Alibaba's 10th Anniversary of Listing: How to 'Weigh' Good Companies in This Era?

![]() 09/19 2024

09/19 2024

![]() 648

648

A company that proactively resonates with societal needs deserves to be measured by more value metrics.

Written by She Zongming

Before the internet, people could live without it; but now, it's hard to imagine life without the internet.

Today, the internet has transformed every aspect of our lives -

Taobao changed the way we shop, WeChat revolutionized social interaction, Douyin (TikTok) altered our entertainment habits, Alipay transformed payment methods, Didi revolutionized transportation, and DingTalk changed the way we collaborate...

If we distill a question from these changes - "Which internet companies have profoundly altered the Chinese way of life?" - Alibaba undoubtedly features prominently in the answer.

Nine days ago, Jack Ma's internal post celebrating Alibaba's 25th birthday brought back memories of the pioneering era of internet development from scratch.

Today (September 19, 2024) marks Alibaba's 10th anniversary of listing.

Ten years ago today, Alibaba officially debuted on the New York Stock Exchange (NYSE) with an IPO that raised $25.03 billion, making it the largest IPO in U.S. stock market history at the time.

This marked a glorious moment for Chinese internet companies. Industry observers noted that Alibaba's listing signified the dawn of the Chinese era in global internet.

A decade later, China's internet industry has weathered many storms and grown substantially, yet it also faces the challenge of overall undervaluation.

Ten years ago, the combined market value of Alibaba and Tencent was 2.5 times that of Amazon. Today, however, the tables have turned, with Alibaba and Tencent's combined market value now less than a third of Amazon's alone.

The "tech septet" on the U.S. stock market boasts a combined market value of $13 trillion (over RMB 92 trillion), while the top seven Chinese internet technology companies have a combined market value of approximately $1 trillion, a stark contrast.

Moments like these underscore the need to consider: What metrics should we use to 'weigh' these Chinese internet technology companies?

01

Taking Alibaba, which has been listed for 10 years, as an example, despite its share price recently breaking through resistance levels and market value surpassing $200 billion again, the topic of Alibaba being significantly undervalued continues to spark industry discussions.

Several data points are worth considering when assessing Alibaba's valuation:

1. Compared to a decade ago, Alibaba's current core performance metrics - revenue, profit, user base, and Gross Merchandise Volume (GMV) - have multiplied severalfold: revenue is 18 times higher, profit 7.5 times, user base 4.3 times, and GMV 5 times, yet its market value remains largely unchanged.

▲Comparison of Alibaba's core performance metrics between FY2014 and FY2024.

2. For comparison, Tencent's revenue in the last fiscal year was 7.7 times that of 2014, profit 4.8 times, and market value approximately 4 times. Amazon's 2023 revenue was 6.46 times that of 2014, with its market value surging approximately 14-fold.

While valuation logic differs, such discrepancies extend beyond mere logic.

3. Typically, mature internet technology companies are valued using the Price-to-Earnings (P/E) ratio (P/E = Share Price / Earnings Per Share). Only loss-making industries and companies are valued using the Price-to-Book (P/B) ratio (P/B = Share Price / Book Value Per Share). In the investment realm, a reasonable P/B ratio range is generally 3-10, with values below 3 indicating undervaluation and above 10 indicating overvaluation.

Alibaba's P/B ratio on the NYSE stands at just 1.3, underscoring its significant undervaluation.

4. Alibaba's current P/E ratio is below the industry average, and the Moving Average Convergence Divergence (MACD) indicator supports its investment value.

Notably, Alibaba is currently experiencing a series of value reassessments:

Having embarked on self-transformation over a year ago, it has returned to a healthy growth trajectory. With strategic focus and investment, its core e-commerce market share remains solid, and Alibaba Cloud's growth has regained momentum;

Since its inclusion in the Stock Connect program on September 10, Alibaba has consistently been the top net buy among Stock Connect constituent stocks;

Alibaba and Tencent have joined forces to break down barriers, with Taobao gradually opening up WeChat Pay, enhancing merchant and consumer experiences while significantly aiding Taobao's expansion into lower-tier markets;

Crucially, Alibaba has completed a three-year rectification period, receiving official praise for "achieving good results"...

Driven by multiple catalysts for share price upside, Alibaba's valuation center is shifting upwards.

02

When mainstream business narratives anchor on market value or share price, they often fall prey to biases that prioritize financial analysis or product superiority in assessing company quality.

Beyond these 'quantifiable' fundamentals and the decade-long multiplication of revenue and profits, what merits greater attention is the multiplication of value created by companies.

Peter Drucker, the "Father of Modern Management," stated in "Management: Tasks, Responsibilities, Practices": "To judge whether a company is good or not, one must consider not only the economic dimension but also the social dimension. The social dimension is crucial to a company's survival; companies are products of society and economics, which can make any company disappear overnight."

In essence, assessing companies should encompass not just financial indicators like revenue and profit but also a more diversified perspective, including the willingness and ability to proactively create social value.

As Alibaba celebrated its 25th birthday, numerous discussions emerged online.

Some mentioned the "Reunion System" developed with support from Alibaba's technical staff, which, in collaboration with public security departments, had helped reunite 5,113 missing children as of May this year.

Others spoke of Gaode Maps' recent installation of "lonely billboards" in uninhabited areas, aiding trekkers in need with offline navigation and satellite emergency services.

Some recalled Alibaba's commitment to support post-earthquake reconstruction in Qingchuan in 2008, pledging "seven years, or even another seven if needed," making it one of the longest-standing supporters.

▲Recently, Gaode Maps erected three "lonely billboards" in deserts, gobies, and grasslands, aiming to aid those in need with its newly launched offline navigation and satellite emergency services.

These optional endeavors, which could have easily been avoided, define the company on a more tangible level.

In his internal post, Jack Ma expressed pride in Alibaba's contribution to societal progress, from empowering countless young entrepreneurs to open stores to using technology to reduce child abductions, solving the challenge of securing train tickets during the Spring Festival travel rush, and many outstanding employees leaving their comfortable lives to serve as rural envoys in impoverished areas... Alibaba's "chivalrous spirit" beyond performance metrics has fortunately been recognized.

A company that proactively resonates with societal needs undoubtedly deserves to be measured by more value metrics.

03

As a long-term value investor, Warren Buffett's Chinese counterpart, Duan Yongping, once said, "Valuation cannot determine a company's true worth. I've never seen Buffett calculate a company's value with a calculator."

He chooses companies primarily based on two factors: business model and corporate culture, "especially corporate culture, which is the foundation of a great company."

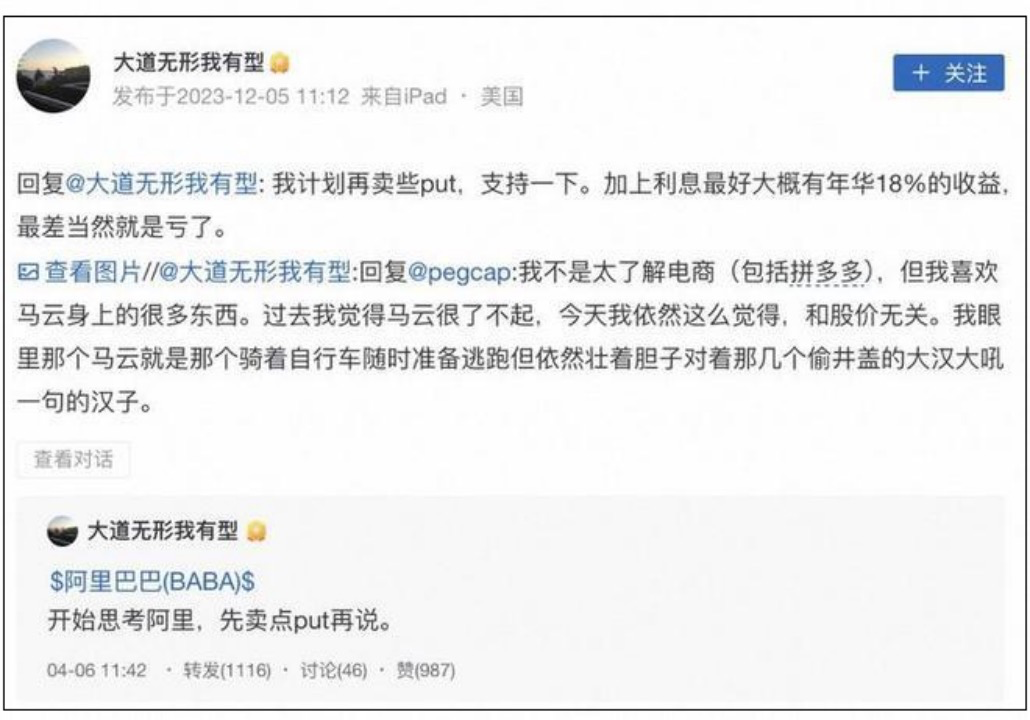

At the end of last year, Duan Yongping boldly stated on the Xueqiu platform, "I used to think Jack Ma was remarkable, and I still do today, regardless of the share price. In my eyes, Jack Ma is the man who, despite riding a bicycle ready to flee, still dares to shout at those stealing manhole covers."

▲At the end of last year, Duan Yongping shared with netizens on Xueqiu his admiration for many aspects of Jack Ma.

He has continuously increased his holdings in Alibaba over several quarters. In the second quarter of this year, his fund, H&H International, added to its Alibaba position, making it the fourth-largest holding after Apple, Berkshire Hathaway, and Google - a clear vote of confidence and endorsement of his beliefs.

The implicit market rationale behind this may be that companies that proactively pursue social value creation tend to be more willing, capable, healthier, and sustainable.

Alibaba has a three-century vision of lasting 102 years, with approximately a quarter of the journey completed.

Over the past 25 years, Alibaba's story of "repeated departures, trial and error, reconstruction, changing the world, and being changed by the world" has enriched people's perceptions of the company.

In his internal post, Jack Ma said, "Alibaba is Alibaba because we have an idealistic spirit. We believe in the future, we believe in the market, and we firmly believe that only kind companies that create genuine value for society can persevere on the 102-year journey."

Ten years after listing, Alibaba continues to respond to the test of "creating genuine value for society."

What lies ahead for Alibaba in the next decade? Time will tell and weigh the answer.

Yet regardless of the moment, we should consider applying a more diversified set of value metrics when assessing the worth of China's internet technology companies.

Operated by Li Wan