Cross-border Select plus a Trusteeship Service: Has 1688 Clarified Its Position for Going Global?

![]() 07/25 2024

07/25 2024

![]() 710

710

In June, 1688 announced the launch of a dedicated "1688 Cross-border Select" portfolio for cross-border buyers, aiming to provide overseas small B buyers with more convenient and efficient procurement channels, as well as more centralized and high-quality product options.

According to official information, this preferred portfolio clearly labels product qualification information, piece weight and dimension parameters, logistics attributes, etc., to facilitate overseas transportation. It also comes with English product detail pages and supports express delivery, making it easier for buyers to distribute products downstream. Merchants will not be charged additional fees for transactions made through this portfolio.

Currently, not all related functions of this section have been launched, and products meeting specific criteria will automatically become 1688 Cross-border Select products. It is expected that the channel will be revamped in July. However, for merchants, this policy currently only offers weighting, without commission or deduction fees, already demonstrating the platform's importance and intention to guide.

On July 25, the official announced that 1688 Cross-border Trusteeship will officially upgrade to 2.0 mode. Merchants can one-click enroll cross-border Select products from their stores into cross-border trusteeship, and the platform will be responsible for product selection and sales through multiple channels outside the station, bringing incremental orders to merchants.

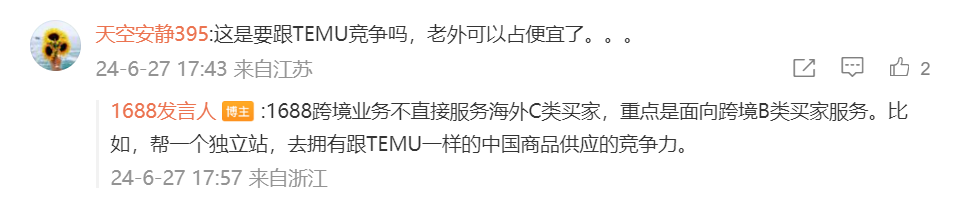

It should be noted that as a B2B e-commerce platform gathering many source manufacturers, 1688's cross-border business differs from the main focus of many current overseas platforms. As stated on its official Weibo account, "1688's cross-border business does not directly serve overseas C-class buyers, but focuses on cross-border B-class buyers, such as helping an independent station have the same competitive advantage in supplying Chinese goods as Temu."

(Source: Weibo @1688 Speaker)

Cross-border commerce has a long history in China, but only in recent years, with the popularity of trusteeship models and the adoption of domestic e-commerce's social/live streaming practices overseas, has cross-border e-commerce undergone a series of channel innovations and become synonymous with businesses seeking incremental growth. After a comprehensive upgrade in transaction scenarios and efficiency, supply often becomes the focus of the next stage of reform, which is also the development trajectory experienced by domestic e-commerce.

Therefore, New Position believes that the launch of portfolios overseas, or in other words, the export of supply chain capabilities, will become a more frequent strategic focus for various enterprises in the future.

At the "Tide Rising Qiantang: The 8th Global Cross-border E-commerce Summit" held on July 18, Lin Jingxian, General Manager of 1688 Cross-border, revealed that 1688's new cross-border strategy focuses on cross-border digital supply chains, creating a "digital chip" for cross-border supply chains centered on the "Select" portfolio, enabling efficient matching between platform products and overseas buyers.

Corresponding to refining the portfolio is the supplier's understanding of overseas consumer demand and the entire supply chain's ability to respond to immediate needs. We see that as cross-border e-commerce advances rapidly and deeply into local markets, defensive actions from local giants like Amazon have also followed suit, and the competition for the quality of source supplies may have already entered the main battlefield.

01. The Preferred Selection Strategy of the "Strictly Selected" Portfolio

Platform data shows that cross-border B-class buyers account for 66% of 1688's users, with high procurement demand.

In 2023, the total cross-border transaction volume on 1688 exceeded 200 billion RMB. The transaction volume is expected to grow by 29% in 2024. The off-platform transaction volume is projected to increase by 71%, the number of off-platform orders by 47%, and the number of off-platform buyers by 288%.

The purpose of "Select" is to achieve mutual matching from both the buyer's and seller's perspectives. Thus, buyers are particularly focused on how 1688 defines "preferred."

Cross-border buyers often focus on the quality, fulfillment, and "bestseller potential" of the products. Therefore, the selection criteria can be summarized into two main points: whether the product has potential to be a bestseller and if it is easy to market overseas.

The officially announced cross-border Select business opportunities include five types: "cross-border opportunities, going-global hot products, cross-border trends, overseas bestsellers, and new product lists." The judgment criteria mainly revolve around keywords like hot sales, bestsellers, and click rates. For example, the standard for "overseas bestsellers" is "hot-selling products of the same type on downstream cross-border platforms."

Contrary to the current e-commerce perception of "low price as a priority," our discussions with merchants in the "New Stance" revealed that price is merely one advantage dimension. Since merchants currently cannot self-nominate or promote their products in this segment, whether a product is "selected by the platform" largely depends on its compatibility with overseas markets. This includes bestseller potential, as well as the granularity of fulfillment and service.

In addition to clearly defined basic entry conditions such as response rate, quality, and fulfillment rate over the past 30 days, the platform also requires merchants to label product qualifications, dimensions, weight, and logistics attributes to accommodate overseas transportation and qualification reviews. The platform will also provide specialized tools for multilingual translation to enable buyers to distribute products downstream more efficiently.

From the seller's perspective, the platform attempts to motivate them with a variety of incentives.

First, selected products will receive an exclusive label. Then, these products will benefit from weighted traffic across the entire platform, including higher search/recommendation weighting coefficients on the main site compared to regular products and various display positions within the cross-border exclusive channels. Additionally, there are exclusive resource slots for the cross-border Select section in fixed marketing campaigns.

The newly announced Cross-Border Managed Service 2.0 is also exclusive to Select products. Previously, the cross-border managed service model only supported the submission of single products that hit business opportunities. Now, products that meet the cross-border Select criteria can be self-submitted by merchants and connected to more channels through official managed services.

In previous articles, "New Stance" analyzed 1688's existing cross-border services "Global Premium Selection" and "Goods Across the Globe." While both aim to enhance the efficiency of B2B merchants in product selection/purchasing/distribution, the newly launched “cross-border select” service features more detailed and stringent product selection standards. It emphasizes the normalization of information submission and categorization to achieve country-specific product aggregation, ensuring the agility of the supply chain.

Revisiting the purpose of launching the Select section, the preferred inventory is the behavior, while enabling deep interactions between upstream and downstream supply chains might be the underlying goal. Lin Jingxian mentioned in his speech that overseas buyers on 1688 are particularly concerned about detailed issues, such as whether products have sales qualifications and opportunities in regions like Europe, Vietnam, and Korea, or whether the suppliers support lightweight customization or brand processing.

As cross-border e-commerce operations deepen, higher-dimensional competitive strategies begin to emerge, such as understanding the logic of why a product becomes a bestseller in different consumer cultures. This clearly requires a higher degree of coordination between upstream and downstream supply chains.

High-Dimensional Competition in the Second Half of the Global Expansion

With 2024 already halfway through, a broad overview of the bustling cross-border e-commerce landscape shows that B2C e-commerce platforms, often referred to as the "Four Little Dragons of Going Global," have gradually completed the construction of fully managed and semi-managed models. Different platforms are beginning to evolve distinct operational details.

According to "LatePost," Temu launched its semi-managed model in March this year and places considerable emphasis on it. The semi-managed recruitment team has now grown to 1,000 members, aiming to attract top sellers from Amazon. Temu encourages merchants to ship directly using Amazon packages, intending to leave users with the impression of "the same goods as Amazon but at a lower price."

In May, AliExpress made the "100 Billion Subsidy for Brand Expansion" its top project for the year, attempting to tap into brand supplies and has already attracted several brands to join. Shein, although relatively late in launching its semi-managed model, imposes stringent requirements on merchants. Only companies are eligible to apply for the semi-managed model, and merchants must provide backend screenshots of their overseas inventory systems to prove they have stock overseas. According to "AMZ123," Shein's subsequent semi-managed business will focus more on over 30 niche categories, providing special support and intensified cultivation for "key categories."

Meanwhile, to counter the competitive pressure from Chinese cross-border e-commerce platforms, Amazon plans to launch a low-price store entry on its main site, featuring low-cost, white-label products. The platform will also adopt aspects of the managed model, intervening more in product promotion and logistics.

All the above changes point to a common goal: cross-border e-commerce platforms aim to penetrate deeper into local overseas markets, becoming the primary platform for merchant operations and the mainstream choice for local consumers. In other words, they want to transform "cross-border" from a limited channel for clearing goods to a comprehensive supply output, offering a more diverse consumption experience.

Therefore, as one of the most critical sourcing channels, 1688's successive improvements in product selection, distribution, and supply replacement processes can be seen as aligning with the immediate needs of downstream B2C cross-border e-commerce platforms. This aligns with the aforementioned goal of promoting deep interactions and cooperation between upstream and downstream supply chains.

Among these initiatives, the current focus on cross-border Select particularly emphasizes the sensitivity to business opportunities. We can understand this by referring to a recently released semi-annual report by Amazon, "Global E-commerce Consumption Trends and Product Selection Insights for 2024."

Amazon, leveraging its extensive database, has analyzed consumer trends in regions such as the United States, Europe, and Japan. This analysis guides its merchants in formulating more targeted product selection strategies and planning. Among the six latest global market consumer trends presented in the report, the comprehensive demand for gardening products, described as "from seed to garden," aligns with the daily lifestyle of typical North American households. In the European market, there is a growing emphasis on fulfilling emotional value, with products and services that evoke positive emotions revealing new business opportunities.

This exemplifies how platforms utilize their informational advantages to guide merchants in identifying business opportunities, fostering an instinct for best-selling products within consumer trends and fashions. Consequently, they can push upstream supply chains to adjust or customize their output. Therefore, 1688’s cross-border "Select" requires selected products to consider more of the "potential to become best-sellers" and to fill out qualification certifications more meticulously. The goal is to ensure every link in the supply chain connects more efficiently, eliminating any cognitive gaps with the target consumer market.

Another perspective worth noting is that in the past, Temu’s fully managed pricing referenced 1688 prices. However, price competition is clearly not the only solution for overseas product distribution. To some extent, 1688 Select replicates the domestic "1688 Strict Selection" strategy, which can also be seen as a choice for differentiated competition.

03. In Conclusion

Alibaba Group has numerous overseas business operations. In previous articles, we have discussed the differentiation between 1688’s cross-border services and its International Station. It appears that these two segments now have distinct customer bases.

The International Station primarily targets large clients, as it was designed from the start to cater to the export trade. Its customer base includes many foreign brand manufacturers, connecting them with domestic factories for customization or OEM services. On the other hand, 1688 Cross-border focuses on small and medium-sized B2B clients overseas, with nearly 600,000 source factories offering a wide range of ready-to-ship products, and connecting overseas buyers through procurement agents.

From white-label products going abroad, to brand suppliers, to upstream supply chain goods being exported, along with the integration of some overseas local supply systems, cross-border e-commerce might shed the "cross-border" label in the coming years. It could evolve into a "global e-commerce" with a holistic perspective, gradually blurring some of the regional and cultural boundaries.

To gain more control over cross-border operations, 1688 is striving to capture the minds of premium upstream suppliers within this vast domain.