State Administration for Market Regulation Releases Document Banning Car Sales at a Loss! BYD and BAIC Swiftly React

![]() 12/15 2025

12/15 2025

![]() 460

460

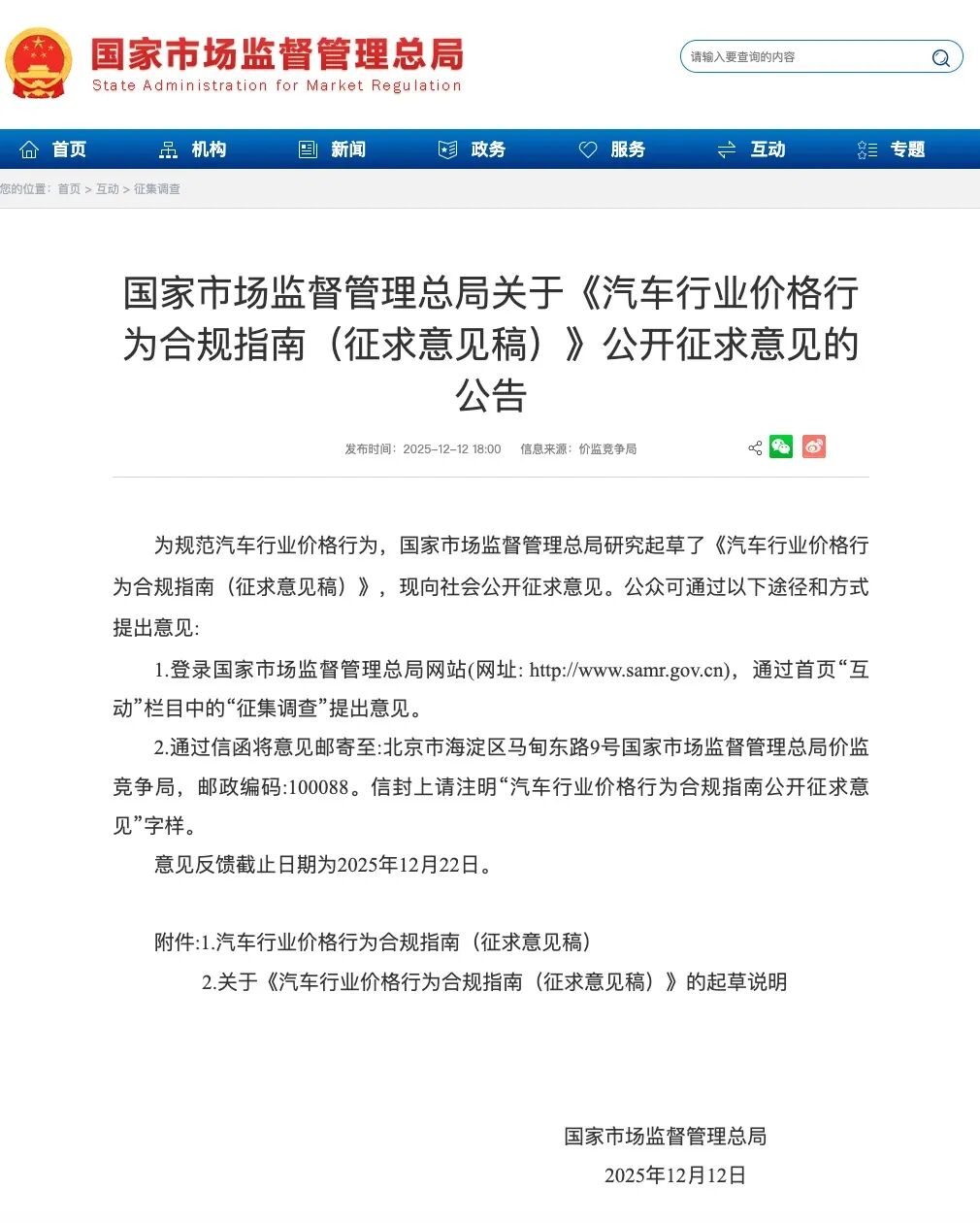

On December 12, the State Administration for Market Regulation opened up for public comment on the 'Compliance Guidelines for Pricing Behavior in the Automotive Industry (Draft for Comments).' This document clearly outlines the price compliance standards that must be adhered to throughout the automotive value chain, covering everything from vehicle production and spare parts manufacturing to pricing strategies and sales practices.

Firstly, it mandates the implementation of comprehensive price management, requiring the establishment of a robust price management system that encompasses all facets of vehicle sales and financial services.

Secondly, it regulates promotional and pricing activities, stipulating that clear and transparent rebate policies must be documented in contracts and other formal agreements, while also respecting the independent pricing rights of dealers.

Thirdly, it calls for the legal suppression of unfair pricing practices, detailing various forms of such misconduct.

Fourthly, it strengthens fair pricing constraints, prohibiting price discrimination against operators under equal trading conditions and price collusion among producers and between spare parts enterprises.

Fifthly, it regulates spare parts and functional fees, mandating that 'paid unlock' functions must clearly disclose the free trial period and fee standards to safeguard consumers' right to know.

Subsequently, experts from the China Association of Automobile Manufacturers provided their interpretation. They highlighted that the 'Guidelines' urge automobile sales enterprises to operate with integrity and refrain from using deceptive or misleading price tactics. The 'Guidelines' also emphasize the importance of 'clear pricing.' Except for legally permitted price reductions to clear overstocked inventory, automobile sales enterprises should avoid engaging in unfair pricing practices aimed at squeezing out competitors or monopolizing the market. They should not indirectly reduce prices to the extent that the actual sales price falls below the purchase cost, which is essentially selling cars at a loss.

The China Association of Automobile Manufacturers believes that these measures will significantly enhance 'price transparency' in the automotive market, effectively safeguard the security and stability of the industrial chain, and protect the long-term interests of consumers.

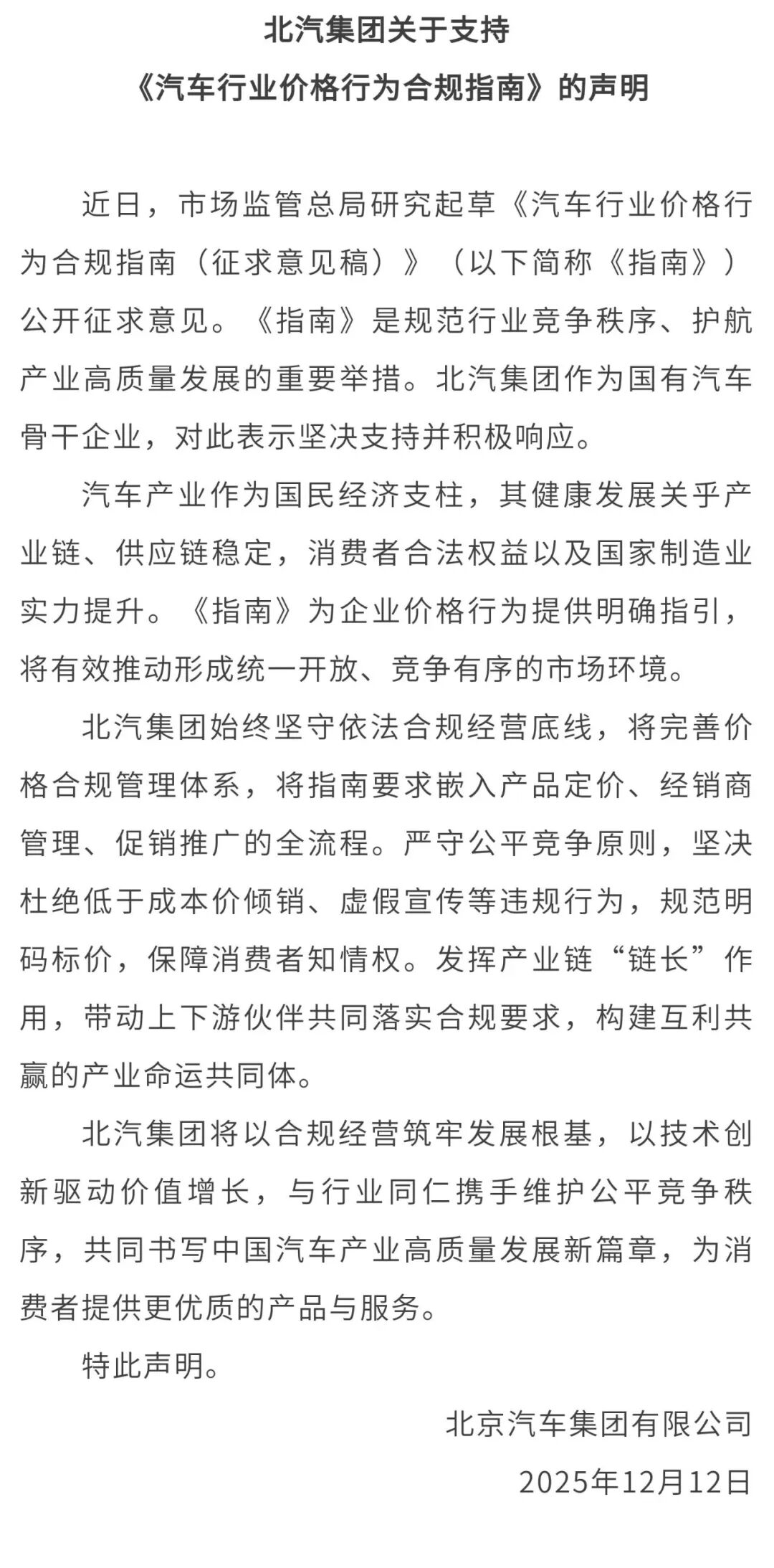

Following the release of the document, BAIC Group was the first to respond. BAIC stated that it would enhance its price compliance management system and integrate the guidelines' requirements into every stage of product pricing, dealer management, and promotional activities. BAIC committed to upholding the principle of fair competition, resolutely putting an end to below-cost dumping, false advertising, and other violations. It would ensure clear pricing and protect consumers' right to know. BAIC also pledged to play a leading role in the industrial chain, driving upstream and downstream partners to jointly implement compliance requirements and build a mutually beneficial industrial community with a shared future.

Subsequently, BYD also issued a statement. BYD emphasized its commitment to a long-term perspective and stated that it would use the 'Guidelines' as a guide to continuously optimize its price management and compliance system. BYD pledged to strictly implement the requirements for regulating price competition behavior, safeguard consumer interests, and resolutely put an end to any form of price fraud and unfair competition. BYD would actively lead the industry, working collaboratively with peers to establish a compliant business order, promote a collaborative and win-win development ecosystem, and contribute to the high-quality development of the automotive industry.

Since the beginning of 2024, the domestic automotive price war persisted until it was forcefully brought to a halt in mid-year. However, the negative impacts of this price war have severely hampered the normal development of the Chinese automotive industry, leading domestic automakers to prioritize price over quality. Moreover, the intense price war has drawn attention from foreign media, sparking discussions about vicious competition, overcapacity, and dumping in the Chinese automotive industry. This has not only damaged the public opinion environment but also posed challenges to the international policy environment for Chinese automobiles entering the global market.

For instance, in the Russian market, Maxim Sokolov, the head of Russia's AvtoVAZ, publicly accused Chinese automakers of large-scale dumping during an interview with Russia's Izvestia newspaper. He claimed that the discount behavior of Chinese automakers 'has exceeded reasonable limits.' Additionally, multiple European and American automakers, as well as countries and regions such as Southeast Asia and Mexico, have become cautious about Chinese automobiles. Mexico, in particular, is considering imposing additional tariffs on Chinese automobiles.

Therefore, for the Chinese automotive industry, it is imperative to swiftly transition from a low-cost, low-price competition model to a quality-driven approach. It is time to bid farewell to internal competition and embark on a sustainable development trajectory.