Pegasus Biosciences submits listing application again with its GLP-1 core product, AI company NobiKan heads to Hong Kong for IPO

![]() 11/18 2024

11/18 2024

![]() 657

657

SSE & SZSE

New Stock Listings

From November 11 to November 17, there were no companies listed on the Shanghai Stock Exchange (SSE) or Shenzhen Stock Exchange (SZSE).

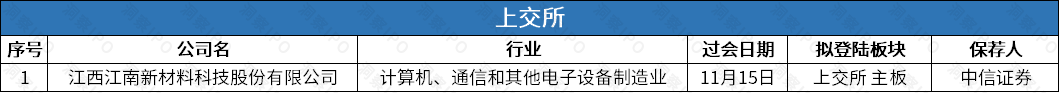

Approved by the Listing Committee

From November 11 to November 17, one company passed the review on the SSE Main Board; no company passed the review on the SZSE.

Data Source: Public Information; Chart Created by Insight IPO

1. Jiangnan New Materials: Primarily engaged in the R&D, production, and sales of copper-based new materials. The company's core products include three major categories: copper ball series, copper oxide powder series, and high-precision copper-based heat sink series.

Submitted Listing Applications

From November 11 to November 17, no companies submitted listing applications on the SSE or SZSE.

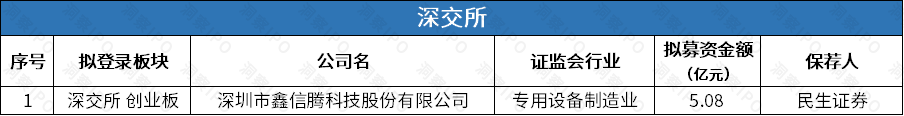

Terminated Listing Reviews

From November 11 to November 17, no companies had their listing reviews terminated on the SSE; one company had its listing review terminated on the ChiNext board of the SZSE.

Data Source: Public Information; Chart Created by Insight IPO

1. XinXinTeng: A high-tech enterprise focused on the R&D, design, production, and sales of industrial automation and intelligent equipment. Its core products mainly include complete machine test equipment, module test equipment, assembly and packaging equipment, and line automation equipment.

HKEX

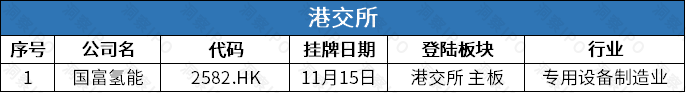

New Stock Listings

From November 11 to November 17, one company was listed on the Hong Kong Stock Exchange (HKEX).

Data Source: Public Information; Chart Created by Insight IPO

1. GuoFu Hydrogen Energy: A manufacturer of hydrogen energy storage and transportation equipment, developing and manufacturing core hydrogen energy equipment across the entire industrial value chain for hydrogen production, storage, transportation, refueling, and utilization. On its first trading day, the stock closed up 20.00%, ending the day at HK$97.00 per share on November 18, a 61.34% increase from the issue price of HK$60.12 per share.

New Share Offerings

From November 11 to November 17, there were no new share offerings on the HKEX.

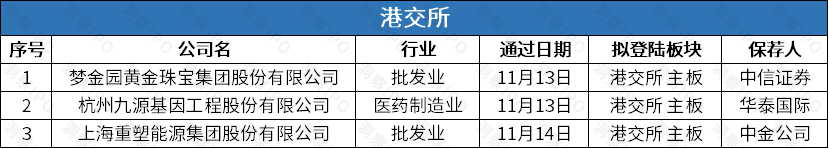

Passed Listing Hearings

From November 11 to November 17, three companies passed listing hearings on the HKEX.

Data Source: Public Information; Chart Created by Insight IPO

1. Mengjinyuan: A manufacturer of original gold jewelry brands focusing on the third-tier and lower-tier city markets in China.

2. Jiuyuan Gene: A biopharmaceutical company focusing on four rapidly growing therapeutic areas: orthopedics, metabolic diseases, oncology, and hematology. The company does not engage in genetic engineering business and is in the process of changing its name, committing to do so within twelve months after issuance.

3. ReShape Energy: A hydrogen energy technology enterprise specializing in the design, development, manufacturing, and sales of hydrogen fuel cell systems, hydrogen energy equipment, and related components, providing hydrogen fuel cell engineering development services that meet customer needs.

Submitted Listing Applications

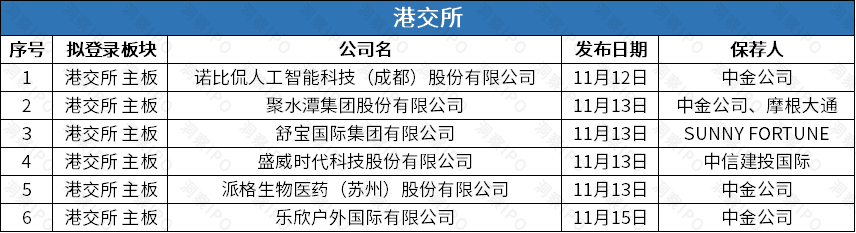

From November 11 to November 17, six companies submitted listing applications on the HKEX.

Data Source: Public Information; Chart Created by Insight IPO

1. NobiKan: Focuses on advanced technologies such as artificial intelligence (AI) and digital twins, with industrial applications in areas like AI+transportation, AI+energy, and AI+urban governance.

2. JuShuiTan: In 2023, it was China's largest e-commerce SaaS ERP provider by related revenue, accounting for a 23.2% market share.

3. ShuBao International: Primarily engaged in the development, production, and sales of personal disposable hygiene products in China, focusing on baby care products in emerging markets in Eurasia.

4. ShengWei Times: An intercity and intracity road passenger transport information service provider, primarily offering intercity road passenger transport services and intracity online car-hailing services.

5. Pegasus Biosciences: A biotechnology company focused on independently researching and developing innovative therapies for chronic diseases (primarily peptide and small molecule drugs), with a particular focus on metabolic disorders.

6. Lexin Outdoor: A manufacturer of fishing equipment, with a product portfolio mainly including hardware and accessories, bags, and tents.

NobiKan disclosed its prospectus on November 12

Planned listing on the Main Board of the HKEX

On November 12, NobiKan AI Technology (Chengdu) Co., Ltd. (hereinafter referred to as "NobiKan") submitted its prospectus to the HKEX for a Main Board IPO listing, with CICC as its sole sponsor.

NobiKan focuses on advanced technologies such as AI and digital twins, with industrial applications in areas like AI+transportation, AI+energy, and AI+urban governance. It primarily provides software and hardware integrated solutions based on AI industry models. NobiKan's self-developed NBK-INTARI AI platform deeply empowers customers in the transportation, energy, and urban governance sectors through intelligent monitoring, detection, and operation and maintenance.

According to Frost & Sullivan, in terms of revenue in 2023, the company was the second-largest provider of AI+power supply system inspection and monitoring solutions in China and the seventh-largest provider of AI+rail transit inspection and monitoring solutions in China.

NobiKan's business comprises three layers: the NBK-INTARI platform, AI industry models, and AI solutions. The NBK-INTARI platform is the company's underlying technology platform, from which various AI industry models are generated; AI industry models are algorithm models built for various business scenarios, continuously trained with business scenario data and industry knowledge to solve business problems in a single dimension or scenario; different AI industry models are combined and interconnected to form software and hardware integrated AI solutions to solve more comprehensive and complex business problems.

The prospectus indicates that the funds raised from this issuance will be used by NobiKan to consolidate its technological capabilities through basic research on core technologies, enhance product and service functions, build R&D technology centers and a new headquarters base, seek potential strategic investment and acquisition opportunities, and for working capital and general corporate purposes. The specific amount of funds raised was not disclosed.

In terms of financial data, from 2021 to 2023, NobiKan achieved revenues of RMB 101 million, RMB 253 million, and RMB 364 million, with revenue growth rates of 150.32% and 43.97% in 2022 and 2023, respectively; net profits were RMB 25.743 million, RMB 63.161 million, and RMB 88.566 million, with net profit growth rates of 145.35% and 40.22% in 2022 and 2023, respectively.

From January to June 2024, NobiKan's revenue was RMB 186 million, an increase of 5.51% year-on-year; net profit was RMB 50.736 million, an increase of 9.64% year-on-year.

The risk factors disclosed in the prospectus by NobiKan mainly involve the company's ability to provide and upgrade commercially viable products and solutions to customers, maintain robust business and financial growth to meet customers' evolving needs, enhance business and financial performance, maintain competitive advantages in business and technology amid fierce competition and changing industry trends, and adapt to evolving laws and regulations.

JuShuiTan disclosed its prospectus on November 13

Planned listing on the Main Board of the HKEX

On November 13, JuShuiTan Group Co., Ltd. (hereinafter referred to as "JuShuiTan") submitted its prospectus to the HKEX for a Main Board IPO listing, with CICC and J.P. Morgan as its joint sponsors.

JuShuiTan has developed cloud-based e-commerce SaaS products that enable merchant customers to connect with over 400 e-commerce platforms in China and globally. The company's products provide a unified and intuitive set of business monitoring, operation, and management tools for customers of different types and sizes, empowering them to make data-driven intelligent decisions and stand out in the rapidly growing e-commerce industry.

According to Frost & Sullivan, in terms of related revenue in 2023, JuShuiTan was China's largest e-commerce SaaS ERP provider, accounting for a 23.2% market share. According to Frost & Sullivan, the size of China's e-commerce SaaS ERP market (in terms of merchant expenditures) was RMB 2.6 billion in 2023. In China's e-commerce operation SaaS market, JuShuiTan also ranked first in terms of total SaaS revenue in 2023, with a market share of 7.5%. Additionally, according to Frost & Sullivan, in terms of related revenue in 2023, JuShuiTan was China's third-largest e-commerce SaaS provider, accounting for a 5.7% market share. China's e-commerce SaaS market includes e-commerce operation SaaS and website management SaaS.

The prospectus indicates that the funds raised from this issuance will be used by JuShuiTan to strengthen its R&D capabilities to enrich its product matrix over the next five years, enhance sales and marketing capabilities, make strategic investments, and for general corporate purposes. The specific amount of funds raised was not disclosed.

In terms of financial data, from 2021 to 2023, JuShuiTan achieved revenues of RMB 433 million, RMB 523 million, and RMB 697 million, with revenue growth rates of 20.69% and 33.29% in 2022 and 2023, respectively; net losses were RMB 254 million, RMB 507 million, and RMB 490 million.

From January to June 2024, JuShuiTan's revenue was RMB 421 million, an increase of 34.85% year-on-year; net loss was RMB 60.339 million.

The risk factors disclosed in the prospectus by JuShuiTan mainly include: if the company fails to improve and enhance the functionality, performance, reliability, design, security, and scalability of its SaaS products to meet customers' evolving needs, it may lose customers; the company invests heavily in R&D, which may negatively impact profitability in the short term and may not yield the expected results; the company recorded net losses and operating cash outflows during the performance record period and may not achieve or subsequently maintain profitability; if the company fails to maintain relationships with e-commerce platforms or adapt to emerging e-commerce platforms, or if e-commerce platforms weaken or hinder the company's ability to integrate its products into these platforms or operate its products in other ways, the company's business and prospects may be significantly adversely affected.

JuShuiTan previously submitted prospectuses to the HKEX on June 19, 2023, and March 21, 2024, but they have since expired.

ShuBao International disclosed its prospectus on November 13

Planned listing on the Main Board of the HKEX

On November 13, ShuBao International Group Co., Ltd. (hereinafter referred to as "ShuBao International") submitted its prospectus to the HKEX for a Main Board IPO listing, with SUNNY FORTUNE as its sole sponsor.

ShuBao International is primarily engaged in the development, production, and sales of personal disposable hygiene products in China, focusing on baby care products in emerging markets in Eurasia. Its flagship baby care brand, "Yingshubao," was named a "2016 Fujian Famous Brand Product" by the Fujian Provincial People's Government. The company has expanded its brand product range to its current core product categories: baby care, female care, and adult incontinence.

According to Frost & Sullivan, in terms of export value in 2023, ShuBao International was the second-largest exporter of baby care disposable hygiene products from China to Russia, accounting for approximately 3.7% of the market share based on China's export value of baby care disposable hygiene products in 2023.

During the track record period, ShuBao International primarily relied on contract manufacturing to market and sell baby care products abroad and export core baby care products to foreign brand owners, bringing their respective brands to emerging markets in Eurasia, such as Russia and Southeast Asia, which accounted for most of the company's revenue during the track record period.

The prospectus indicates that the funds raised from this issuance will be used by ShuBao International to purchase machinery for adding baby care and female care product production lines, purchase machinery for adding non-woven fabric production lines, enhance branding, marketing, and promotional activities, upgrade warehouses and invest in IT infrastructure, and for general working capital. The specific amount of funds raised was not disclosed.

In terms of financial data, from 2021 to 2023, ShuBao International achieved revenues of RMB 263 million, RMB 408 million, and RMB 655 million, with revenue growth rates of 55.02% and 60.41% in 2022 and 2023, respectively; net profits were RMB 10.006 million, RMB 41.860 million, and RMB 58.900 million, with net profit growth rates of 318.35% and 40.71% in 2022 and 2023, respectively.

From January to May 2024, ShuBao International's revenue was RMB 281 million, an increase of 16.58% year-on-year; net profit was RMB 19.209 million, a decrease of 39.33% year-on-year.

The risk factors disclosed in the prospectus by ShuBao International mainly include: a significant portion of revenue during the track record period came from top retailers in Russia; the company relies on the highly competitive baby disposable hygiene product market in Eurasia; the company recorded net current liabilities and net liabilities during the track record period; the company's customers may delay and/or default on payments; the company's direct-to-consumer (D2C) business is affected by changing consumer preferences; during the track record period, most of the company's D2C sales were conducted on multiple third-party digital platforms; the company's business and financial performance may be significantly impacted by fluctuations in raw material prices.

ShuBao International previously submitted a prospectus to the HKEX on May 10, 2024, but it has since expired.

ShengWei Times disclosed its prospectus on November 13

Planned listing on the Main Board of the HKEX

On November 13, ShengWei Times Technology Co., Ltd. (hereinafter referred to as "ShengWei Times") submitted its prospectus to the HKEX for a Main Board IPO listing, with CSC International as its sole sponsor.

ShengWei Times is an intercity and intracity road passenger transport information service provider, primarily offering intercity road passenger transport services and intracity online car-hailing services. Leveraging its extensive experience and capabilities in online ticketing services, the company cooperates with multiple passenger transport enterprises to provide customized passenger transport services, meeting the diverse travel needs of passengers in different scenarios. It has established strong partnerships with major industry participants, such as passenger transport enterprises, major aggregation platforms, and online travel agencies (OTAs). Relying on its strategic partnerships and extensive network in the intercity passenger transport sector, the company actively seeks opportunities in the online car-hailing service sector. It aims to build a nationwide travel service network with cities as nodes and intercity routes as lines, providing users with diversified travel solutions that cater to multiple scenarios, needs, and preferences within and across cities.

According to Frost & Sullivan, in terms of ticket sales volume in 2023, ShengWei Times ranked first in China's road passenger transport information service market. In terms of the number of "Network-Based Car-Hailing Operation Licenses," as of June 30, 2024, the company ranked second in China's online car-hailing service market; in terms of the number of provincial passenger transport digitization projects as of June 30, 2024, the company was the largest provider of digitization and business solutions in China's road passenger transport market.

The prospectus indicates that the funds raised from this issuance will be used by ShengWei Times to strengthen business operational capabilities by expanding its product and service offerings and optimizing its team structure; pursue acquisitions, investments, and strategic alliances; enhance brand awareness; improve R&D capabilities; upgrade internal systems and office environments; and for working capital and other general corporate purposes. The specific amount of funds raised was not disclosed.

In terms of financial data, from 2021 to 2023, Shengwei Times achieved operating revenues of RMB 554 million, 816 million, and 1.206 billion, respectively, with year-on-year growth rates of 47.41% and 47.86% in 2022 and 2023. Adjusted net profits were -RMB 55.608 million, -RMB 50.532 million, and -RMB 17.756 million, respectively.

For the first half of 2024, Shengwei Times reported an operating revenue of RMB 726 million, a year-on-year increase of 25.69%, with an adjusted net profit of -RMB 16.73 million.

The risk factors disclosed in Shengwei Times' prospectus mainly include: the company's reliance on partnerships and cooperation with local governments, industry regulators, and business partners (including aggregation platforms and OTA) for continuous business expansion; termination or deterioration of these partnerships may adversely affect the business; the company's ride-hailing service business relies on cooperation with a limited number of aggregation platforms; failure to attract and retain riders and drivers cost-effectively or increase the usage of the company's ride-hailing services by existing riders may significantly impact the business, operating results, and financial condition; the company faces risks related to payment processing and payment fraud; and the company may be viewed as conducting payment services without a license.

PeiGe Bio disclosed its prospectus on November 13th

Aiming to list on the Hong Kong Stock Exchange's Main Board

On November 13th, PeiGe Biomedical (Suzhou) Co., Ltd. (hereinafter referred to as "PeiGe Bio") submitted its prospectus to the Hong Kong Stock Exchange for a proposed Main Board IPO, with CICC as its sole sponsor.

PeiGe Bio is a biotechnology company focused on independently researching and developing innovative therapies for chronic diseases (primarily peptides and small molecule drugs), with a particular emphasis on metabolic disorders. It has independently developed one core product and five other candidate products to capitalize on market opportunities in common chronic and metabolic diseases such as Type 2 Diabetes (T2DM), obesity, Non-Alcoholic Steatohepatitis (NASH), Opioid-Induced Constipation (OIC, a gastrointestinal disorder caused by opioid use), and Congenital Hyperinsulinism (a rare endocrine disorder characterized by persistent hypoglycemia).

The core product, PB-119, is a self-developed, long-acting Glucagon-Like Peptide-1 (GLP-1, a peptide hormone that lowers blood glucose levels) receptor agonist nearing the commercialization stage. It is primarily used for first-line treatment of T2DM and obesity. It has demonstrated various benefits in blood glucose control, cardiovascular health, and weight management in multiple clinical trials. In September 2023, the New Drug Application (NDA) for PB-119 in China for the treatment of T2DM was accepted by the National Medical Products Administration, marking an important milestone towards commercialization.

According to the prospectus, the funds raised from this issuance will be used by PeiGe Bio to support the commercialization and indication expansion of its core product PB-119, fund the further development of its main product PB-718, support the ongoing and planned research and development of other pipeline candidate products, business development activities, strengthening overseas operations, working capital, and other general corporate purposes. The specific fundraising amount was not disclosed.

In terms of financial data, from 2022 to the first half of 2024, PeiGe Bio did not generate any operating revenues but recorded other revenues of RMB 23.547 million, 14.635 million, and 5.049 million, respectively. Net profits for the same periods were -RMB 306 million, -RMB 279 million, and -RMB 202 million, respectively.

The risk factors disclosed in PeiGe Bio's prospectus mainly include: the company's business, financial condition, operating results, and prospects over the next few years heavily depend on the successful approval and sales of PB119; the company collaborates with third parties to develop candidate drugs, and failure of these third parties to fulfill their contractual obligations or meet expected timelines may prevent regulatory approval or commercialization; the company intends to partner with third parties for the commercialization of candidate drugs but may struggle to find qualified partners, achieve the desired collaboration with clinical research partners, or have limited or no control over the marketing and sales efforts of commercialization partners; the market size for candidate drugs may be smaller than anticipated; the company has incurred significant net losses since its inception and may continue to incur net losses in the future, potentially failing to achieve or maintain profitability.

PeiGe Bio previously submitted its prospectus to the Hong Kong Stock Exchange on February 23, 2024, which has since expired.

Lexin Outdoor disclosed its prospectus on November 15th

Aiming to list on the Hong Kong Stock Exchange's Main Board

On November 15th, Lexin Outdoor International Limited (hereinafter referred to as "Lexin Outdoor") submitted its prospectus to the Hong Kong Stock Exchange for a proposed Main Board IPO, with CICC as its sole sponsor.

Lexin Outdoor currently focuses on fishing equipment, offering a comprehensive and diversified product portfolio primarily comprising hardware and accessories, bags, and tents. Suitable for various fishing scenarios such as carp fishing, competitive fishing, lure fishing, fly fishing, and ice fishing, Lexin Outdoor provides a one-stop OEM/ODM solution for outdoor equipment brands, covering the entire process from product design to manufacturing, leveraging an extensive product portfolio, advanced product design and innovation, flexible supply chains, and strict quality control.

Additionally, in 2017, Lexin Outdoor acquired Solar, a renowned British carp fishing brand, marking the steady growth of its OBM business. With continuous resource investment and an industry-leading supply chain, Solar's sales tripled in fiscal year 2024 compared to fiscal year 2018.

According to Frost & Sullivan, Lexin Outdoor is the world's largest fishing equipment manufacturer, with a 20.4% market share based on 2023 revenue.

The prospectus states that the funds raised from this issuance will be used by Lexin Outdoor for brand development and promotion, product design and development, establishing a global fishing tackle innovation center, upgrading production facilities and enhancing digital capabilities, working capital, and general corporate purposes. The specific fundraising amount was not disclosed.

In terms of financial data, for the fiscal years ended June 30th, 2022 to 2024, Lexin Outdoor reported operating revenues of RMB 908 million, 622 million, and 512 million, respectively, with year-on-year growth rates of -31.47% and -17.76% in FY2023 and FY2024. Net profits were RMB 102 million, 79.255 million, and 61.724 million, respectively, with year-on-year growth rates of -22.18% and -22.12% in FY2023 and FY2024.

The risk factors disclosed in Lexin Outdoor's prospectus mainly include: fierce competition in the fishing tackle industry; potential reputational damage, product returns or recalls, and significant adverse impacts on business, financial condition, and operating results due to poor product performance or defects or failure to maintain an effective quality control system; the company's success hinges on strong relationships with key customers; and the company's international operations expose it to risks and uncertainties related to international trade policies, trade protection measures, geopolitical factors, and other compliance and regulatory requirements.