Pet Companion Robots: Embodied AI Born from Human Anxiety

![]() 02/06 2026

02/06 2026

![]() 552

552

Editor: Lv Xinyi

The advent of embodied AI has sparked a range of “anxieties,” rooted in our natural aversion to new technologies. These concerns represent a necessary phase for the acceptance and integration of new tech products.

In the realm of embodied AI, pet companion robots have taken a unique path. Rather than creating distance, they have thrived by addressing the everyday anxieties of pet owners.

Ask any pet owner: Have they not fretted over their pet's well-being when left alone at home, fearing potential mischief or accidents?

This has created a tangible and self-contained business cycle. Historically constrained by technology, products like smart litter boxes, automatic feeders, and health-monitoring collars—some even capable of “translating” animal sounds—have already entered the market. A variety of constantly evolving smart pet products have laid the groundwork for pet companion robots.

From a manufacturer's perspective, pet companion robots are not only a response to a “real need” but also embody multiple “clear business strategies.” Firstly, the pet market is valued in the hundreds of billions, while embodied AI holds trillion-dollar commercial potential. As the convergence of these two sectors, pet companion robots benefit from the expanding pet economy and provide a practical entry point for the robotics industry.

Secondly, within the broader context of household embodied AI, pet companion robots offer a grounded approach. Starting with pet companionship, they accumulate technical expertise in navigation, obstacle avoidance, interaction, and operation within family settings, while building capital for long-term development.

From any perspective, this is an appealing proposition for investors and a product that consumers are eager to purchase.

What defines a “good” pet companion robot? While many might appreciate rich functional designs that cater to diverse needs, its core value actually lies in its ability to alleviate the psychological burdens of pet owners.

“What if no one takes care of it when I go home for the holidays?”

“Will it wreck the house while I'm at work?”

“Will it get depressed if no one plays with it?”

These concerns are not just daily topics among pet owners in our company but also common anxieties shared by all pet owners. While they may seem abstract, they are real and universal issues: insufficient companionship time, lack of pet-raising knowledge, and untransferable responsibilities. Unlike humans, pets cannot clearly express abnormalities, making it difficult for owners to recognize their emotions.

In the past, such anxieties have fueled the growth of a massive “pet economy,” encompassing boarding and veterinary services. Data shows that China's pet market reached RMB 345.3 billion in 2024, with the smart pet products segment surpassing RMB 10.2 billion, accounting for 20% of the pet supplies market. The smart feeding, health monitoring, and environmental cleaning sectors led growth, while pet companion robots saw a 210% year-on-year sales increase.

Previous products were mostly “mobile cameras” that recorded pets' daily lives through fixed or tracking modes but lacked active or passive interaction capabilities and failed to generate data-driven or visual diaries. Today, technological advancements have brought noticeable changes. While not yet “general-purpose” in a true sense, pet companion robots are no longer single-function devices but comprehensive solutions.

Several robot products tailored for pet scenarios have emerged:

• Tuya Smart's Aura focuses on automatic feeding, health monitoring, and remote care;

• FrontierX Vex emphasizes daily pet recording and automatic video generation;

• Earlier products like ROLA Mini focused on mobile patrol and remote monitoring.

From a technical standpoint, these products are not overly complex. They avoid the challenges of humanoid robots, such as dynamic lower-limb balance or intricate upper-limb manipulation, and do not require a high-level understanding of the physical environment or complex interactions. For pets, stable basic mobility, fixed-point patrol, and fundamental audiovisual perception suffice.

In other words, these are products with relatively low “embodied intelligence content.” However, this “simplicity” does not reflect technical mediocrity but rather a pragmatic choice by manufacturers: shifting technical challenges from physical machine-world interactions to emotional human-centered care.

In pet companionship scenarios, robot manufacturers focus not on designing functional support for pets but on addressing human anxieties.

Thus, the core competitive barrier of similar products lies not in technical specifications but in accurately capturing anxiety signals. These products remain in households with minimal presence and high stability, essentially serving as “buffers” for human anxieties:

- The value of FrontierX Vex lies not in whether it truly “accompanies” pets like a friend but in how its automated recording and editing relieve owners of the tedious yet unavoidable task of documentation.

Caption: FrontierX's Vex pet camera robot

- The appeal of Aura extends beyond feeding or monitoring; it provides inexperienced and highly stressed pet owners with psychological reassurance that “professional support is always present” when facing potential health risks.

Ultimately, pet companion robots appear to be playmates for pets but actually serve as tools to compensate for human anxieties.

A persistent question remains: Is a pet, whether free or costing thousands of yuan, truly “worthy” of a robot costing thousands or even tens of thousands? According to iResearch, the average annual pet-raising cost in China reaches RMB 4,440, primarily spent on pet food, healthcare, supplies, and related services. Pet supplies are increasingly detailed, with smart pet products accounting for 50.8% of expenditures—the largest share.

Thus, while smart products' share is rising, average spending remains limited. Introducing a product costing hundreds or thousands more raises questions about consumer tolerance. Will these products suffer the same 30-40% return rates as companion robots or AI toys? These questions demand answers.

However, evaluating them solely based on “functional cost-effectiveness” easily leads to negative conclusions. Is their value truly limited to functionality?

First, technical integration costs are undeniable. Mobile navigation, environmental perception, and continuous AI interaction systems are far more complex than traditional pet products like litter boxes, which rely on “mechanical structures + simple sensors.”

Yet technical complexity alone cannot explain the vast price range, from hundreds to tens of thousands. The crucial factor is emotional value.

In interviews, Tuya Smart staff described Aura as an “emotional partner” and health manager for pets. The robot continuously observes, records, and identifies abnormalities, providing early warnings—tasks humans struggle with and often overlook.

Caption: Tuya Smart's Aura

During CES, Aura's final price was not announced, but Tuya Smart staff reported that someone “was willing to pay USD 3,000 to take it home.” This decision was driven by emotion, not rational calculation.

Commercially, this mirrors human companion robots: the former satisfies human needs for “being accompanied,” while the latter provides reassurance that “someone is taking care of it for me.”

Technological advancements enhance traditional pet companion products, but the premium and wide price range stem from emotion-driven value. Willingness to pay may replicate existing patterns in the companion robot market: affluent buyers opt for high-end models like LOVOT, while budget-conscious consumers choose simplified alternatives like Ropet.

Notably, such products may evolve into ecological gateways. For example, if Aura further integrates with pet boarding services, veterinary appointment systems, or even smart home ecosystems, its premium would derive not just from hardware but also from ongoing services.

In a recent interview, Na Jingdan, VP of Marketing and Strategic Partnerships and CMO at Tuya Smart, stated: “The pet scenario is not the endpoint but the first stop for household robots.”

This remark reveals the deeper significance of such products.

Household robots represent a technically demanding endgame scenario, requiring a delicate balance between safety, reliability, cost, and experience. Achieving long-term stable operation in homes is never immediate.

Thus, a pragmatic approach involves appropriate dimensionality reduction and decomposition.

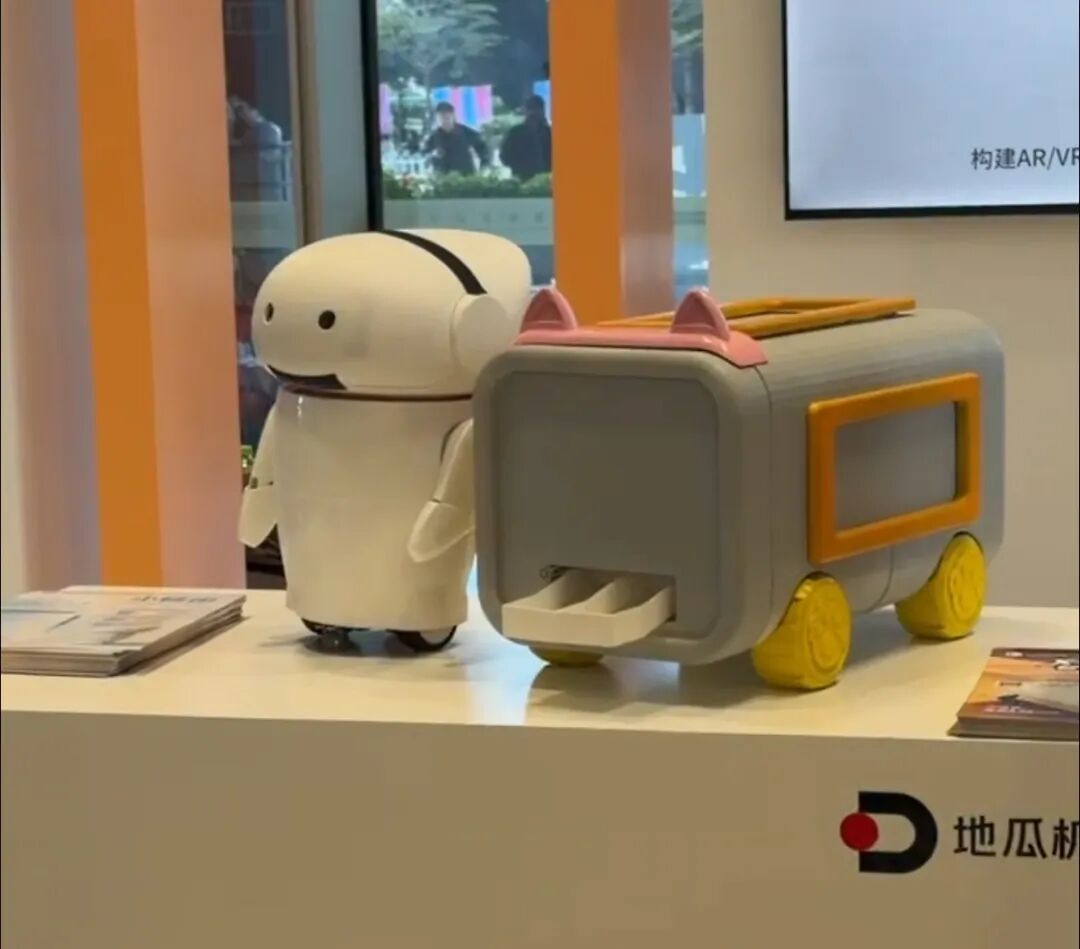

Past practices confirm this. Products like smart litter boxes or educational robots, which may seem “less robotic,” have occupied significant positions in corporate revenue structures. At Diguabot's DDC2025, we saw pet-designed robots sharing common traits: manageable technical difficulty, avoiding complex motion control or fine manipulation, relying on basic mobility and audiovisual perception; yet highly polished, adding intelligence to mature, market-accepted product forms.

Caption: Left is the "Xiaonuotuan" companion robot; right is a pet companion robot.

Such products can directly target the market, representing truly viable commercialization options.

However, short-term commercial returns are just one aspect. Within the broader embodied AI landscape, these products serve as exploratory moves.

Pet companion robots demand less precision and reliability than household or industrial robots, offering greater tolerance for error. They act as “minimum viable products” for technologies like large models, multimodal perception, and low-power chips, accelerating commercialization across the embodied AI field.

Meanwhile, as robots accompany pets, they accumulate navigation, obstacle avoidance, interaction, and operational experience in household environments. This data and engineering capability will ultimately feed into genuine household companion robots—those designed to “accompany humans.”

Thus, these seemingly low-threshold or even “marginal” products, branded as “robots,” are not the final answer but a crucial step toward it. The convergence of a booming pet economy and technological warmth reveals that industrial evolution is not easily achieved. Through continuous attention to human needs, robots are slowly but steadily transforming from “tools” to “partners.”

Today, robots enter homes as “pet caregivers.” Tomorrow, as technological-emotional connections strengthen and industrial ecosystems mature, they will respond more naturally to humanity's deep-seated expectations for companionship and care.