Action Cameras Are Selling Like Hotcakes: How Will "DJI and Others" Tackle the Smartphone Maker Onslaught?

![]() 11/14 2025

11/14 2025

![]() 331

331

Can OPPO and Vivo Overturn DJI's Reign?

Author: Li Jinlin

Editor: Li Ji

Typesetting: Annalee

Double 11 sales figures indicate that action cameras have emerged as one of the initial products to transition from being a "novelty" to a "must-have."

According to the 2025 China E-commerce Development Report, the transaction volume for action cameras soared by 6,191%. Data from JD.com's self-operated platform during the October 30-November 11 period revealed that DJI dominated the top five spots in the action camera category with offerings like the Osmo Action 5 Pro, Osmo Action 4, and Osmo Nano, cementing its status as the sales leader.

Just over a month prior, OPPO and Vivo announced their foray into the action and panoramic camera markets, with plans to unveil new products by 2026.

Faced with a rapidly evolving and expanding action camera market, the entry of smartphone manufacturers is poised to ignite a full-blown competition. As technological boundaries blur and innovation often arises at the crossroads, this cross-border clash in imaging devices could unlock a new realm of possibilities.

DJI Ousts GoPro, Now Faces OPPO and Vivo

"DJI Nano transformed me into a Korean drama heroine—I dub it the beauty restoration wizard!"

"For landscape aficionados, the Insta360 Ace Pro 2 is a must-own, boasting a built-in Leica filter that delivers breathtaking scenery with minimal parameter tweaking and a touch of German elegance."

"It's not that digital cameras are out of reach; action cameras simply offer better bang for the buck."

In recent years, the surge of social media and lifestyle documentation has made owning an action or panoramic camera the new norm, with the short video era fueling unprecedented growth for handheld smart imaging devices.

Currently, DJI and Insta360 are locked in a fierce duel, while GoPro, once the undisputed global leader, has gradually faded into the background.

GoPro is seldom recommended on social media these days.

Six years ago, when DJI made its market debut with the Osmo Action, many believed GoPro had monopolized the market for nearly two decades, with the brand synonymous with action cameras. DJI's challenge seemed destined for failure.

Yet, today, DJI commands a 66% global market share, with products like the Osmo Action 5 Pro and Osmo Nano establishing absolute dominance. In contrast, GoPro's market share has dwindled to 18% this year.

While pinpointing GoPro's downfall is challenging, one thing is evident: challengers ascend to leadership by seizing the right opportunities at every juncture.

In the first three quarters of 2025, domestic brands DJI and Insta360 accounted for over 70% of the action camera market. However, declaring future dominance is premature as market reshuffling persists, with OPPO, Vivo, Xiaomi, and other smartphone makers accelerating their entry.

DJI products are selling rapidly on JD.com.

Smartphone makers' cross-border foray into action cameras capitalizes on their consumer electronics expertise, exploiting the contrast between stagnating smartphone growth and the high-profit potential of action cameras.

From a strength perspective, smartphones and action cameras share core hardware supply chains, including CMOS sensors and optical lenses. Years of imaging algorithm development can be directly leveraged, such as Vivo's V3 chip with 4K cinematic imaging and heterogeneous computing architecture, and OPPO's Suspension anti-shake solution (floating stabilization technology), eliminating the need to build technical systems from scratch.

In terms of channels and ecosystems, smartphone makers boast established global online and offline networks. OPPO and Vivo's extensive network of over 200,000 offline stores can directly stock and showcase products, while partnerships with electronics retailers fill gaps in lower-tier markets. More critically, action cameras can seamlessly transfer files to smartphones, enable cross-device editing, and even sync with smart bracelets to trigger recordings, creating a differentiated ecosystem experience.

Regarding cost control and price tolerance, smartphone makers' massive procurement scales confer stronger bargaining power, and profits from their primary smartphone business can subsidize short-term losses in action cameras. This enables them to price entry-level models between 1,299-1,599 yuan, filling a market void. Combined with their vast user bases and brand recognition, they can precisely target potential customers through data analysis, significantly reducing market education costs.

However, smartphone makers face notable shortcomings. Professional action cameras must endure extreme conditions like underwater use and sub-zero temperatures. The Insta360 X4 employs fluororubber seals and fully concealed dive housings, while the DJI Action 5 utilizes aerospace-grade materials to meet these demands—areas where smartphone makers lag.

Additionally, in terms of user perception, Insta360 has aligned with extreme sports enthusiasts, and DJI has captured Vloggers, while smartphone makers are perceived as mass-market brands. Breaking into professional circles will demand considerable time and effort.

What Will an Application Ecosystem Battle Bring to Action Cameras?

Since official announcements about Vivo and OPPO entering the action camera market surfaced this year, both companies are expected to launch new products in 2026, targeting this burgeoning market.

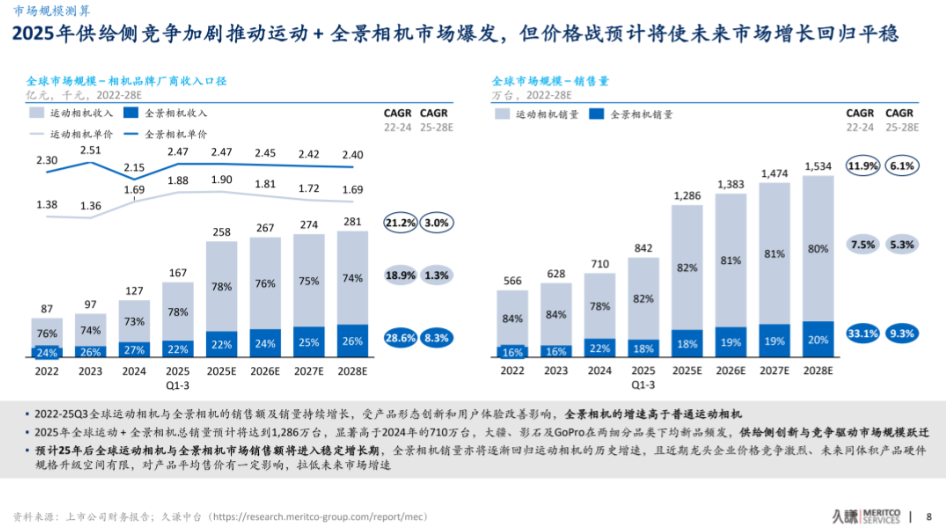

According to Frost & Sullivan, the handheld smart imaging device market reached 36.47 billion yuan in 2023 and is projected to maintain a 12.9% CAGR from 2023-2027, reaching 59.2 billion yuan by 2027. The panoramic camera market, capable of 360° recording, is valued at 5 billion yuan, with potential growth in video conferencing, robotics, and other new applications beyond lifestyle, sports, and entertainment documentation.

Source: Jiuqian Zhongtai Consumer Report

In the near-term competition, smartphone makers are likely to make inroads in the entry-level market first, targeting potential users in lower-tier markets with 1,299-1,599 yuan models and offering "smartphone + action camera" bundles. This will directly siphon market share and potential customers from Insta360 and DJI.

Long-term, smartphone makers will challenge the high-end market. Once product capabilities and user perception are established, they can further expand R&D, potentially compelling leading brands to lower prices and compress high-end product margins.

More notably, smartphone makers grasp the significance of focusing on applications rather than just specifications, driving the market from "hardware-driven" to "software and ecosystem-driven." By integrating action cameras into their "smartphone + tablet + watch" ecosystems, they offer a more open experience compared to the relatively closed ecosystems of Insta360 and DJI.

However, smartphone makers' entry is more about expanding market scale than devouring specific brands' market share. In the short term, their involvement will inject more imagination and innovation into the market, enriching this competitive landscape.

Yet, as the competitive landscape shifts from a duopoly to a multi-polar hierarchy, a reshuffle is inevitable. Factors like technological patents, accessory ecosystems, ecological and pricing advantages, and niche market segmentation will all shape future market dynamics.

Meanwhile, user demands and consumption trends are evolving rapidly. As the consumer base expands, action and panoramic cameras will undergo a fundamental transformation, becoming productivity tools with new consumption labels rather than just equipment for extreme sports and outdoor scenarios. Attributes like experience, usability, and community engagement will become increasingly paramount.

Lightweight designs will dominate, intelligent features will proliferate rapidly, with AI shooting and auto-editing becoming standard. More users are willing to pay a premium for these capabilities. Ecosystem experiences will become a competitive core, with smartphone makers' multi-device interconnected ecosystems setting a benchmark, prompting leading brands like Insta360 and DJI to accelerate ecosystem openness.

Ultimately, technology thrives on disruption. In this era of competitive growth, innovation potential is more likely to be unlocked.

Therefore, there's no need to rush in discussing who will become the next market leader. When industry competition shifts from hardware specifications to multi-dimensional battles centered on AI-driven intelligent experiences, software ecosystem completeness, and differentiated innovation, the best era for consumers has finally arrived.