Why are there more and more ads in your Moments?

![]() 11/05 2024

11/05 2024

![]() 550

550

Recently, a poll was conducted on Weibo asking users to choose between WeChat and iPhone, attracting over 100,000 participants, with 84% opting for WeChat.

While alternative smartphones exist, no viable alternative to WeChat does. A survey by the Journal of Modern Media Studies at the Communication University of China revealed that 42.2% of respondents spend an average of 2.5 hours or more on WeChat daily, outpacing engagement on other social media platforms.

As China's most widely used social media app, WeChat's position is virtually unshakeable.

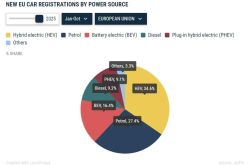

Simultaneously, WeChat's commercial returns for Tencent are increasingly significant, particularly with the growth of video accounts and mini-programs. However, Tencent's Q2 financial report attributed part of the ad revenue growth to Tencent Video (due to popular dramas and variety shows).

Yet, the long-form video business lags behind short-form video. On one hand, long-form videos require substantial investment to produce eye-catching content; on the other hand, it's challenging to substantially improve ad load and monetization efficiency[1].

Tencent's decision to prioritize long-form video is somewhat puzzling, considering video accounts drive more ad growth. Some predict that video accounts may account for the majority of the 19% year-on-year ad growth.

Since video accounts' monetization model has been validated by other short-form video platforms, they commercialize faster within WeChat, boasting higher monetization rates and ad loads than Moments or official accounts.

In Q2 2023, Tencent disclosed that video accounts contributed 3 billion RMB to ad revenue, accounting for over 12%. At that time, monetization was in its infancy (with "Boost Packages" introduced in Q2 2023 and "Comment Section Ads" in Q3 2023), and the contribution curve is only becoming steeper.

In contrast, Moments' ad revenue potential may not be Tencent's priority in the short term, even lagging behind emerging mini-program ads in monetization calls. Moreover, since 2020, WeChat has stopped publishing data on individual business modules, only disclosing user data in Tencent's financial reports.

Recently, Blackbox Research released a valuable "2024 WeChat Moments User Research Report," revealing counterintuitive findings such as:

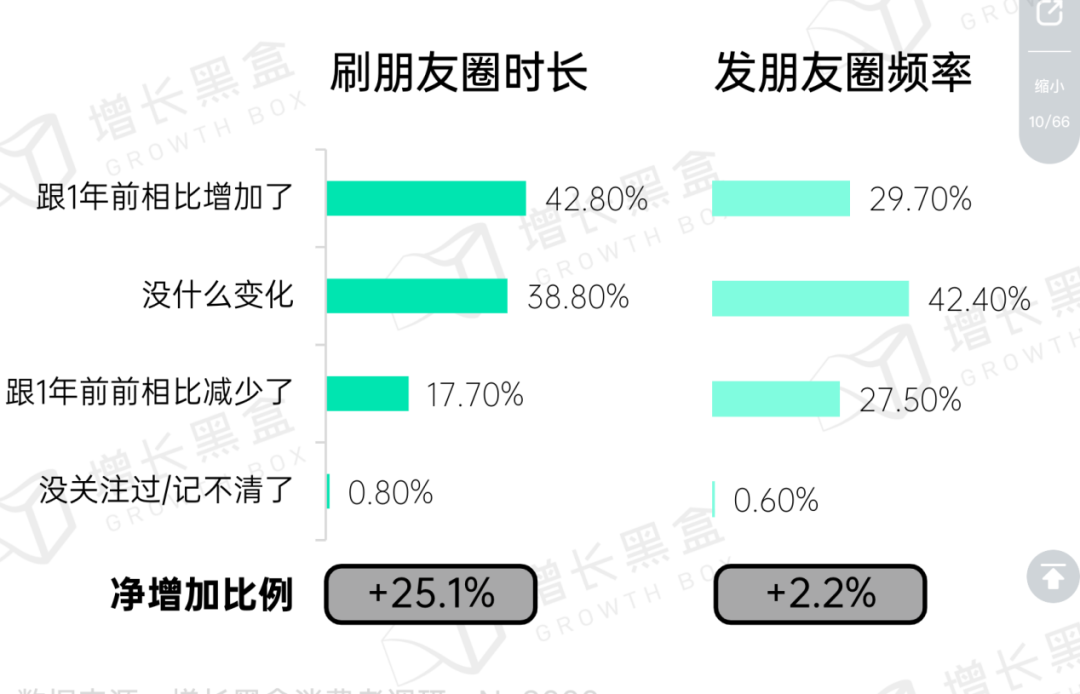

● 74.7% of WeChat users utilize Moments daily;

● 43% spend more time on Moments, with only 17% spending less;

● 47.6% of high-income individuals increased their Moments usage;

● Moments posting frequency only increased by 2.2%.

Why do Moments seem less lively? It's not that people dislike Moments; rather, there are more passive users, preferring to scroll rather than post.

This isn't the report's core focus but rather uses numbers to prove Moments as a goldmine for ads.

1

Content Supply and Demand Gap

A previous survey by China Youth Daily found that 63.9% of respondents set their Moments to be visible for only three days[2]. This could explain why Moments seem quieter—like wife cakes without wives, Moments may lack friends.

Contrary to this perception, Moments remains highly engaging. Blackbox Research data shows that nearly 43% of users spend more time on Moments year-on-year.

At a 2019 WeChat Open Class, Allen Zhang said, "Many say they want to quit Moments or rarely use it. But this is a misconception in the internet world."

As Zhang predicted, social needs remain unchanged, driving both posting and scrolling.

The focus is on how Moments' commercial value has changed. The survey data shows decreasing content supply but unchanged or increasing demand, indicating a supply-demand imbalance. Blackbox Research suggests that high-quality ad content in Moments can fill this gap, attracting consumer attention—a future business opportunity.

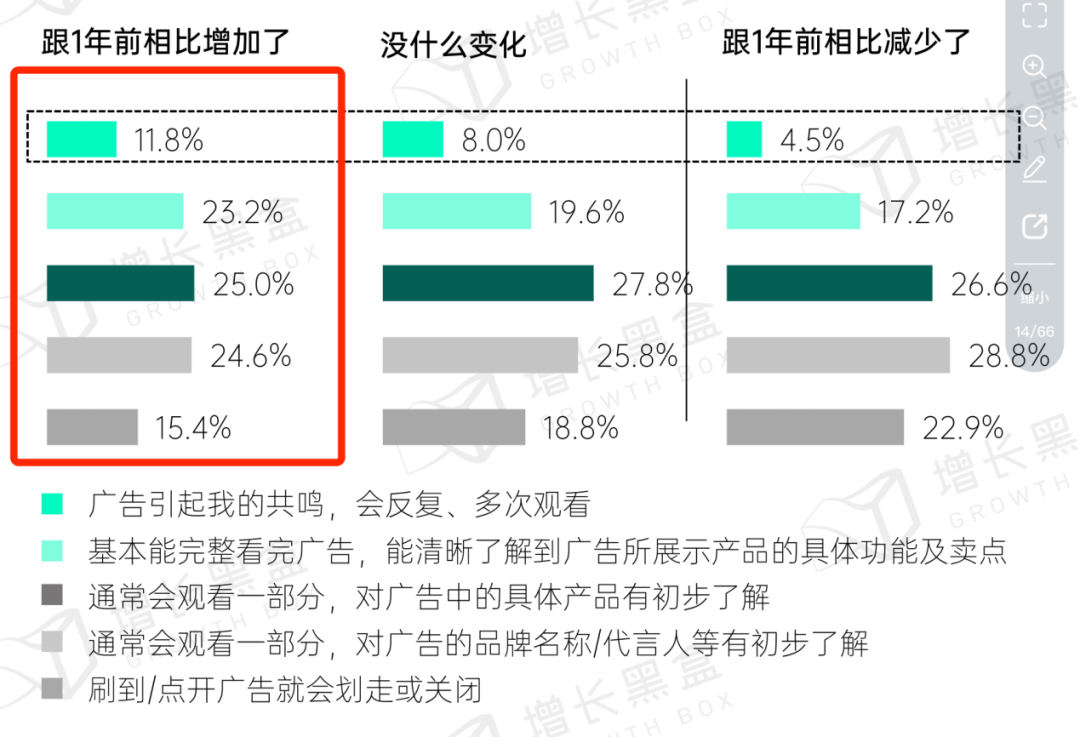

The survey included an ad-related question, revealing that users spending more time on Moments are more likely to engage deeply with ads. They're more likely to rewatch ads, watch them in full, and less likely to close them immediately.

This suggests users value Moments information more, providing brands with deeper ad impact.

Another valuable report finding is that Moments naturally filters ideal ad audiences. Those spending more time on Moments are more open to external information, possibly experiencing "information anxiety," making them more susceptible to influence.

Since Moments ads are endorsed by friends and acquaintances, they leave a deeper impression. Moments isn't just about acquaintance socializing but a "public space" filtered through acquaintances, balancing privacy and openness, offering information flow unique to other channels.

2

Brand Ads' Broad Appeal

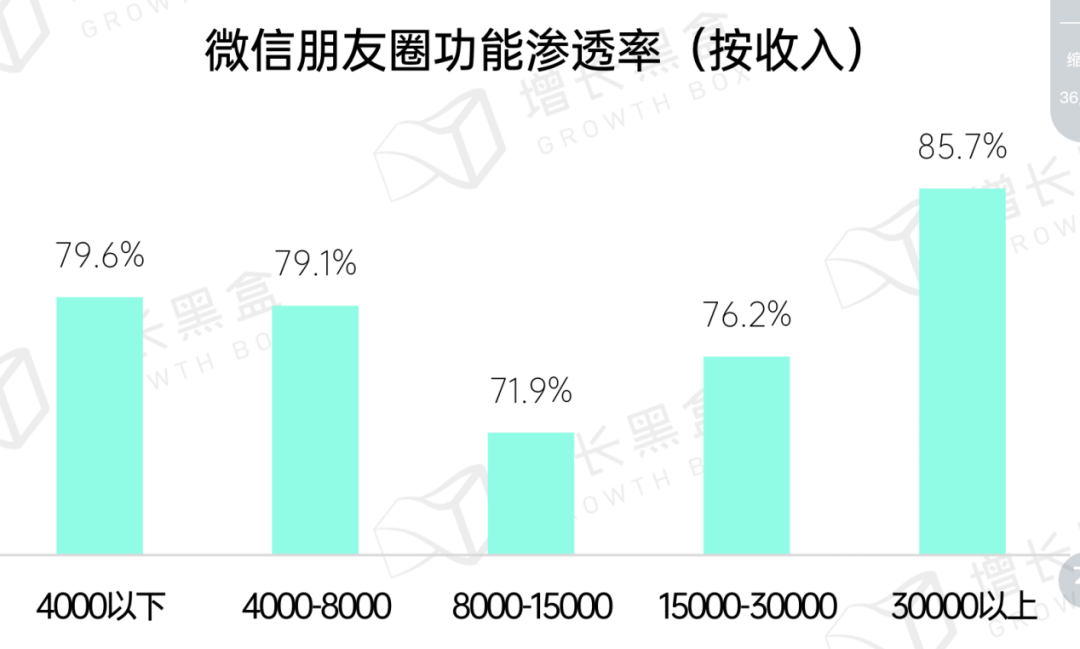

Counterintuitively, the report found that wealthier individuals are more inclined to use Moments.

Those earning over 30,000 RMB monthly have the highest Moments penetration (85%) and increased usage.

Additional survey findings include:

1. Higher income individuals trust Moments more than other platforms.

2. Their trust in Moments ads increases, while annoyance and disruption decrease.

3. After seeing Moments ads, they're more likely to show interest, engage, register, or try products offline.

4. Luxury and car enthusiasts prefer Moments, with some interest in B2B services also rising.

In summary, high-income individuals are more inclined to engage with and spend on Moments information.

Moments now reaches high-end audiences traditionally targeted by offline ads. In closed environments like elevators or subways, 79.4% of high-income individuals prefer scrolling through Moments over static ads (68.3%).

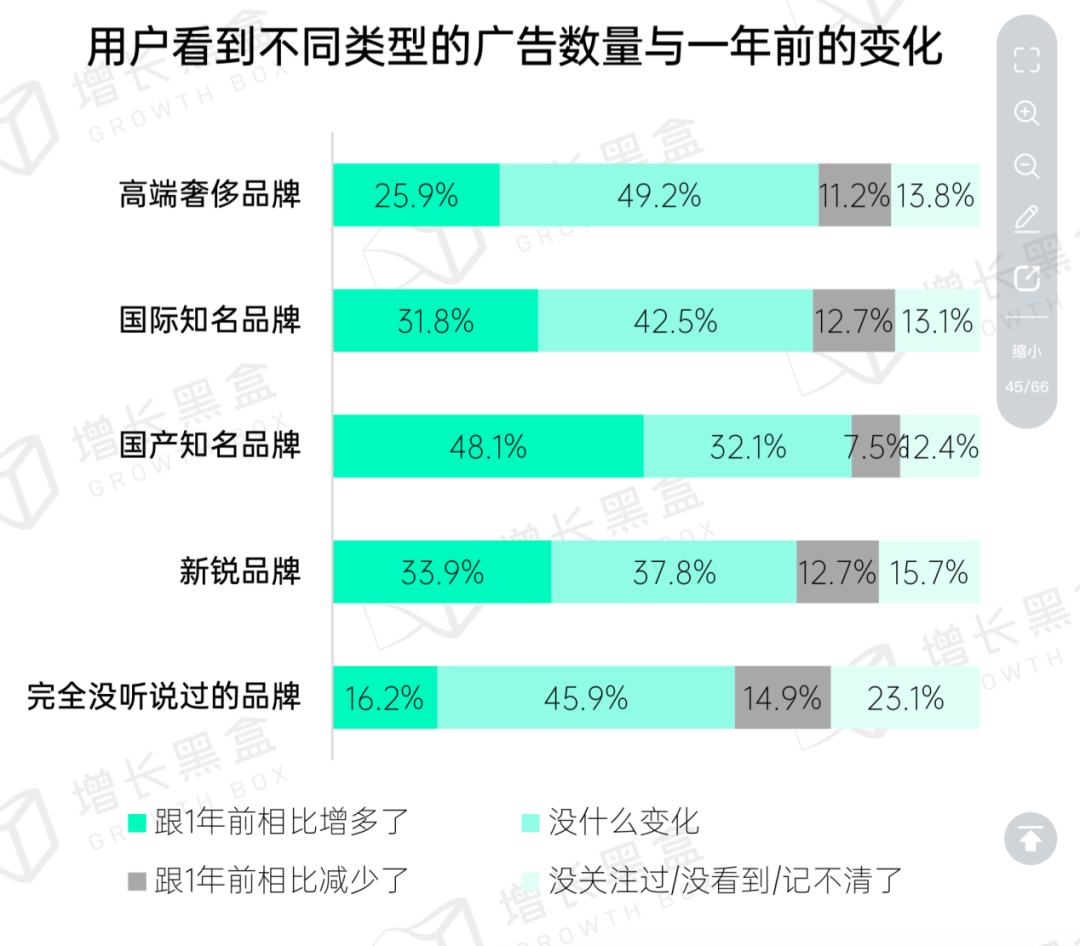

This raises the question of whether Moments' "premium" feel and high-quality audience create an entry barrier. However, survey data shows Moments ads are compatible with brands of all sizes, with increased exposure across all brand tiers.

Moments ads aren't limited to single-channel exposure; they inspire actions within Moments and "spill over" to engage with brands across platforms.

One proof is that 84% of users take follow-up actions after seeing Moments ads, most commonly searching for more product information. This shows Moments ads effectively spark interest, especially in the luxury industry.

Interestingly, even without clicking on ads, users can still be influenced. The report shows that some users, merely exposed to ad covers, subsequently search for related information. This "blind influence" accounts for 30-50% of total searches across industries.

Some of these "blindly influenced" users return to WeChat mini-programs to register or purchase.

3

Where's the Growth Potential?

The report identifies untapped Moments potential. In the past three months, 21% of Moments users haven't seen ads, and those who have only seen ads on average on 40-50% of other social media platforms (XiaoHongShu, Douyin, Weibo, Kuaishou). This indicates a differentiated audience.

There's ample room for brand exposure and conversion among Moments users. 68% have never purchased advertised brands, and 40% are in under-exposed areas. Significant exposure potential remains in business services and beauty/personal care.

The report also highlights blue ocean opportunities in vertical niches, notably business services.

However, this contrasts with the overall decline in social media usage. A recent Chinese internet market study found that the penetration of major new media platforms (Douyin, Kuaishou, Weibo, XiaoHongShu, Bilibili) decreased year-on-year, with user engagement growth slowing.

The issue isn't with social media platforms but with changing consumer behavior. In an era of 28.5 apps per person and a 3-second attention span, loyalty is rare.

Social media fatigue (SMF), a psychologically defined condition, is driving more people to quit social media, as scrolling brings stress and anxiety rather than pleasure.

Despite this, brands' social media marketing budgets remain stable. Studies show that the social media ad market share, including short videos, grew from 22.5% in 2019 to 35.9% in 2023.

As marketing budgets tighten in 2024, 68% of advertisers plan to increase social media spending, rising to 73% among high-budget advertisers. Brands prioritize social media marketing despite financial constraints.

This paradox means more money and competition for limited consumer time and attention, reducing social media marketing efficiency and brand building difficulty.

In this environment, the WeChat ecosystem, represented by Moments, offers brands a "safe haven" against the decline. While it may not drive exponential growth, it nurtures brand presence in consumers' minds, mitigating marketing budget risks.

*For the report, follow Decode and reply with "Moments" in the backend.

[1]Tencent's Q2 2024 Business Update and Outlook, ShawnQin[2]63.9% of Respondents Set Moments to Visible for Three Days, China Youth Daily

Disclaimer: This article is based on publicly available information or data provided by interviewees. Decode and the author do not guarantee the completeness or accuracy of this information. Under no circumstances does the information or opinions expressed herein constitute investment advice for anyone.