ECOTRON's Product Acceleration: A Direct Countermeasure to Huawei Ecosystem's Encirclement

![]() 12/24 2025

12/24 2025

![]() 459

459

Introduction

ECOTRON is poised to step onto a battlefield dominated by Huawei's 'realms' and 'boundaries'.

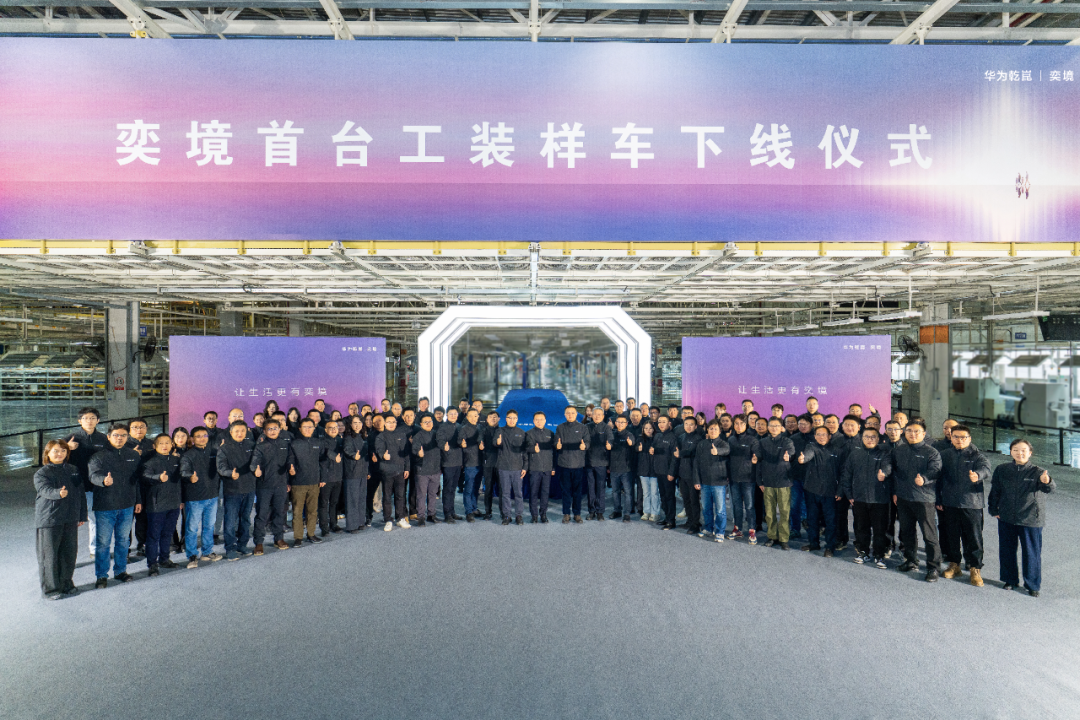

On December 22, the all-new brand ECOTRON, co-developed by Dongfeng Motor and Huawei Qian Kun, unveiled its first prototype vehicle. From the brand's official announcement on November 20 to the unveiling of the prototype, a mere 32 days have elapsed—a lightning-fast pace in an industry notorious for its lengthy development cycles.

This full-size SUV prototype heralds ECOTRON's aggressive foray into the high-end market, leveraging a 'fully Huawei-powered' approach, with plans for a formal debut at the Beijing Auto Show in April 2026. It also signifies a further expansion of Huawei's smart vehicle solution collaboration portfolio, solidifying the presence of its 'realm' series matrix.

Together with GAC Motor's previously announced 'Qijing' and SAIC-GM-Wuling's 'Baojun Huajing', ECOTRON forms the 'New Three Realms' alliance, where Huawei empowers traditional mainstream automakers. This clearly showcases an alternative deep collaboration pathway beyond Huawei’s Harmony Intelligent Mobility, setting the stage for internal and external battles within the Huawei ecosystem.

01 ECOTRON's 'Fully Huawei-Powered' Entry

In reality, as ECOTRON ambitiously plans its debut at next year’s Beijing Auto Show, it is not entering an untapped blue ocean market. Instead, it faces a fiercely competitive red ocean jungle, shaped by Huawei’s own ecosystem strength, where internal competition is already intense. All brands within the Huawei ecosystem are on high alert.

The architect of this competitive landscape is Huawei’s full-throttle advancement of its Harmony Intelligent Mobility and HI Mode ecosystems. According to multiple sources, Huawei’s product roadmap for 2026 is a saturated attack aimed at seamless coverage of mainstream price segments, impacting all participants in the automotive market.

Under the AITO, Luxeed, Enjoyland, Ultimate, and Shangjie brand matrices, over ten new or refreshed models are scheduled for release throughout the year. This translates to at least one major Huawei-backed vehicle hitting the market every one to two months on average, creating a sustained market impact with continuous brand presence.

ECOTRON’s first full-size SUV aims to fill the strategic gap between VOYAH and eπ, targeting the high-end family smart SUV market priced between 250,000 and 350,000 RMB. Unfortunately, this price range and user demographic overlap precisely with the core stronghold of AITO—Huawei’s current sales leader.

AITO’s M7, the benchmark for family SUVs, along with the M8 and flagship M9, has already established strong brand recognition, user loyalty, and channel barriers in this segment. Meanwhile, Luxeed’s planned large luxury MPV V9, with its mobile smart space selling points, targets elite family users seeking space and tech experiences akin to SUVs, further intensifying the competition.

In other words, even before ECOTRON’s official debut, it finds itself encircled by Huawei’s established brands. A deeper challenge lies in the fact that ECOTRON’s reliance on 'fully Huawei-powered' technological advantages risks dilution as Huawei’s smart vehicle technologies become platformized and standardized.

As is widely known, Huawei’s Qian Kun Intelligent Driving and Harmony Cockpit are rapidly evolving from exclusive features of a few flagship models to standard configurations across more partner brands. When Huawei’s deep empowerment becomes an industry norm, any partner brand hoping to achieve market success solely through the Huawei label will face significant difficulties.

Ultimately, competitive success will hinge more on the comprehensive product experience, emotional brand resonance, cost control capabilities, and precise marketing reach. For Dongfeng, rooted in traditional manufacturing and still learning high-end brand operations directly facing consumers, this presents an even more daunting challenge.

Thus, the unveiling of ECOTRON’s prototype marks only the first step in Dongfeng’s arduous journey. Its ability to break through the Huawei-dominated competitive storm in 2026 will depend on whether Dongfeng can forge its own, difficult-to-replicate systematic capabilities beyond Huawei’s technological empowerment.

This battle will serve as a critical test of whether Dongfeng’s self-owned passenger vehicles can leverage the smart electric vehicle trend to truly ascend to a new level.

02 The Future of Dongfeng’s Self-Owned Passenger Vehicles

Evidently, the challenges facing the ECOTRON brand extend beyond a single product line’s market breakthrough; they represent a concentrated reflection of the structural dilemmas encountered by its parent company, Dongfeng Motor Group, in the deep waters of intelligent and electric transformation across its entire self-owned passenger vehicle sector.

Facing undifferentiated market firepower from allies and partners under Huawei’s technological aura, along with encirclement from new forces and traditional giants, Dongfeng’s ability to achieve genuine brand elevation and scale breakthroughs cannot rely solely on the success of the ECOTRON brand.

The true determinant lies hidden within Dongfeng’s profound and resolute systemic transformation and new strategic chessboard initiated in 2025. In June 2025, Dongfeng Motor underwent a far-reaching internal restructuring, establishing Dongfeng eπ Automotive Technology Company.

This new entity integrates the three brands—Dongfeng eπ, Dongfeng Fengshen, and Dongfeng Nanomi—aiming to connect the entire value chain of R&D, manufacturing, and sales to construct a new landscape for self-owned passenger vehicles. The concurrently released 'Wings of the Future' strategy demonstrates Dongfeng’s resolve to burn its bridges.

Its core objective is clear: to end the fragmented, resource-draining multi-brand operations of the past and build a self-owned passenger vehicle group capable of lightning-fast market response and highly synergized resource allocation. This marks a fundamental shift in Dongfeng’s management logic from traditional technology orientation to user and market orientation.

Moreover, Dongfeng has a clear technological roadmap: its self-developed solid-state batteries will enter vehicle integration in 2026, offering a range exceeding 1,000 kilometers and maintaining over 70% range retention even at -30°C. Simultaneously, an ultra-high-voltage architecture supporting '5-minute charging for 450 kilometers of range' and a 10,000-ton integrated mega-casting technology will also achieve mass production in 2026.

These technologies are no longer mere concepts on PowerPoint slides but have clear mass production timelines. They collectively point toward a goal: creating products with generational advantages in core 'three electric' experiences during the critical 2026-2027 window, thereby opening a second front centered on electric technology beyond Huawei’s smart vehicle strengths.

Collaboration with Huawei represents strategic synergy rather than technological procurement. This enables Dongfeng to leverage Huawei as its strongest accelerator on the indispensable path to intelligence. Meanwhile, through core technologies like self-developed solid-state batteries and high-voltage platforms, Dongfeng firmly safeguards its traditional moats in mechanical quality, safety standards, large-scale manufacturing, and cost control while attempting to establish new future-oriented moats.

Building on these technological foundations, Dongfeng has implemented unprecedentedly clear brand differentiation and strategic focus, forming a multi-dimensional offensive combination: ECOTRON targets the mid-to-high-end smart market, eπ Technology positions itself in the mainstream passenger vehicle market, and Dongfeng Fengshen concentrates on the global energy-efficient vehicle market.

This is clearly a layered and rigorous combination. It constitutes the underlying logic of Dongfeng Motor’s response to the fierce 2026 new energy vehicle market battle, a strategic layout that avoids single-point dependency on external technologies while maximizing its core strengths and forming a diversified, synergistic development ecosystem.

Crucially, Dongfeng’s collaboration with Huawei has established a deep strategic synergy system for the ECOTRON brand: 'one team, ten billion investment, three years of deep cultivation.' Both sides have formed a joint R&D team, invested billions in funding, and plan to spend three years meticulously refining products to jointly create the product matrix with the highest Huawei content.

Therefore, when examining ECOTRON’s challenges and Dongfeng’s future strategy, a deeper proposition emerges: ECOTRON’s success depends not merely on whether it uses the most advanced Huawei technologies but on whether Dongfeng can internalize Huawei’s market reverence, user insight, technological obsession, and efficiency pursuit as new organizational genes through this process.

Only when technological fusion ascends to systemic evolution and cognitive revolution can Dongfeng not only build competitive smart vehicles but also forge a modern automotive enterprise capable of consistently creating blockbusters and adapting to the brutal decade-long elimination race ahead. This represents the deepest strategic intent behind the combination.

Whether Dongfeng’s self-owned passenger vehicles can ascend to a new level essentially hinges on whether its organizational body can complete a perilous leap toward the smart electric era. The unveiling of ECOTRON’s prototype marks only the beginning of this grand evolutionary experiment, and the 2026 market battle will serve as the first true testing ground for its evolutionary outcomes.

Editor-in-Charge: Li Sijia Editor: He Zengrong

THE END