Earning and Profiting: How Apple Navigates Dual Revenue Streams in China

![]() 02/06 2026

02/06 2026

![]() 554

554

Apple's Financial Report Amidst 'Apple Tax' Controversy

On January 29 (local time), Apple Inc. unveiled its financial results for the first quarter of fiscal year 2026 (ending December 27, 2025), showcasing record-breaking core financial metrics. Alongside overall growth driven by demand for the iPhone 17, another significant segment—Services—achieved a global revenue milestone, surpassing $30 billion for the first time, reaching $30.013 billion, up approximately 14% year-over-year, marking multiple consecutive quarters of all-time highs.

Notably, revenue from the Greater China region played a pivotal role in this performance. The robust active user base and digital content consumption habits in the Chinese market provided a crucial driver for growth in service revenue.

In the first quarter of fiscal year 2026, revenue from Greater China soared to $25.53 billion, up 38% due to iPhone 17 demand, accounting for 17.7% of Apple's total global revenue and ranking first in contribution to global revenue growth.

"We witnessed the highest number of upgrade users ever in mainland China, along with double-digit growth in users switching from other platforms," stated Cook during the earnings call.

Source: Internet

The rapid expansion in the Greater China market, particularly the strong demand for the iPhone 17, directly expanded Apple's ecosystem of active users and provided the most direct impetus for sustained growth in service revenue. Against this backdrop of high growth and revenue, the ultra-high profit margins of the services segment are even more striking. Its gross margin stands at an astonishing 77%, far exceeding the company's overall gross margin of 46%. This not only surpasses Kweichow Moutai's net profit margin of 50% but also exceeds the gross margins of many monopolistic enterprises—truly a lucrative venture. This implies that for every $100 in service revenue, gross profit after deducting costs reaches $77. Thus, the Greater China region not only contributes to hardware revenue but also serves as the most critical foundation and nutrient source for the "profit tree" of the services business.

The strength of service revenue lies in the network effect generated by Apple's massive base of active device installations (recently disclosed to exceed 2.5 billion). App Store transactions, paid subscriptions, iCloud storage, Apple Music, and more are all deeply intertwined with the user base. Due to the high efficiency of digital content distribution in the Chinese market, commissions from the China App Store contribute significantly lucrative profits to Apple, commonly referred to in the market as the "Apple Tax."

Source: Internet

According to reports from Caijing Magazine, based on fiscal year 2024 data, the Apple Tax accounts for 10% of total revenue in Greater China, compared to 8.8% in the United States and only 4.6% in Europe. This means that for every $10 Apple collects in China, $1 comes from the "Apple Tax," compared to $0.88 in the U.S. and less than $0.50 in Europe—indicating a relatively higher burden in China.

Extrapolating from these proportions, Apple Tax revenue in Greater China reached approximately RMB 50 billion in 2025. With a quarterly gross margin of 77%, the annual gross profit from the Apple Tax amounts to around RMB 38.5 billion, making it an absolutely lucrative business.

However, despite such high revenue, there are no signs of policy changes regarding the persistently high Apple Tax in Greater China.

The 'Apple Tax' Remains Firmly in Place in China

Calculations by Wall Street analysts reveal the global money-making power of the "Apple Tax": annual sales on the U.S. App Store alone reach approximately $21 billion, with profits highly sensitive to changes in "Apple Tax" rules. Analysts generally estimate that if global "Apple Tax" policies were forced into large-scale adjustments, Apple's earnings per share (EPS) could face a 2% to 6% decline. In other words, the high-profit "moat" sustaining Apple's services business is essentially built on "mandatory taxes" imposed through its market dominance, rather than purely from market competition or exceptional service.

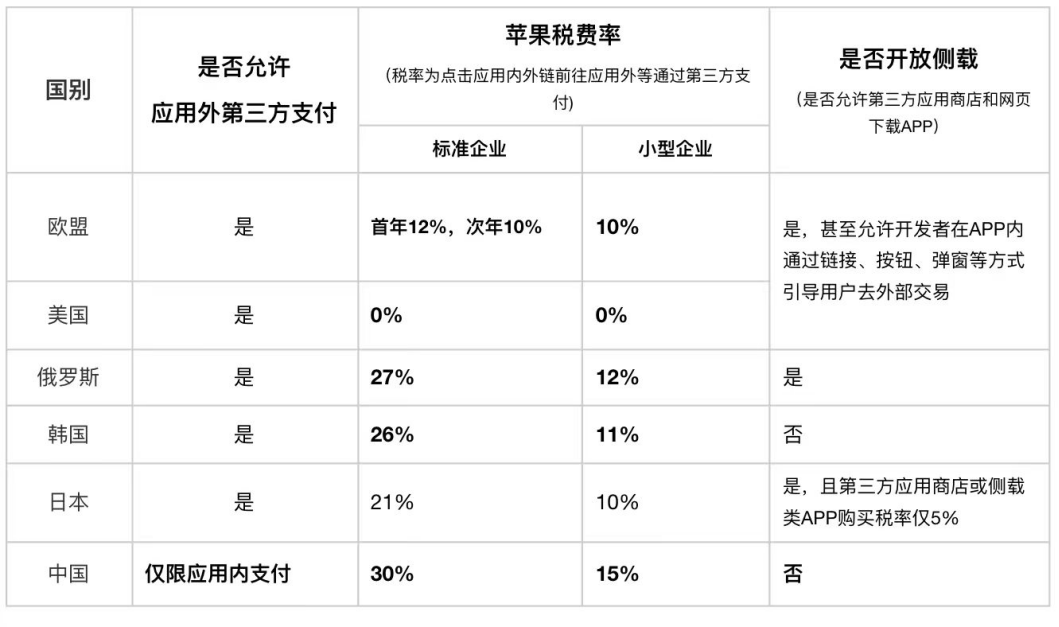

Since 2024, a global wave of opposition to the "Apple Tax" has emerged. U.S. courts ordered Apple to open up third-party payments and waive commissions, while the EU, Australia, Japan, South Korea, and other regions have also pressured Apple into changes through legislation or judicial rulings. For example, the U.S. relaxed restrictions on third-party payments, waiving commissions—a significant step forward. However, these measures have not benefited the global market.

Source: Internet

In stark contrast to the global regulatory trend of tax reductions, the "Apple Tax" in China remains "rock-solid." Multiple statistics show that Apple's commission levels in China not only remain at the highest tier but also show no signs of loosening in critical areas such as substantive opening of payments or rate reductions. This seemingly anomalous situation is the ultimate manifestation of Apple's strategy of "selling goods and collecting taxes simultaneously" in the Chinese market: on one hand, China is the largest single market for hardware products like the iPhone; on the other, Apple continues to levy the world's highest "toll fees" on the vast Chinese developer and consumer base through the digital service walls built by the App Store.

Apple has justified its mandatory use of IAP (In-App Purchase) by citing "system security" and "user privacy," claiming that third-party payments are unsafe. However, this reasoning is flawed—some physical e-commerce apps do not require IAP, undermining the claim that "third-party payments are less secure than Apple's."

In 2025, a ruling by Australian regulators explicitly stated that there is no evidence Apple's payment methods are more secure than others, largely refuting Apple's safety arguments—yet this has not prompted significant changes in the Chinese market.

Even on November 14, 2025, when Apple officially announced the "App Store Mini App Partner Program," offering a 15% revenue commission reduction for developers participating in the program when selling eligible in-app purchases, the apparent concession is filled with restrictive conditions.

Source: Internet

According to Apple's announcement, apps eligible for reductions must adopt specific technical interfaces designated by Apple (such as age declaration range APIs, advanced commerce APIs, etc.). This initiative is small-scale and targeted, failing to substantially address the mainstream 30% commission rate for mainstream apps or respond to fundamental demands for opening third-party payments or lowering base rates. It appears more as a "strategic delaying tactic" in response to regulatory pressure and public concerns, aimed at pacifying market sentiment rather than improving the existing commission structure.

In November 2024, Apple released the report "Apple Ecosystem in China—Value Research for Users and Developers," attempting to address controversies. The report emphasized that "most Chinese developers do not pay commissions" (primarily referring to free apps or physical goods transactions) and claimed the actual average commission rate is "less than 5%." However, multiple app developers pointed out that this conclusion is significantly misleading, as its calculation base includes many marginal apps that do not generate IAP transactions. For developers relying on virtual goods monetization such as live streaming tips or game recharges, the 30% rate remains the universal standard, with Apple deliberately diluting the core conflict.

Take the most familiar scenarios of live streaming tips or game recharges as an example: for a $100 consumer purchase, $30 is immediately deducted by Apple's IAP system. The remaining $70 is further subject to payment channel fees (approximately $5–$10) and content platform splits, often leaving content creators or development companies with less than $50. For digital content industries with high research and development costs, such one-way high commissions can devour most profit margins, stifling the possibility of innovation and trial-and-error.

As of now, the App Store in the Chinese market still maintains the world's highest commission rate: developers must pay Apple a standard commission of up to 30% (with a preferential rate of 15% for small and medium-sized developers with annual revenues below $1 million) and are strictly prohibited from using third-party payments or directing users to external webpages to complete transactions. This closed policy constitutes "triple deprivation": developer profits are squeezed, consumers face hidden price increases, and industrial competitiveness is suppressed.

Looking back, even as the world's second-largest single market teeters on the brink of a regulatory storm, Apple's strategy remains to maintain a "privileged stance" in China. Standing at the historic peak of its brilliant financial report, Apple is actually at the center of a regulatory maelstrom: Shanghai courts' 2024 judicial recognition of "market dominance" laid the legal factual basis for subsequent civil lawsuits and potential administrative penalties.

Consumers Are Awakening, and the Chinese Market Is No Longer a Regulatory Island

Faced with unfair policies, Chinese consumers' awareness of rights protection has awakened.

On October 20, 2025, 55 Chinese consumers filed a complaint with the State Administration for Market Regulation (SAMR), alleging that Apple Inc. holds market dominance in intelligent terminal application transaction platforms under the iOS system in China (excluding Hong Kong, Macau, and Taiwan), engaging in restricted transactions, tying arrangements, and unfair pricing, seriously infringing upon the legitimate rights and interests of Chinese consumers.

This complaint not only demands compensation and apologies but also extends to Apple's business model:

(1) Open up third-party payment channels and waive all forms and amounts of commissions for third-party payments outside of IAP;

(2) Open up iOS app acquisition channels outside of the Apple App Store and waive all forms and amounts of commissions, technical service fees, and other charges;

(3) Reduce the China Apple Tax (30%) to a rate lower than the most favorable proportion in other global regions.

These three demands form a complete set of reform requests, marking a shift in Chinese consumers' stance from passive acceptance to active rights protection while echoing the core directions of industry regulation.

On social media, many Apple users have posted questions like, "Why are the same services more expensive on iPhones?" Some users have realized, "Why does only China have to pay the highest tax?" Individual complaints are gradually evolving into inquiries about fair rights.

Source: Xiaohongshu

Antitrust lawyer Wang Qiongfei bluntly stated to the media that Apple has lowered tax rates and opened payments due to regulatory pressure in major global markets (Europe, the U.S., Japan, South Korea) but maintains the highest tax rate in China—a form of "discriminatory pricing." He pointed out that this policy "effectively increases the global operational costs of Chinese digital enterprises, undermining the international competitiveness of the entire industry."

Even industry giants like Tencent and ByteDance cannot escape Apple's strong constraints. Bloomberg reported that Apple has continuously pressured large Chinese app developers in recent years to disable features that might bypass IAP payments, such as chat windows with third-party payment links in games.

At the legal level, China's judiciary and regulators are cautiously yet firmly advancing along two tracks. First is judicial confirmation: in 2024, Shanghai courts recognized Apple's "market dominance" in China's iOS app distribution market in relevant rulings, paving the legal path for subsequent antitrust lawsuits alleging abuse of dominance. Second is administrative regulation: while rumors of a 2025 SAMR investigation into the App Store's anti-competitive behavior have not been officially confirmed, combined with the global regulatory wave—from hefty fines under the EU's Digital Markets Act to U.S. court-mandated opening of external links and pressure from Japan, South Korea, and Australia to lower taxes—the Chinese market is no longer a regulatory island.

Multiple analyses suggest that Chinese regulators are more likely to adopt a hybrid strategy: drawing on European and U.S. experiences to set a localized timeline for opening third-party payments and app stores in China, while coordinating with the Supreme People's Court's ongoing review of the "Apple Tax" appeal case to form combined judicial and administrative pressure. The outcome of this struggle will likely determine the profit distribution pattern and global competitive standing of China's digital market for the next decade. If the "Apple Tax" wall obstructing China's digital market finally crumbles, the entire ecosystem's soil and climate will be reshaped.

Saying no to the exorbitant "Apple Tax" is not just about directly reducing consumption or transaction costs—it is about the return of choice and fair trading rights. Users and developers will finally transform from passive tax bearers into market participants with bargaining power and the ability to reshape rules. This tangible sense of gain is precisely the most intuitive value an open ecosystem can deliver.

In Conclusion

From a long-term perspective, a market environment characterized by more transparent rules, fairer competition, and a more rational allocation of profits will comprehensively bolster the adaptability, innovation capacity, and overall competitiveness of China's digital economy on the global stage. This scenario not only presents a historic opportunity that must be grasped but also poses a significant challenge regarding the digital industry landscape for the coming decade.

For global behemoths such as Apple Inc., a fair and robust app ecosystem serves as the bedrock for the sustained growth of both the company and its iconic iPhones. The time for transformation has arrived.

- END -