of the few profitable companies in the generally loss-making shared mobility industry.

Notably, Dida's ride-sharing business accounted for 66% of its total business in 2018 and grew to 95% by 2023, occupying a pivotal position. In contrast, Caocao Mobility and Ruqi Mobility, which focus on ride-hailing, highlight the profitability potential of ride-sharing services.

Source: pixabay

Furthermore, ride-sharing operates on a lightweight model, where platforms do not need to establish their fleet or bear the operational costs of leasing fleets. Compared to ride-hailing, ride-sharing does not require operating licenses and has lower operational thresholds, offering significant advantages.

Moreover, in the current four-wheeled vehicle travel market, ride-sharing accounts for only 1% of the share. By 2025, China's ride-sharing (carpooling) market is expected to reach RMB 113.9 billion, with a compound annual growth rate of 41.8%.

Based on total transaction value, the potential market size of ride-sharing is expected to reach RMB 522.9 billion by 2025. The ride-sharing market is projected to be the fastest-growing segment in the future. As consumer habits evolve, ride-sharing usage scenarios will better align with user needs, transforming the ride-hailing market from a red ocean of stock to an incremental market for ride-sharing.

Moreover, the ride-hailing market has nearly reached saturation this year. Cities like Jingdezhen, Suzhou, Chongqing, and Putian have issued saturation warnings due to excess capacity in their ride-hailing markets, publicly cautioning against entering the industry.

Like Caocao Mobility and Ruqi Mobility, Amap used to focus on ride-hailing. By joining ride-sharing, Amap aims to break the saturation in the ride-hailing market, address its shortcomings, and cater to market demands.

Challenges in commercialization loom, but Amap's "ambition" goes beyond

By joining the ride-sharing business, Amap not only aims to address shortcomings, cater to user needs, and seize incremental opportunities in the ride-sharing market but also seeks to solve commercialization challenges.

From an internet perspective, Amap ranks among the top five most active monthly products in China. According to QuestMobile, Amap's monthly and daily active users have stabilized at over 100 million, but in terms of profitability, Amap lags behind the other top four players.

Compared to Google Maps, the leader in global map navigation platforms, which boasts over 1 billion monthly active users and dominates its vertical, its total revenue is not as impressive as one might expect. Taking its largest source of income, advertising, as an example, it only accounts for around 5% of its parent company Google's advertising revenue, highlighting a significant gap.

It is evident that profitability challenges cannot be solely attributed to Amap; rather, they are prevalent among map navigation software. The reason behind this is straightforward.

Navigation maps were initially positioned as a tool-type product, a rigid demand for clear travel navigation needs. However, once users obtain the necessary information and reach their destination, they often exit the app. This "use and go" user behavior limits the ability of map navigation platforms to build an in-app ecosystem that combines monthly and daily active users with long sessions.

Most internet products monetize by keeping users engaged for as long and frequently as possible within the platform, then monetizing through advertising, e-commerce, and other means.

Thus, the only direction for tool-type products to expand is to integrate navigation, aggregated ride-hailing, and store-visit services into a full chain, ultimately leading to local lifestyle services. Over the past few years, Amap has gradually transformed from a mere map software into a "super app" that integrates travel, ticketing, social networking, and local lifestyle services.

Therefore, joining ride-sharing at this juncture undoubtedly reflects Amap's consideration of the ride-hailing market's development challenges and its intention to shift those "functions" originally belonging to ride-hailing and taxis to ride-sharing, bridging the gap between navigation and store visits, thereby facilitating local lifestyle services.

Moreover, as an aggregation platform, Amap naturally possesses high inclusiveness, seamlessly accommodating various platform vehicles, enhancing order acceptance rates while providing users with more options.

Ride-sharing rivals ride-hailing in convenience but offers additional benefits. By strategically planning routes, ride-sharing can transport multiple passengers on a single trip, alleviating road transport capacity constraints to some extent while providing more efficient transportation services, truly a "multi-benefit" solution.

Amap's approach lies in satisfying user needs on multiple dimensions, enhancing product-user interaction frequency, and ultimately achieving monetization.

Regarding pricing, Amap's ride-sharing service also demonstrates higher cost-effectiveness. According to user feedback, the price for exclusive Amap ride-sharing orders generally remains around RMB 1 per kilometer, while shared rides are even more economical at an average of RMB 0.7 to 0.8 per kilometer.

Combining efficiency, cost-effectiveness, and convenience, Amap undoubtedly exhibits stronger appeal. As it transitions from a standalone navigation tool to a lifestyle service platform, the completeness of its full chain will directly correlate with its progress in solving commercialization challenges.

Robotaxi: An inevitable "challenge" for aggregation platforms, starting with data

Over the past few years, Amap's commercialization efforts have revolved around one major direction and two paths. The major direction is local lifestyle services, with one path focusing on store visits (akin to Meituan's model) and the other pursuing aggregated ride-hailing (similar to Didi's approach).

Meituan and Dianping's local lifestyle services, particularly store visits, have centered around "content," playing a role in user search, traffic diversion, and evaluation system construction for catering, ticketing, tourism, and travel services.

As an aggregation platform, Amap recently introduced the "four-wheel direct delivery" service model, once again aggregating multiple mainstream delivery platforms. Leveraging Amap's ride-hailing partnerships, it offers users differentiated instant delivery services, striving for speed, differentiation, and cost-effectiveness.

Source: pixabay

However, whether centered on content or focused on differentiation and cost-effectiveness, local lifestyle service platforms will face a common enemy: Robotaxi. This stems from changing travel patterns, particularly impacting aggregated ride-hailing platforms first.

The reason lies in costs. Typically, a 10-kilometer ride-hailing trip costs around RMB 20, whereas a similar trip with Luoborunbao costs only a quarter of that, showcasing a clear cost advantage.

Moreover, as Robotaxi becomes prevalent, low prices will once again dominate the shared mobility market. Facing this gap and trend, Amap's relaunched ride-sharing service, with its price advantage, may temporarily fend off competition but may not fare well in the long run.

Entering the Robotaxi market, autonomous driving companies and automakers hold inherent advantages due to their core cost benefits and mature manufacturing technologies. Amap, unable to easily join the fray, may find itself in a passive position.

However, considering driving and user data, Amap's aggregation platform nature, coupled with its hundreds of millions of monthly active users and diverse vehicle options, can generate substantial driving data.

With data in hand, Amap can form effective ties even as Robotaxi threatens, contributing to its commercialization efforts. After all, the advancement and iteration of autonomous driving rely on real-world driving data for training and optimization.

As a shared mobility platform, Amap follows a similar path to Google Maps, with "local lifestyle services" as its destination. From a core business perspective, while Meituan focuses on food delivery, Amap prioritizes aggregated ride-hailing. Therefore, whether addressing the impact of Robotaxi or deepening its roots in local lifestyle services, ride-hailing remains a top priority for Amap.

Ultimately, in the harsh market, realizing platform value maximization and transitioning from an aggregation "tool" to a service aggregator will be Amap's long-term challenge.

Source: HKG Research Society