Has MiniMax Spent Only $500 Million in Four Years? Is It Poor?

![]() 12/24 2025

12/24 2025

![]() 508

508

In China's large model landscape, MiniMax has always been a hard-to-classify 'maverick.'

While peers are raising billions in funding, engaging in a computing power arms race, and even spending extravagantly on user acquisition channels, MiniMax has dropped a bombshell in its prospectus: since its founding in 2022, it has spent only about $500 million in total.

What does $500 million mean?

In Silicon Valley, it's not even enough to satisfy OpenAI's appetite—the latter's cumulative spending is estimated to have reached $40 billion to $55 billion. Domestically, this amount might only cover a major tech company's traffic acquisition costs for half a year.

Questions arose following the prospectus: in the high-stakes gamble of AGI, where trillions are at play, can a mere $500 million buy a ticket to the future? Is MiniMax running out of money? Is it forced to 'downgrade consumption' to survive in this brutal elimination race?

But when you truly examine the prospectus, you'll find that this 'poverty' is actually a challenge to industry inertia in human efficiency.

/ 01 /

Victory of Efficiency: 1% of the Funds and a 29-Year-Old Team

The most striking impression from MiniMax's prospectus is its ultimate efficiency.

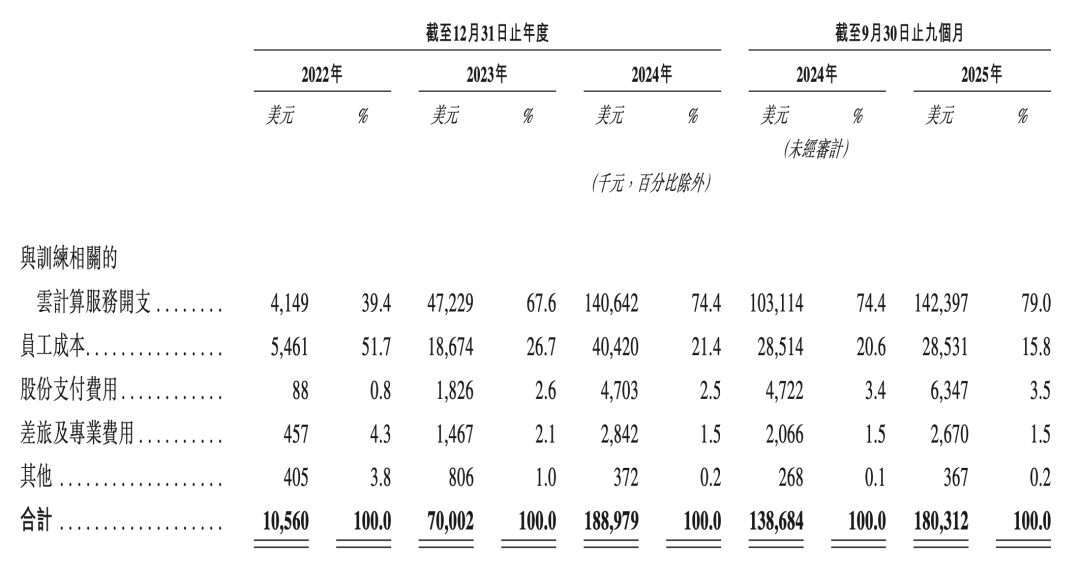

Since commercialization began in 2023, MiniMax's revenue has reached $3.46 million, soaring to $30.52 million in 2024, a staggering 782.2% year-over-year increase. In the first nine months of 2025, revenue surged another 175% to $53.44 million, far surpassing last year's total.

In the first nine months of 2025, while MiniMax's revenue grew by over 170% year-over-year, R&D spending increased by only 30%, and sales and marketing expenses actually decreased by 26%.

This divergence in data confirms a key logic: MiniMax's growth does not rely on massive traffic acquisition (user acquisition spending) but on model intelligence and user word-of-mouth (product strength).

More notably, according to the prospectus, MiniMax's adjusted net loss remained nearly flat in 2025 compared to the same period last year. For a rapidly growing tech company, this means the loss ratio is narrowing significantly.

The reason for the narrowing losses is simple: improved model engineering efficiency. In 2023, MiniMax's cloud computing service expenditures for training exceeded 1365% of revenue. By the first nine months of this year, this figure had dropped to 266.5%.

A striking contrast: from its founding to September 2025, MiniMax has spent approximately $500 million (about 3.5 billion RMB) in total. In comparison, OpenAI's cumulative spending is estimated between $40 billion and $55 billion.

This means MiniMax has achieved a globally leading full-modal company with less than 1% of the funds.

In an industry where 'burning money' is the consensus, this capital efficiency is itself a core competitiveness (competitive advantage).

Supporting this high efficiency is an extremely young AI-native team.

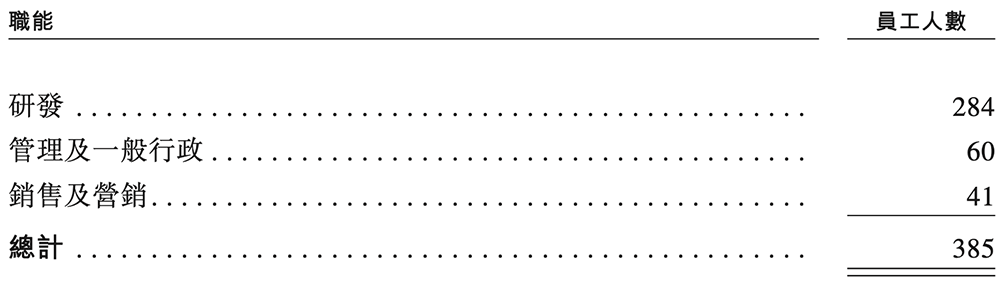

As of the end of September 2025, the company has only 385 employees, with an average age of 29, and nearly 74% are R&D personnel.

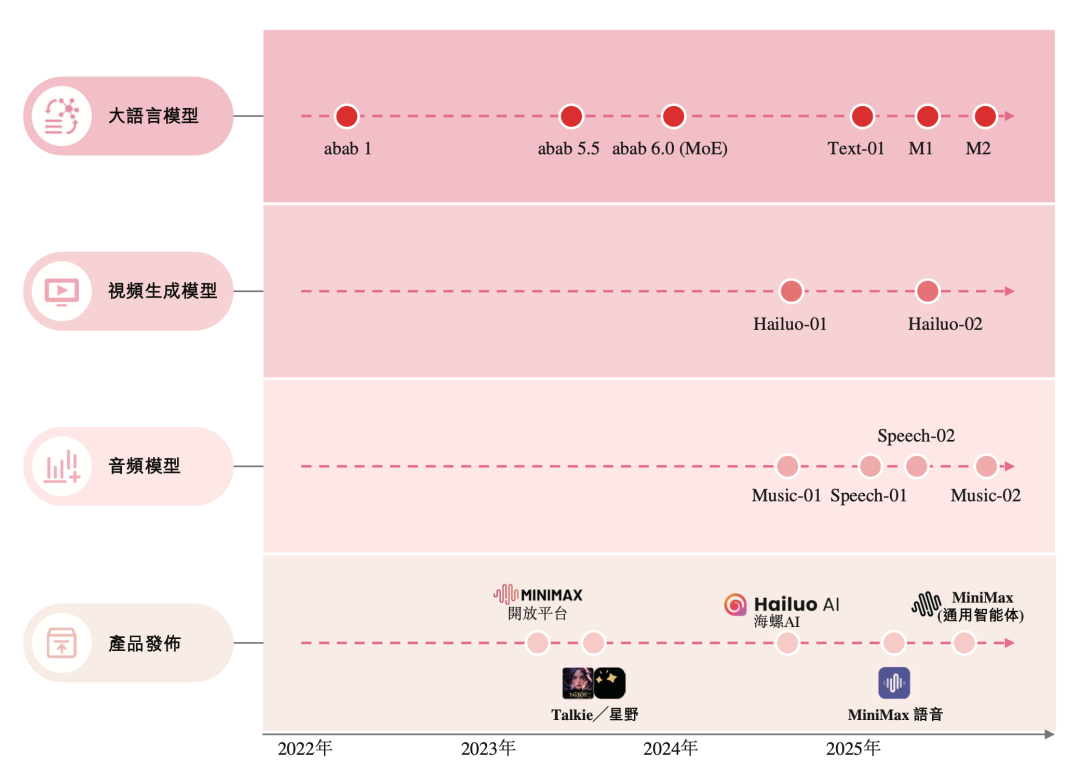

Without the redundant structures of traditional tech giants, this young team has achieved leadership in text, video, and voice full-modal models, as well as global product R&D and operations, in less than four years through flat management.

This 'small team, big output' combat effectiveness provides MiniMax with a profound financial moat.

As of September 30, 2025, MiniMax still has a cash moat of $1.1 billion on hand, while Loss during the same period (losing $187 million in the same period). At this burn rate, even without IPO funding, the company's cash can sustain operations for over four years.

/ 02 /

Globalization: MiniMax Finds Another Path for Large Model Entrepreneurship

Besides ultimate efficiency, 'globalization' is another keyword in MiniMax's prospectus.

A straightforward data point: over 70% of MiniMax's revenue comes from overseas.

For a Chinese large model startup, this revenue structure is distinctive. While most peers still face direct pressure from domestic internet giants, MiniMax has completed a closed-loop validation from technical capabilities to commercialization in the global market.

One of the most direct yet overlooked factors behind overseas revenue as a pillar is that MiniMax was one of the earliest and most decisive large model companies to bet on overseas expansion.

As early as 2023, MiniMax began promoting Talkie (AI character companionship) to overseas markets, focusing on North America and other high-subscription regions. In August 2024, MiniMax released the video generation model Video 01 and the Hailuo AI video generation product, which quickly spread among overseas content creators, marketers, and social media users.

These moves were not impromptu but stemmed from a judgment made by MiniMax founder Yan Junjie at the company's inception:

Once AI becomes a focal point of public attention, the domestic market will likely fall into a 'purely free' competition, leaving little room for startups to survive. Therefore, internationalization was a necessary path from the start.

Around this core judgment, MiniMax achieved breakthroughs in both model and product capabilities.

On the model side, MiniMax's strategy is aggressive yet pragmatic. The open-sourced MiniMax M2 in late October ranked among the top five globally and first in open-source on the Artificial Analysis leaderboard.

Beyond rankings, what matters more commercially is developers' real choices. On the renowned model aggregation platform OpenRouter, M2's daily call volume once surged into the global top three due to its cost-effectiveness and coding capabilities, successfully entering Amazon Bedrock's model library.

This 'vote by usage' means MiniMax's models have become one of the default foundations for overseas developers to build applications.

On the product side, MiniMax's strategy is equally clear: encapsulate model capabilities into scalable, monetizable AI-native applications as quickly as possible.

MiniMax directly serves global consumers through native products like Hailuo AI, Xingye/Talkie (AI social), and MiniMax Voice. As of September 30, To C revenue grew by 181% year-over-year, and the number of paying users surged 15-fold in less than two years.

Among them, Hailuo AI has become a globally leading AI video generation platform, helping users worldwide create over 590 million videos to date.

With products like Hailuo AI, MiniMax Audio, and Talkie taking shape, MiniMax has built a relatively complete AI-native application matrix. To date, its self-developed multimodal models and native applications have served 212 million individual users and over 130,000 enterprise clients and developers across more than 200 countries and regions.

Based on this, MiniMax's commercialization path appears more three-dimensional: subscription services, in-app purchases, and enterprise APIs progress in parallel, diversifying revenue sources beyond heavy reliance on a single client or project.

This contrasts sharply with the long-chain model of many domestic large model companies, where 'capability demonstration precedes revenue realization.'

From the results, MiniMax's overseas expansion is not mere market expansion but a structural choice: using global markets to validate models and productization to shorten the commercialization path.

Precisely because of this, it has carved out a relatively independent growth trajectory closer to the global AGI narrative amid intense domestic competition.

/ 03 /

Conclusion

Technological development is gradual, and so are products.

Reviewing China's internet history, the ultimate winners—MiHoYo, Meituan, ByteDance, Li Auto, etc.—all share a common footnote: they rarely achieved massive success with their first product but stabilized their footing with second or even later offerings.

In this prolonged process, the core competitiveness (competitive advantage) is not a single blockbuster hit but the ability to 'always be present.'

In the early days of the large model industry, most companies started on the same line: funding, computing power, parameter scale, and leaderboard rankings formed a nearly unified competitive grammar.

But as time passes, this grammar is losing its effectiveness. The gap in model capabilities is narrowing, with open-source and closed-source models intertwining. What truly differentiates companies now is who can faster acquire real users, real usage scenarios, and real cash flow.

MiniMax's choice, in essence, is to prioritize 'how to be used' over 'how to be proven' earlier on. Whether pursuing ultimate efficiency, overseas expansion, productization, or multimodality, these seemingly dispersed decisions ultimately point to the same goal:

Shortening the path from technology to value, ensuring models exist not just in launch events and papers but in real user scenarios.

Today, the large model game is far from over. In this sense, MiniMax may not have an easy journey, but it has at least chosen a path closer to the long-term answer.

By Lin Bai