E-commerce sellers are facing a traffic dilemma that requires drastic change

![]() 10/21 2024

10/21 2024

![]() 552

552

Writer | Dong Erqian

Editor | Yang Xuran

A month ago, Zhang Dayi, a well-known internet celebrity who once shared the limelight with Wei Ya and Li Jiaqi and witnessed the golden age of e-commerce, announced that she would indefinitely delay the launch of new products on her e-commerce platform store.

In her farewell letter, she described the many problems she faced, but they are also common dilemmas for many e-commerce sellers:

"Revenue does not equal profit."

"I don't like taking risks on things that prioritize appearance over substance."

"Many seemingly successful internet celebrities are barely scraping by."",Looking back further, at the end of May, the female clothing brand "Lola Code" on Douyin also announced its closure after its final livestream.

The founder of Lola Code admitted in an interview that the exorbitant cost of traffic was the primary reason for its closure. "The cost of traffic has increased tenfold. Fewer people were doing this before, but now there are more people competing for traffic, driving up costs. This has a significant impact. Just because you stumbled upon our livestream this time, it doesn't mean you'll see it next time," he said.

Behind these similar sentiments lies a common dilemma faced by the entire e-commerce industry—both platforms and merchants are trapped in a quagmire of traffic dependence, and as traffic costs soar to such heights, the model of driving growth through traffic investment has become unsustainable.

Moreover, while the high cost of traffic is relatively obvious, the operational costs incurred to improve traffic conversion efficiency have also soared, with many of these costs hidden in the details. As Zhang Dayi put it, "The hidden costs of content creation, livestreaming on various platforms, anchors, models, back-office operations, design, warehousing, and more have continued to rise."

Tracing the source of traffic reveals that only platforms that can access cheaper traffic can pass it on to e-commerce sellers at a lower cost. When platforms themselves struggle to acquire traffic, the pressure naturally shifts to platform sellers.

01

Caught in a Dilemma

Brands of the Times

In 2012, Zhang Liaoyuan quit his job with an annual salary of 280,000 yuan to found Three Squirrels in a private home in Wuhu. It was also in this year that Taobao Mall officially changed its name to Tmall, and the newly founded Zhang Liaoyuan posted online about the opportunities in e-commerce, stating, "A new era has arrived, and e-commerce has five years of opportunities to create an internet e-commerce brand."",Based on this assessment, Zhang Liaoyuan, who had secured $1.5 million in funding from IDG, invested heavily in e-commerce traffic promotion. According to his recollections, in the first two months after Three Squirrels launched on Tmall, he spent approximately one to two million yuan per month on promotion, including purchasing Taobao Train and search advertising slots and participating in Juhuasuan events.

Zhang Liaoyuan indeed reaped substantial rewards. During the 2012 Singles' Day event, Three Squirrels achieved a single-day sales volume of 7.66 million yuan, ranking first in snack sales. It then maintained its position as the top snack brand on Tmall's Singles' Day for eight consecutive years, riding the wave of soaring online traffic to become the first e-commerce snack stock.

However, starting from the year after its listing, Three Squirrels' share price entered a sustained downward trend, primarily due to the erosion of profits by high sales expenses, echoing Zhang's assessment of the "five-year opportunity."

Three Squirrels' share price performance (since listing)

It is a widely accepted logic that the shelves of e-commerce platforms are infinite, and consumers have infinite long-tail demands. This creates a vast opportunity for matchmaking transactions between the infinite supply and infinite demand, which is the core reason for the rise of all online brands.

However, consumers' attention is always limited, especially in today's increasingly competitive landscape. The sales volume of products appearing on the first page of search results cannot be compared to those on the tenth or more pages.

E-commerce platforms must also consider how to allocate limited traffic, and traffic prices have become the most crucial interest diversion valve in the entire e-commerce ecosystem. Many merchants have little leverage in their negotiations with platforms and can do little but accept the terms, ensuring that platforms can continuously monetize traffic. However, whether their interests are fully met is not the core of the entire distribution mechanism.

This dilemma is shared by merchants such as Three Squirrels, Zhang Dayi, and Lola Code.

Small and medium-sized sellers face even greater challenges. Fang Yu, the head of a lighting factory, once told the media that she used to spend just 100 yuan a day on platform promotion, but now spends up to 400-500 yuan. In the past 30 days, her store's promotion expenses amounted to 11,400 yuan, almost consuming 70% of her profits.

This traffic investment has now reached a dilemma: either continue to increase promotion investments to maintain orders but with minimal profit or watch sales stagnate or even decline.

A clear indication of these dilemmas is that compared to the myriad of Taobao and Douyin brands that emerged in previous years, we haven't seen many new brands emerge online lately. Essentially, this is the irreconcilable contradiction between increasingly scarce traffic (i.e., potential demand) and continuously growing supply.

It's like a never-ending marathon where everyone is sprinting towards the finish line, but there will be no winners.

02

The Traffic Dilemma

A Top-Down Traffic Dilemma

In the year Three Squirrels was founded, abundant online traffic was virtually free.

Alibaba even banned guide websites such as Mogujie and Meilishuo for contributing too much traffic. Jack Ma famously stated internally that "traffic inlets should be prairies, not forests." His implication was that Alibaba could not support a few large traffic inlets and should instead balance its reliance on different traffic sources.

At that time, China's internet industry was booming, with small and medium-sized content platforms like Fanli.com, Mogujie, Meilishuo, Zhe800, and Chuchu Street all enjoying significant traffic. However, today, many of these smaller internet companies have either been acquired by larger players or eliminated, leading to increasing centralization of traffic.

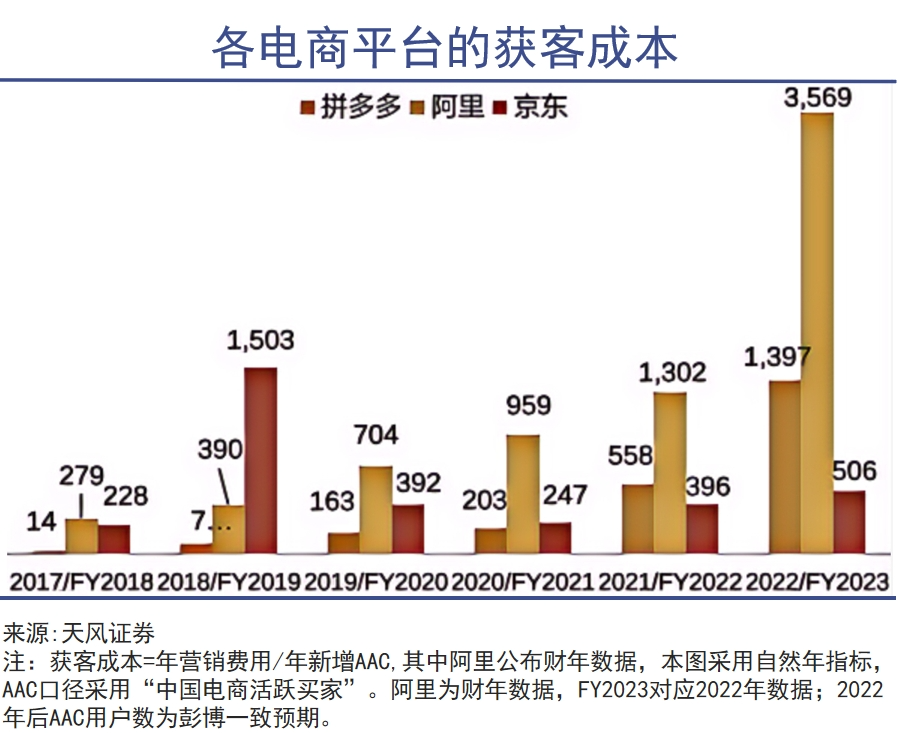

The growth of China's internet user base has also stagnated for a long time, resulting in rising customer acquisition costs for e-commerce platforms. In 2014, Alibaba's per capita customer acquisition cost was 55 yuan, but it has now soared to 3,569 yuan.

Another obvious manifestation of the traffic dilemma is the increasingly competitive Double 11 shopping festival on platforms. All e-commerce platforms hope to attract massive traffic during this period, leading most of them to start Double 11 pre-sales activities even a month in advance this year.

For merchants, "competing" for traffic is the keyword of Double 11. Smaller merchants cannot compete with larger ones, less popular ones with more popular ones, and those with less investment with those who spend more. In the fierce competition during the promotional period, some merchants may even experience unexpected declines in traffic.

"In 2022, small and medium-sized livestreaming rooms could still receive naturally allocated traffic from the platform without paid promotion, but in 2023, the trend of requiring merchants to use paid traffic to intervene is becoming increasingly apparent," said the head of a laundry detergent bead brand on Douyin.

Not only do small and medium-sized brands share this sentiment, but even top brands and platform's flagship anchors face similar issues.

In a 2021 livestream, Simba revealed that he spent 25 million yuan on buying traffic but only attracted 800,000 viewers in an hour. He questioned, "Where did the 20-30 million yuan I spent go? Why do you charge me even when I'm promoting my own apprentices?"

It's important to note that private domains and social trust have always been the core differentiators of Kuaishou's "semi-familiar community," with higher e-commerce loyalty and conversion rates than other platforms. If this is the case on Kuaishou, one can only imagine the situation on other platforms.

Traffic is already a significant issue, but converting traffic into sales is an even bigger challenge. Even well-known internet celebrities like Zhang Dayi struggle with this, let alone smaller and medium-sized merchants, especially factory sellers who prioritize price advantages over brand building and focus solely on expanding sales channels.

Netizen "DanielV587" shared that as a factory brand, he only cares about increasing sales volume, even if it means sacrificing profits for quantity. However, the current e-commerce model heavily emphasizes operational investments, with expenses for store setup, traffic acquisition, and operational and design teams all eating into profits. He summarized his true need as, "Is there a solution that allows us to sell products without investing too much money or time in operations?"

03

Beyond Interest Distribution

The Underlying Source of Traffic Lies in User Perception

Soaring traffic costs continue to compress merchants' survival space.

Multiple merchants have told the media that their traffic promotion expenses on e-commerce platforms account for more than 50% of their cost structure, with some even reaching 70%. Industry observers have even predicted that "many merchants will not survive more than three years under the current rules and regulations."",This can deteriorate the overall supply of e-commerce, reducing consumers' purchasing desire. Many platforms have already experienced this firsthand.

The increasing number of returns, for example, reflects the fact that product gross margins can no longer support marketing expenses, leading to a reduction in quality to artificially inflate gross margins. This ultimately leads to discrepancies between products and their advertised descriptions, resulting in a significant increase in return and exchange rates.

The most severe consequence of this is the slowdown in the growth rate of the entire e-commerce industry as products become increasingly untrustworthy through e-commerce channels. Wei Wenwen, President of Douyin E-commerce, has publicly acknowledged that Douyin E-commerce's GMV grew by 46% year-on-year in the past year, a significant slowdown compared to the 320% and 80% growth rates in 2023 and 2022, respectively.

Starting in the second half of this year, platforms like Alibaba, JD.com, and Pinduoduo have introduced "billions of relief measures" to reduce the burden on merchants, including service fee refunds, deposit reductions, waiving logistics transfer fees, upgrading merchant after-sales services, and automatically refunding technical service fees.

However, these measures essentially involve platforms ceding some benefits to sellers in a fiercely competitive environment. They only mitigate the conflicts at the surface level and fail to address the root causes of the dilemma.

The underlying logic of traffic sources lies in users' perceptions of platforms and products. Ultimately, those who can create greater value for users will attract more traffic, which can then be allocated to platform merchants of all sizes. This is the true solution to escaping the traffic dilemma.

Users' demands for products can be summarized as "more, faster, better, cheaper," with "cheaper" carrying the most weight. Overlaying this with Chinese consumers' evaluation system reveals that high cost-effectiveness is always the most compelling factor, followed by stable and durable quality. "Elegant brands" imbued with bourgeois aesthetics often fall outside the evaluation system of most ordinary consumers.

Therefore, Pinduoduo, which has successfully cultivated a perception of high cost-effectiveness among users, theoretically possesses a much broader traffic pool, as evidenced by its past development results.

By leveraging this perception of high cost-effectiveness, Pinduoduo can access more and cheaper traffic, enabling it to reduce or even eliminate traffic fees in exchange for merchants offering lower prices. For example, the requirements for accessing Pinduoduo's resources (such as the Billion Subsidy Program, flash sales, and homepage listings) are primarily products with cost-effective advantages.

Especially for factory sellers who lack the resources or intention to build brands, this traffic allocation logic aligns perfectly with their operational characteristics. They can offer attractive prices without considering brand premiums, but expecting them to do so while also paying exorbitant traffic fees is undoubtedly a tall order.

Factory sellers, who do not have to consider brand building costs, have effectively become "disruptors" within the entire e-commerce ecosystem. They set the lower limit for pricing within the internet e-commerce landscape, but without platforms offering them free exposure opportunities, these low-priced products would ultimately be drowned out amidst the sea of paid traffic.