Will China's Game Globalization Lose Ground First in 2026?

![]() 02/06 2026

02/06 2026

![]() 537

537

In 2026, the first “fatal” pitfall in game globalization erupts suddenly.

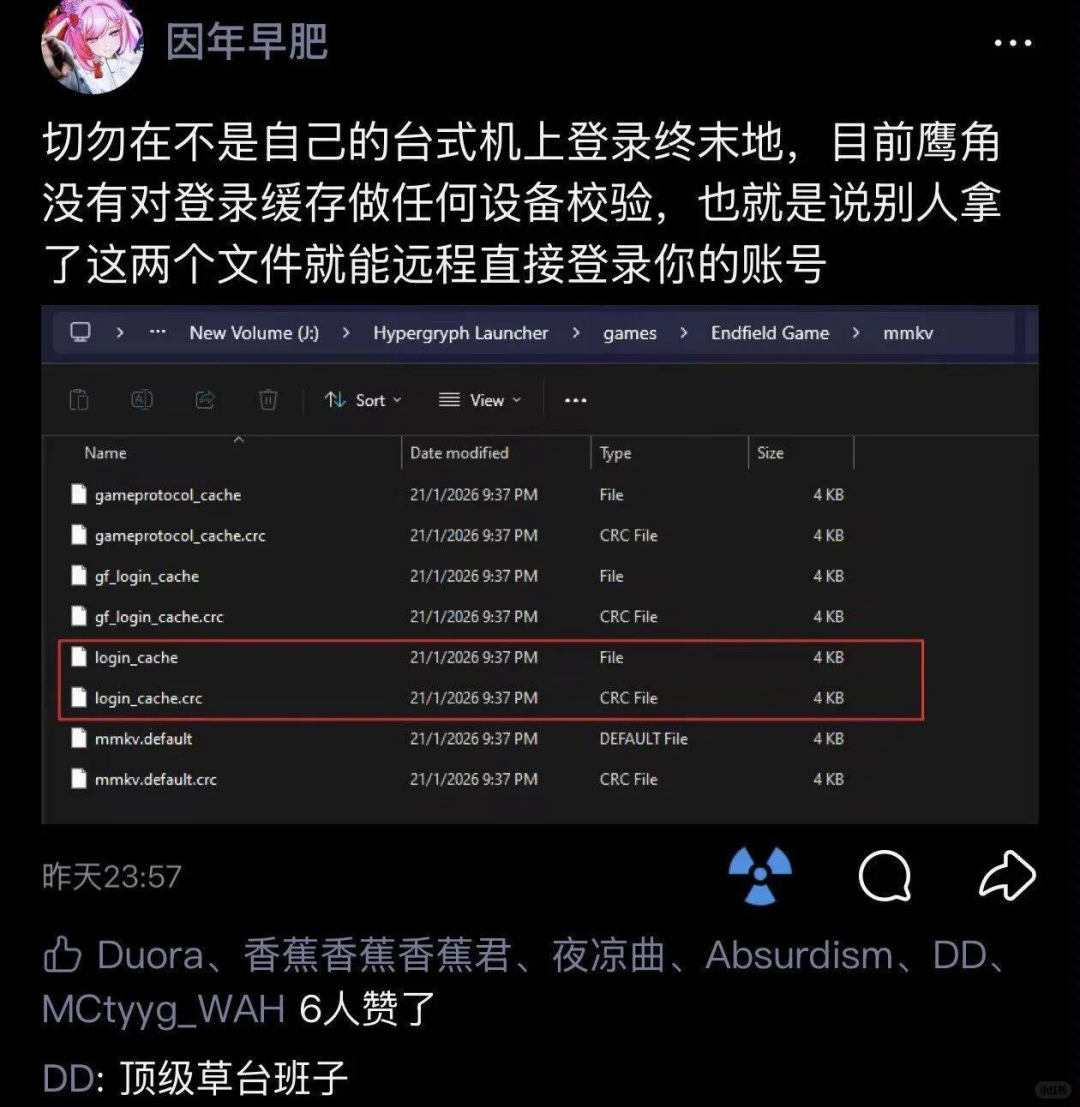

On January 22, during the global open beta of Hypergryph's "Arknights: Endfield," a random deduction incident occurred with the overseas server's payment interface—while players were making in-app purchases, the system randomly deducted funds from other linked accounts, resulting in the bizarre scenario of “others topping up, you footing the bill.” One player was deducted a maximum of €15,264.19 (approximately RMB 120,000), triggering an explosive wave of complaints and a trust crisis within the global player community.

The official response was to issue collective refunds. However, according to California's Unfair Competition Law, large-scale cycles of “wrongful deduction-refund” are classified as “systemic financial fraud,” which can be deemed money laundering.

Under such circumstances, California can directly initiate public prosecution against Hypergryph's subsidiary, with minimum compensation for such cases reaching as high as $200 million. In response, Hypergryph International promptly devised countermeasures—upgrading its user agreement to require users to “voluntarily” waive their right to “class-action lawsuits.”

The security risks posed by "Arknights: Endfield" do not end there. The game also suffered from bugs such as remote account theft using two files and multiple unauthorized deductions.

Under Under pressure from multiple parties (multiple pressures), on the day of the incident, Hypergryph's recruitment page featured a position for “Legal (Contracts).”

The importance of legal compliance and payment security in game globalization was once again thrust into the spotlight for companies.

At this juncture, we spoke with industry veterans to discuss the emerging trends and potential pitfalls to avoid in the game globalization sector in 2026.

According to incomplete statistics, domestic game companies shut down a total of 117 games in 2025.

The secondary genre (hereinafter referred to as “2D games”) remained the hardest hit, with over 20 projects shut down or suspended.

The reasons behind this are not difficult to understand.

2D games, characterized by “gender-based aesthetics” and “character infatuation,” often attract a group of the most “demanding” users. Beyond engaging in role-playing, world exploration, and simulated combat, players invest significant emotional energy into the game's NPCs and Guide to Characters (strategy characters), leading to heightened emotional attachments. Once these emotions overflow, the “added value” of emotional satisfaction transforms into higher “moral” expectations for both the characters and the game company.

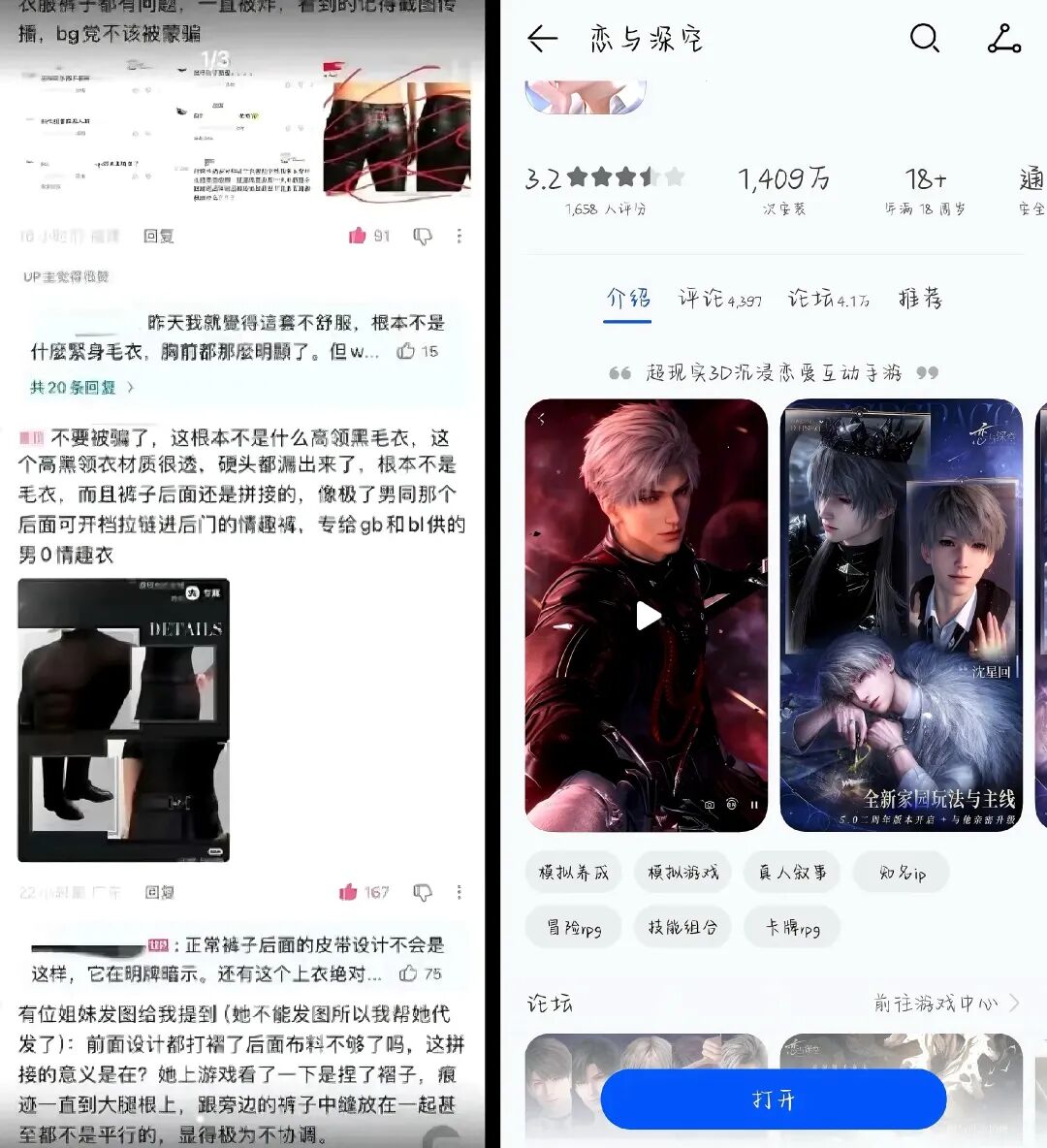

Recently, Papergames once again found itself embroiled in controversy over suspected plagiarism of "Guardian" and ambiguous labeling as an otome game.

Players express dissatisfaction with the male protagonist's outfit and game labeling

These intense emotions are inevitably built upon high expectations for a series of “infrastructure” elements within 2D games, including character design, visuals, world-building, storylines, and interactive text. This means that in the “invisible war” of aesthetic comparisons and visual evolution, the less outstanding titles are quickly abandoned.

At the same time, the distribution costs for 2D games are enormous. Beyond traditional advertising and user acquisition, various offline pop-up events, coser appearances, and comic convention interactions are also essential. These high distribution costs inevitably compress profit margins, making 2D games one of the most “labor-intensive yet unrewarding” genres in the industry.

Of course, this does not mean game companies should ignore players' content and emotional needs. On the contrary, games centered on “emotional compensation” must always follow the trends of the emotional economy. However, for the vast majority of companies, their content creation capabilities and productivity struggle to meet players' basic demands, condemning them to gradual obsolescence and elimination in the fiercely competitive market. This results in a pronounced “80-20 effect” within the genre.

Now, let's return to the topic of the “new money-making formula.”

Undoubtedly, the darling of 2025 is undoubtedly the “New SLG+X” model.

In the 2025 monthly Top 30 overseas revenue rankings for domestic mobile games, SLGs consistently occupied one-third of the list for nearly a year. Data Source: Sensor Tower

The success of “New SLG+X” lies precisely in its ability to satisfy players' emotional needs. On one hand, the core strategic gameplay of SLGs is universally applicable with minimal comprehension barriers. By further segmenting the game system into distinct stages and implementing a tiered progression from light to heavy gameplay, it better meets players' demands for a rich gaming experience.

On the other hand, the Diversified integration (diverse integration) of “+X” endows the game with various attributes such as social interaction, sports, and gambling, further enriching the game ecosystem. Through “extracurricular interactions,” it strengthens user engagement while stimulating players' willingness to spend and increasing their sunk costs. This, in turn, compels players to deeply immerse themselves in the ecosystem in search of more diverse gaming experiences, forming a dual closed-loop model of emotional and experiential cycles both within and outside the game.

So, will “New SLG+X” remain dominant in 2026?

Despite the substantial spending on user acquisition leading to relatively low profit margins for SLGs, the industry's response is mostly affirmative. The only change is that “X” may see further diversification. In this major sports year of 2026, football and basketball are likely to become focal points for industry practitioners.

After all, “New SLG+X” represents a rapidly replicable success path, and the industry has yet to find a more cost-effective blockbuster formula.

Has AI truly begun to “dominate” the game industry?

In late December 2025, a set of intriguing data seemed to declare a phased victory to the outside world.

According to Totally Human Media, the number of games on Steam that proactively disclosed the use of generative artificial intelligence (generative AI) reached 10,258, accounting for 8% of all games on the platform. These games collectively generated approximately $660 million in total sales on Steam.

In November 2025, Tim Sweeney, CEO of Epic Games (the second-largest PC game distribution platform), publicly endorsed the view of motion capture designer Matt Workman on Twitter, Speak frankly (bluntly stating) that “AI-made” disclosure labels on game stores like Steam are meaningless. However, the reason behind this is his belief that “AI will be involved in the development of almost all future games.” He argues that such data disclosures are not only meaningless but could also harm the emotional connection between game companies and players. After all, for now, replacing concept artists with generative AI still faces significant backlash from both players and industry professionals.

At the beginning of 2026, AI's foray into gaming seems even more aggressive.

Early in the year, a small game titled "Internet Giant Simulator" suddenly went viral, achieving over 50,000 daily page views (PV) on its launch day. Behind this overnight sensation were merely two gaming novices with no development or coding experience. Relying on AI tools, they managed to develop a blockbuster hit from scratch within a week while working full-time jobs at major tech companies.

Similarly, another game, "Cyber Hiking: Life and Death Aetai Line," also gained popularity shortly after. These successive successes seem to validate the words of Zhu Huaimin, Vice President of 37 Interactive Entertainment, who once said, “Gaming has become the best scenario for AI technology applications.”

"Internet Giant Simulator" game interface

Of course, there are also dissenting voices.

An employee from a 2025 blockbuster game development company told Xiaguang Society that their company only applied AI in covert marketing efforts. For instance, they used AI to collect information on local market sentiment and then employed AI NPCs to impersonate players, enriching the gaming experience and stimulating market interest to boost local user engagement with the game.

A game company executive with a ten-figure annual revenue revealed that their company had invested nearly a billion yuan in AI development. However, whether for asset generation or customer service interactions, AI proved entirely unusable.

“The promotional images generated by AI have a distinctly artificial taste and are easily recognizable. As customer service agents, their responses are too unintelligent. After players make a purchase, they seek interaction and communication with the game company. After we replaced human agents with AI, we received a flood of complaints.”

In his view, the only benefit of AI for game companies is the optimization of office processes, such as automatic contract filing and supplier price comparisons. “For game production and operations, AI is still just hype.”

Some time ago, a trivial piece of game industry news caused a major stir on social media.

According to insiders, Tencent's "Delta Force" team chose Iceland for their year-end team-building event and would distribute year-end bonuses equivalent to 24 to 36 months' salary.

At a time when the game industry has been shrouded in the shadow of a “waning golden age,” with frequent layoffs and game shutdowns, as well as declining mainstream esports viewership and sponsors “fleeing,” this simple revelation seemed to hint at a “hidden secret”—the game industry still has a promising future.

In 2025, China's self-developed games generated $20.455 billion in overseas market revenue, up 10.23% year-on-year. Self-developed mobile games accounted for $18.478 billion in overseas revenue, a 13.16% increase.

This marked the sixth consecutive year that game globalization surpassed the $100 billion threshold. That year, the top 10 highest-grossing games globally generated nearly $12.3 billion in revenue.

2026 appears to be another major year for gaming.

Globally, not only has Rockstar Games announced that "GTA 6" will premiere in November 2026 for PlayStation 5, Xbox Series X/S platforms, but Capcom's "Resident Evil 9: Requiem," Bungie's new extraction shooter "Marathon: Lost Starship," and IO Interactive's reboot of the classic IP "007: Rising Star" are all set to release in 2026.

Domestic game companies are also joining the fray. According to public information, Tencent-backed Chengdu Ophiuchus Studio's Eclipse Edge team is developing the single-player game "Tide of Oblivion," while a “prequel” to "F.I.S.T.: Forged In Shadow Torch" titled "Animal Punk," NetEase's urban open-world RPG "Infinite," and miHoYo's major new title "Honkai: Fateful Spirits" are all slated for release in 2026.

It is worth noting that the rise of mini-programs and SLGs since 2025 has indeed attracted a wave of new entrants motivated by “quick money,” further exacerbating the shadow of plagiarism in the game industry. Meanwhile, although "Black Myth: Wukong" has garnered global attention and recognition, domestic AAA games remain in a relatively nascent stage, with significant room for improvement in productivity and competitiveness. Companies capable of supporting long-term development are scarce, and the market is flooded with projects that falsely claim to be “AAA” while exuding a strong air of fraud.

Against this backdrop, major studios continue to pursue their unique “visionary dreams.” Whether by establishing a presence overseas, investing in local studios to foster global game development from a global perspective, or boldly introducing “Chinese-style” games to the global market, or even investing heavily in unproven genres.

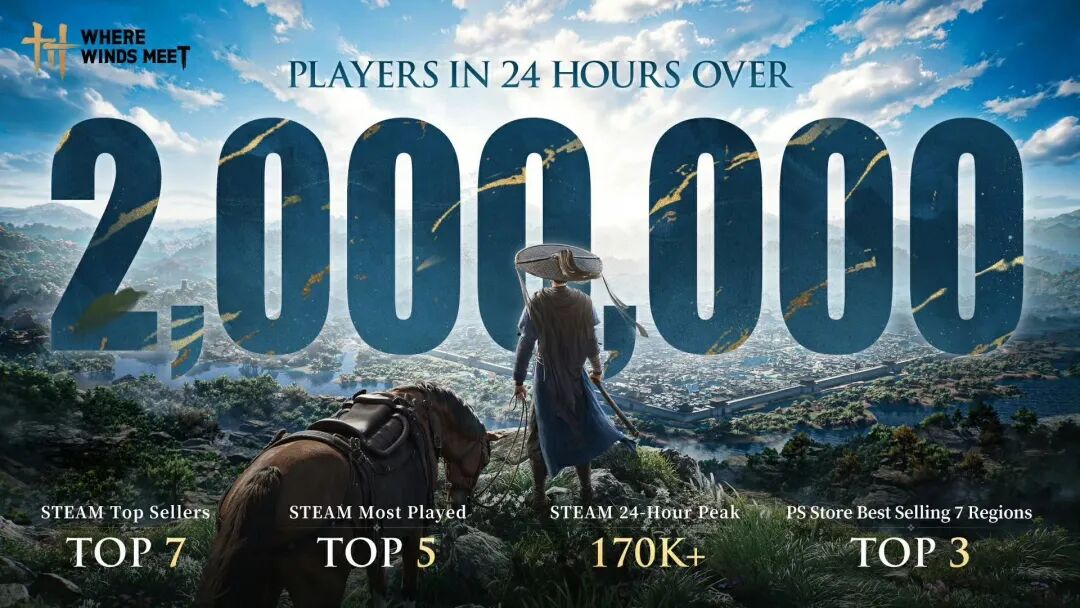

On the first day of the international release of "Where Winds Meet" on Steam, the number of concurrent players exceeded 2 million.

It is reported that a certain mid-sized Chinese game company has also invested billions of yuan in developing an Open World game.

This year, the United States, Japan, and South Korea remained the core regions for game globalization, accounting for nearly 60% of the market share.

However, growth opportunities have shifted to Latin America and the Middle East.

"Nowadays, all games relying on user acquisition advertising consider the Middle East, aiming to capture this market," an industry practitioner revealed. The reason behind this still lies in costs: "For the same price, customer acquisition and reach in the Middle East can be ten times that of Europe and the United States."

Wang Jiali, head of the Game Ecosystem Association, revealed that the eCPM in the Middle East market ranges from $4 to $6+, with high-quality content reaching $8 to $12, while in Europe and the United States, it is only $1.5 to $3. Meanwhile, Saudi gamers spend an average of $270 per year on games, 5.5 times that of the Chinese market.

A young and affluent population, extremely high willingness to pay, well-developed digital infrastructure, long-standing content supply shortages, and policy dividends at the national level—these structural advantages collectively create a golden window of opportunity characterized by "high growth, high value, and high adaptability."

For small and medium-sized teams, especially independent game developers, under the normalization of game licenses, choosing niche categories + emerging markets and adopting a lightweight, rapid trial-and-error approach is also a good decision. In 2025, the number of new small and medium-sized game companies going global increased by 26% year-on-year.

At the same time, the Middle East has shown an "extremely embracing" attitude towards game globalization in recent years, offering support through policies, infrastructure, and funding. The region is also willing to sustainably develop the esports industry to further improve the local gaming ecosystem.

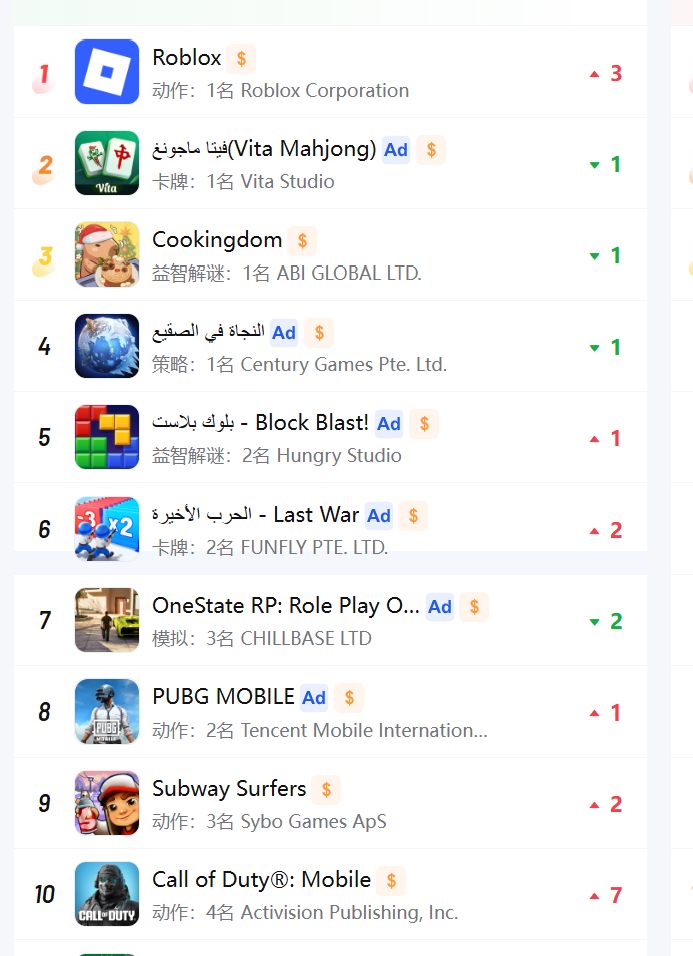

Chinese-developed games account for over one-third of Saudi Arabia's real-time game charts.

Southeast Asia, particularly Vietnam, is also a booming region.

In recent years, Vietnam's gaming industry has shown discontinuous growth. According to Google and AppMagic, Vietnam's app and game downloads reached 6.7 billion in 2024, with nearly 12,000 downloads per minute, ranking it TOP1 for the year.

However, at the same time, Vietnamese mobile games focus on casual games, with revenue primarily generated through advertising, resulting in very low ARPU. Over the past year, Vietnam's export revenue was less than $80 million, less than one-tenth of the global average.

This does not hinder the enthusiasm for the gaming industry in the Vietnamese market or its potential to become a new hotspot for game exports in the eyes of other countries.

In 2025, the number of viewers of the Vietnamese-language League of Legends channel increased by 44%. According to South Korean media, the DRX team from the League of Legends Korean league will host regular-season matches in Vietnam as their home venue in 2026, undoubtedly aiming to boost revenue.

For Chinese game developers, Vietnam has also become a testing ground for game globalization.

It is understood that all game companies going global conduct trial operations in Vietnam. This is certainly not because the Vietnamese market has sufficient potential or strong consumer willingness but because the Vietnamese market has an exceptionally strong willingness to provide feedback.

A game operator stated bluntly that Vietnamese players are particularly willing to test games and communicate with customer service to provide feedback. The information they offer is highly beneficial for game developers to improve and modify their projects. Most importantly, all of this is almost "free" (in China, game testing and trial play often require a certain fee, which can reach up to $15 per person), significantly reducing the cost of going global.

An unavoidable issue is that the shifting dynamics of the game globalization market will continue to exist and may even intensify in the coming years. In Wang Jiali's view, as policies in the Japanese market tighten, games may exhibit a situation similar to e-commerce—where some resources choose to withdraw from the Japanese market and flow into emerging markets.

Nearly 60% of global game users obtain game information through social platforms. The rise of emerging groups such as cross-platform players and female users makes "customized creativity + precise interaction" the key to breaking through.

If, in the past, game promotion overseas relied on global platforms like Steam, now the rise of DTC (Direct-to-Consumer) is unstoppable.

"The operation of friend hubs and gaming communities is becoming increasingly important in game promotion and distribution. Only by engaging in deep communication with users can you truly build connections with them, thereby fostering user loyalty and extending the game's lifecycle," Wang Jiali said. In his view, by 2026, the promotion of independent games will also shift from relying on global platforms to adopting DTC models.

This also means that as game globalization moves beyond its wild west phase and reaches a crossroads of growth, we should recognize the necessity of building a healthy ecosystem for the entire industry.

Beyond the games themselves, user communication spaces, the advancement of esports projects, the construction and cultivation of IPs, and commercialization models outside of applications will form a synergistic matrix that collectively drives the global influence of games.

When discussing the key themes of game globalization in 2026, Wang Jiali believes it is "cultural attributes." "In the past, major game companies did not consider cultural integration when developing games. However, now companies entering the Middle East market have made very deep localizations in terms of religious beliefs, cultural customs, and user habits, such as introducing night battle modes to encourage Middle Eastern gaming."

Of course, issues related to cross-border payments remain a challenge the industry must face.

For game developers, independently building and operating payment channels is still difficult. Numerous issues need to be resolved, including differences in overseas compliance, complex cross-border settlement processes, foreign exchange conversion losses, and security protection in payment processes. There is even a need to avoid significant payment vulnerabilities caused by "sudden inspirations."

For example, the issue with "Arknights: Endfield" this time stemmed from a process blocking bug caused by the company's Redis thread pool not being decoupled and unequal. The security verification and user reputation issues of its partner, PayPal, also once again drew external attention.

Undoubtedly, for Chinese game developers, competing in the global market is not just about the games themselves. To achieve true long-term success, they must also build a solid infrastructure beyond content, ensure a smooth payment and gaming experience for users, and enhance trust in the international market.