AI Trends and the Prospects of Chip Stocks in the Hong Kong Stock Market

![]() 11/14 2025

11/14 2025

![]() 513

513

Following a month of consolidation in the Hong Kong stock market, the Hang Seng Index is once again nearing the 27,000-point threshold. The resolution of the U.S. government shutdown has eased short-term market anxieties. Historical data indicates that November and December are traditionally strong months for U.S. equities. With the recovery of U.S. macroeconomic indicators and the anticipated Federal Reserve rate cut in December, there are solid grounds for optimism regarding the forthcoming performance of the Hong Kong stock market.

As the year draws to a close, the global market is expected to maintain its focus on AI technology. The recent correction in the U.S. stock market's AI sector has been relatively mild, with debates over a potential bubble reflecting market caution rather than a confirmed bubble. In the Hong Kong stock market, AI investment is not as widespread as in the U.S., thus there is no significant bubble. Instead, AI has propelled many companies into a 3-5 year growth phase, presenting attractive investment opportunities in the Hong Kong market.

For instance, the newly launched Hong Kong Information Technology ETF (159131) is a notable option, with 70% of its portfolio dedicated to hardware. Although Hong Kong's AI sector is relatively nascent, the domestic substitution trend remains robust, making it a sector worth monitoring in the upcoming AI-driven market.

The Certainty of the AI Theme

Despite recent discussions in the U.S. stock market about a potential AI bubble, it is evident that no such bubble exists at present.

To evaluate the presence of a bubble, first, we must consider whether the valuations of AI tech stocks are excessively high. In reality, tech stocks in both Hong Kong and the U.S. are trading within a Price-to-Earnings (PE) range of 15-25 times, with no particularly extreme valuations.

Furthermore, AI is an industry poised for growth over the next five years. Currently, Google is trading at 25 times PE, while NVDA is just slightly above 20 times PE, indicating that market valuations remain cautious.

Next, we should examine the leverage situation within the AI industry.

Admittedly, some companies, such as Oracle and Meta, have increased their leverage. However, the market is discerning, with funds recently avoiding these two companies as they need to demonstrate the reliability of their leverage in the short term.

In fact, a review of the capital expenditures (Capex) of tech stocks in Hong Kong and the U.S. reveals that companies' current free cash flows can adequately cover their AI investments. This directly contradicts the bubble theory, as global tech companies are expected to continue and even expand their AI investments.

Having confirmed the absence of an extreme bubble, we can now look ahead to the future performance of the Hong Kong stock market. I believe it will likely continue to emphasize the AI theme. AI can be categorized into hardware and application sectors, but often, AI hardware outperforms AI applications for a certain period.

According to CICC's outlook for the Hong Kong stock market in 2026, it suggests that the year may witness continued fluctuations in the credit cycle and the persistence of industry trends.

Specifically, AI investments will persist, and policy support will intensify.

CICC predicts that, given the current limited fiscal stimulus, policymakers will prioritize technological advancements. Drawing from Japan's experience, fostering new growth points, particularly in the technology sector, is a preferred strategy.

In other words, AI is not only a pivotal theme in the U.S. but also aligns with domestic policy preferences in China.

Technology Policy Support: Technology is accorded significant importance, with particular emphasis on 'Artificial Intelligence+'.

Currently, China's R&D expenditure and fiscal spending on science and technology continue to grow steadily, with year-on-year increases of 8.9% and 5.3%, respectively, in 2024.

As attention to technology (especially AI) increases, policy support is expected to accelerate further. In late October, the '15th Five-Year Plan' proposals underscored the need to 'accelerate high-level technological self-reliance and innovation, and develop new quality productivity forces in line with local conditions,' emphasizing the urgency to expedite AI innovation and governance.

At the funding level, the third phase of the National Integrated Circuit Industry Investment Fund ('Big Fund') was established in May 2024 with a registered capital of 344 billion yuan, surpassing the combined total of the first and second phases. Subsequent funds will be gradually invested in the semiconductor sector.

On October 31, the National Development and Reform Commission announced the complete disbursement of 500 billion yuan in new policy-based financial instruments, with project investments totaling approximately 7 trillion yuan, focusing on areas such as the digital economy and AI.

CICC predicts that under baseline conditions, the profit growth rate of Hong Kong-listed companies in 2026 will be 3%. With limited momentum for a significant upward cycle in the economy and corporate profits, this favors industries like AI technology that inherently require leverage.

Chinese tech giants also have a strong incentive to invest in AI. Capital expenditure plans indicate that tech giants will sustain their AI investments.

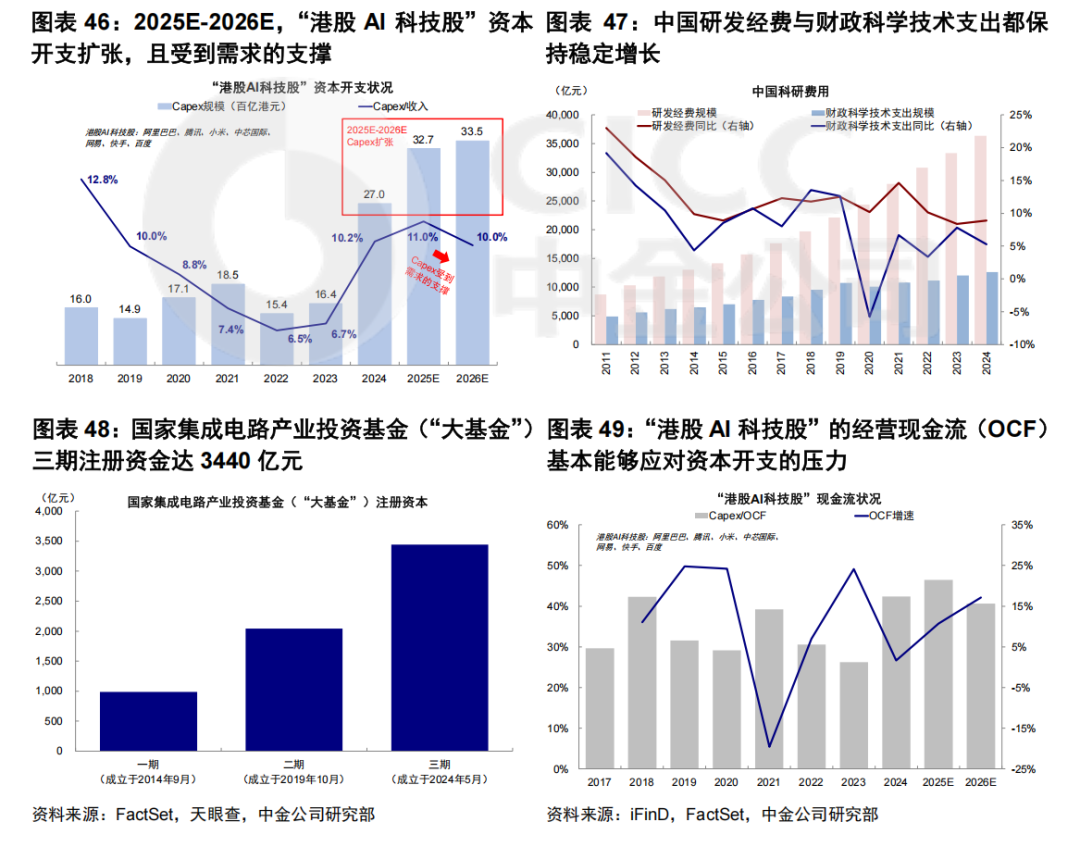

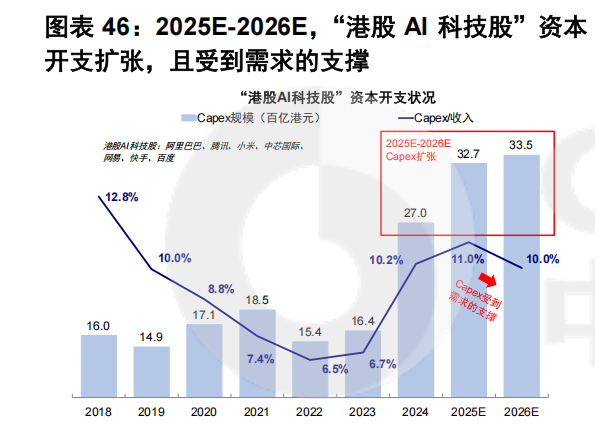

Market expectations suggest that the capital expenditure scale of 'Hong Kong AI tech stocks' may increase by 21.4% in 2025 compared to 2024, and even with a high base in 2026, capital expenditure is expected to continue expanding.

According to market expectations, the proportion of capital expenditure to revenue for 'Hong Kong AI tech stocks' is expected to decline from 11.0% in 2025 to 10.0% in 2026, supported by demand, with AI business performing impressively.

Taking cloud services as an example, the revenue growth rates of major internet cloud providers (Alibaba Cloud, Tencent Cloud, Baidu Intelligent Cloud) have significantly increased, rising from 11.7% in the fourth quarter of 2024 to 23.2% in the second quarter of 2025.

Therefore, considering both policy and corporate perspectives, AI will remain a central theme moving forward.

Returning to our initial point, in the AI market, AI hardware often takes precedence. Although China's AI hardware sector still lags behind the U.S., under the trend of domestic substitution, there will always be core companies that benefit, such as SMIC and Hua Hong Semiconductor as prime examples.

In this context, utilizing ETFs for allocation is a prudent approach, as it can mitigate technological volatility and enhance the overall beta of the tech market. The Hong Kong Information Technology ETF (159131) is a commendable option, as it is the first ETF in Hong Kong focused on the hard tech sector represented by 'semiconductor chips'.

This ETF tracks the CSI Hong Kong-listed Information Technology Composite Index, with 70% of its weight in AI tech hardware companies and 30% in software companies.

As illustrated in the chart below, SMIC accounts for 19.4% of the weight, Xiaomi 10%, Lenovo 8%, and Hua Hong Semiconductor 5.1%. The top ten weighted stocks account for 72%, indicating a higher concentration of leading companies.

The index has risen by 47% this year, which is a commendable increase. It is expected to benefit even more in the upcoming AI market, making the Hong Kong Information Technology ETF (159131) a compelling option. For those interested in AI application stocks, the Hong Kong Internet ETF (513770) is also worth considering, as these two ETFs can form a software + hardware allocation.