A collective outbreak, the bull market is back to Chinese stocks!

![]() 10/10 2024

10/10 2024

![]() 577

577

The atmosphere of the bull market has shifted back to Chinese stocks.

On October 10, Chinese stocks surged significantly, with over ten stocks, including China Railway Engineering, China Railway Construction, China State Construction Engineering, China Communications Construction, CSSC Hanguang, and COFCO Technology, reaching their daily upper limits. Stocks like China Power Construction Engineering, China Nuclear Engineering & Construction Group, and MCC Group also rose by more than 8%.

Due to their social responsibilities, state-owned enterprises (SOEs) naturally have weaker asset return capabilities. Now, this bias is likely no longer valid.

According to data from the State-owned Assets Supervision and Administration Commission (SASAC), from 2016 to the end of 2021, central enterprises have reduced the number of legal entities by more than 19,000, accounting for 38.3% of the total. They have also streamlined their management hierarchy to within five levels, disposing of inefficient and invalid assets in a timely manner. By the end of 2021, the labor productivity of central enterprises was 694,000 yuan per person, an 82% increase from 2012.

Ning Gaoning, a renowned leader of state-owned enterprises who has headed four Fortune 500 companies, previously mentioned in an interview, "Today, the competitive pressure on SOEs is no less than that on private enterprises. It is unrealistic to expect to get by with just doing the bare minimum."

Improved efficiency leads to a simultaneous increase in profitability.

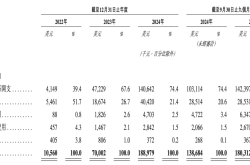

According to statistics from GF Securities, since 2018, especially after 2021, the profitability of SOEs has been significantly higher than that of private enterprises. Conversely, the valuation of SOEs is still far lower than that of private enterprises (less than half).

It can be seen that the proposition of resetting the valuation of SOEs is not a one-sided wish of policy but an inherent requirement of improving operational quality.

SASAC has also stated that in the future, SOEs should focus on indicators such as labor productivity, return on equity, and economic value added rate. They should target world-class enterprises for value creation by enhancing quality, efficiency, and stable growth in a targeted manner, effectively improving asset returns.

The improvement in the return on assets of SOEs remains a significant focus for the future. This is not only significant for the capital market but also crucial for the stable operation of the national economy.

Imagine that the current state-owned asset base is approximately 300 trillion yuan. If the asset return rate increases by one percentage point, it could generate an additional 3 trillion yuan in fiscal revenue. This would undoubtedly provide the most powerful direct supplement to fill the gap left by tax cuts and fee reductions as well as the cooling of land finance, and it would also provide sufficient room for macroeconomic policy adjustments.

SOEs are fully capable of achieving this.

Over the past decade, central enterprises have invested a cumulative total of 6.2 trillion yuan in research and development, accounting for more than one-third of their total investments. In 2022, R&D investment exceeded 1 trillion yuan for the first time. Key core technologies have been broken through and accumulated, especially in core areas related to future national competitiveness such as power grids, communications, and energy.

Twenty years ago, foreign enterprises were the first choice for job seekers, followed by private enterprises, and finally state-owned enterprises. Today, in some industries, this order may have reversed.

In terms of talent, capital, technology, and management, today's SOEs are on par with private enterprises.

Borrowing to invest, borrowing to consume, and borrowing to repay debts are the fundamental drivers of today's world economic development. Whether there is room for "leveraging" under controllable risks largely determines whether economic growth can continue.

Comparing current SOEs with private enterprises, the former have greater room for debt expansion.

Since 2015, central enterprises have achieved remarkable results in "deleveraging," while private enterprises have seen their debt levels rise instead of fall. From 2017 to 2021, the asset-liability ratio of state-owned enterprises decreased from 60.4% to 57.1%, while that of private enterprises increased from 51.6% to 57.6% over the same period. Subsequently, this trend continued, and now private enterprises have surpassed state-owned enterprises in leverage ratio.

Furthermore, SOEs have obvious financing cost advantages.

Currently, there is a credit spread of 170 basis points between the credit bonds of private enterprises and central enterprises, and a spread of 143 basis points between private enterprises and local state-owned enterprises. This means that the financing cost of central enterprises is more than 1.4% lower than that of private enterprises.

Therefore, if a sector needs to be chosen to leverage the economy, SOEs clearly have greater momentum and potential, especially given the current setback in private sector confidence.

According to GF Securities' calculations, if the debt ratio of central enterprises is brought back to the 2016 high, it could potentially add approximately 15 trillion yuan in new credit.

Assuming that each 4 yuan of credit generates 1 yuan of GDP, leveraging SOEs could potentially unleash up to 3.75 trillion yuan of GDP, equivalent to approximately 3 percentage points of growth.

It is important to note that emphasizing the role of SOEs does not negate the importance of private enterprises.

For decades, there has been an abundance of discussion about whether private enterprises or SOEs are the main players in the national economy. Some support the idea of state advancement and private retreat, while others advocate the opposite. The debates have gone back and forth, with each side taking turns to argue their case.

The real Chinese economy is far more exciting than academic discussions - China has accomplished in decades what took the West centuries to achieve, in its unique way.

Today's renewed emphasis on the value of SOEs is simply another objective requirement in the course of history.

Disclaimer

This article involves content related to listed companies, based on personal analysis and judgment by the author based on information publicly disclosed by listed companies in accordance with legal requirements (including but not limited to interim announcements, periodic reports, and official interaction platforms). The information or opinions in this article do not constitute any investment or other business advice. Market Value Observation shall not be held responsible for any actions taken as a result of adopting the content of this article.

——END——