China's Former Leading ODM Smartphone Manufacturer Divests ODM Business to Focus on Chip Manufacturing

![]() 12/31 2024

12/31 2024

![]() 617

617

According to third-quarter data, the current top ten global smartphone brands include Samsung, Apple, Xiaomi, OPPO, VIVO, Transsion, Lenovo, Honor, realme, and Huawei.

However, what many people overlook is that these smartphone brands are often supported by numerous ODM (Original Design Manufacturer) partners. These manufacturers, despite not branding their devices, are instrumental in designing and manufacturing smartphones.

Known as ODM manufacturers, they facilitate the production of smartphones for various companies, yet these devices only bear the logos of Xiaomi, OV, Samsung, and others, rendering the ODM manufacturers largely invisible.

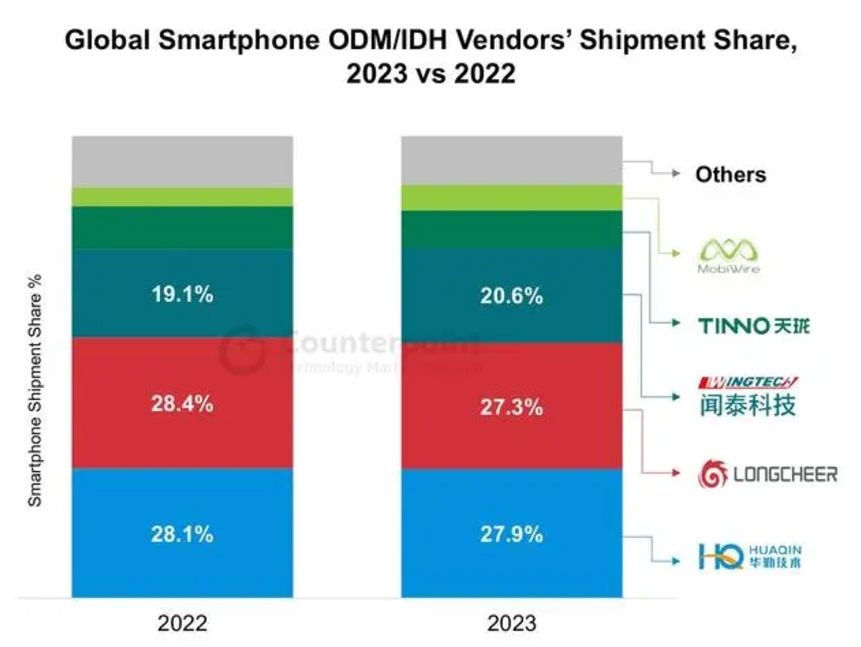

Data indicates that in 2022 and 2023, ODM smartphones accounted for approximately 300 million units, representing roughly 25% of global smartphone sales.

Among these 300 million units, Longcheer led the market in 2022, followed by Huaqin. By 2023, Huaqin had ascended to the top spot, with Longcheer dropping to second, while Wintech consistently maintained its third position.

Yet, several years ago, Wintech held the global lead, with Longcheer and Huaqin trailing behind.

However, a significant shift is about to take place in the ranking of these ODM manufacturers. Wintech, the former market leader, plans to sell its entire ODM business to concentrate solely on chip manufacturing.

Wintech's journey into the chip industry began in 2019 when it acquired Nexperia Semiconductors for 26.854 billion yuan. Nexperia, a leading automotive chip manufacturer, sells over 100 billion chips annually and ranks among the top globally in several IC automotive markets.

Following the acquisition, Wintech emerged as the only IDM (Integrated Device Manufacturer) chip company in mainland China with comprehensive capabilities in chip design, manufacturing, packaging, and testing.

Post-acquisition, Wintech's performance was nothing short of remarkable. However, its recent success has been largely fueled by its chip business, with the ODM segment struggling to turn a profit. In 2022, Wintech's ODM business incurred a loss of 1.569 billion yuan, followed by another loss of 447 million yuan in 2023, both covered by its profitable chip operations.

Recently, Wintech made the strategic decision to sell its ODM business entirely, redirecting its focus solely on chip manufacturing.

According to media reports, Wintech intends to sell all nine companies associated with its ODM business to Luxshare-ICT and designated parties. With these nine companies previously valued at nearly 30 billion yuan, the transaction is expected to fetch a multi-billion yuan price tag.

Once the ODM business is divested, Wintech will concentrate exclusively on its Nexperia Semiconductors operations and chip manufacturing, stepping away from smartphone design and production.

Clearly, Wintech's acquisition of Nexperia laid the groundwork for this strategic focus. Without that initial move, it's uncertain what direction Wintech might have taken.