The collective counterattack of new automakers has begun

![]() 09/10 2024

09/10 2024

![]() 581

581

The Chengdu Auto Show has concluded, and sales figures for August from various manufacturers have been released. One clear signal emerging from this data is that new automakers are about to launch a collective counterattack.

This time, virtually every company has introduced new products, which will be launched intensively over the next one or two months.

Let's take a look at each company individually.

01

Zeekr

Zeekr sold 18,015 vehicles in August.

Among the many new automakers, Zeekr has been one of the most aggressive and has made significant strides.

Zeekr's strategy is straightforward: to position their products as all-around competitors in their respective segments. This approach has indeed benefited Zeekr, with sales continuing to grow.

However, Zeekr seems to have hit a sales plateau, with monthly sales reaching 18,000 but lacking further momentum.

This may be partly due to their rapid product iteration pace and partly due to a lack of timely advancements in intelligent features (especially autonomous driving).

In response, Zeekr launched its Intelligent Driving System 2.0 in August, abandoning the Mobileye solution in favor of in-house development. The system comes standard with lidar and dual Orin-X chips, and city navigation is also on the agenda.

However, as this is a new implementation, its effectiveness remains to be seen.

During Zeekr's recent financial results conference, the company reiterated its sales target of 230,000 vehicles for the full year.

From January to August, Zeekr delivered a total of 121,540 vehicles. To achieve its target, Zeekr faces significant sales pressure in the coming months, with the upcoming Zeekr 7X expected to play a crucial role.

An Conghui stated, "The Zeekr 7X is as important to Zeekr as the Boyue was to Geely. It represents the company's position in the new energy SUV market." "Our goal is to become the benchmark in our segment. If the benchmark is 10,000 units, we aim for 10,001."

If this is the case, monthly sales of 10,000 units for the Zeekr 7X may be considered a minimum requirement.

Considering that the Zeekr 7X will only be launched on September 20th, its impact on September sales will be minimal, placing significant pressure on sales in the following three months.

It is currently known that orders for the Zeekr 7X exceeded 20,000 units in the first week after its announcement.

Apart from the Zeekr 7X, the Zeekr MIX is also expected to be launched in the fourth quarter of this year.

Looking ahead to next year, Zeekr has two more new models planned: a new shooting brake based on the 007 architecture and a large flagship SUV (featuring NVIDIA's Thor chip for the first time, offering both pure electric and super hybrid powertrains).

02

IM Motors

IM Motors has shown impressive sales performance recently, exceeding 6,000 units for three consecutive months.

During the Chengdu Auto Show, IM Motors unveiled pre-sales for its all-new IM LS6, priced between RMB 229,900 and RMB 299,900.

While the pre-sale price is indicative, the actual market price is expected to be lower.

The all-new IM LS6 comes standard with six key features: the "Lingxi" digital chassis, intelligent four-wheel steering system, lidar and Orin-X chip, Qualcomm Snapdragon 8295 and IMOS Future Cockpit with Falcon Smart Lighting System, and a rare 121° zero-gravity comfort seat in its class.

Personally, I believe this is exactly what the IM LS6 should be: a true all-around competitor.

Moreover, early orders come with limited-time benefits, including:

1. A RMB 2,000 deposit can be used to offset RMB 12,000 of the final payment, effectively reducing the price by RMB 10,000.

2. Free premium features worth RMB 23,800, including a 121° zero-gravity co-pilot seat (worth RMB 9,800), Aether perforated top-grain leather seats (worth RMB 8,000), four-door double-glazed soundproof windows (worth RMB 2,000), RNC active cabin noise control (worth RMB 2,000), and a 4-day Sky Air concert sound system (worth RMB 2,000).

3. A RMB 3,000 customization fund for exterior accessories.

4. Lifetime free access to IM AD's high-definition map-based city NOA feature (worth RMB 36,800).

5. A free official charging gun and discharging gun (worth RMB 1,438).

IM Motors' benefits and configurations are quite substantial, making even the entry-level model highly competitive.

Pre-sales of the IM LS6 have been impressive, with over 5,000 orders placed within the first 10 hours of pre-sale.

With the official launch scheduled for September 26th, the IM LS6 is expected to drive further sales growth for IM Motors.

03

Voyah

Voyah's monthly sales figures are as follows: 4,521 units in May, 5,507 units in June, 6,015 units in July, and 6,156 units in August, for a cumulative total of 42,547 units from January to August.

Voyah now needs a hit model to boost sales significantly.

During the Chengdu Auto Show, Voyah unveiled two new models: the all-new Voyah Dreamer and Voyah Zhiyin.

First, let's talk about the all-new Voyah Dreamer.

What sets the all-new Voyah Dreamer apart is the integration of Huawei's intelligent driving and cockpit systems, elevating Voyah's MPV experience to the forefront of the industry.

As a result, the all-new Voyah Dreamer has garnered over 14,000 orders (as of September 1st).

However, the main attraction is the family SUV, the Voyah Zhiyin.

Pre-sale prices for the Voyah Zhiyin have been announced, ranging from RMB 209,900 to RMB 266,900, which is even lower than that of Letao L60 by RMB 10,000.

The Voyah Zhiyin boasts impressive features such as over 900km of range (on specific versions), an 800V high-voltage platform, 5C ultra-fast charging (515km in 15 minutes), CDC adjustable damping suspension, and Huawei's intelligent driving technology.

Currently, the Voyah Zhiyin has received over 10,000 orders.

It all sounds promising, but considering that similar models from competitors will also be launched soon, the Voyah Zhiyin still faces pressure.

As always, the final outcome will depend on its configurations and pricing.

Voyah's sales target for this year is 100,000 units, but with current sales still below half that figure, monthly sales will need to exceed 10,000 units in the coming months.

This incremental task will primarily rely on the Voyah Zhiyin.

Voyah has not yet announced the launch date for the Zhiyin, possibly waiting to see how competitors move before finalizing pricing and configurations (likely to be announced at the Voyah User Night in 2024).

04

SL03

SL03 delivered over 20,000 units in August (20,131 units), showing strong momentum. Cumulative deliveries from January to August reached 120,700 units.

However, considering its sales target of 252,000 units for the year, SL03 cannot afford to rest on its laurels. To achieve this target, monthly sales will need to increase further.

In fact, SL03 has been quite active with new models this year, mainly concentrated in the second half.

In June, the SL03 G318 was launched, followed shortly by the G318 Urban Edition (originally scheduled for September 10th but later postponed).

The SL03 S07 was launched on July 25th.

The SL03 L07 and SL03 S05 were unveiled at the 2024 Chengdu Auto Show.

The SL03 L07 is SL03's second sedan, while the SL03 S05 is its first compact SUV. The former is expected to be launched this month, while the latter will be launched in October.

During the Chengdu Auto Show, SL03 CEO Deng Chenghao stated, "It's time for SL03 to accelerate its pace."

What many people don't know is that in August alone, SL03 received over 20,000 firm orders, with over 14,000 for the SL03 S07 in its first month on the market. "We believe the SL03 S07 will become a monthly sales hit of 15,000 to 20,000 units globally," he added.

With the upcoming launches and deliveries of multiple new models, SL03's product line will become more comprehensive, and sales are expected to increase significantly.

Li Pan, brand director of SL03, stated in an interview that monthly sales would reach 30,000 units in November and 40,000 units in December.

If this delivery pace is maintained, SL03 could deliver at least 110,000 units in the next four months.

Impressive indeed.

05

AITO

AITO sold only 3,712 units in August.

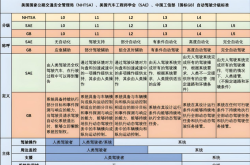

As shown in the graph above, AITO's sales performance has been relatively weak this year, which explains why the company has decided to embrace range-extended electric vehicles (REEVs).

The upcoming AITO 07 will be AITO's first model to offer both pure electric and range-extended powertrains. The new car will be launched on September 26th.

The AITO 07 is crucial for AITO as it needs a high-volume model to help boost sales and break into the market.

Yong Jun, Vice President of AITO Technology, expressed hope that the AITO 07 will help elevate AITO's sales from the current level to 100,000, 200,000, or even 300,000 units annually.

Therefore, the success of this model is paramount.

In addition to the AITO 07, other AITO models will also be offered with range-extended powertrains.

However, whether range-extended electric vehicles can directly resolve AITO's current challenges remains to be seen and will require time to validate.

The end.