Taobao leads the new trend: a campaign to reduce the burden on e-commerce businesses

![]() 09/20 2024

09/20 2024

![]() 526

526

In ecosystem research, the story of wolves in Yellowstone National Park in the United States is widely known.

In the 1920s, when gray wolves in the park were hunted to extinction, elk multiplied rapidly and devoured large numbers of willow saplings, leading to ecological degradation and starvation for the elk, many of which died from hunger. Seventy years later, when wolves returned, the ecosystem of Yellowstone National Park stabilized and regained vitality.

One lesson learned from nature is that balance is crucial for a healthy ecosystem.

This rule also applies to various "ecosystems" distributed in the business world, such as the e-commerce industry that is currently reflecting on the value of "involution."

Over the past year, players in the e-commerce industry have been fiercely competing for users, acting like pendulums swinging indefinitely towards consumers. However, changes in consumer trends and purchasing habits, along with frequent adjustments to platform rules, have inadvertently increased the operating costs for businesses. Merchants forced into this involutional spiral have found themselves in a difficult position with few words to describe their plight.

However, in recent months, the industry has begun to show signs of reversal. Starting with Taobao's pioneering move to adjust its "only refund" policy, the survival of businesses has become a key focus for the e-commerce industry. Perhaps realizing the importance of business health to maintaining platform ecosystems, platforms have swung their pendulums towards merchants, competing to reduce their burdens and provide support.

With policies being introduced intensively and support measures diversifying, will the e-commerce industry enter a new and more orderly development cycle as a result?

01

Taobao and Others Shift Their Focus of "Pleasing"

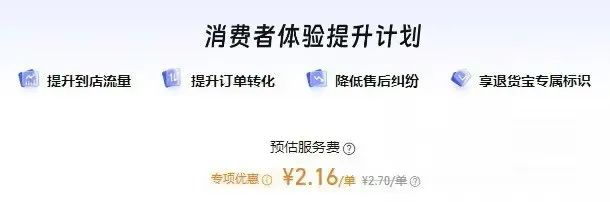

On September 12, Taobao merchants received a pop-up message when logging into their backend: "Return Guarantee" is newly launched.

This service targets return and exchange scenarios. Once merchants join, consumers who purchase products marked with the "Return Guarantee" service and successfully apply for a return or exchange will receive up to 26 yuan in shipping reimbursement for the first weight of the package.

For merchants, the platform estimates that return and exchange costs can be reduced by at least 10% and up to 30%. Some Taobao merchants have shared on Xiaohongshu that before joining "Return Guarantee," their shipping insurance cost 1 yuan per order, while after joining, it dropped to 0.71 yuan per order. Other merchants have reported similar reductions from 1.6 yuan to 1.41 yuan per order.

▲ A merchant shows the change in shipping costs displayed in the store backend on Xiaohongshu

An e-commerce operations expert said that before the official launch of "Return Guarantee," the news had already caused a stir in various groups. Some worried that the platform would find new ways to "exploit" merchants, while others feared being targeted by fraudsters or wanted to seize the traffic dividends during the early stages of the service's launch.

In his view, Taobao's move is straightforward: reduce merchants' after-sales costs and ease their operating pressures.

"Noise Reduction NoNoise" believes that this is a telling signal in itself. Over the past year, the essence of extreme involution in the e-commerce industry has been to "please" consumers. To compete for their mindshare, platforms have engaged in a race to offer the lowest prices and the best service experiences.

While competing on price and service is the right path, excessive involution ultimately hurts merchants, as they are the ones providing prices and services while bearing most of the operating costs. From introducing price comparison systems, canceling pre-sales promotions, to enforcing shipping insurance during events, and implementing the "only refund" policy, consumers' shopping and return experiences have become smoother, but merchants' survival space has become increasingly cramped.

It's not that the interests of consumers and merchants are opposed to each other. Product quality, supply chain efficiency, and service experience are inherent to the retail industry. However, when responding to market changes and competitive pressures, e-commerce platforms' stress reactions have been overly intense, causing distortions. When the rules designed to "please" consumers are one-size-fits-all or even unfair, merchants face increasing operating pressures.

Over the past year, e-commerce businesses have struggled due to macroeconomic factors. In the first half of 2023, online retail sales of physical goods grew by 10.8% year-on-year, accounting for 26.6% of total retail sales of consumer goods. By the first half of 2024, the year-on-year growth rate of online retail sales of physical goods dropped to 8.8%, with total retail sales of consumer goods accounting for 25.3%.

As consumption trends become more conservative and operating rules change, the pressure is transmitted layer by layer, gradually breaking the balance of the ecosystem. Imbalance inevitably leads to a new round of order evolution.

This is because in a healthy business ecosystem, balancing the interests of consumers and merchants ultimately benefits consumers. Conversely, merchants may either leave the market, cut corners to pass on costs, or abandon innovation, ultimately harming consumers.

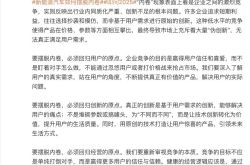

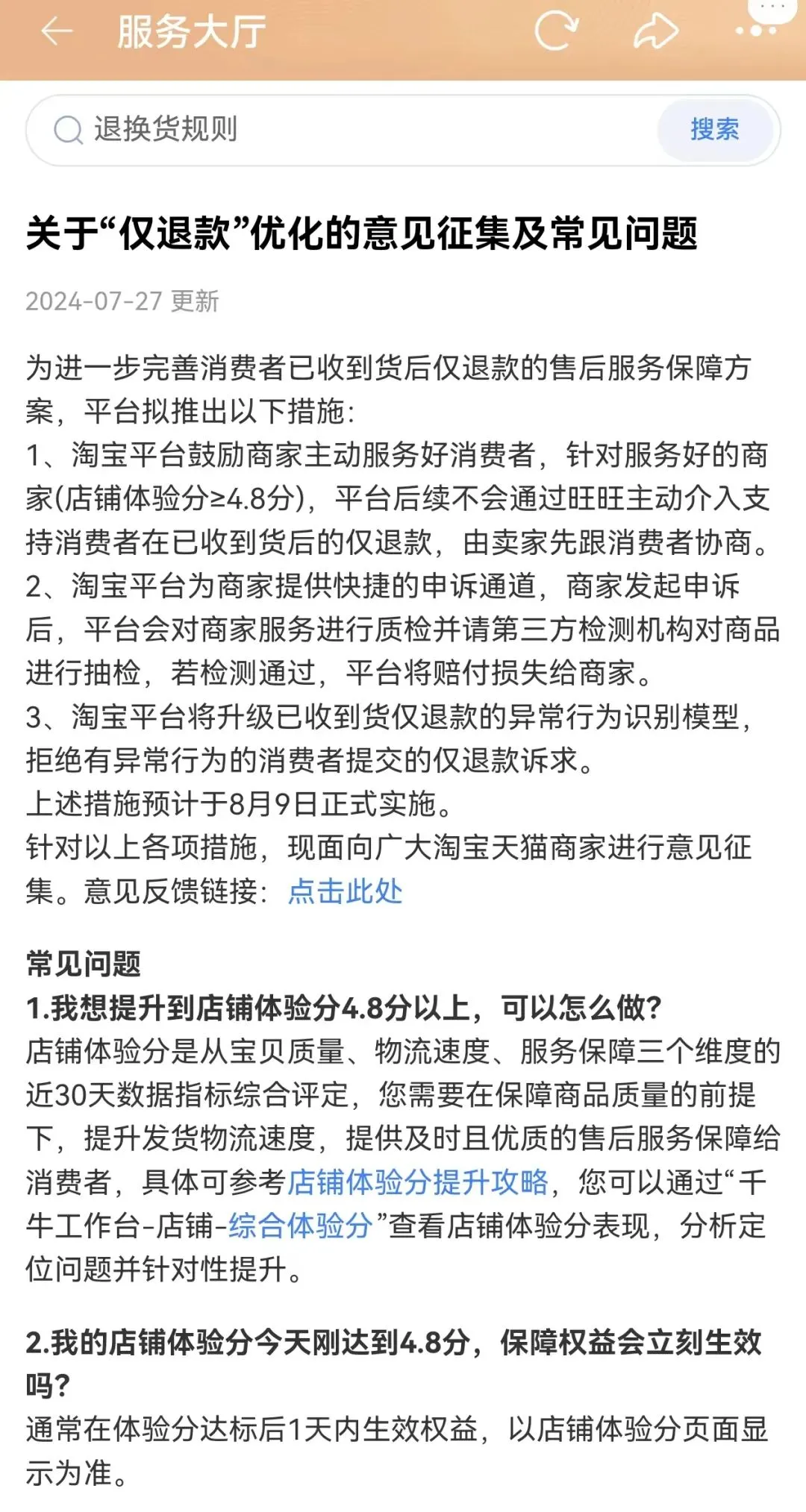

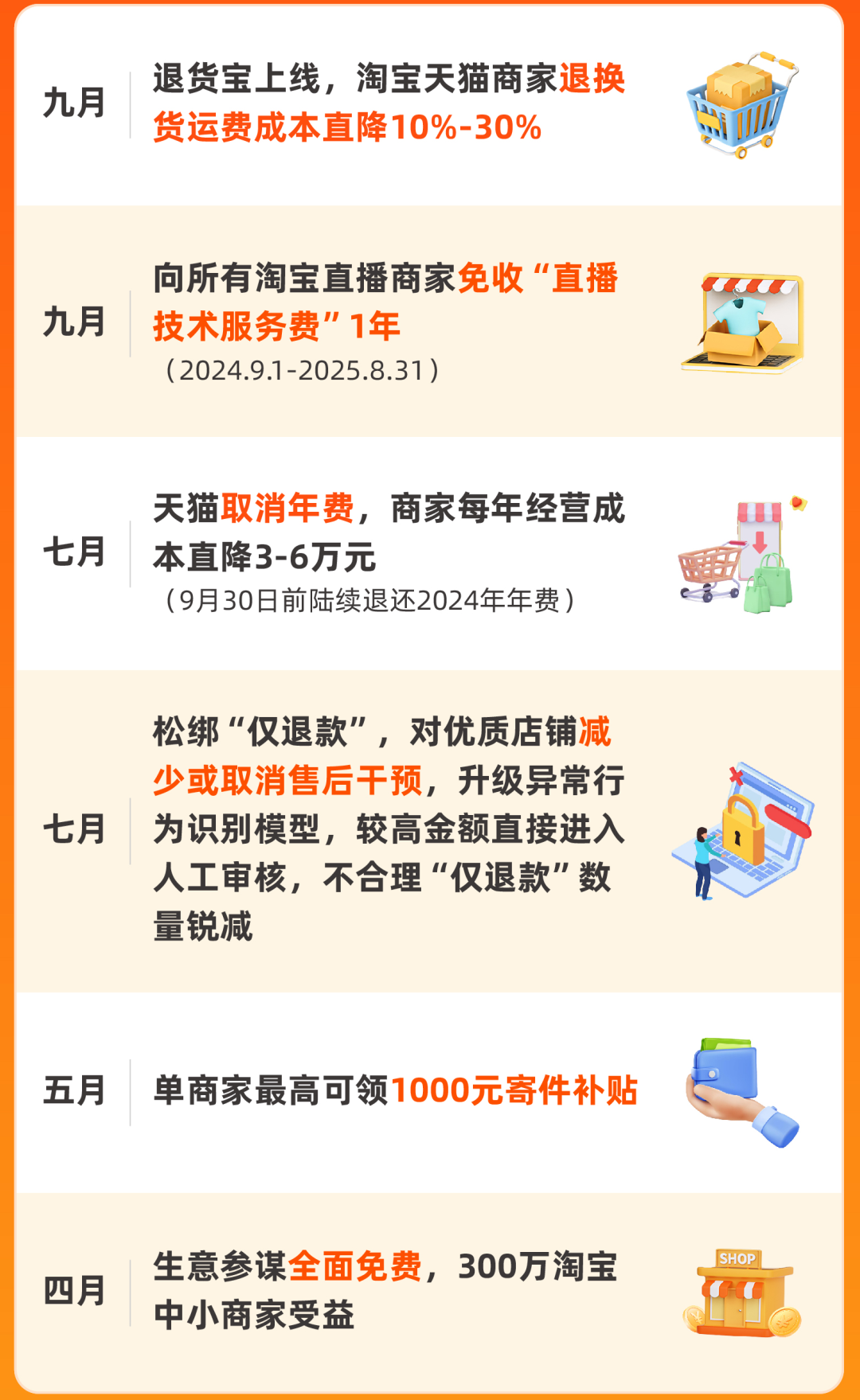

Taobao and Douyin clearly recognize the importance of a healthy ecosystem evolution. Taobao was the first to make a move, adjusting its "only refund" policy in July by easing restrictions for high-rated stores, aiming to reduce merchants' risks of facing zero-cost purchases while still safeguarding consumer experiences.

▲ Taobao's new "only refund" policy

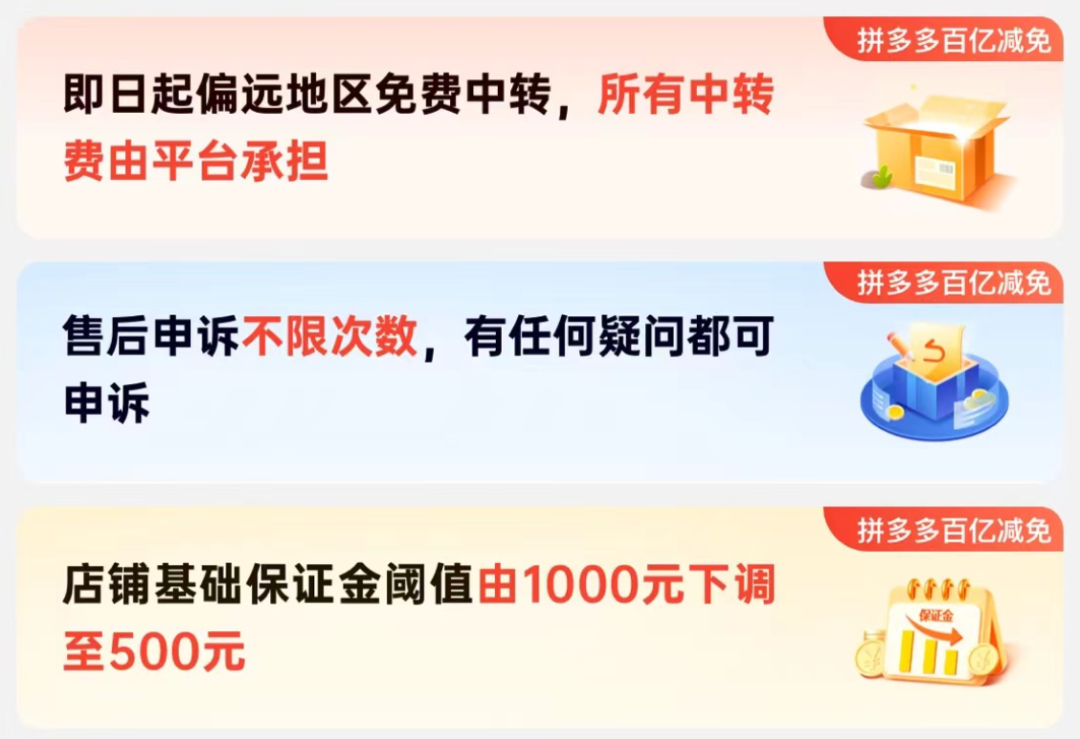

Subsequently, Pinduoduo, the originator of the "only refund" policy, also shifted its stance subtly. In September of this year, Pinduoduo began testing upgrades to its merchant after-sales service system, allowing merchants to appeal against abnormal orders, malicious complaints, and negative consumer experiences.

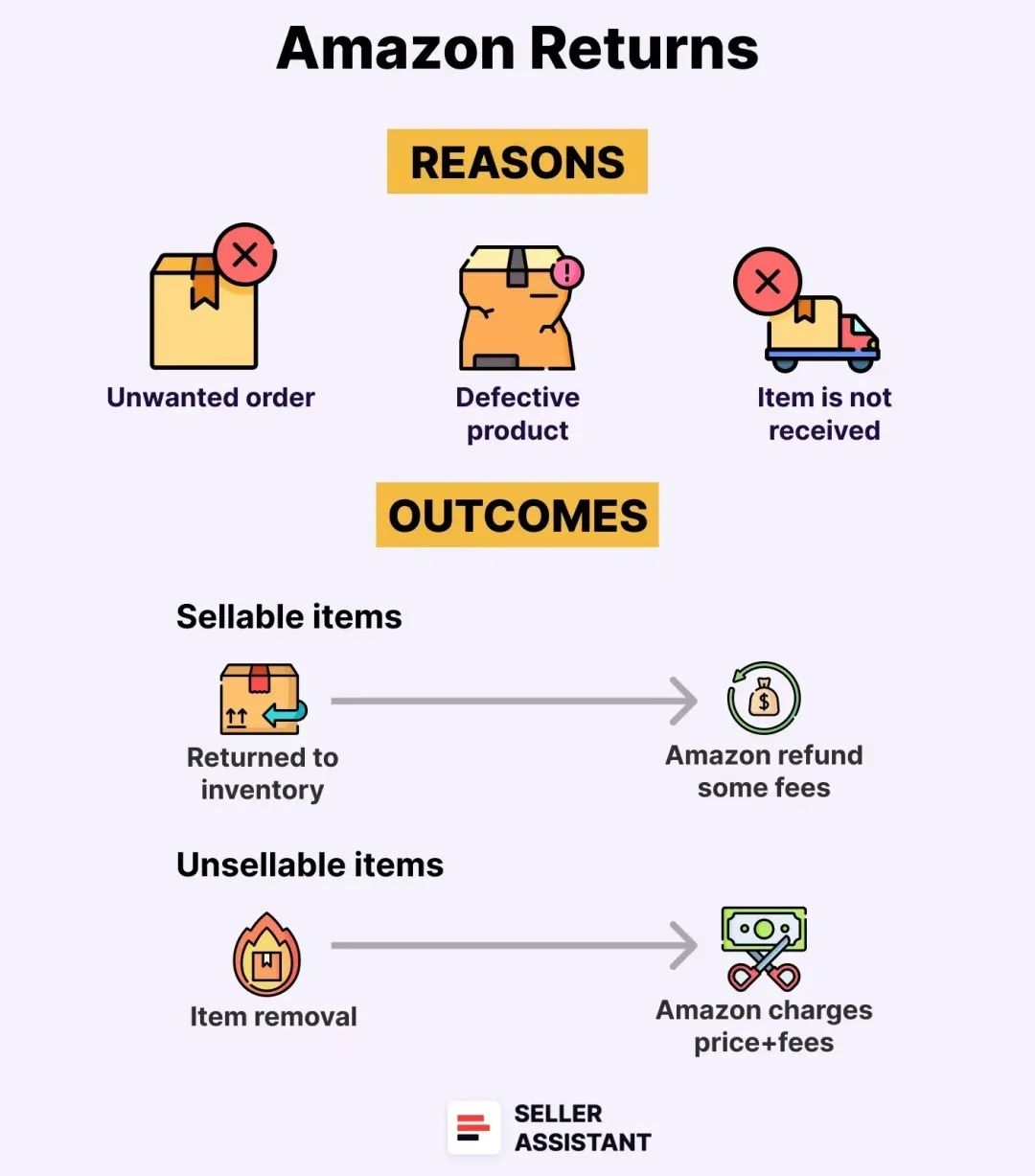

From a broader perspective, the emergence of "Return Guarantee" is simply another continuation of the easing of the "only refund" policy, representing one of the actions taken by e-commerce platforms to shift their focus from low prices to ecosystem sustainability and business environment optimization.

Overnight, merchants have become the new targets of "pleasing."

02

Reducing the Burden on Merchants

E-commerce Giants Pursue Different Strategies

Based on public information, following Taobao's lead, JD.com, Douyin E-commerce, and Pinduoduo have all intensified their efforts to signal support for reducing merchants' burdens. However, due to their unique ecosystems and development goals, the speed and intensity of burden reduction, as well as current priorities, vary among these platforms.

In terms of e-commerce operating costs, merchants typically bear at least store setup fees, operational tool fees, platform service fees, traffic promotion fees, and after-sales expenses on a platform.

According to previous reports by "The Information," traffic promotion fees typically account for the largest proportion of costs. This is why, in April of this year, Taobao officially announced AliMama's "Full-Site Promotion" for Taobao merchants, promising ROI certainty, operable full-site traffic, and rapid product scaling. Subsequently, JD.com not only upgraded its "Full-Site Marketing" product under the Jingzhuntong suite but also provided traffic incentives for live streaming and short videos. New merchants who participate in tasks and meet incentive thresholds can receive fixed-value traffic coupons worth 5,000 yuan.

▲ Jingzhuntong's "Full-Site Marketing"

Source: Jingmai Merchant Center

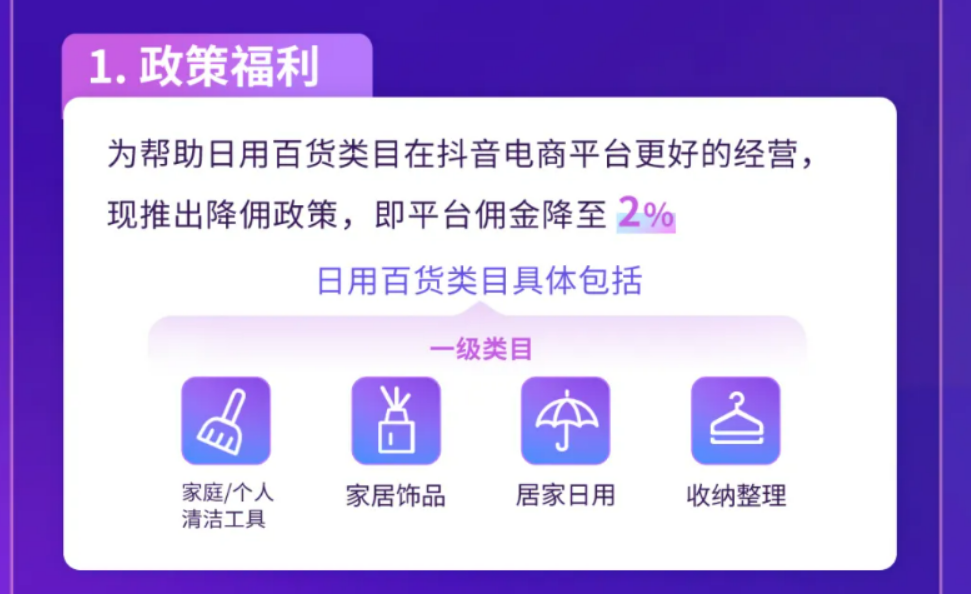

In terms of platform service fees, Tmall announced in July that it would abolish annual fees, while Taobao Live announced that it would waive live streaming technology service fees for one year starting in September, signaling a reduction or waiver of commissions for merchants. Currently, various e-commerce platforms have introduced policies, with Douyin E-commerce reducing commissions for daily necessities merchants to 2%, and Pinduoduo announcing on September 5 that it would reduce the basic deposit for millions of merchants' stores by 50%, from 1,000 yuan to 500 yuan.

▲ Recent adjustments to merchant policies by Douyin and Pinduoduo

While it is undoubtedly beneficial for platforms to help merchants reduce operating costs, many merchants view store setup and tool fees as fixed costs with a relatively low proportion. Commissions and traffic fees are positively correlated with GMV. In contrast, the rising cost of after-sales services is a more significant pain point.

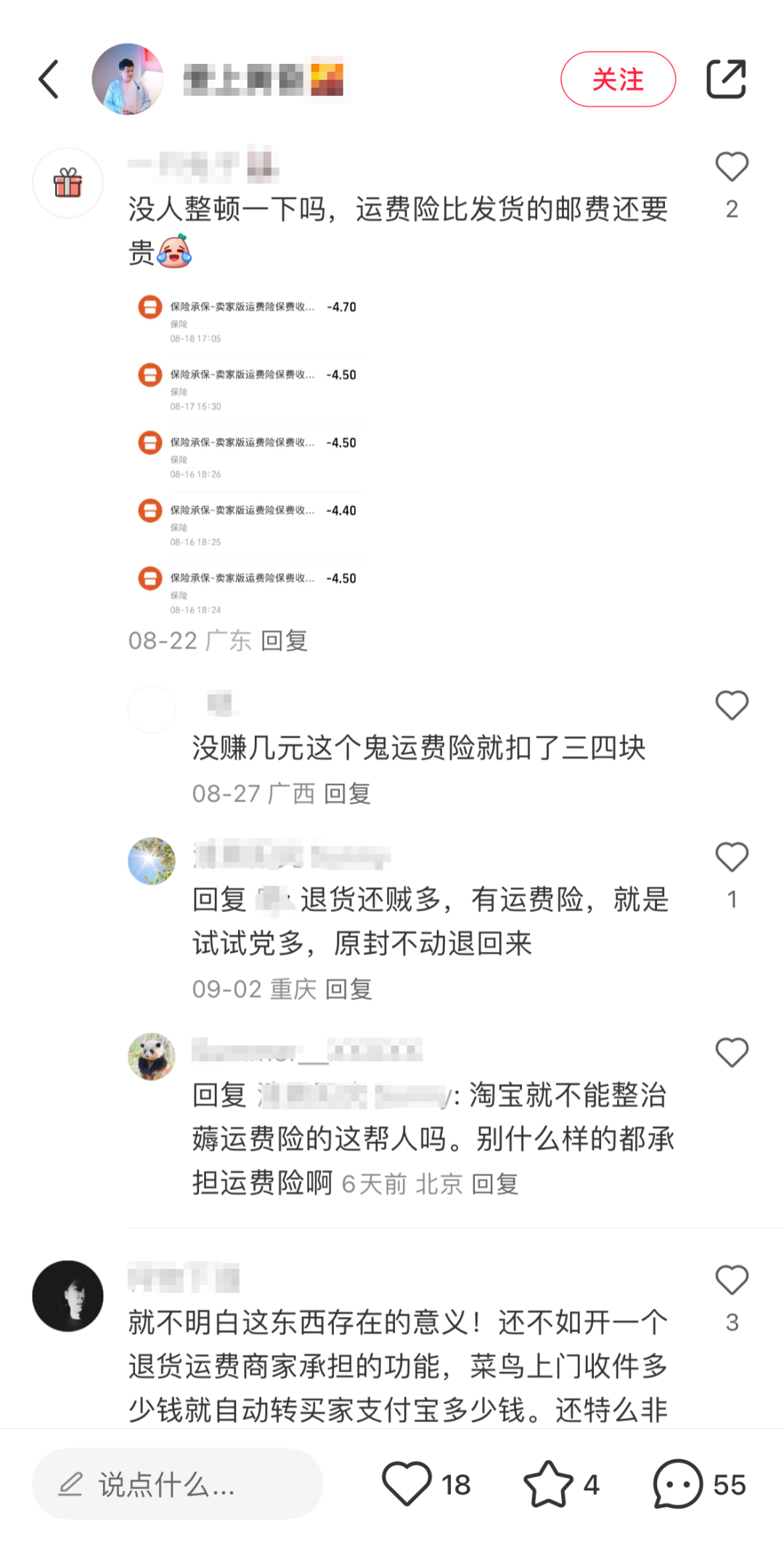

On social platforms, some merchants have labeled the "only refund" policy and shipping insurance as their "real nightmares." The lack of specific restrictions in the "only refund" policy allows some buyers to exploit loopholes, with bizarre cases like a 1,400 yuan refrigerator being subject to a "only refund" request due to installation issues even trending on Weibo. The increasing return and exchange rates in e-commerce have led to higher shipping insurance costs and a proliferation of shipping insurance fraud, further increasing merchants' return and exchange costs, especially for small and medium-sized merchants with weaker risk resistance and more vulnerable operations.

▲ Discussions on return costs among some Taobao merchants on Xiaohongshu

Based on some merchants' reflections on Xiaohongshu, women's and children's clothing are among the categories with high shipping insurance costs, averaging around 3-4 yuan per order, as big data combines store return rates and industry-wide return rates to determine a comprehensive fee range. A small jewelry merchant revealed that their store's shipping insurance costs have risen from 0.5 yuan to 1.4 yuan per order over several years of operation.

At this point, Taobao's pioneering move to tackle after-sales services is clear: by reducing after-sales costs and addressing the biggest pain point for small and medium-sized merchants, it aims to boost their operating confidence.

However, after-sales service is also the most complex aspect of e-commerce transformation. While store setup, commissions, and traffic promotion are simply service transactions between merchants and platforms, after-sales involves the platform's direction, merchants' costs, and consumer experiences, making it the most challenging area to balance the interests of all parties, directly constrained by changes in social consumption sentiment and the quality of the platform ecosystem.

▲ A meticulous merchant records their pursuit of goods from a "only refund" buyer

Taobao's pioneering move to address after-sales services is driven by both market competition and its own DNA. Alibaba's mission is to make it easy to do business anywhere, and merchants, especially small and medium-sized ones, have always been the cornerstone of Taobao's ecosystem, enabling affordable prices and a "versatile Taobao." "Making it easy to do business anywhere" takes on different meanings in different eras, and in the current era of extreme involution, perhaps nothing is more urgent than creating a healthy business environment and boosting long-term operating confidence for merchants. After 20 years of market evolution, Taobao and Tmall have more refined business infrastructure and rules, making it easier to advance this transformation.

▲ A summary of Taobao's recent measures to benefit and reduce costs for merchants

Other e-commerce platforms are also adjusting their strategies based on their unique ecosystem characteristics. For example, Pinduoduo's recent signals indicate a focus on supporting high-quality merchants. Having risen to prominence outside the fifth ring road with its white-label and industrial belt resources, Pinduoduo has always struggled with product quality and branded merchants as weaknesses in its ecosystem. It is foreseeable that Pinduoduo's main focus in the coming period will be to further improve product quality, leveraging traffic and subsidies as levers.

As for the Douyin E-commerce ecosystem, it currently faces at least two challenges: expanding product categories and scaling its shelf space. Currently, Douyin E-commerce focuses on four key categories: apparel and underwear, food and beverages, beauty and skincare, and maternal and child products. To achieve greater growth, the platform needs to increase the penetration of larger categories such as daily necessities and home appliances, so these vertical merchants can expect additional support. The reduction in commissions for daily necessities merchants may be just the beginning. Regarding shelf space, well-known branded merchants and large supply chain merchants are likely to receive more policy preferences.

03

Appreciation for Healthy Competition

It is foreseeable that the trend of e-commerce platforms "pleasing" merchants will continue.

From an observer's perspective, the shift in e-commerce trends is a positive development.

First, market competition is becoming more orderly, benefiting both merchants and consumers. The majority of merchants are small and medium-sized enterprises and individuals. Small and medium-sized enterprises are the "capillaries" of China's economy, contributing over 60% of GDP and over 80% of urban employment. Providing more operational certainty for small and medium-sized merchants is beneficial for economic recovery and consumption stimulation.

In a healthy e-commerce ecosystem, the "value" consumers receive is not just low prices but also superior service experiences, stimulated consumer demand, and a fairer shopping environment. For example, if the "only refund" policy remains unchanged, high-quality buyers who have never abused the policy would ultimately share the costs incurred by abusers, as merchants are likely to pass on their after-sales costs to product prices.

Second, after traversing the detour of imitation, e-commerce platforms are now focusing on the differentiated value of their respective ecosystems, potentially accelerating the industry's entry into a virtuous development path. According to Tmall's first-quarter 2024 store opening data, the number of newly established merchants increased by 60% year-on-year.

Healthy competition brings a sense of crisis, leading to reflection, reform, review, and optimization, thereby stimulating new growth. Just as Pinduoduo previously resisted easing the "only refund" policy, even in the face of concentrated protests from merchants, it is now making policy adjustments for the sake of its ecosystem.

This trend is not limited to domestic e-commerce platforms but also extends to international players like Amazon.

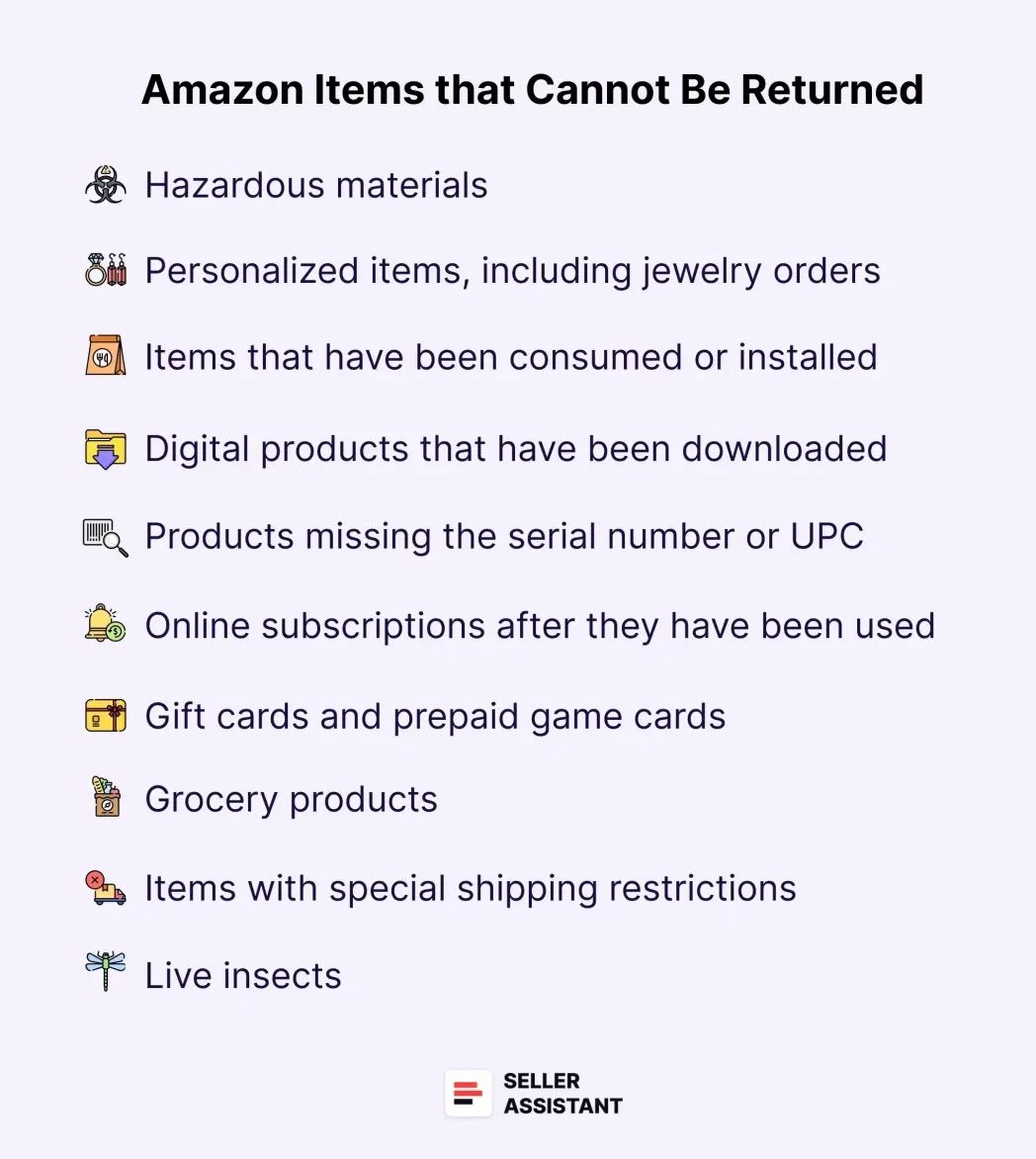

Following the easing of the "only refund" policy in China, Amazon, the originator of this policy, also updated its "refund without return" solution last week, enabling sellers to customize their return and refund policies based on business needs.

▲Amazon's updated return policy last week

Under the competitive pressure of Shein and Temu, Amazon began reducing commissions for low-priced clothing products in Europe, Japan, and Canada in May this year. In Canada, clothing products priced below CAD 20 have seen their commissions reduced from 17% to 10%.

We also noticed that in this process, the self-positioning of e-commerce platforms is also being adjusted. They are gradually transitioning from being the rule-makers and overlords of the 'refund only' policy to designers of the ecosystem and service providers balancing the interests of merchants and consumers.

As for the effectiveness, it will depend on the upcoming Double 11 performance.