Accelerating Commercial Spaceflight: Policies Ignite, Capital Bets, We Head Toward a Trillion-Dollar Cosmos丨Golden Eye

![]() 11/14 2025

11/14 2025

![]() 414

414

Every rocket ignition propels the future into the stars.

In October 2025, construction officially began on a dedicated vessel for reusable rocket recovery at the Hainan Commercial Space Launch Site. Meanwhile, LandSpace's 'Zhuque-3' carrier rocket completed the first phase of its maiden flight, with the next step being to challenge rocket recovery technology.

This is no longer a concept in PPTs; it's China's commercial space sector engaging in a 'space race' up close.

01

Why Should We Care About Commercial Spaceflight?

When we use mobile navigation, check weather forecasts, or watch satellite broadcasts, these services are all underpinned by commercial spaceflight.

Today, commercial spaceflight is no longer exclusively operated by national teams but has transformed into a true commercial sector through marketization, encompassing rocket launches and satellite applications. Enterprises have become the main drivers of innovation, with competition driving progress. While pursuing commercial returns, they are also advancing humanity's space exploration endeavors.

This industrial chain has formed a complete system:

The upstream sector covers rocket and satellite manufacturing and supporting industries, including key links such as specialty gases, high-end bearings, and 3D printing materials. Jiufeng Energy's liquid hydrogen fuel, Guoji Precision Industries' aerospace bearings, and Plantech's 3D-printed components are all important parts of the industrial chain.

The midstream sector includes launch services, satellite measurement and control, and ground equipment, directly related to whether satellites can accurately enter orbit and operate stably.

The downstream sector involves applications such as navigation, communication, remote sensing, and satellite internet, forming a complete service chain from space to users.

Data Source: National Strategy Institute, Shanghai Jiao Tong University

The landscape is clear: the Beijing-Tianjin-Hebei region, Yangtze River Delta, and Pearl River Delta, the three major industrial clusters, act like three enormous bowstrings, fully drawing the arrow of China's commercial spaceflight. By the end of October 2024, the number of domestic commercial space enterprises had surged to 537, up from just 141 in 2018. Behind this 2.8-fold increase over six years are countless engineers with bloodshot eyes and capital's intense betting.

The policy drumbeats are also growing louder.

In October 2025, the top-level design will firmly anchor 'building a space power' as a goal for the '15th Five-Year Plan.' What truly ignited the fuse was news in late August this year: satellite internet licenses are about to be issued.

This is like issuing 'pre-sale permits' to real estate developers. With the license announcement, wealth will pour in. Downstream 'constellation operators' can finally legitimately expand their territories, while mid- and upstream rocket and satellite manufacturing receive a boost.

02

Constellation Battle: Who Leads the Greedy Snake?

The answer lies at the end of the industrial chain: downstream 'constellation operations.'

Large-scale satellite networking plans directly drive demand for satellite manufacturing and rocket launches. Currently, domestic GW constellations and 'Qianfan' constellations are rapidly networking. Data shows that China's in-orbit satellites have exceeded 900 and continue to grow rapidly.

The issuance of satellite mobile communication licenses is continuously expanding terminal application scenarios. From navigation and positioning to remote sensing monitoring, from broadband communication to IoT services, the expansion of downstream applications injects sustained momentum into the entire industrial chain.

The launch segment is the foundation for realizing all plans. Currently, China's commercial rocket sector is making significant progress:

The Hainan Commercial Space Launch Site is constructing a reusable rocket sea-based recovery system, with command and control vessels and two types of recovery ships already under construction. Participating units are advancing construction on schedule to ensure delivery by the end of 2026.

LandSpace's 'Zhuque-3' Yao-1 carrier rocket completed the first phase of its maiden flight from October 18 to October 20. This rocket features autonomous high-precision return, soft landing, and reusability after orbital launch missions. The second phase will focus on orbital launch as the main mission goal while attempting first-stage recovery.

Once recovery technology matures, launch costs will drop from the luxury consumption of 'launching once costs as much as scrapping a BMW 7 Series' to the everyday expense of 'filling up a tank of gas.' Industry estimates suggest costs could fall to one-tenth of current levels. Only then will the gates to space truly be kicked open.

03

Money is Pouring Madly into Space

Capital never misses a game that could change the world, especially the space game.

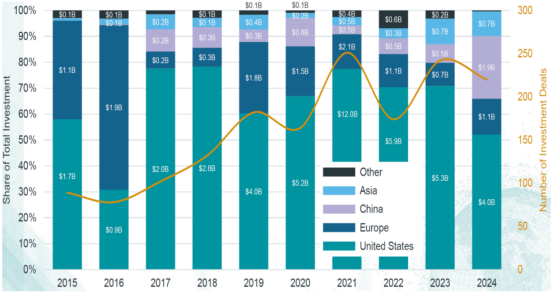

According to Bryce Tech's '2025 Commercial Space Investment and Financing Report,' global commercial space enterprises completed 220 investment and financing transactions in 2024, totaling $7.8 billion, with an average deal size of $35.5 million, up from $32 million in 2023.

Data Source: Bryce Tech 'Start-Up Space 2025'

The global investment and financing landscape is changing. In 2024, U.S. commercial space enterprises received $4 billion in investment and financing, down $1.3 billion year-on-year; while Chinese enterprises' financing increased from $542 million to $1.9 billion, accounting for 24% globally.

This rise and fall represent a dramatic shift in the global space capital balance.

The growth in Chinese financing mainly comes from satellite manufacturers and launch service providers building large-scale satellite constellations. With capital support, these enterprises are accelerating technological R&D and capacity expansion.

Between 2015 and 2024, the global commercial space sector completed 1,634 investment and financing transactions, totaling approximately $65 billion. Spacecraft launch, satellite communication, commercial crewed spaceflight, and spacecraft manufacturing are the four largest areas in terms of investment and financing scale.

Notably, investment and financing in China's commercial space sector are not only growing in scale but also optimizing in structure. Besides traditional rocket manufacturing and launch services, upstream raw materials and components, midstream ground equipment, and downstream operational applications are receiving more capital attention.

A more robust and resilient industrial ecosystem is emerging under capital's nurturing.

04

Market Size: Not Trillions, But Tens of Trillions in the Cosmic Ocean

Currently, the global commercial space market is a behemoth worth $480 billion. Established fields like positioning/navigation/timing, ground stations/equipment, satellite TV, and satellite communications still dominate.

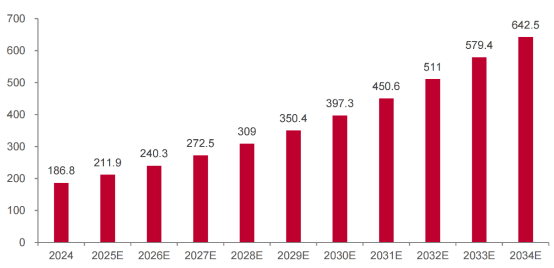

Global Rocket Launch Market Size 2024-2034 ($Billions)

Source: Precedence Research

The rocket launch services market, the original track, is becoming incredibly broad:

According to Precedence Research, global launch services market revenue was approximately $18.68 billion in 2024 and is expected to grow to $64.25 billion by 2034, with a compound annual growth rate of 13.15%.

The Space Foundation's report paints an even busier picture: in 2024, the world achieved 259 orbital launches, averaging one rocket launch every 34 hours. The sky above has never been so crowded and busy.

China's market potential is even more staggering.

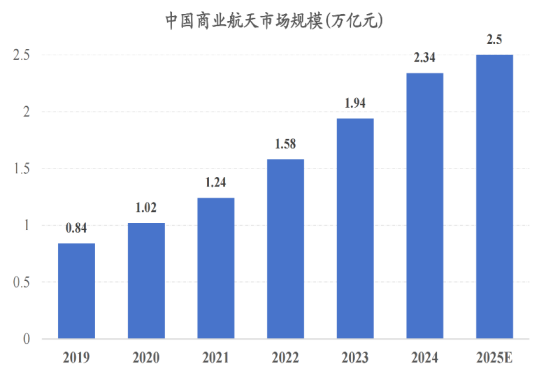

Data Source: CCID Think Tank '2025 Outlook on China's Commercial Space Industry Development'

CCID Think Tank predicts that China's commercial space sector will exceed 2.5 trillion yuan in total scale by 2025. To date, three major commercial space industrial clusters have formed domestically, with rapid enterprise growth. Annual investment and financing exceed 5.47 billion yuan, commercial launch success rates reach 96%, and launch frequency accounts for 39%.

This cosmic ocean can accommodate all ambitions, wisdom, and all-in courage.

05

Key Enterprises in Industrial Chain Links Emerging

In the rocket launch sector, several enterprises have become important players. Galaxy Power, LandSpace, Space Pioneer, i-Space, CAS Space, Oriental Space, OneSpace, Deep Blue Aerospace, and Expace are collectively driving industry development. The first five have initiated IPOs, with several planning maiden flights of new reusable rockets in 2025-2026.

Source: Jiazi Guangnian Think Tank

Upstream in the industrial chain, a group of enterprises play crucial roles in key links. They don't build entire rockets but use their unique expertise to control vital points in the chain:

Jiufeng Energy, as a clean energy service provider, has expanded into specialty gases and participates in commercial space fuel supply. Its Hainan project achieved successful trial production of some units in 2024 and supplied liquid hydrogen for the first launch at Hainan Commercial Space Launch Site's Position 1 on March 12, 2025.

Plantech, a 3D printing enterprise, has supported multiple commercial space clients, with participating projects entering mass production.

Farsoon Technologies launched the UT252P ultra-high-temperature 3D printing system for commercial space, supporting high-melting-point polymers like PEEK, and introduced cold metal fusion and large-scale copper alloy printing technologies.

Union Optotech participates in commercial space through high-temperature superconducting solutions, with its subsidiary Jiangxi Union Optotech Superconducting Technology Co., Ltd. winning bids for projects from the Commercial Space Launch Technology Research Institute.

Longxi Bearings participates in the commercial space market through joint bearing technology, ranking globally in variety and sales volume of commercial space joint bearings.

Guoji Precision Industries holds an important position in commercial space bearings, maintaining a high market share in carrier rocket bearings, with its wholly-owned subsidiary Luoyang Bearings Research Institute capable of R&D across all aerospace bearing series.

Gaohua Technology participates in the commercial space market through aerospace-grade sensors, with products covering monitoring links in multiple rocket systems.

06

Conclusion

We stand at a fascinating juncture.

Policy support continues to strengthen, key technologies keep breaking through, capital investment grows steadily, and enterprise innovation thrives. A group of the smartest and most daring Chinese are sprinting at the front lines.

Every rocket launch not only sends satellites into orbit but also forcefully propels an entire restless industrial chain, an imaginative application ecosystem, and a definitive trillion-dollar market toward the cosmic ocean waiting to be explored.

This wave of China's commercial spaceflight is no longer a blueprint concept but a reality that each of us can truly perceive.

And you and I are witnessing this history firsthand.

- END -