October revenue of 19 IT companies in Taiwan, China hits record high

![]() 11/14 2024

11/14 2024

![]() 547

547

This article is compiled by ICVIEWS

In October, the total operating revenue of 19 major IT companies in Taiwan, China increased by 11.2% year-on-year.

The combined operating revenue of 19 major companies in Taiwan, China, which supply semiconductors and digital products to global IT giants, increased by 11.2% year-on-year in October. Sales of servers and semiconductors for artificial intelligence (AI) continued to be strong, setting a new record since statistics began in 2013.

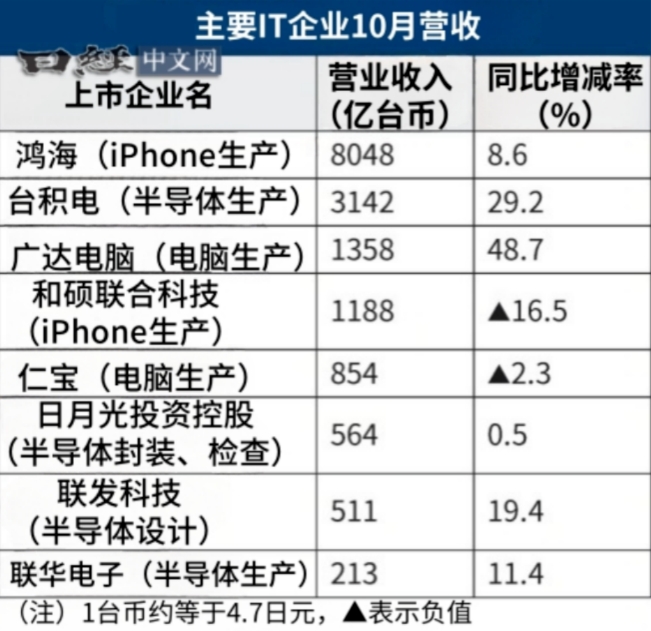

A survey of the operating revenue of 19 major IT-related companies in Taiwan, China revealed a total of NT$1,748.2 billion in October. Among them, 13 companies saw an increase in revenue, while 6 saw a decrease. In terms of total revenue, the previous high was NT$1,706 billion in September 2022.

In the electronics manufacturing services (EMS) sector, Quanta Computer, with its strength in server production, achieved a significant 48.7% increase in revenue. Foxconn, the largest player in the global server market with a 40% share, also recorded an 8.6% increase in revenue.

Taiwan Semiconductor Manufacturing Company (TSMC), the world's largest semiconductor company, achieved a record-high monthly revenue of NT$314.2 billion in October, up 29.2% year-on-year. Its advanced semiconductor foundry services for generative AI, such as those from NVIDIA, performed strongly.

Other companies in the semiconductor sector also reported notable revenue growth. MediaTek, a major semiconductor developer and designer with Chinese smartphone vendors as its primary customers, benefited from the launch of new products for high-end models, resulting in a 19.4% increase in revenue.

United Microelectronics Corporation (UMC), a major semiconductor foundry involved in mature products for consumer and automotive applications, saw its revenue increase by 11.4%, marking the second consecutive month of growth. Advanced Semiconductor Engineering (ASE), the world's largest semiconductor packaging and testing company, also achieved a 0.5% increase in revenue.

Two major players struggled in the sluggish market for liquid crystal displays (LCDs) used in TVs. AU Optronics saw its revenue decline by 1.4%, while Innolux fell by 2.3%.

Taiwanese IT companies deeply benefit from AI

In the current global technological development trend, AI has become a key force driving change across various industries. AI technology is applied across multiple IT industry segments, from chip manufacturing to electronic device assembly. For Taiwanese IT companies, they occupy a crucial position in the global electronic supply chain. Taiwan has long had significant advantages in semiconductor manufacturing and electronic contract manufacturing, which are closely related to the development of AI.

In the AI era, their benefits are primarily reflected in hardware manufacturing. For example, with the surging demand for AI servers, Foxconn can take on a large number of server contract manufacturing orders due to its strong precision manufacturing capabilities and large-scale production experience. As AI servers have high manufacturing requirements, such as high-speed signal transmission and efficient heat dissipation technologies, Foxconn can optimize its manufacturing processes to meet these demands, thereby gaining more business and profit.

TSMC holds a near-monopoly position in the advanced process chip manufacturing sector. Many AI chip design companies, such as NVIDIA, rely on TSMC's advanced process technology to produce high-performance AI chips. As AI's demand for computing power continues to increase, so does the demand for more advanced process chips. TSMC can gain significant economic benefits by providing high-quality chip manufacturing services to these customers.

Companies like Quanta Computer, Pegatron, and Compal also benefit from the upgrading of intelligent hardware devices. For example, as AI technology is integrated into laptops, features such as voice assistants and intelligent image recognition have been added, changing the performance and design requirements for these devices. These contract manufacturers can leverage their R&D and production capabilities to collaborate with brand manufacturers to launch more competitive AI-enabled laptop products, thereby increasing market share and profitability.

ASE can meet the packaging and testing needs of AI chips by continuously researching and applying new packaging technologies, such as advanced 3D packaging. This consolidates its position in the semiconductor packaging and testing sector and enables it to gain more business orders from the mass production of AI chips.

MediaTek can explore new markets by designing chips specifically for AI applications, such as AIoT (Artificial Intelligence of Things) chips. In areas like smart homes and wearable devices, these chips provide local AI computing capabilities, making devices more intelligent. UMC can benefit from chip manufacturing by collaborating with chip design companies like MediaTek and utilizing its manufacturing capabilities to produce these AI chips.

These IT companies collaborate in the AI wave to form a complete ecosystem. For example, chips manufactured by TSMC can be supplied to design companies like MediaTek for chip design verification and mass production. Contract manufacturers like Foxconn and Quanta can assemble these chips into various smart devices, while ASE is responsible for chip packaging and testing to ensure quality and performance. This tight industrial ecosystem enables Taiwanese IT companies to leverage their respective strengths and mutually benefit from the AI development trend.

*Disclaimer: This article is originally created by the author. The content represents their personal views. Our sharing is for discussion purposes only and does not imply endorsement or agreement. For any objections, please contact us.