Disney: Besides the approaching inflection point, management also painted a "big pie" for the next three years

![]() 11/18 2024

11/18 2024

![]() 692

692

Hello everyone, I'm Dolphin!

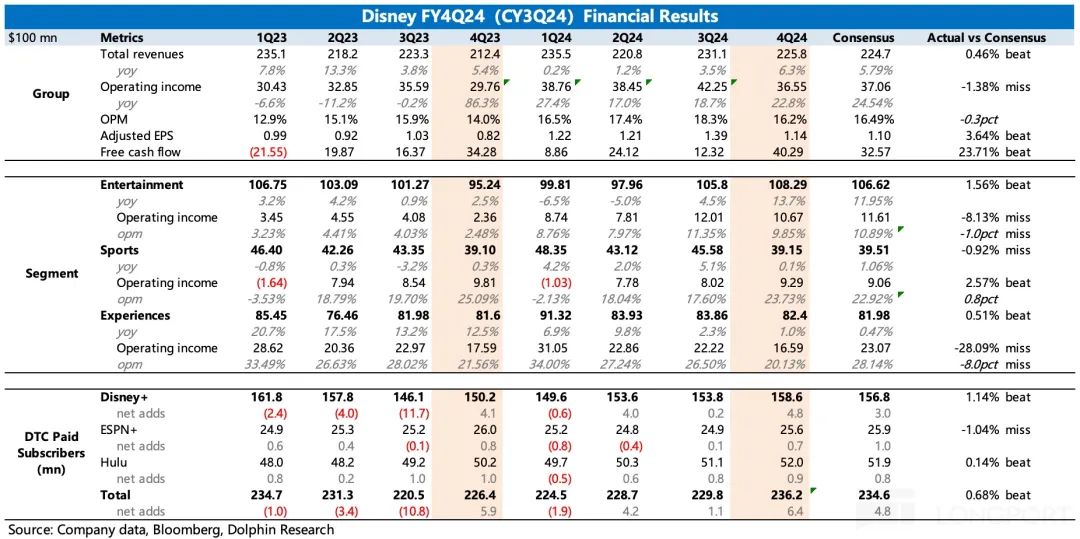

Disney released its fourth-quarter (CY24Q4) fiscal 2024 earnings before the US market opened on November 14, 2024 (EST). The fourth-quarter results largely reflect the current trends across Disney's various businesses with minimal changes:

1) Streaming business continues to grow revenue and expand profitability through price increases and account sharing measures;

2) The experiences business is under growth pressure in the short term due to the fading post-pandemic dividend (in the US) + Olympic Games diversion (in Paris) + slowing demand (in Shanghai). The impact of the Olympic Games and the post-pandemic dividend is expected to significantly slow down in the next quarter. Coupled with the commissioning of new cruise ships, offsetting some impacts of the two hurricanes, revenue growth will rebound;

3) In the entertainment business, film sales have started to recover strongly as they enter a new product cycle. The decline in cable business remains unchanged but has slowed slightly (Dolphin speculates that it may be related to the US election and Olympic Games, which have boosted advertising revenue and offset some impacts). Therefore, in terms of growth rate, the overall recovery of the entertainment business is the most obvious;

Compared to expectations, Disney's Q4 results were neither surprising nor disappointing (adjusted EPS was higher than consensus estimates but in line or slightly below the latest estimates of top institutions). What truly supported the market's positive feedback on the Q4 earnings report was the company's significantly better-than-expected guidance for the next three years (2025/2026/2027). To a certain extent, this alleviated market concerns about when the experiences business would accelerate growth, the impact of divesting the Indian Star business on 2025 earnings, and the growth driver of the ESPN flagship launch in 2026.

Simply put, although the Q4 results alone cannot yet confirm a true inflection point, under the company's guidance, except for the first quarter of fiscal 2025 (corresponding to October-December 2024 of the calendar year), when earnings are expected to remain under pressure (due to hurricanes + new cruise ship cost recognition), the subsequent growth expectations mean that the inflection point and medium- to long-term growth have been clearly communicated to the market through this earnings report.

Based on the company's latest guidance and a closing market capitalization of $208.4 billion as of November 15 after earnings were announced, the adjusted EPS for 2026 is calculated to be below 18x (the company's guidance for 2026 and 2027 is for double-digit growth. If we assume a more conservative forecast, expecting 15% growth in 2026 and 10% growth in 2027), which is obviously lower than the historical central range of 20-25x. In a pessimistic scenario, the above valuation may be higher than the profit growth rate of the past three years. However, even if this conservative assumption holds true, market sentiment during the inflection point period will be relatively positive. For example, institutions may start resuming the use of the Sum of the Parts (SOTP) valuation method, thereby increasing the overall valuation of Disney. The use of SOTP valuation actually implies a gradual and steady growth expectation for each business in the future.

Below are the details of the earnings report

I. Understanding Disney

As a nearly century-old entertainment empire, Disney's business structure has undergone multiple adjustments. Dolphin has provided a detailed introduction in "Disney: The 'Fountain of Youth' for the Century-Old Princess".

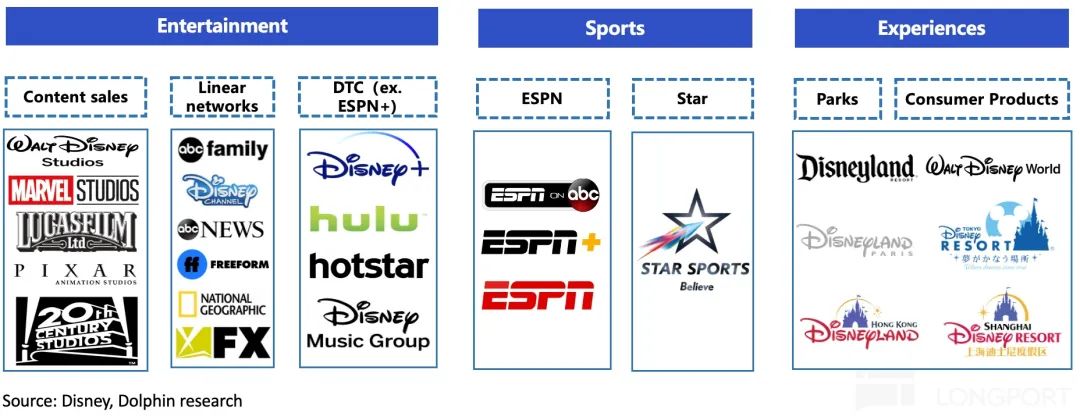

In the past year, there have been significant changes at the group level, including a change in leadership, a shift in business structure, and a change in strategic focus. Under the new business structure, there are three main segments: [Entertainment], [Sports], and [Experiences]:

1. What's the difference between the old and new structures?

The new structure highlights the strategic importance of ESPN by establishing a sports business unit consisting of ESPN channels and ESPN+. This underscores the company's focus on sports.

(1) The [Entertainment] segment includes: existing cable channels, DTC (excluding ESPN+), and content sales. It has also disposed of some overlapping business lines and lower-revenue traditional channels during the integration process.

(2) The [Sports] segment includes: ESPN channels, ESPN+, and Star.

(3) The [Experiences] segment includes: park experiences, hotel stays, cruises, merchandise sales, etc. It is similar to the previous business but may have some discrepancies in specific financial data due to business adjustments.

2. Investment logic framework

(1) The change in framework reflects an important strategic adjustment: content and distribution channels are no longer separate businesses but are integrated. The new business structure is primarily divided based on different content.

This may address a fundamental issue from the source – the same content may be suitable for premiere on different channels. In the past two years, Disney struggled with the question of whether to release blockbuster films first on Disney+ or in theaters. After attempting a simultaneous online and offline release, it negatively impacted the final box office performance of some popular films. This, in turn, harmed actor compensation and disrupted Disney's relationships with some star actors.

(2) The [Experiences] segment has been relatively mature for many years. With the support of its top IP, Disney's theme park business maintains a leading position and is more affected by overall consumer spending. Under normal circumstances, it can be considered a stable cash flow.

(3) [Entertainment] essentially involves the production and distribution of Disney films, encompassing renowned studios, traditional channels, and streaming channels. Therefore, revenue fluctuations are primarily related to Disney's film scheduling and the overall film market's spending power.

Among them, the streaming business remains the focus of Disney's medium- to long-term business strategy. However, in the past two years, it was originally positioned as a growth business that could generate incremental revenue and profits while Disney's traditional businesses remained stable. However, competition in the streaming front has intensified during the pandemic. Despite Disney's significant investments, it incurred heavy losses due to its lack of accumulated advantages in self-produced content.

As two ends of a seesaw, while the streaming business thrives, the old traditional media business cannot remain unscathed. With the declining trend of traditional media, streaming is no longer purely incremental for Disney; instead, it largely compensates for the decline of traditional channels.

(4) Disney's new favorite, the [Sports] segment, may represent a new growth path. Although ESPN has been operating within Disney for many years, sports content and related industries are also attracting the attention of more streaming companies. For example, Netflix has also repeatedly mentioned its emphasis on and increased investment in sports content.

A recent development is that Disney will join forces with peer Warner Bros. and integrate its Fox content to launch a new version of ESPN in 2025, essentially doubling down on its bet on the sports sector.

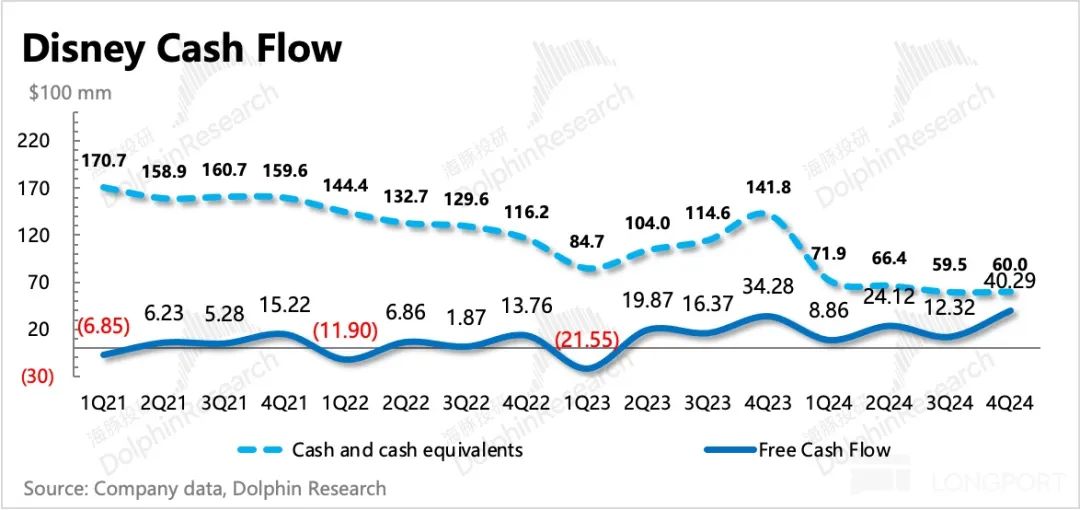

II. Continued profit improvement, steady start of investment cycle

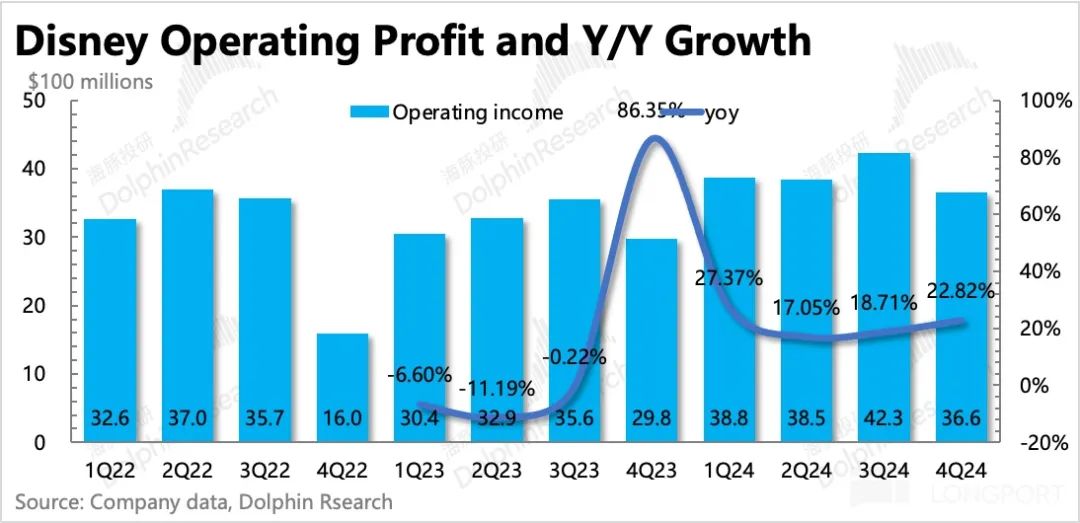

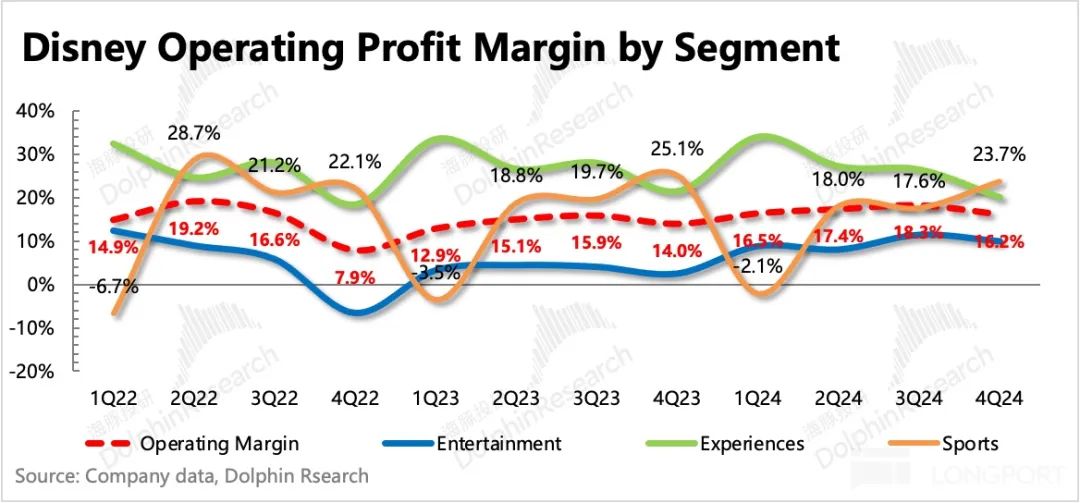

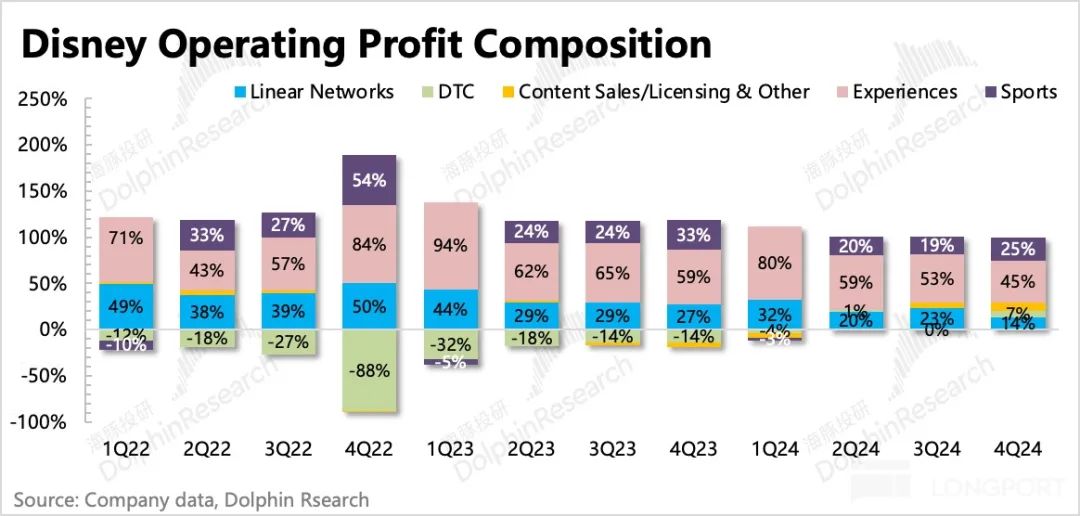

The group's operating profit for the fourth quarter was $3.66 billion, a year-over-year increase of 23%, with an operating profit margin of 16%, a year-over-year increase of 2.2 percentage points, primarily driven by the entertainment business. The main contributors were:

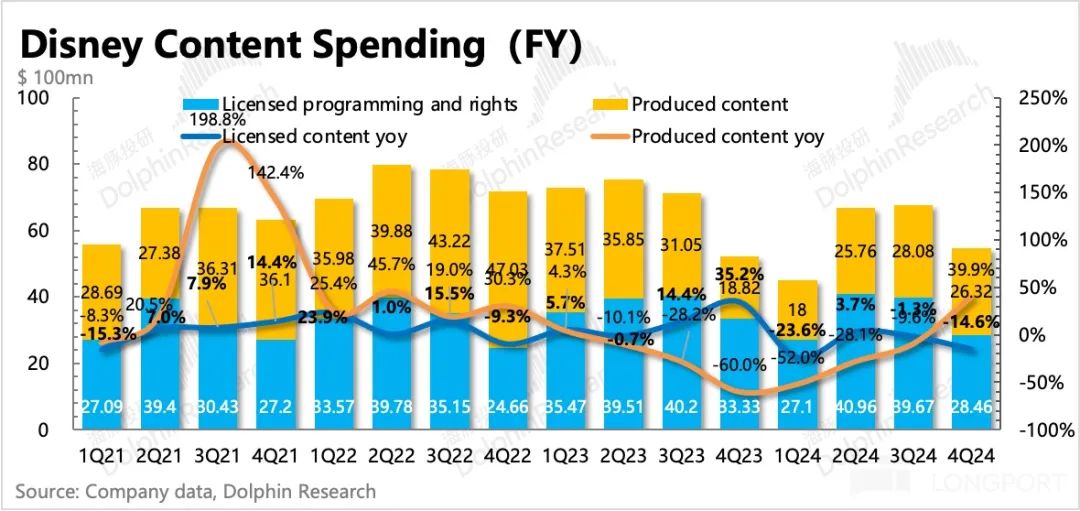

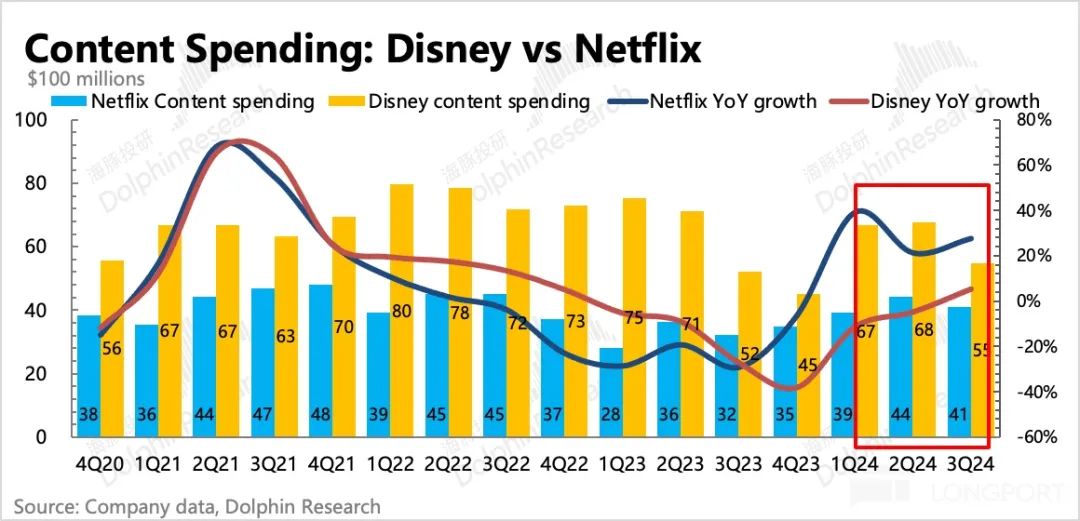

(1) The streaming business (excluding ESPN+ and Star) achieved outstanding loss reduction results again, mainly due to price increases, user growth (driven by bundled packages, advertising packages, account sharing, and other strategies), which jointly drove revenue growth. However, content expenditures are expected to continue to increase steadily in the future.

(2) "Inside Out 2" grossed $1.7 billion globally, and "Deadpool and Wolverine" grossed $1.34 billion globally. Currently, they rank as the top two films in terms of box office revenue for 2024, making significant contributions to the turnaround in content sales in the third quarter.

(3) Cable TV revenue and profit margins continued to decline year-over-year, mainly due to the impact of a strike in the same period last year, which resulted in lower cost recognition and made last year's figures appear higher. This year, however, revenues have returned to normal levels – due to a decrease in the realization rate of average costs, it is inevitable that profit margins will continue to decline unless inefficient cable channels are further divested. During the conference call, management mentioned that after an internal assessment, they have decided not to fully sell the assets of the cable channels.

From a profit contribution perspective, the profit contribution share of DTC continued to increase slightly due to revenue growth, while the share of the parks business declined due to recent pressures. The sports business saw a quarter-on-quarter increase due to the summer being the peak season for sports events. However, year-on-year, the operating profit of the sports business declined by 5%, mainly due to rising costs related to the copyright of American college football games.

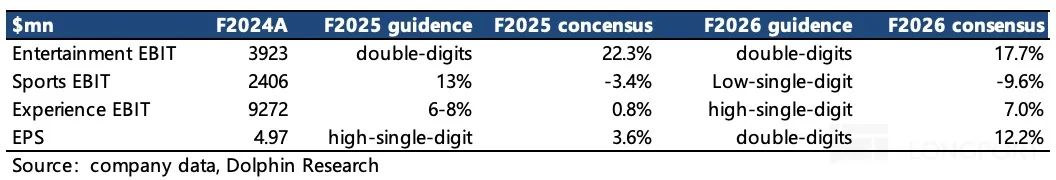

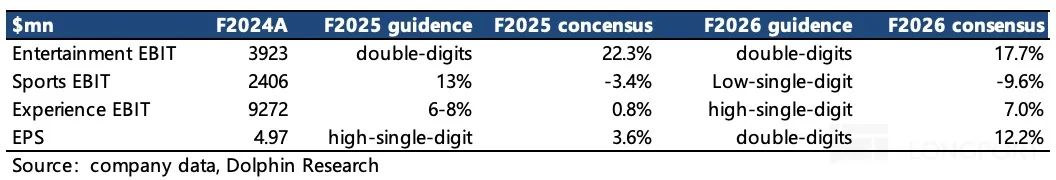

Looking ahead, the company's guidance for EBIT and EPS growth for fiscal years 2025, 2026, and 2027 is overall better than market consensus estimates.

(1) In terms of trends, fiscal year 2025 will still face some headwinds, mainly in the first half (October 2024 to March 2025 of the calendar year):

On the one hand, experience revenue is still affected by the fading post-pandemic dividend. The first quarter will be impacted by hurricanes, and while the two new cruise routes can bring incremental revenue, the short-term cost recognition is also high. Generally, the return on investment (ROI) tends to be low in the beginning and high in the later stages. It is expected that the operating profit growth rate of the experiences business in 2025 will be in the range of 6%-8%.

On the other hand, content investments will continue to increase in 2025 (following proactive project cuts and the impact of strikes in the previous year). However, an important driver of entertainment business revenue – the flagship version of ESPN+ – will not be launched until the second half of 2025. The new version of ESPN is highly anticipated by management as it will not only feature rich sports content but also introduce AI technology for targeted recommendations to users, improving the marketing ROI for advertisers.

Judging from content investments in recent quarters, although the scale of investments is still declining year-over-year, the decline rate has gradually slowed down. A bottoming-out rebound is expected in fiscal year 2025, especially as Disney+ expands into international markets, which necessitates domestic investments. This investment cycle trend can also be observed in Netflix. However, Disney management has indicated that investments will increase moderately and steadily, meaning that ROI will be considered while making investments.

(2) After the small trough in 2025, the overall profits and segment operating profits for 2026 and 2027 exceeded expectations, maintaining an overall double-digit growth trend.

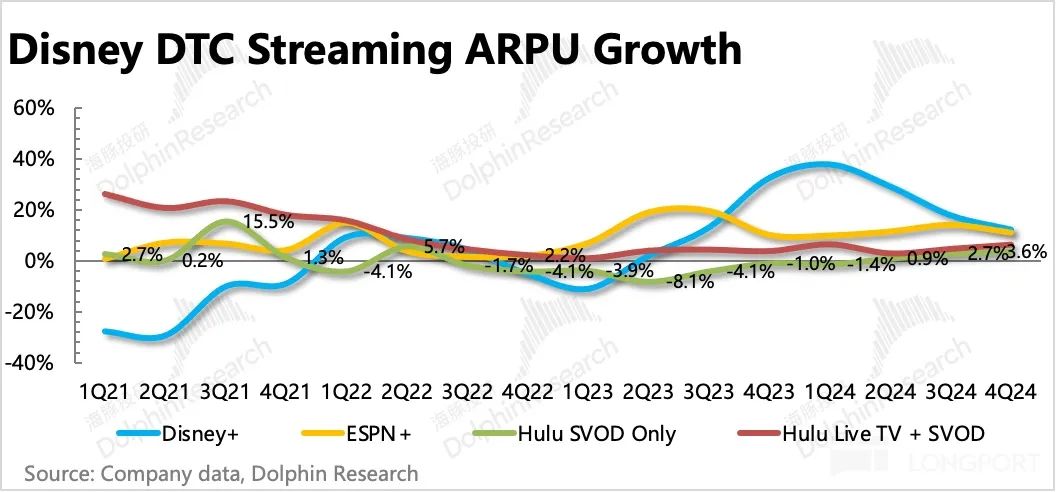

III. DTC: Is the purpose of price increases to increase AVOD users?

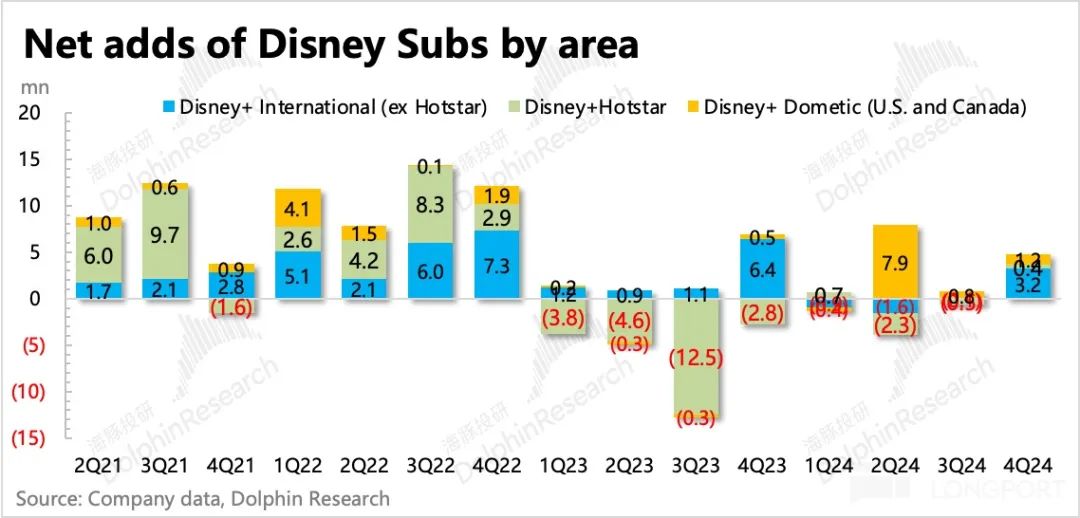

The increase in Disney+ subscriptions in the fourth quarter was mainly from international regions, with a quarterly increase of 3.2 million, while North American subscriptions increased by a net 1.2 million. The box office success of "Inside Out 2" also attracted nearly 1.3 million users to revisit the classic "Inside Out" on Disney+.

Bundled packages, advertising packages, and account sharing plans collectively drove user growth, which exceeded expectations. In particular, advertising package subscriptions grew rapidly, with 60% of new US subscribers choosing the AVOD package. Among the overall existing subscriber base, 37% of total subscriptions are AVOD subscriptions, and globally, this figure is 30%.

Although the growth drivers of the streaming business are well-known, they still include: 1) expanding the subscriber base (continuing to promote account sharing and advertising packages); 2) gradually increasing pricing; and 3) improving user engagement through improved recommendation engines to enhance platform stickiness and better monetize through advertising and paid subscriptions.

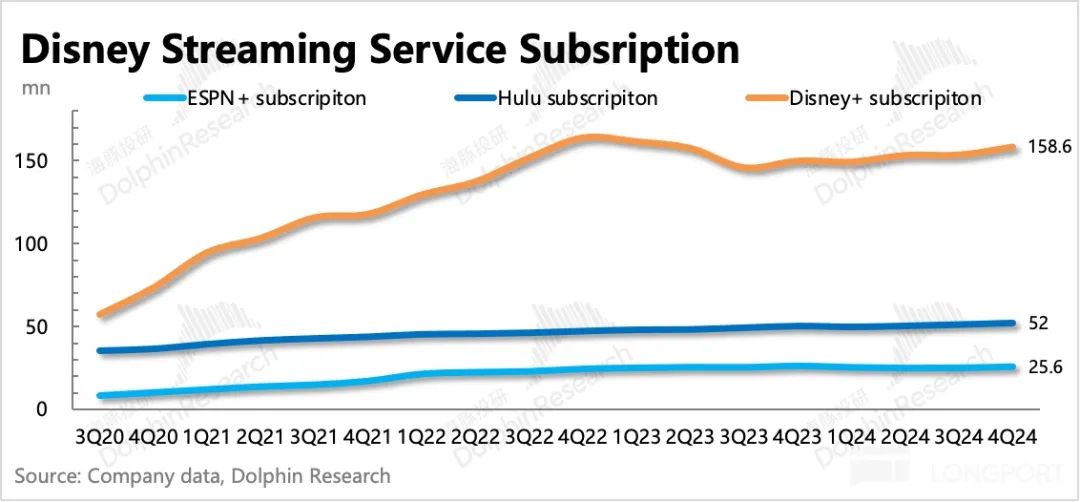

As of the end of this quarter, Disney+ had 159 million subscribers, ESPN+ had 25.6 million, and Hulu had 52 million, totaling 236.2 million subscribers. In the short term, the company's operational focus for streaming remains on reducing losses through price increases. A strategic shift mentioned during the conference call was that in the short term, management places a higher priority on user growth than price increases. Price increases are intended to "force" users to choose the lower-priced AVOD option. An increase in the proportion of AVOD users indirectly lowers the overall ARPPU, effectively obscuring the impact of price increases.

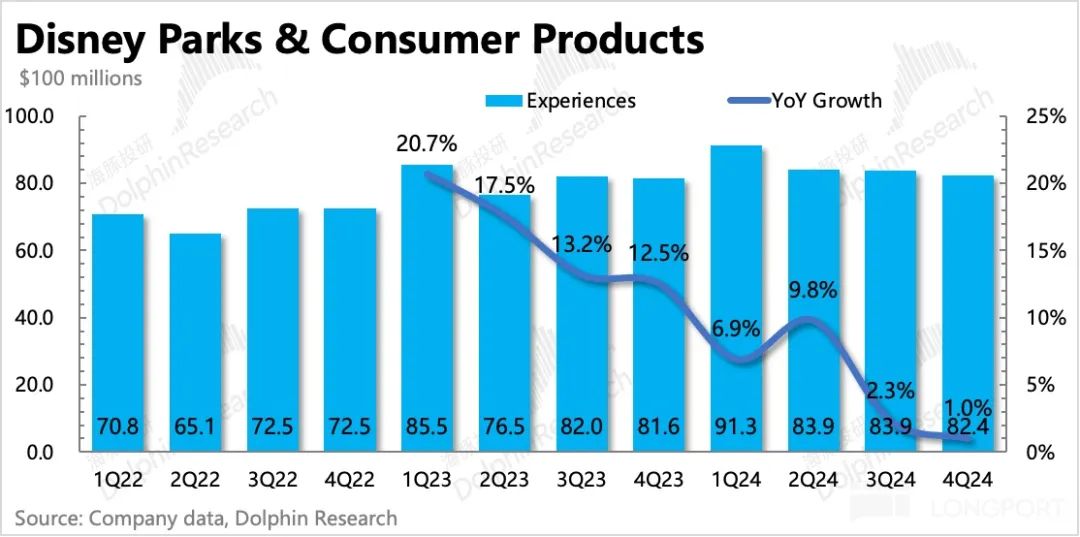

IV. Theme Parks: Short-term Disturbances + Continued Cooling of Demand

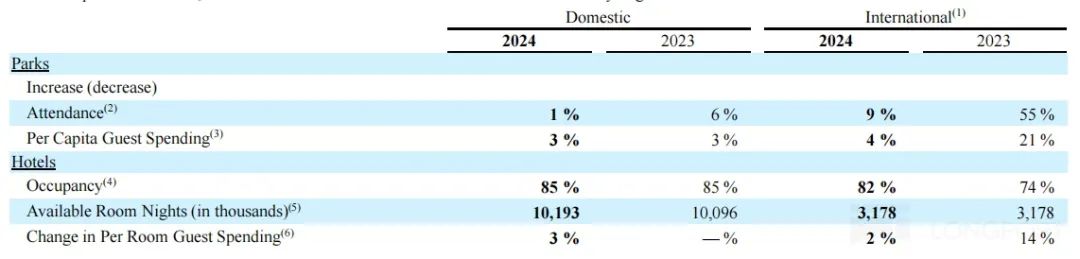

Revenue from theme parks and consumer products in the fourth quarter amounted to RMB 8.24 billion, representing a year-on-year increase of 1%, continuing the slight slowdown. Within the internal structure, park business grew at a rate of 0.8%, while consumer products increased by 2.3%. The market had certain expectations regarding the cooling of demand.

Further breaking down the changes in volume and price drivers: The company did not disclose the situation for the fourth quarter separately, but according to Dolphin Insights' estimation from annual data breakdown, the domestic market remains basically stable, with growth acceleration expected once the impact of the post-pandemic cycle is overcome. However, the international market is experiencing a high base effect, along with short-term demand disruptions or declines due to events, resulting in certain pressure on overall revenue.

Specifically, domestic park attendance remained flat year-on-year, while international attendance declined significantly. This is due to both the high base effect and the diversion of visitors due to the Olympics in Paris. Additionally, Shanghai Disneyland experienced an overall slowdown in demand from the previous quarter, which continued into the fourth quarter, impacted by changes in China's consumption environment and recent price increases.

V. Arrival of the Film Product Cycle

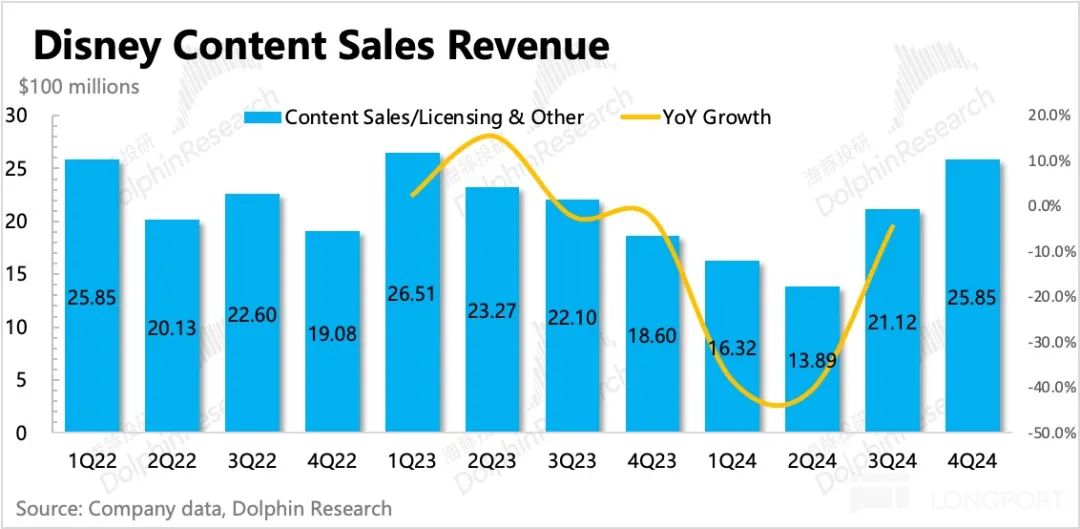

Content sales revenue increased significantly by 39% year-on-year in the fourth quarter, showing marked improvement from the previous quarter. This was primarily driven by "Inside Out 2," released on June 14, which grossed USD 1.7 billion, ranking first globally in box office sales. Additionally, "Deadpool & Wolverine," released in July, grossed USD 1.3 billion, ranking second.

Looking ahead to 2025, the film slate is abundant. Newly scheduled blockbusters include "Captain America: New World of the Brave," "Lilo & Stitch," "Fantastic Four: First Light," "Zootopia 2," and "Avatar 3," among others. These are projects that were delayed due to the pandemic, content adjustments, and strikes in the previous two years. Under the current stable operating environment, they are expected to receive steady investment and scheduling, thereby maintaining growth in content sales.

VI. Cable Media Focuses on Efficient Operations

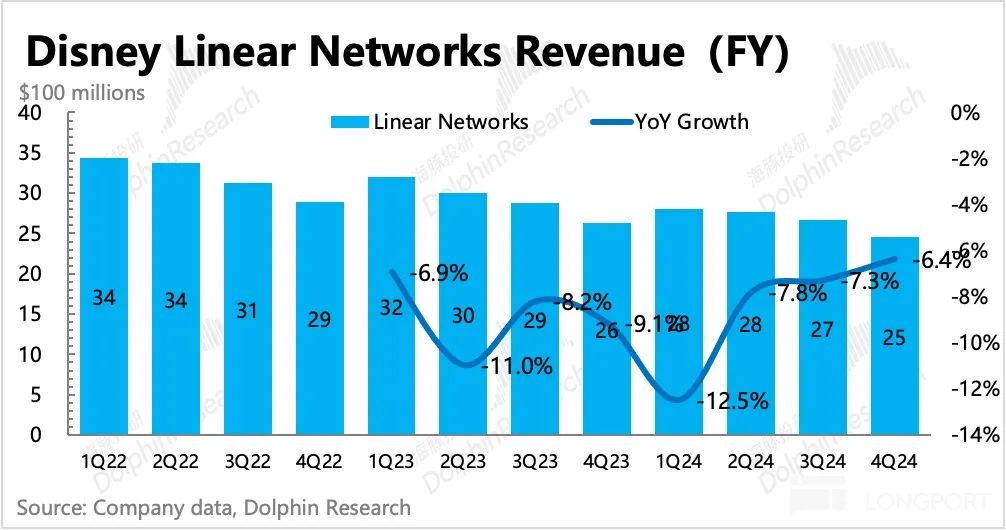

Cable TV revenue still declined by 6.4% year-on-year in the fourth quarter, unable to withstand the general trend of cord-cutting. However, the short-term slowdown is estimated to be related to increased advertising due to the Olympics and the US presidential election. From a revenue breakdown perspective, similar to the previous quarter, subscription revenue declined more than advertising revenue.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Investment Research. For reprints, please obtain authorization.