Flash Express broke below its IPO price for three consecutive days, with shares plunging nearly 10%

![]() 10/10 2024

10/10 2024

![]() 661

661

With the enrichment of instant delivery business scenarios, more and more participants are flooding into the market, gradually weakening Flash Express's first-mover advantage.

Original @ Xinshang

On the third trading day after its IPO, Flash Express continued to experience a price break!

On October 8, after the opening of the U.S. stock market, Flash Express's (ticker: FLX) share price continued to decline, with intraday losses exceeding 10% at one point. At the close of trading that day, Flash Express's share price finally settled at $15.00 per share, down nearly 10% from its IPO price, reducing the company's market value to $1.065 billion.

It is worth mentioning that Flash Express successfully listed on Nasdaq on October 4 at an IPO price of $16.5 per share, with a market value of $1.17 billion. However, on the second trading day after its listing (October 7), Flash Express encountered a "price break," although the closing price managed to remain at $16.49 per share, down 8.44% for the day. On the third trading day after its listing, Flash Express continued to experience the embarrassment of a broken share price.

01

40% valuation decline

After a decade of development, Flash Express finally succeeded in landing on the Nasdaq stage.

In fact, as early as 2020, Du Shangbiao, Vice President of Flash Express, revealed in an interview with the media that the company might soon go public. Unfortunately, in June 2020, Dada Group, a competitor of Flash Express, beat them to the punch by going public in the United States and successfully won the title of "the first instant retail stock." At the end of the following year, SF Express's same-city delivery service also successfully listed on the Hong Kong Stock Exchange. Flash Express's path to going public has finally come to fruition.

In the ten years since its establishment, Flash Express has undergone a total of nine rounds of financing. After completing its D++ round of financing in March 2021, Flash Express's valuation soared to $2 billion (approximately RMB 14 billion). However, according to the 2024 Hurun Global Unicorn List, Flash Express's valuation is approximately RMB 7 billion, a significant decline of about 40% from 2021.

Flash Express is a one-to-one urgent delivery platform in the same-city instant delivery industry, providing on-demand dedicated delivery services to individual and corporate customers. It employs riders from third parties through a "crowdsourcing" model, with the entire service process handled by a single Flash Express delivery person, adhering to the principle of "one person, one order."

According to data from iResearch Consulting, Flash Express accounts for approximately 33.9% of the independent one-to-one dedicated delivery service market in China based on 2023 revenue. Flash Express emphasizes in its prospectus that it belongs to a niche industry, "independent on-demand express delivery," and holds a dominant market share. Competitors such as Dada, SF Express's same-city delivery service, and UU Runners are far behind Flash Express in terms of market position.

However, the instant delivery market has now changed, and the boundaries of instant delivery services have gradually become blurred. The concept of "independent on-demand express delivery" may not yet be clearly understood by consumers.

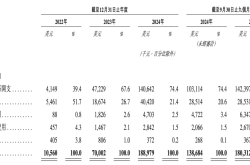

Financial data shows that from 2021 to 2023 and the first half of 2024, Flash Express's revenue was RMB 3.04 billion, RMB 4.003 billion, RMB 4.529 billion, and RMB 2.284 billion, respectively, while its net profit was RMB -291 million, RMB -180 million, RMB 110 million, and RMB 124 million, respectively. Flash Express's prospectus notes that it achieved profitability in 2023 primarily due to an increase in government subsidies determined at the discretion of relevant government departments.

Rider costs are Flash Express's most significant expense, with compensation paid to riders accounting for 90.5%, 90.3%, 87.8%, and 85.4% of revenue, respectively. In 2021, Flash Express had approximately 1.1 million registered riders, but by the end of June this year, this number had surged to 2.7 million, although the proportion of truly active riders was relatively small. Based on 2023 data, each active rider delivered 9.3 orders per day, with a total of 270.7 million orders for the year, and only about 3% of Flash Express's registered riders were actively delivering on the platform.

02

Surviving in the cracks between giants

From the perspective of the entire instant delivery market, Flash Express's market share is actually not large. Food delivery is the main driver of instant delivery demand, accounting for approximately 70% of the market share, with Meituan Waimai and Ele.me firmly holding onto this market. Next come supermarket convenience stores, fresh food home delivery, and other services accounting for over 20% of the market, with representative companies including Dada and SF Express's same-city delivery service. Flash Express's business accounts for only 6.6% of the overall market, with a clear gap in scale compared to these companies.

As business scenarios continue to diversify, an increasing number of participants are flooding into the instant delivery market, gradually weakening Flash Express's once-significant first-mover advantage.

In the traditional logistics and delivery sector, SF Express offers SF Express Same-City Delivery, errand running, and shopping services, with an average delivery time of one hour across the city. As the delivery arm of JD.com's instant retail business, Dada Group's operations have further integrated into the JD.com ecosystem this year, with the original instant retail brands JD.com Hourly Delivery and JD.com Home Delivery fully integrated and upgraded to "JD.com Instant Delivery," promising delivery in as little as 9 minutes. Ele.me's instant logistics platform Fengniao Jipei similarly provides home delivery services for catering, supermarkets, errand running, and other comprehensive lifestyle services for consumers.

Amap announced partnerships with multiple instant delivery companies to provide errand services through its platform. Hello Bike is leveraging its operational experience and user base in the shared bike and scooter sectors to expand its instant delivery services. Additionally, the two short video giants, Douyin and Kuaishou, are intensifying their layouts in the instant retail market.

With multiple players entering the market, competition has become increasingly fierce, and price wars are inevitable. In this predicament, price cuts seem to be a potent tool for Flash Express to address challenges.

A Flash Express rider in a first-tier city told the Economic Observer Network that since last year, Flash Express has repeatedly notified them of price cuts, and they have clearly noticed a decline in income per order. The prospectus shows that from 2021 to 2023 and January-June 2024, Flash Express's average revenue per order was RMB 19.2, RMB 18.8, RMB 16.7, and RMB 16.5, respectively, showing a significant downward trend.

iResearch Consulting predicts that by 2026, the order volume of the instant delivery service industry will approach 95.78 billion orders, nearly one trillion. In comparison, Dada Group has yet to achieve profitability and its current share price has plummeted by over 90% from its IPO price. SF Express's same-city delivery service only achieved full-year profitability last year. While Flash Express has successfully landed on the capital market, whether it can stand out in this fierce competition remains to be further observed and tested by the market.