The wave of digitalization and intellectualization spurs IT benefits opportunities, and Lingxiong Technology's deep layout is expected to stand out

![]() 10/29 2024

10/29 2024

![]() 429

429

The Hang Seng Index is currently experiencing a "magical" fluctuation. Undervalued rebound, instant surge, and rapid correction. These changes are concentrated on a single curve, leaving the market at a loss.

However, in reality, all trends are always anchored in the long term. This long-term perspective may exceed the general expectations. This is because it requires a long transmission chain in between. It's like how AI sparked a boom in the secondary market, but AI has actually been accumulating technology for decades to achieve this.

Each era has its own hot topics, which are underpinned by productivity and investment opportunities. To seize these opportunities, we need to start from the phenomena and deduce the behind-the-scenes supporting factors of the industry.

Identify the hot topics of the era during the "chaotic period" of investment

Over the past two years, enterprises and employees active in industrial parks may have noticed an increase in service providers offering computer leasing, equipment operation and maintenance, and other services, with promotional flyers appearing frequently.

Investors concerned about the broader IT industry trends may have noticed that this sector has already produced listed companies, represented by Lingxiong Technology (the parent company of Xiaoxiong U-Rent brand), which innovatively created the DaaS (Device-as-a-Service) model in the previous two years.

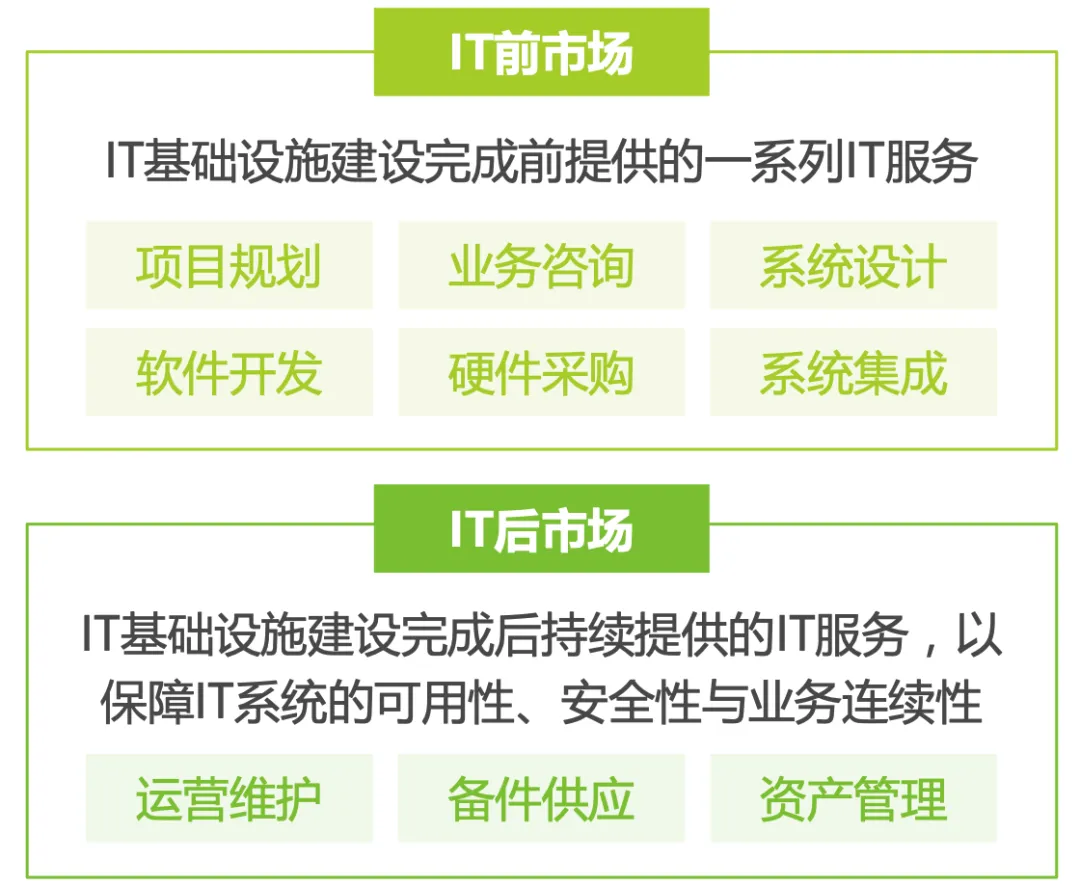

As the name suggests, the DaaS model provides device subscription (leasing), IT technology subscription, device recycling, and SaaS-based device management services throughout the entire lifecycle of IT devices. It spans both the pre-market and post-market of IT, targeting cost pain points in enterprises' digital and intelligent transformation processes, especially those related to hardware investment and its subsequent maintenance. As a result, it has gradually gained popularity.

CICC estimates that China's DaaS market size is expected to exceed 81 billion yuan in 2024 and will exceed 100 billion yuan in 2025. This is a typical overlooked investment opportunity amidst popular trends.

Amid the current pursuit of new computer technologies like AI across society and the ongoing promotion of enterprises' digital and intelligent transformation, there are essentially two paths with growth and investment potential:

Firstly, breakthrough technologies like AI that can transform production methods often have significant investment value, but they are prone to over-hype in the short term. Secondly, factors that help various industries adapt to the changes of the times, such as the renewed growth in related hardware, training, management, and operation and maintenance services as AI gains popularity, also contribute to new growth. The same logic applies to the growing popularity of the DaaS model. Essentially, the value of these businesses lies in helping enterprises reduce costs, improve quality, and enhance efficiency.

Understanding this logic will reveal why the DaaS model is gaining popularity and where the new opportunities in the IT market stem from.

IDC statistics show that the overall size of China's IT services market reached US$17.66 billion (approximately RMB 148.74 billion) in the second half of 2023, with year-on-year growth basically in line with the previous forecast of 4.6%. IT services here encompass hardware, software, systems, project management support, and more.

(Image source: iResearch)

CCID Consulting's "2023-2024 Annual Report on China's IT Services Market" indicates that the compound annual growth rate of China's IT services market size will reach 14% over the next three years. This suggests that as the business environment changes, domestic IT services continue to grow, as enterprises rely on such services to better reduce costs, increase efficiency, and navigate economic cycles.

Where do changes originate? The arrival of a "turning point"

The demand for IT services and DaaS, fueled by digital and intelligent transformation and enterprises' need to reduce costs and enhance efficiency, embodies the interdependence between trends and supporting industries. This interdependence means they always reach turning points together.

For example, the IT industry has been around for many years. Why is it that changes like the rise of DaaS are occurring at this current juncture? It's primarily because many factors in this industry have accumulated over time and now have the ability to influence the industry's demand for digital and intelligent transformation. This gives rise to a transmission chain.

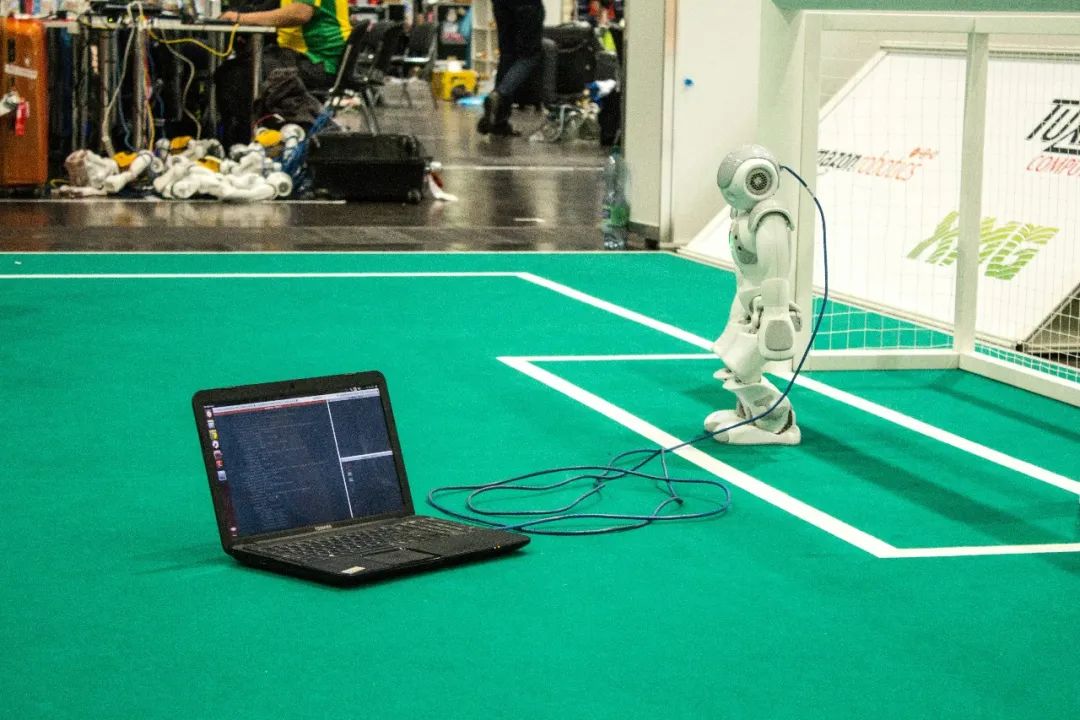

Firstly, the traditional industrial development model has reached a turning point. The most notable change is that as digitalization and intelligence reshape the operating foundation and business processes of traditional enterprises, there are fewer manual workers on the production line and more engineers using computers to guide everything.

(Image source: Unsplash)

At this point, enterprises' demand for traditional labor may decline, but IT equipment remains indispensable. And as more engineers carry computers to carry out frontline work, the demand for device management and maintenance will also increase, necessitating new and improved solutions.

Qin Shuo, a renowned financial writer, recently pointed out in an interview with Henan Daily that SMEs are currently under considerable pressure, and it is precisely at this time that top executives need to understand digital transformation or have "specialists" to assist. The core of enterprise digitization lies in "optimizing the end-to-end processes of the enterprise using digital tools" and "starting with easy-to-operate single points."

From this perspective, IT equipment is an excellent entry point for digitalization, at least for SMEs.

Taking Lingxiong Technology as an example, the number of its device subscription business customers in the first half of 2024 surged 35.8% year-on-year, with total device subscriptions increasing 15.2% year-on-year to approximately 3.112 million units. Some institutions have estimated that Lingxiong Technology's DaaS service model can help enterprises reduce their initial investment by up to 97.4% and their operating costs by approximately 10%-30% within three years.

Meanwhile, the second point is that macro guidance from the market and policy has also reached a critical juncture.

In fact, top-level policies have long been committed to promoting the digital and intelligent transformation of industries, but now measures are becoming more specific and focused, necessitating more thorough implementation.

For instance, earlier this year, the National Data Administration and 16 other departments jointly issued the "Three-Year Action Plan for Data Elements (2024-2026)." Where does data come from? The core of data elements is software, but the entry point and foundation are IT hardware. The greater emphasis on the importance of data will encourage SMEs to adopt efficient and low-cost IT device management services as soon as possible, thereby catching up with the "express train" of data.

Additionally, heavyweight policies such as the "Action Plan for Promoting Large-Scale Equipment Renewal and Trade-in of Consumer Goods" and the "Opinions on Accelerating the Comprehensive Green Transition of Economic and Social Development" are also guiding enterprises to choose efficient and low-burden models like DaaS. By selecting professional services, enterprises can reduce operating costs and enhance the vitality of the socio-economic landscape at the macro level.

Finally, as one of the best "assistants" for digital and intelligent transformation, the DaaS model is currently in vogue, and its penetration is accelerating, as evidenced by the successful listings of companies like Lingxiong Technology in recent years.

Like other popular industries like AI, Lingxiong Technology has undergone extended development. What's most important is the refinement of its service model:

On the one hand, in terms of capability, Lingxiong Technology initially started as a wholesale and retail business for used computers and soon recognized the market demand for subscriptions. Today, it satisfies customers' daily device usage needs through device subscriptions and recycling, while addressing their long-term operational maintenance and management requirements through IT technology subscriptions and SaaS-based device management services, achieving full-lifecycle IT device services.

Both SMEs and large enterprises can benefit from this model as long as they have relevant needs. For instance, customized leasing options are available for short-term events or exhibitions, while long-term device subscription services are suitable for enterprises building teams and configuring IT equipment.

(Image source: Xiaoxiong U-Rent official website)

On the other hand, in terms of positive guidance for the industry, Lingxiong Technology's entrepreneurial journey has attracted renowned industrial shareholders such as JD.com, Tencent, and Lenovo. With a focus on IT devices and enterprise needs, these parties have jointly explored better and more comprehensive services, thereby continuously enhancing the quality of industry services. Furthermore, as a leading enterprise in the DaaS industry, Lingxiong Technology has promoted the establishment of the DaaS Service Professional Committee under the China Association of Small and Medium Enterprises and provided critical support for its operations. With its support, the industry is expected to further standardize, benefiting more enterprises.

Conclusion

In summary, investment value essentially boils down to "overt" and "covert" lines. Capital market exploration involves digging into areas like DaaS that may not be immediately apparent but harbor significant value.

These areas often require a long-term perspective as they are mostly growth-oriented enterprises. Their influence is unleashed only after their served industries or clients achieve certain milestones.

In the first half of this year, the number of privately registered enterprises in China increased by 7.8% year-on-year to over 55 million. These enterprises may require digital and intelligent transformation, subscribe to more IT devices, and potentially embrace AI and various subscription services in the future. While change takes time, services that are truly effective for business operations will eventually reach their prime.

Source: Hong Kong Stocks Research Society