26.7 million users! Institutions predict the global satellite IoT market will enter a stage of "explosive" growth

![]() 10/21 2024

10/21 2024

![]() 486

486

Original article from IoT Think Tank

According to the World Bank's "World Development Report 2023", 95% of the world's population is concentrated in just 10% of the Earth's landmass. This means that only about 10% of the Earth's surface is accessible for terrestrial connectivity services, leaving ample room for imagination in the development of satellite IoT. As a complement to terrestrial cellular and non-cellular networks, satellite IoT is particularly suited for applications in agriculture, asset tracking, maritime transportation, oil and gas industry exploration, utilities, construction, and government sectors.

With the gradual maturing of technology, standards, and the industry as a whole, the global satellite IoT communications market is experiencing robust growth. No, perhaps the word "robust" is not accurate enough. According to many IoT analytics agencies, this market is poised to enter a phase of "explosive" growth.

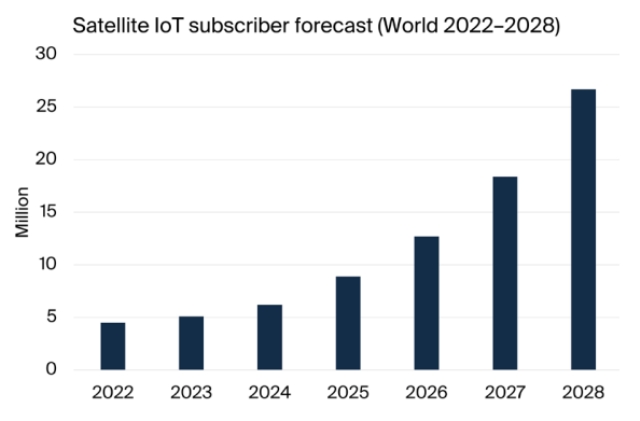

CAGR approaching 40%! Subscriber numbers soar to 26.7 million

Recently, Berg Insight released its latest research report on satellite IoT, which revealed that the number of global satellite IoT subscribers exceeded 5.1 million in 2023 and is projected to soar to 26.7 million by 2028, with a compound annual growth rate (CAGR) of 39.2%.

Satellite IoT Market Size (Source: Berg Insight)

Satellite IoT connectivity revenue is projected to grow from €302.9 million ($330.4 million) in 2023 to approximately €1.35 billion ($1.47 billion) in 2028. However, it is worth noting that monthly ARPU is expected to decline to €4.20 ($4.60) by 2028.

This forecast is not far off from Omdia's research, which predicts that as hardware costs, such as for gateways, continue to decline and new standards emerge, direct communication with IoT devices via satellite is becoming a viable option for enterprises to retrieve data from remote devices. Omdia expects satellite IoT revenue to exceed $1.5 billion by 2030.

You may be wondering: The opportunity for satellite IoT has always existed, so why will it enter a critical window in recent years? IoT Think Tank has mentioned in previous articles that standardization and cost issues are significant reasons.

Traditional satellite communications are based on proprietary solutions, with each constellation having its own set of protocols, leading to high overall costs and limited qualitative growth in user numbers. However, with 3GPP initiating research on Non-Terrestrial Network (NTN) in the 5G standard R17 phase, covering standards development for radio access networks, bearer networks, core networks, and terminals, mainstream players in the satellite communications industry have started investing more resources in 3GPP standards.

NTN Technology Development and Standard Implementation (Compiled by IoT Think Tank)

Currently, there are over half the world's population connected to cellular networks, with mature devices and ecosystems. For satellite IoT vendors in the 3GPP camp, the large ecosystem of standardized products and components in the cellular communications domain offers opportunities for technology providers to rapidly expand and ensure compatibility between devices. Additionally, they can effectively leverage the cellular communications industry chain and user base to rapidly expand the user base of space-based networks, thereby reducing the costs of network construction, maintenance, and promotion for an integrated space-terrestrial network. The reduction in costs undoubtedly adds significant momentum to the increase in user numbers and explosive growth of the industry.

Both established and new players are entering the fray, intensifying competition in the satellite IoT market

With the market growing rapidly, established satellite operators and dozens of startups are competing for a share of the IoT connectivity market, intensifying competition. In my opinion, the current landscape of satellite IoT operators can be described as "four superpowers and many newcomers."

The "four superpowers" refer to Iridium, Orbcomm, Viasat (Inmarsat), and Globalstar, the four largest global satellite IoT network operators today.

Iridium: Recently, in August, Iridium released its second-quarter financial results, showing a 4% increase in revenue compared to the previous year. Commercial IoT data remained the primary driver of Iridium's growth, with quarterly revenue up 20% year-on-year to $41.6 million. Iridium also increased its average revenue per user (ARPU) in this segment from $7.48 a year ago to $7.70 in the second quarter due to a new contract with a major customer. Iridium added 83,000 commercial subscribers in the second quarter, with IoT data subscribers accounting for 81% of all billing commercial subscribers. Currently, Iridium leads the market with 1.8 million satellite IoT subscribers.

Orbcomm: Today, Orbcomm's business scope has expanded from satellite operations to providing end-to-end IoT solutions, with 715,000 satellite IoT subscribers.

Viasat (Inmarsat): ViaSat is an established American satellite operator established in 1986 and operates in the United States and globally. In May 2023, ViaSat acquired Inmarsat for $7.3 billion, creating a global leader in satellite communications with a broad global spectrum portfolio across Ka, L, and S bands. Inmarsat has not yet reported its IoT subscriber numbers.

Globalstar: Globalstar is a globally renowned telecommunications company that generates revenue through the provision of mobile satellite services. Currently, Globalstar has 480,000 satellite IoT subscribers.

"Many newcomers" refers to a wave of new entrants further disrupting the satellite IoT landscape, including OQ Technology, AST SpaceMobile, Omnispace, Sateliot, Galaxy Space, Ligado Networks, Lynk, Skylo, and Starlink (3GPP 4G/5G); EchoStar Mobile, Fossa Systems, Lacuna Space, Innova Space, and Eutelsat (LoRaWAN); as well as Hubble Network (Bluetooth). Many of these new entrants are leveraging the concept of low-Earth orbit (LEO) nanosatellites and exploring innovative connectivity technologies.

Here, I introduce two well-known and distinctive startups:

Sateliot is the first company to operate a Low Earth Orbit (LEO) 5G IoT satellite constellation. In March 2023, Sateliot joined the Global Certification Forum (GCF), becoming the first satellite operator to achieve device interoperability based on 3GPP standards. In April 2023, with the help of SpaceX, Sateliot successfully launched the world's first 5G satellite in LEO. It is reported that Sateliot has secured orders worth €187 million from over 350 customers in 50 countries. The company aims to use these early revenues to achieve €500 million in revenue by 2027 and further reach €1 billion in revenue by 2030.

Hubble Network is historically the first company to establish a Bluetooth connection directly with satellites. In March of this year, Hubble Network piggybacked on SpaceX's Transporter-10 mission to send two satellites into orbit for the first time. Subsequently, the company confirmed that it had successfully received signals from a 3.5mm Bluetooth chip located over 600 kilometers away. In the future, Hubble plans to build the first "production constellation" consisting of 36 satellites, which will enable connections with Hubble satellites for approximately two to three hours per day anywhere in the world.

Hybrid satellite-terrestrial connectivity emerges as a recognized new opportunity

In addition to research on the market and competitors, several institutions have mentioned a notable trend in their satellite IoT report insights: the rise of hybrid satellite-terrestrial connectivity solutions. Clearly, in the coming years, collaboration between satellite operators and mobile operators will become increasingly prevalent as they jointly explore the vast opportunities in satellite-terrestrial connectivity.

For example, in July 2023, Sateliot, mentioned earlier, collaborated with Telefónica to facilitate the world's first 5G roaming connection in space. Specifically, Sateliot demonstrated the use of a regular SIM card configured on Telefónica Tech's Kite platform on an IoT cellular device, transmitting data end-to-end through the Telefónica network and seamlessly switching to the Sateliot network.

Skylo is the most active provider of NTN hybrid cellular/satellite products recently, collaborating with Deutsche Telekom, BICS, emnify, floLIVE, Monogoto, O2 Telefónica (Germany), Particle, Soracom, Transatel, and 1GLOBAL (Truphone).

Public information indicates that Skylo does not directly operate its own satellites but acts as a service provider, leveraging its partners' satellite resources and its own terrestrial infrastructure to provide services. The company has globally deployed terrestrial stations that constitute its unique Radio Access Network (RAN) infrastructure. Skylo's technical capability lies in optimizing satellite links between different types of constellations to ensure connectivity even in areas lacking traditional cellular network coverage.

Other satellite IoT operators collaborating with mobile operators and MVNOs include Starlink, OQ Technology, Omnispace, Lynk, Intelsat, Viasat, and AST SpaceMobile, among others, which are not listed here one by one.

In summary, with the realization of global connectivity and the integration of terrestrial and satellite technologies, the future of IoT communications looks increasingly boundless.

References:

"The Satellite IoT Communications Market," Berg Insight

"Satellite IoT to Reach €1.35 bn in Revenue and 26.7 mn Subscribers," telecomlead

"Startup Announces the First-Ever Bluetooth Connection with a Satellite! Is It a 'Dark Horse' or a 'Scam'?" IoT Think Tank

"Star Startup Sateliot Aims to Earn €1 Billion through Satellite IoT!" IoT Think Tank