Business monotony and inability to transform: Shansong's window of opportunity is closing soon

![]() 10/12 2024

10/12 2024

![]() 516

516

This article is the 849th original work of Shenqian atom

No breakthroughs now

No expectations for the future

Meng Fanliao | Author

Edited by Shenqian Atom Studio

From disclosing the listing filing notice in July, submitting the prospectus to Nasdaq on September 13, to being listed on October 4, Shansong's journey to the stock market was surprisingly smooth.

What makes Shansong unhappy is that its share price has been falling continuously since its listing. On October 4, Shansong's offering price was $16.5 per share, with a market value of $1.17 billion. However, it began to decline the next day. As of the close on October 10, Eastern Time, Shansong's share price had fallen to $12.4 per share, with a total market value of $881 million.

In 2021, Shansong's valuation once reached as high as 13 billion yuan. Now, after its listing, the market value has declined significantly. Perhaps under the competitive pressure from giants like Dada, Meituan, and SF Express, the capital market seems to have abandoned this once industry leader.

Missed the timing of going public: Feeling powerless in the face of competitors

Founded in 2013 and entering the market as an intra-city express delivery service, Shansong defined the service standards and delivery times for one-on-one urgent delivery services.

At that time, the energy demonstrated by the new forces in this emerging sector made the capital market eager. For example, Didi emerged in the ride-hailing market, ByteDance and Kuaishou in the content sector, and Meituan in the O2O market. Nowadays, these emerging forces have become world-class technology giants.

For start-ups, the abilities and vision of their founders are closely related to the company's future. Xue Peng, the founder of Shansong, graduated from the Department of Information and Computational Science at Tsinghua University in 2005 and later pursued further studies at University College London in the UK. During his studies abroad, Xue Peng, who has always been interested in logistics, delved deeply into various aspects of the logistics industry.

After returning to China, Xue Peng briefly entered the logistics sector, but the results were not satisfactory. Coinciding with the peak period of the Internet, Xue Peng, with a technical background, immediately realized that to stand out in this fiercely competitive market, he had to take a different approach. He founded Shansong and proposed the "one-on-one urgent delivery" model, completely disrupting the traditional express delivery service model.

Relying on the efficiency advantages of one-on-one urgent delivery, Shansong quickly expanded to cover multiple cities in China and recruited a large number of riders. By June 2024, Shansong had covered over 290 cities, recruited nearly 3 million riders, and served over 100 million users.

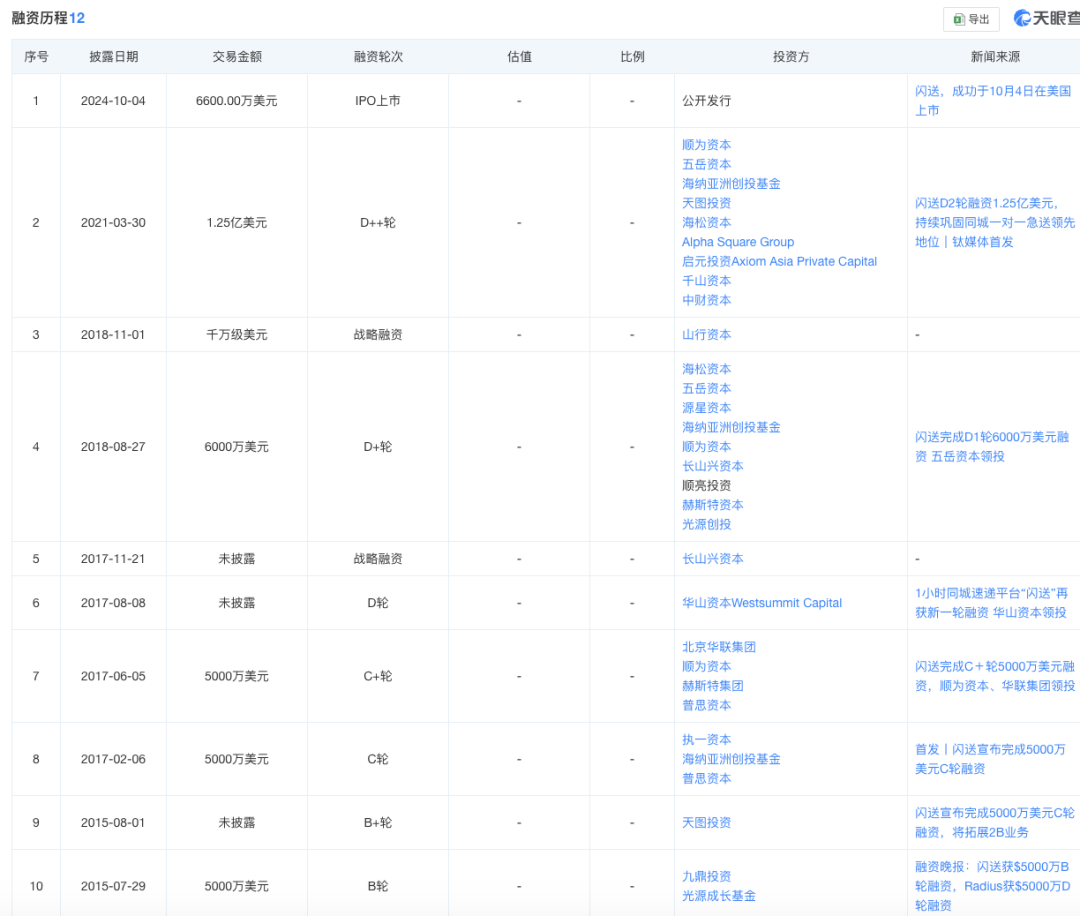

Shansong was once one of the most highly anticipated emerging forces, attracting significant capital attention. In 2014, shortly after its launch, Shansong received angel funding of several million yuan from Matrix Partners China. Since then, it has garnered significant attention from various investment institutions and completed a total of 11 funding rounds before going public, raising a cumulative total of $339 million. While providing funds, these investment institutions also helped Shansong rapidly expand its business scale and supported its continuous investment in technology, marketing, and branding.

During the early stages of the mobile internet, the entrepreneurial atmosphere was intense, and countless competitors emerged in every promising sector. For example, there was the money-burning battle between Kuaidi, Didi, and Uber, and the "Hundred Group War" in group buying, which was followed by the O2O wave. After Shansong broke through the traditional logistics industry by emphasizing the concept of intra-city instant delivery, many competitors entered this sector as well.

In 2014, Dada was officially launched and later merged with JD Daojia, becoming one of Shansong's earliest competitors. Subsequently, traditional logistics giant SF Express launched SF Express City, and companies like Fengniao Express, Meituan, and Huolala also entered this sector. These competitors have strong capabilities in terms of capital, technology, and branding, directly limiting Shansong's further development.

Facing competition, Shansong once had the opportunity to turn the tide through an IPO. As early as 2020, rumors emerged that Shansong was seeking to go public, but the plan ultimately fell through. However, that year, Shansong's competitor Dada Nexus successfully listed on the U.S. stock exchange, earning the title of "first stock in instant retail." Later that year, SF Express City also successfully listed on the Hong Kong Stock Exchange. On October 4, 2024, Shansong listed on Nasdaq, but it had already missed its best opportunity.

No breakthroughs now: High costs not sustainable in a limited market share

In the entire instant delivery market, Meituan Waimai and Ele.me firmly occupy 70% of the food delivery market, while Shansong's business accounts for only 6.6% of the overall market. Although iResearch data shows that based on 2023 revenue, Shansong holds approximately 33.9% of the market share in China's independent one-on-one express delivery service market, maintaining its position as the market leader. However, in such a competitive environment, failing to capture a larger market share, whether in terms of branding or capital, does not seem sufficient to support Shansong's long-term leadership.

The prospectus shows that from 2021 to the first half of 2024, Shansong's revenue was 3.04 billion yuan, 4.003 billion yuan, 4.529 billion yuan, and 2.284 billion yuan, respectively, with net profits of -291 million yuan, -180 million yuan, 110 million yuan, and 124 million yuan. The prospectus notes that Shansong achieved profitability in 2023 primarily due to increased government subsidies discretionarily determined by relevant government departments, which are not sustainable.

As of the end of June 2024, Shansong had 2.7 million riders. During the reporting period, Shansong's rider costs accounted for 90.5%, 90.3%, 87.8%, and 85.4% of total revenue, respectively. In 2023, only about 3% of the riders actively using the Shansong platform were actually registered riders, with each active rider completing 9.3 orders per day.

The low utilization rate of riders is a significant pain point constraining Shansong's profitability. For example, on Douyin, a Shansong rider named Xiao Yang, who loves riding motorcycles, completed 6 orders in 8 hours in 2023, earning 327 yuan. However, he spent 1.5 hours waiting for orders during those 8 hours.

The prospectus shows that from 2021 to 2023 and the first half of 2024, Shansong's average revenue per order was 19.2 yuan, 18.8 yuan, 16.7 yuan, and 16.5 yuan, respectively, showing a significant downward trend. It is evident that to maintain overall financial performance, Shansong is gradually sacrificing the interests of its riders.

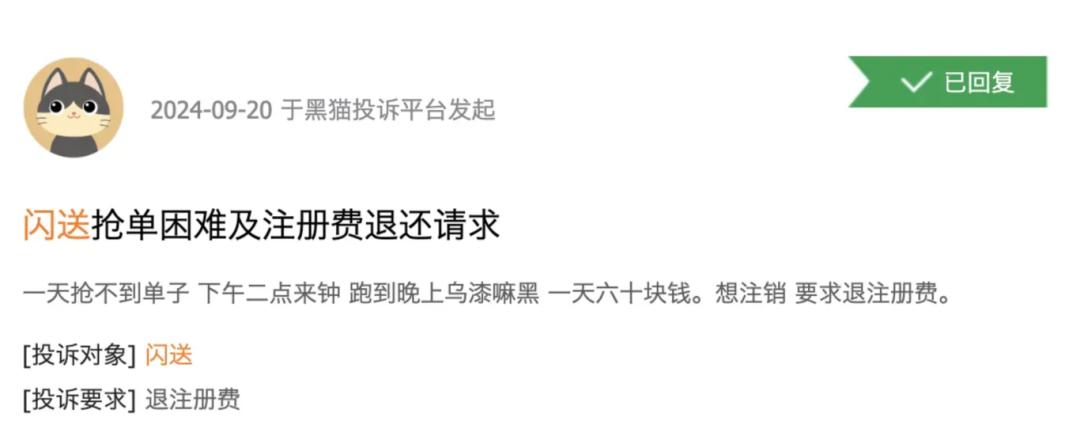

The inability to establish effective positive feedback among riders has led to resistance from many of them towards Shansong. On Heimao Complaints, numerous riders have begun to lodge complaints against Shansong. Some users have also reported struggling to secure orders throughout the day, earning as little as 60 yuan despite working from early afternoon until late evening. Others have requested to cancel their registration and receive a refund of the registration fee. Additionally, some riders have criticized Shansong for using deceptive tactics and unfair terms.

No expectations for the future: Business monotony and inability to transform

According to Frost & Sullivan, the number of orders in China's instant delivery industry reached approximately 40.88 billion in 2023, with a year-on-year growth of 22.8%. It is projected that by 2028, the market size will reach 81.31 billion orders, maintaining an average annual growth rate of 14.7% over the next five years. However, in the face of this rapidly growing market, Shansong is exhibiting significant weakness.

SF Express City offers one-hour delivery, errand running, and purchasing services. JD.com, which integrates various businesses, can deliver goods in as little as 9 minutes. Cainiao Logistics also offers half-day delivery services. In the local lifestyle sector, the delivery capabilities of Meituan and Ele.me are well-known, while Douyin and Kuaishou are also increasing their presence in this area. Furthermore, travel companies like Huolala, Didi, and Hello Bike have also started offering errand services.

In the instant delivery sector, the services offered by competitors are becoming increasingly similar, weakening Shansong's competitive advantage in delivery efficiency. It seems that only Shansong is still rowing against the current.

In its prospectus, Shansong states that the proceeds from this IPO will be used to expand its customer base and increase market penetration, build its brand image, invest in technology and research and development, and for general corporate purposes.

However, with a highly specialized business model and a lack of strong backing, Shansong's service scenarios are primarily concentrated in high-frequency areas such as food delivery, fresh produce, and retail convenience, limiting its broader service scenarios and revenue streams. Compared to companies like Dada and SF Express City, Shansong lacks the support of large enterprise customers, making it more challenging for the company to expand its customer base and increase market penetration.

Given Cui Peng's technical background, Shansong should have been one of the first companies to embark on big data and artificial intelligence transformation. However, the current focus of Shansong may still be more on mobile internet technology, providing customers with more convenient ordering methods and real-time order tracking services.

In an interview, Du Shangbiao, Vice President of Shansong, stated that the company's digital system enables rapid and accurate order matching and efficient dispatch of delivery capabilities. However, he also emphasized that unlike other platforms that prioritize order consolidation for maximum efficiency, Shansong allows each order a 10-minute window to ensure the safety of its delivery personnel and avoid potential hazards such as running red lights or speeding. Does this mean that from the outset, Shansong did not prioritize technology at the highest level?

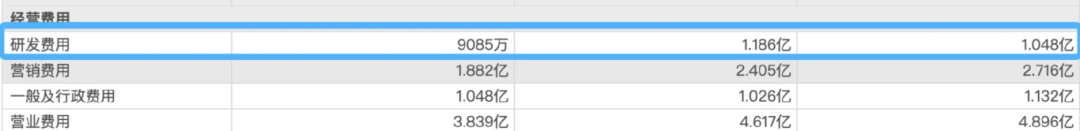

From 2021 to the first half of 2024, Shansong's research and development expenses were 104.8 million yuan, 118.6 million yuan, 90.85 million yuan, and 41.32 million yuan, respectively. In the era of artificial intelligence, such investments make it difficult for Shansong to achieve significant gains. Particularly in the past year and a half, R&D investments have significantly decreased, making it difficult to classify Shansong as a technology-first company.

Although Shansong is increasing its application of cutting-edge technologies such as big data, artificial intelligence, and the Internet of Things to create a smarter and more efficient logistics and delivery system, it seems to be lagging behind when everyone else is introducing large model products.

Currently, Shansong is facing significant competition from numerous giants and is already showing signs of weakness. If it insists on maintaining its one-on-one urgent delivery model without transforming and lacks more advanced technological support, where does its future lie?