50 basis points cut directly, is the Fed the ultimate boss of US stocks?

![]() 09/20 2024

09/20 2024

![]() 601

601

If we start from the beginning of 2022, after a two-and-a-half-year cycle of dollar interest rate hikes, the US dollar finally entered a new stage last night - the interest rate cut cycle. As for the magnitude of the rate cut, which is of greatest concern to the market, the Fed's initial 50 basis points cut seems to have given the market a "sweet upfront, bitter aftertaste" medicine. Why do I say that?

I. The market's "stance" before the rate cut: expectations are a bit chaotic

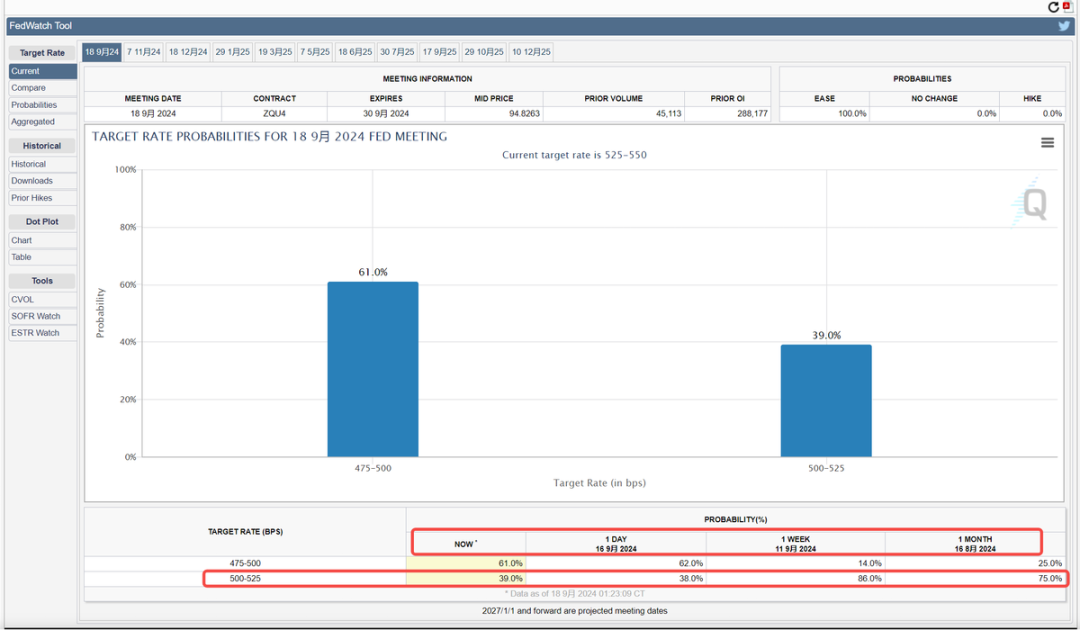

From the FedWatch tool, the market's expectations for how many basis points the Fed would cut interest rates over the past two weeks have been like a roller coaster - the Fed says it bases its decisions on data, so the market has been trading back and forth based on high-frequency macroeconomic data each time:

Just a week ago, due to the robust performance of August CPI and PPI inflation data, market expectations for a 25 basis points rate cut directly fell to a low-probability event of around 25%. Even after the subsequent release of core retail sales, which grew by 0.3% month-on-month, which was also considered decent, and with some major media outlets calling for a 50 basis points rate cut without opposition from the Fed, the market unexpectedly raised the probability of a 50 basis points rate cut back up to 60%.

Nonetheless, with the fluctuations in expectations, many funds in the equity market have not fully bought into the prospect of a 50 basis points rate cut. From an expectation management perspective, this time around, it seems a bit chaotic.

II. Can a rate cut be both "big" and "hawkish"?

As the first rate cut since the post-pandemic era, this rate cut can be characterized as both "big" and "hawkish": big in that it directly cuts 50 basis points for the first time, and hawkish in that the Fed's teleconference and dot plot suggest that the 50 basis points cut should not be linearly extrapolated, and that future decisions will still be data-driven. This 50 basis points cut is merely to demonstrate the Fed's commitment to supporting the economy.

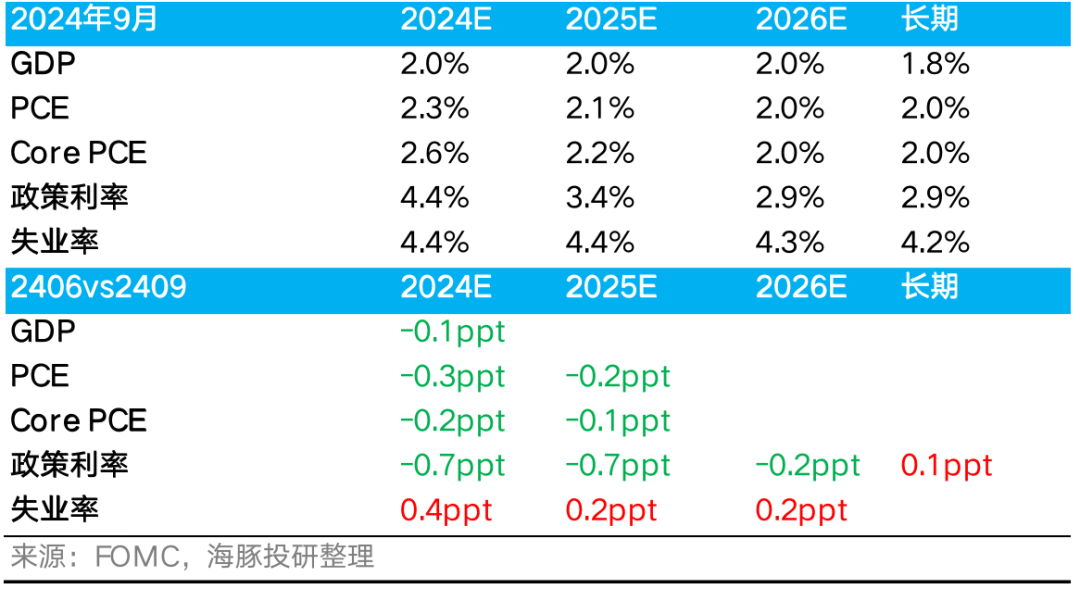

As can be seen from the Fed's latest economic projections, it is guiding for two more meetings this year, each with a 25 basis points rate cut, bringing rates down to 4.25%-4.5%. Then, a total of 100 basis points will be cut in 2025, followed by another 50 basis points in 2026, with the final steady-state nominal interest rate set at 2.75%-3%.

Compared to market expectations, while the initial 50 basis points cut is unexpectedly large, the subsequent rate cuts are significantly slower. Coupled with a neutral unemployment rate consistently below 4.5%, and PCE and core PCE guidance continuing to converge towards 2%, the Fed's economic projections point to a path of "perfect soft landing" - lower interest rates, looser policy, but continued inflation moderation, sustained employment, and economic growth.

An interesting aspect of the teleconference was when several reporters repeatedly asked Powell if this was a "catch-up" rate cut. While Powell denied that the Fed was again "behind the curve" and emphasized that current inflation and consumption data are still favorable, and that the large rate cut is more focused on forward-looking considerations, he also acknowledged that if the July employment data had been known in advance, a rate cut might have indeed occurred at the previous meeting on July 31.

In Dolphin Capital's view, this illustrates two points:

a. Among various economic indicators, the current unemployment rate and new job creation are truly core data, as subsequent CPI and PPI reports have not raised alarms at the Fed. Powell has stated that the policy goal is to "restore price stability without a painful increase in unemployment," and he has addressed the persistent housing inflation and the possibility that rate cuts may further prolong the disinflation process in housing. His responses included that lower mortgage rates after rate cuts could help some second-hand homes return to the market, and that housing supply constraints are beyond his control and more a matter for real estate developers and the government.

b. The dot plot of economic projections released by the Fed to some extent merely reflects the Fed's aspirations, and by guiding the market to trade on these aspirations, it does not necessarily mean that this path will materialize. The largest revision in the root variables of the economy, as seen in the latest economic projections, is to the unemployment rate, and the significantly lower policy rate expectations are merely a result of this root variable change.

Therefore, a key area to track for future rate cut expectations will be the labor market: How is labor participation? How much has labor supply increased? How much has job demand decreased? How much has the unemployment rate increased, and is it within a "manageable" range below 4.5%?

Especially given the downward revisions to new nonfarm payrolls in recent months, it is prudent to build in some margin for error and consider potential rate cut reductions based on past months' adjustments. At least, this is how the Fed, as expressed by Powell, would likely view the data. Furthermore, Dolphin Capital is not overly concerned about this hawkish rate cut guidance; the key remains employment data, particularly if weakness in employment is primarily due to excess supply from an influx of immigrants rather than weakening corporate job demand, the economic impact may not be as severe.

III. Opportunistic Fed? Dislikes deflation more than inflation

At this juncture, let's revisit the Fed's actions on rate hikes and cuts amid economic uncertainty: From initially characterizing inflation as "transitory," to acknowledging in late 2021 that inflation was persistent and would continue to rise, the Fed's first rate hike in February 2022 was still a modest 25 basis points. Of course, as inflation soared, the pace of rate hikes quickly accelerated from 25 to 50 basis points (once), then four consecutive 75 basis points hikes, bringing rates up to 4.5% before slowing to 50 basis points in late 2022 and entering a slower pace of 25 basis points hikes in 2023.

In the face of clear inflationary pressures, the Fed was labeled as "too late, too slow." However, when it came to rate cuts, the Fed responded swiftly. After signaling rate cuts late last year, inflation resurged earlier this year, necessitating a delay. By mid-year, with weakening employment, the September rate cut of 50 basis points, coupled with hawkish expectations management, seemed aimed at stabilizing inflation gains through expectations management during the rate cut process, ultimately facilitating faster rate cuts to ease blue-collar cash flow pressures and government debt repayment burdens.

The same Fed, the same chairman, with hesitant rate hikes versus decisive rate cuts, appears to suggest that policymakers with control over monetary policy have a much higher tolerance for inflation than recession or deflation. For a large economy like the US, which has experienced significant cyclical fluctuations, this is worth pondering.

IV. Slowdown is real, but no major slump

Let's review the core economic data since the beginning of August (the last FOMC meeting): Apart from the three June, July, and August employment reports, which were significantly revised downwards (due to both supply and demand factors) and served as a clear trigger for rate cuts, other data since August have pointed to an economic slowdown.

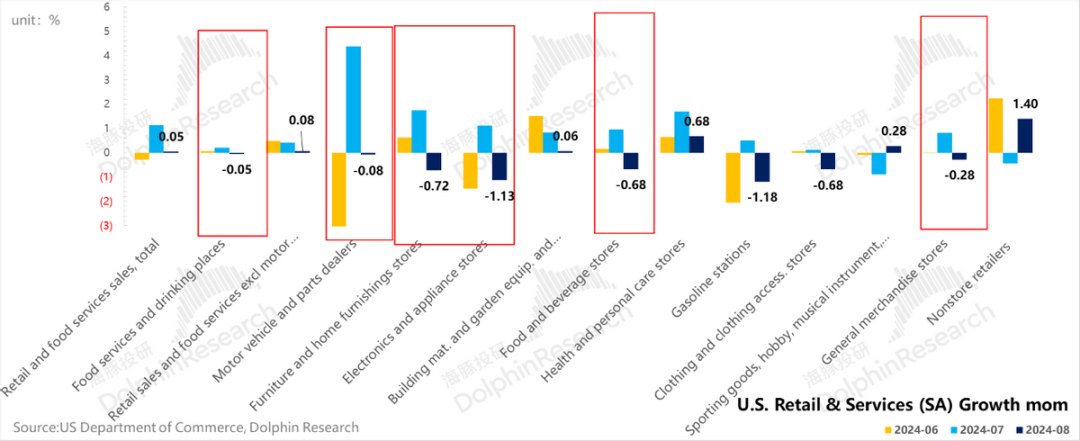

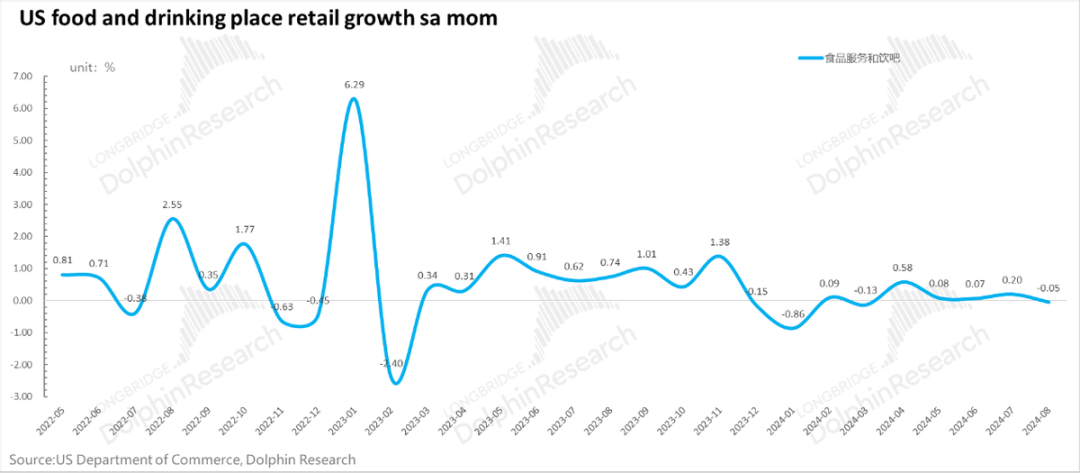

For example, the latest August retail sales figures, while seemingly weak on the surface, still demonstrate resilience. The seemingly stagnant 0.05% month-on-month growth in seasonally adjusted retail sales in August may suggest stagnation, but this follows a high base from the previous month. Excluding the more volatile categories of automobiles and parts, gas stations, building materials, and catering services that are less related to physical retail sales, core retail sales still grew by 0.3%, not far behind the 0.4% growth in the previous month.

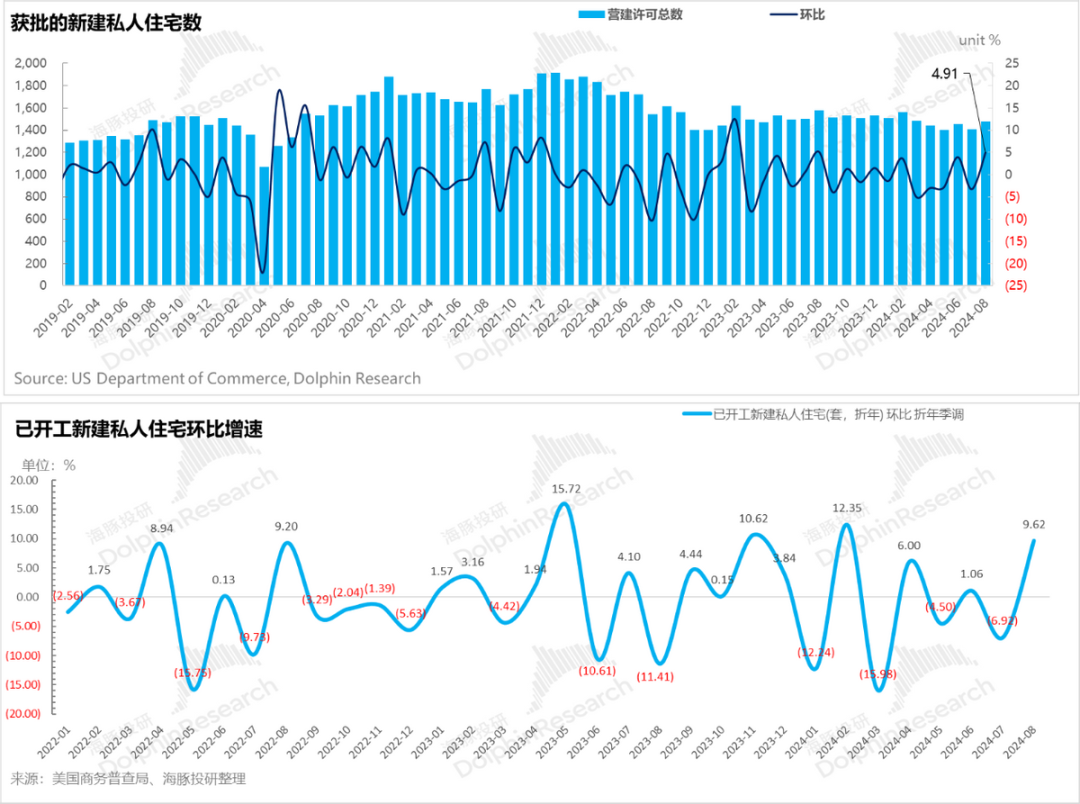

Meanwhile, as the real estate market quickly priced in rate cut expectations, the US real estate sector has shown signs of recovery, with the latest August building permits and privately-owned housing starts both rebounding month-on-month.

However, there are also clear signs of weakness in some sectors. For example, catering services, a significant component of overall consumer spending, has seen its month-on-month growth momentum weaken for three consecutive months, possibly indicating a further weakening of consumer spending momentum.

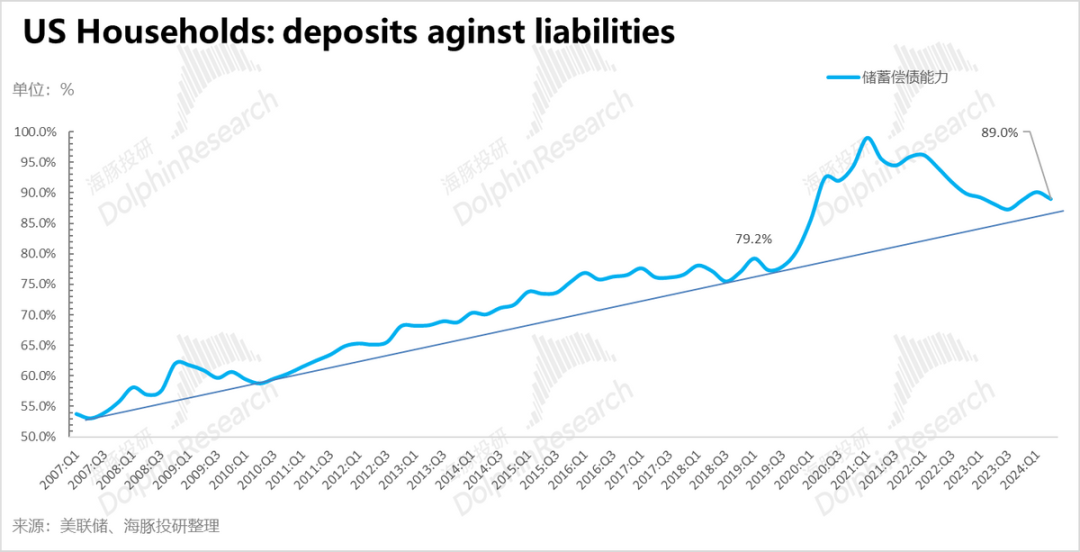

In addition, the latest second-quarter household balance sheet data shows that by the end of the quarter, US households' overall savings relative to their debt repayment capacity were gradually returning to historical trends. The room for consumer spending released through savings compression is also diminishing.

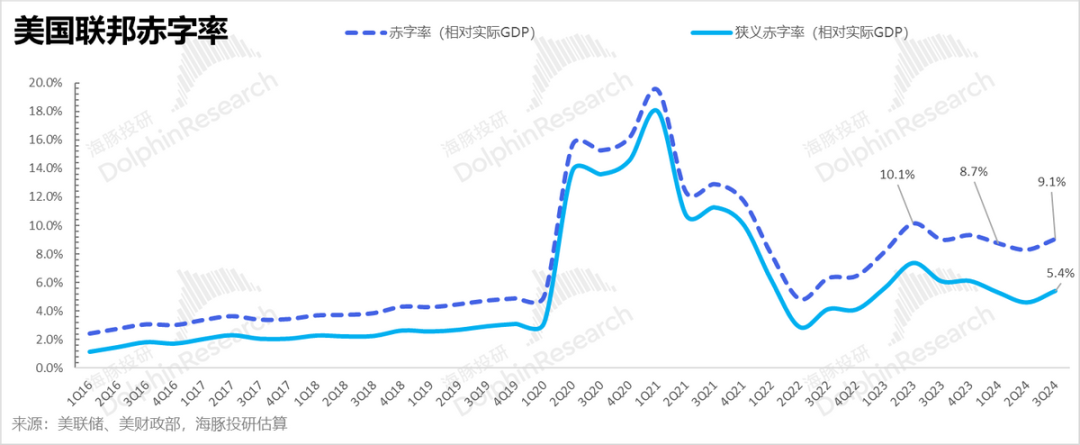

However, government investment and spending continue, with the US federal government incurring a deficit of $380 billion in August. Excluding interest payments, the real deficit invested in the real economy was $300 billion. At this pace, Dolphin Capital estimates that the US deficit in the third quarter may again surge upwards.

Overall, it can be seen that during this rate cut cycle, as a demand-driven economy, the three major demand-generating sectors have not significantly contracted, and household balance sheets remain relatively healthy. There is indeed no likelihood of a major economic slump during the rate cut process. Overall, while the magnitude of this rate cut is significant, it still points to a path of monetary easing and economic soft landing.

V. Finally, the rate cut has come, is the opportunity here?

From last night's trading, the market was initially excited about the larger-than-expected 50 basis points rate cut. However, after the press conference began, the market realized something was off. While the rate cut magnitude was dovish, the Fed's tone during the teleconference was clearly hawkish, with a relatively slow pace of future rate cuts planned, and even an upward revision of the steady-state policy rate by 10 basis points.

Under this combination, while the rate cut was sufficient in magnitude, the market began to expect a more cautious pace of rate cuts, and the market rally did not last long. If the Fed's underlying goal of supporting employment and its relatively aggressive rate cut stance hold true, Dolphin Capital believes that in the context of possible economic weakness, accommodative monetary policy remains a positive factor for equity assets.

In particular, assets in the US stock market that have been suppressed under high-interest rate policies, such as real estate and automobiles, as well as relatively cyclical assets in technology, such as internet advertising, could be considered.

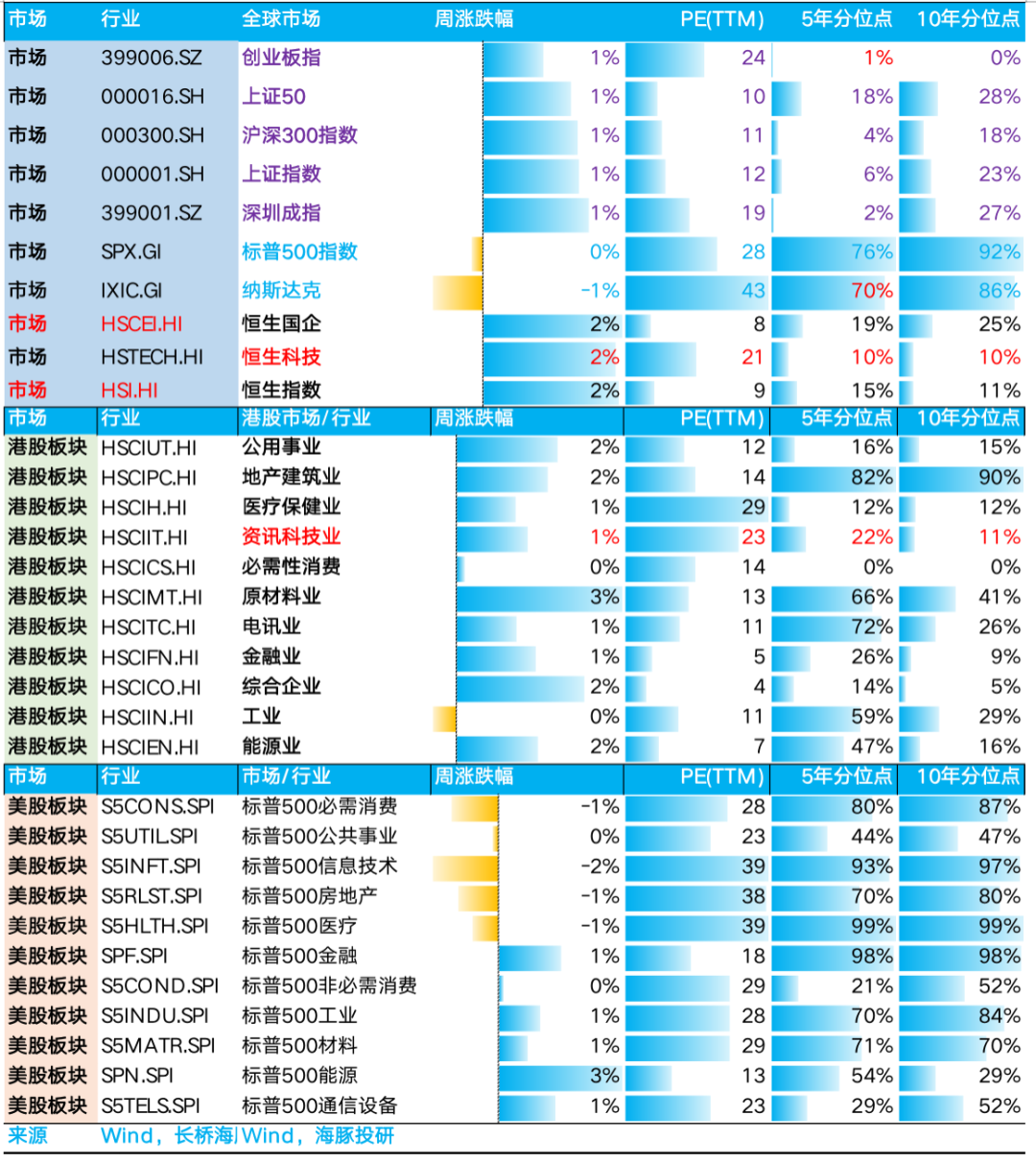

Similarly, Hong Kong assets, which Dolphin Capital has been closely watching and have previously mentioned, are more sensitive to the loose monetary environment in the US due to the currency link. Coupled with their currently low valuations, there is hope for a recovery. Moreover, as foreign interest rates fall, it opens up room for domestic borrowing costs to be reduced. If monetary policy can ease further relative to US rate cuts, there may be room for policy maneuvering.

However, whether the recovery can be sustained depends primarily on internal factors, i.e., the resilience of their own fundamentals. Judging from consumption during the recently concluded Mid-Autumn Festival holiday, consumer spending is further weakening, which is not good news for most mature cyclical assets that Dolphin Capital focuses on, such as internet e-commerce and advertising.

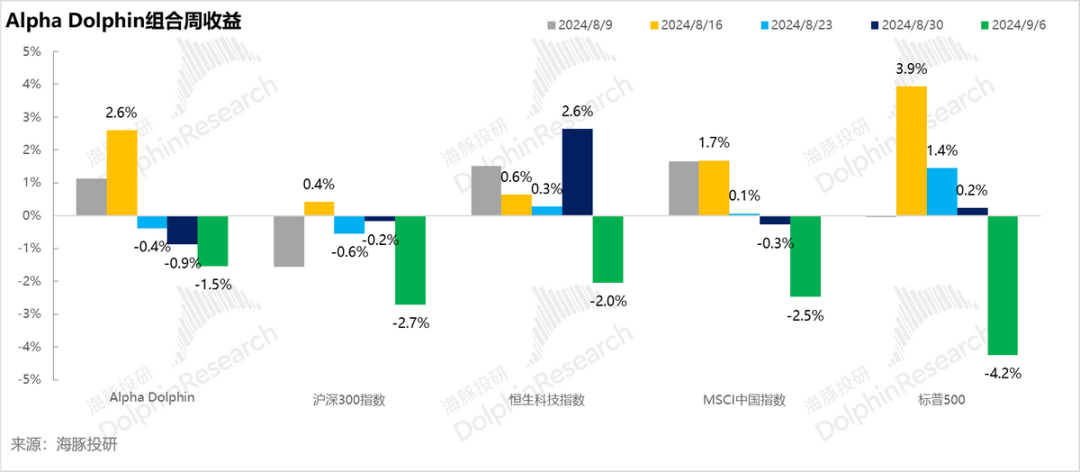

VI. Portfolio adjustments and returns

There were no portfolio adjustments last week (as of September 15), and portfolio returns rose by 2.1%, outperforming the MSCI China Index (-0.5%), Hang Seng Tech Index (-0.2%), and CSI 300 Index (-2.2%), but underperforming the S&P 500 (+4%). This is primarily due to further declines in Chinese assets amid weak consumer spending prospects during the holiday season, while some US stock market funds had already priced in the 50 basis points rate cut in advance.

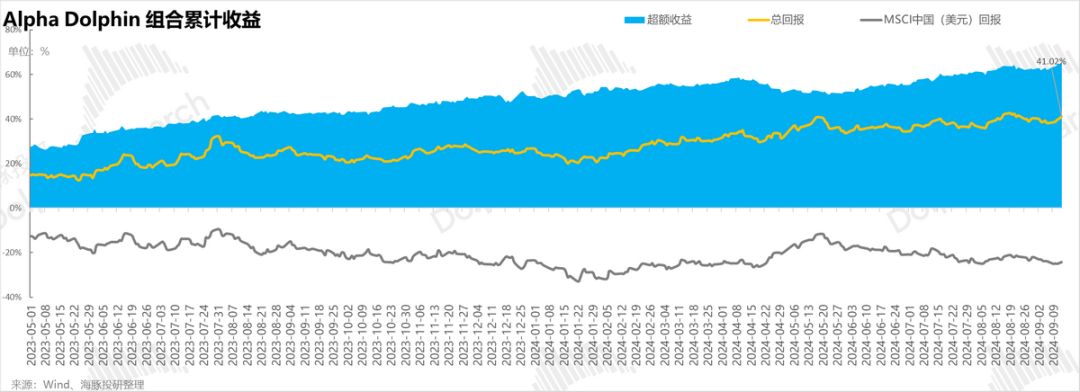

Since the inception of the portfolio test to last weekend, the absolute return on the portfolio was 41%, with an excess return of 65% compared to MSCI China. In terms of asset value, Dolphin Capital's initial virtual assets of $100 million have now fallen to $142 million.

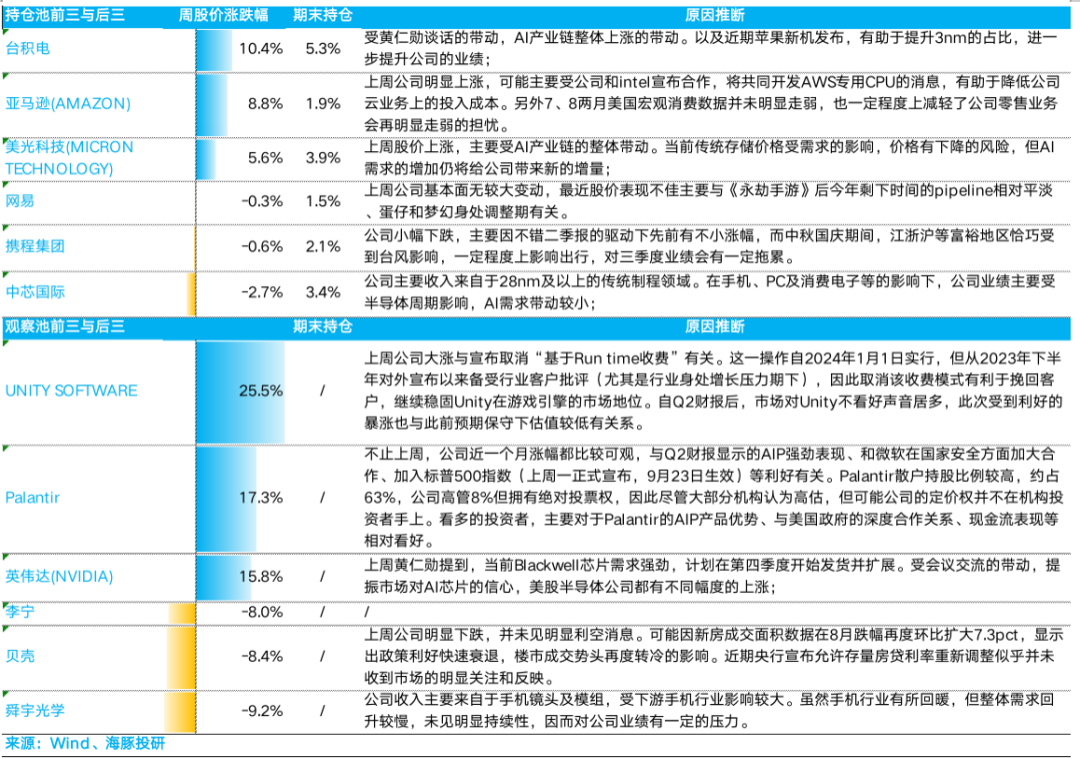

Individual stock profit and loss contribution

In the week of September 15th, driven by NVIDIA's Jen-Hsun Huang's speech, the entire AI sector rebounded. Furthermore, with the interest rate cut, the market gradually began to speculate on a 50 basis point rate cut. Asset classes sensitive to interest rates, such as Unity and Palantir, exhibited high stock price elasticity under the stimulus of news and fundamentals.

However, regarding Chinese assets, as the Mid-Autumn Festival approached, consumption indicators related to the holiday, such as baijiu (a type of Chinese liquor) and mooncakes, weakened again. Additionally, due to the typhoon, consumption in the alcohol and tourism sectors was also sluggish, leading to negative expectations in real estate and consumer sectors.

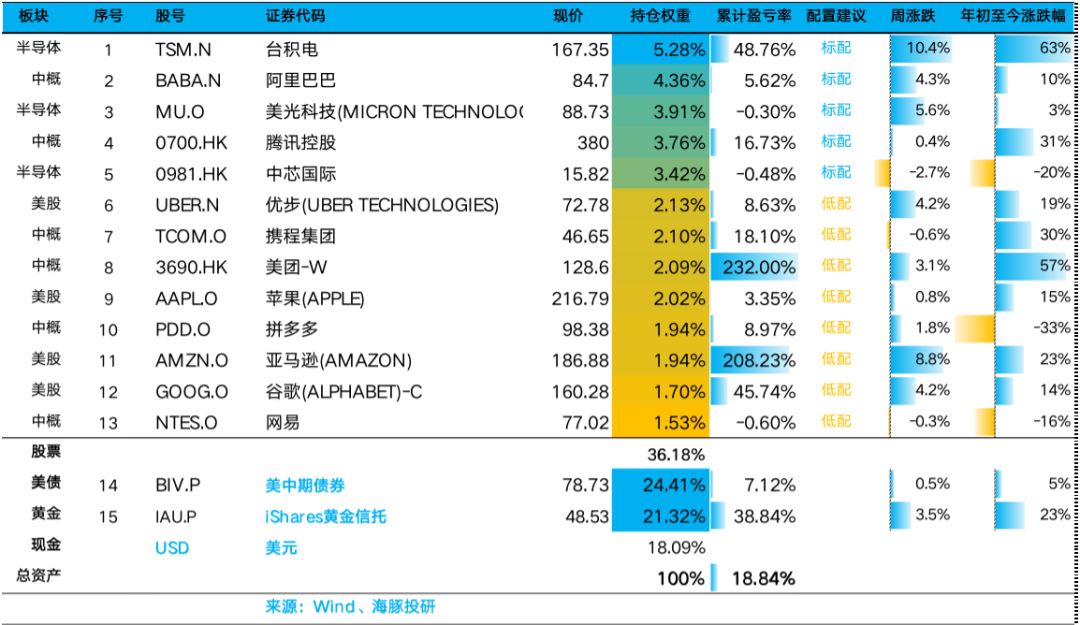

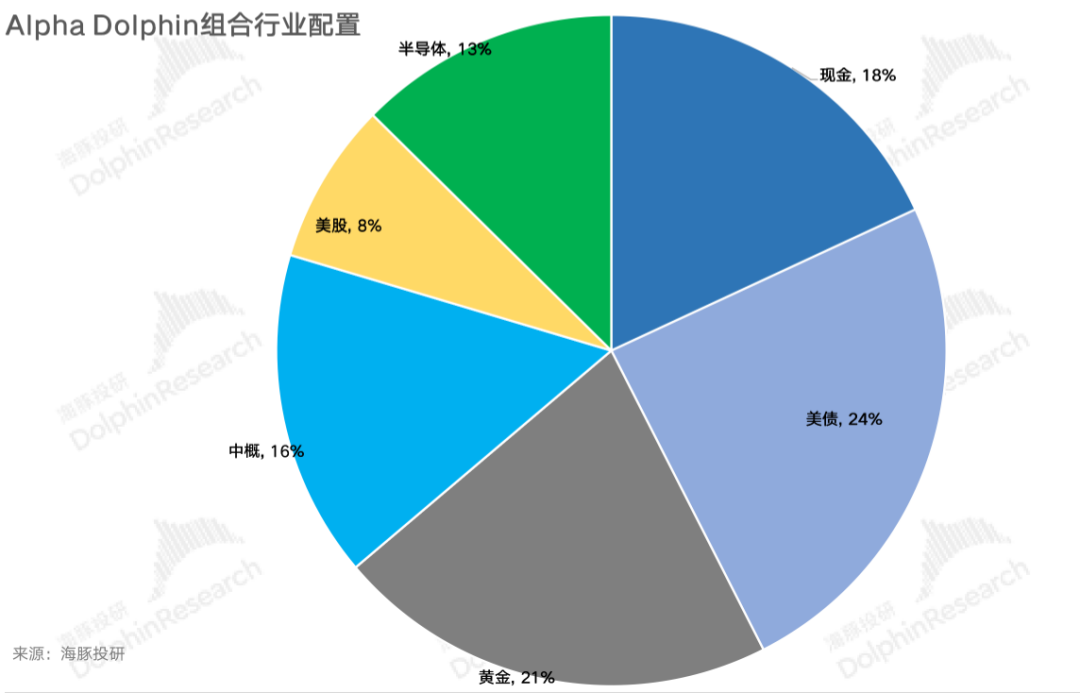

Portfolio asset distribution

The Alpha Dolphin virtual portfolio holds a total of 13 individual stocks and equity ETFs, with 5 standard positions and 8 underweight equity assets. The remaining assets are distributed across gold, US Treasuries, and USD cash. Currently, there is still a significant amount of cash and cash equivalents, and there are plans to increase positions in the near future. As of last weekend, the asset allocation and equity holdings weights of Alpha Dolphin are as follows:

- END -

The copyright of this article belongs to the original author/organization. The current content represents only the author's views and is not related to the position of Dolphin Investment Research. The content is for investors' reference only and does not constitute any investment advice.

// Reprint Authorization

This article is an original work of Dolphin Investment Research. Please obtain reprint authorization if you wish to reprint it.