Lalamove's 4th Attempt at a Hong Kong IPO Amid Driver Exploitation Controversy

![]() 10/09 2024

10/09 2024

![]() 579

579

Despite being a leading player in the urban logistics industry, the question remains whether Lalamove, which relies heavily on drivers for profit, can successfully tap into the capital markets.

Original @Xinshang

Lalamove's Fourth Attempt at a Hong Kong IPO.

Recently, Lalamove's parent company, LaLa Technology Holdings Limited, quietly updated its prospectus on the Hong Kong Stock Exchange and disclosed its interim results for 2024. Goldman Sachs, Bank of America Securities, and JPMorgan Chase acted as joint sponsors. This marks Lalamove's fourth attempt at a Hong Kong IPO, following the failure of its initial plan to list in the US in June 2021.

While competitors in the same industry, such as Full Truck Alliance and GOGOVAN, have already successfully gone public, Lalamove, despite its leading market share, faces significant pressure due to its unsuccessful IPO attempts.

According to Lalamove's latest financial results, revenue for the first half of 2024 amounted to USD 709 million, representing a year-on-year increase of 18.17%. Operating profit reached USD 178 million, up 39.13% year-on-year, with a net profit of USD 184 million and an adjusted net profit of USD 213 million. Lalamove facilitated approximately 338 million orders, a year-on-year increase of approximately 30%, and its global gross transaction value (GTV) reached USD 4.6 billion, up 17% year-on-year.

According to Frost & Sullivan, Lala Technology holds a commanding 53.9% market share based on global closed-loop freight transaction value (GTV), firmly establishing itself as the world's largest logistics transaction platform.

Significant Cost Cuts and Turnaround to Profitability

Lalamove's prospectus details its financial performance over the past three years (2021-2023), with revenues of USD 845 million, USD 1.036 billion, and USD 1.334 billion, respectively. During this period, profits were USD -2.086 billion, USD -49.09 million, and USD 973 million, while adjusted profits were USD -651 million, USD -12.1 million, and USD 391 million, respectively.

Notably, in 2023, Lalamove successfully turned the corner from chronic losses to profitability.

Lalamove operates a platform model that connects and serves merchants and drivers, facilitating a closed-loop transaction from online ordering to smart order matching, automatic order dispatching, and after-sales service. Prices are pre-set by merchants and drivers and are fully transparent to both parties. Lalamove's revenue is derived from three main sources: freight platform services, diversified logistics services, and value-added services.

Freight platform services contribute the most significantly to Lalamove's profits, accounting for 53.7% of revenue in the first half of 2024. This revenue stream comprises membership fees paid by drivers and commissions earned from completed freight orders. Most drivers choose to become Lalamove members, as membership status and level directly impact order allocation, success rate, and commission rates.

It's worth noting that commission income has shown an upward trend, while membership fee income has decreased. From 2021 to the first half of 2024, commission income's share of total revenue increased from 5.7% to 31.4%, while membership fee income's share decreased from 42.1% to 22.0%. The driver community has played a crucial role in Lalamove's turnaround to profitability.

Furthermore, Lalamove's sales and marketing expenses have undergone significant adjustments, decreasing from USD 673 million in 2021 to USD 179 million in 2023. Notably, sales and marketing expenses in 2022 decreased by 70.57% year-on-year, and by 9.60% in 2023. This suggests that Lalamove's path to profitability has involved both compressing drivers' profit margins and substantially reducing sales and marketing expenses.

However, the sustainability of Lalamove's profitability remains uncertain in the long run.

Business Model Challenges and Soaring Complaints

Lalamove's business model inherently limits its ability to effectively regulate and manage drivers, as it primarily functions as an intermediary.

Consumer complaint platforms like Heimao Tousu (Black Cat Complaints) feature numerous complaints against various urban logistics platforms, with Lalamove topping the list with nearly 7,000 complaints. These complaints often center on drivers failing to fulfill orders, hiking prices during transportation, and displaying poor attitudes during disputes.

Moreover, Lalamove has faced controversy over its treatment of drivers.

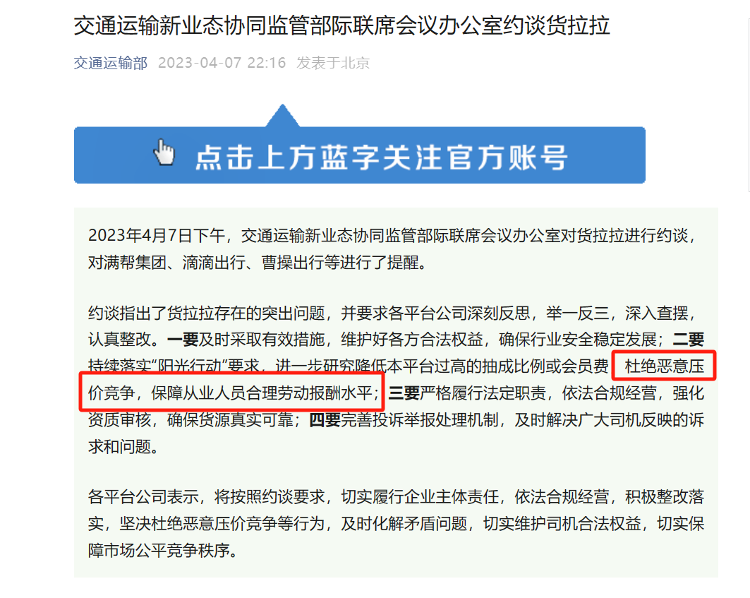

In June 2022, Lalamove introduced a "multi-factor pricing model" and "special discounted orders," effectively lowering prices, which led to nationwide service disruptions in mid-November and attracted regulatory scrutiny. In October 2023, Lalamove again drew criticism for its "negotiated order" feature, which encouraged drivers to compete on low prices, further sacrificing their earnings.

While Lalamove has provided job opportunities for numerous drivers and improved freight matching efficiency, the intensifying competition in the industry has brought to light numerous underlying issues. Industry insiders argue that drivers' livelihoods directly reflect the platform's response to market pressures. When a platform resorts to pitting drivers against users to retain market share, it signals a growth bottleneck.

To date, Lalamove has completed 11 funding rounds, raising a total of USD 2.662 billion from prominent investors. In 2023, it was included on the Hurun Global Unicorn List with an estimated valuation of approximately USD 90 billion. Notably, within less than two years, Lalamove has updated its prospectus four times, actively seeking access to the capital markets, underscoring its eagerness for an IPO.