Thoughts on Baidu's Intelligent Driving: How Can Technological Visionaries Avoid Getting Lost on the Long Road to Commercialization?

![]() 12/26 2025

12/26 2025

![]() 344

344

In the final month of 2025, the autonomous driving taxi (Robotaxi) industry hit the accelerator.

First, Baidu's Luobo Kuaipao reached strategic cooperation agreements with platforms like Uber and Lyft, launching a pilot project for driverless taxis in London, UK, in 2026. Meanwhile, the autonomous driving rivalry between Tesla and Google intensified, while domestic Robotaxi players raced to launch pilot projects globally.

This year undoubtedly marks a turning point for the industry's large-scale commercialization, with a steady stream of positive developments. However, the capital market's response seems to have hit pause.

Following Baidu's series of high-profile international cooperation announcements, the market reaction was lukewarm, with the stock price falling 7% over the past three months.

Why are investors holding their wallets tight as technology accelerates? Where will Robotaxi head in 2026?

Robotaxi Reaches Turning Point, but Why Is Baidu's Stock Price Stagnant?

Looking back at 2025, the Robotaxi industry has transitioned from regional pilots to city-level commercial operations.

Baidu's Luobo Kuaipao has made frequent global expansion moves, securing Dubai's first autonomous driving test license and forming strategic partnerships with global ride-hailing giants Uber and Lyft to launch pilots in key markets like Germany and the UK.

Image Source: Luobo Kuaipao Autonomous Driving Official WeChat

However, amid the rapid advancement of autonomous driving, the capital market has raised new doubts about Baidu's technological exploration, which once again leads the market.

This is not Baidu's first time standing at the forefront of technological transformation. However, reflecting on its past experiences in O2O, mobile payments, and other fields, the outcome of 'rising early but arriving late' has left investors wary.

In emerging fields, Baidu demonstrates foresight but consistently faces two deep-rooted issues.

First, its resources are scattered, making it difficult to maintain a highly focused approach. Baidu struggles to establish an unshakable, absolute advantage in any single field. Second, Baidu often finds itself caught in the difficult balance between short-term profitability and long-term strategic investment. Baidu's problem is not a lack of vision for trends but rather a lack of the resilience to 'endure and dominate' them.

While partnerships with Uber and others open up global market potential, before the model can be proven to achieve scalable profitability, it resembles more of a 'cost center' requiring continuous validation than an immediate 'profit center.' This directly contributes to the 'positive news desensitization' in the stock price.

Baidu faces its own challenges, but competitors are not slowing down. Heading into 2026, leading autonomous driving players are formulating aggressive commercialization plans, intensifying competition.

Consequently, the capital market has chosen to 'remain on hold' in response to Baidu's repeated announcements of progress in autonomous driving.

Investors are waiting to see whether Baidu, which has a long battle line and significant historical burdens, can emerge victorious in this decisive final showdown for the future of autonomous driving against competition from Tesla, Waymo, and domestic peers.

Baidu's Must-Answer Question: How Can a Technological Pioneer Win the Long Race of Commercialization?

As a pioneer in China's Robotaxi sector, Baidu has invested over 150 billion yuan ($21 billion) over a decade, placing it in the global first tier of autonomous driving technology. However, this has also burdened it with heavy expectations.

When Luobo Kuaipao announced in Wuhan that it had achieved operational-level user experience (UE) revenue balance, many believed it marked an 'autonomous driving Sputnik moment.' However, this enthusiasm was short-lived, as the market continues to await Baidu's answer on what will drive scalable commercial success after technological feasibility has been proven.

Looking ahead, the competition in Robotaxi will shift from a technological research and development sprint to a commercial operations endurance race.

On one hand, the true commercialization threshold lies in reducing the per-kilometer operational cost below that of traditional transportation. According to a Barclays research report, hardware costs will continue to decline with economies of scale, while operational expenses such as charging, maintenance, insurance, and data compliance will become the primary factors determining long-term profitability.

On the other hand, competition is expanding globally. China, the United States, and the Middle East have emerged as core battlegrounds, with domestic leading players unanimously viewing overseas expansion as a top priority. However, launching pilots in multiple global locations requires far more effort and resources than focusing solely on the domestic market.

Under the pressure of this 'operational and overseas expansion' long-term competition, Baidu will once again face multiple challenges.

First, does Baidu possess the patience for a prolonged investment period?

Although Luobo Kuaipao's order volume continues to grow rapidly, the timeline for overall profitability at the group level remains unclear. More critically, pressure on Baidu's core cash cow business may weaken the group's ability to support innovative ventures.

Baidu's core online marketing revenue has declined for multiple consecutive quarters, falling 18% year-over-year in the third quarter of 2025. Against the backdrop of 'cost reduction and efficiency enhancement' becoming the industry's mantra, investors cannot help but worry whether Baidu can sustainably support the capital expenditures required for its autonomous driving business.

Second, intense fluctuations in technological roadmaps introduce strategic uncertainty.

Recently, Baidu founder Robin Li delivered an internal speech at a quarterly executive meeting, announcing that Luobo Kuaipao would completely abandon the multi-sensor fusion approach and fully transition to the pure vision scheme pioneered by Tesla. The core rationale behind this decision is to pursue extreme cost reductions and faster implementation speeds. Li admitted that if Baidu fails to seize this time window, 'it will lose its dominance in the Robotaxi track (translation note: ' track ' means 'competitive arena' or 'track').'

However, this strategy implies partially discarding past technological accumulations, increasing future development uncertainties and raising questions about the continuity of Baidu's technological strategy.

Finally, a fundamental conflict exists between the valuation logic of traditional businesses and cutting-edge technology ventures.

Baidu's business portfolio is complex, comprising mature but slowing advertising operations alongside future-oriented businesses like AI cloud and intelligent driving that require substantial investments. Some investment institutions have pointed out that if a sum-of-the-parts (SOTP) valuation method is used to calculate the value of intelligent driving and other businesses separately, Baidu's market capitalization should see a significant increase.

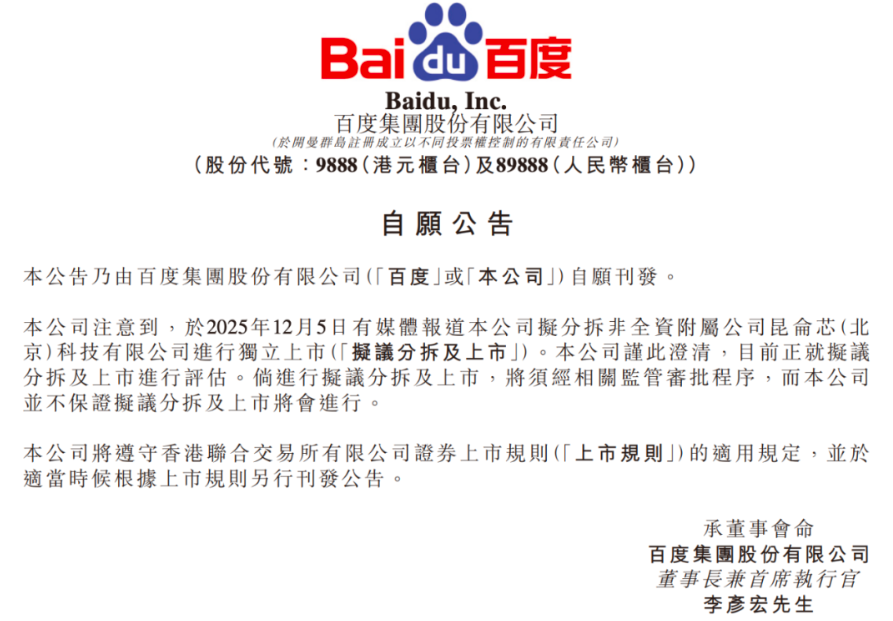

This has led Baidu to explore a potential solution: spin-offs. Recently, Baidu's plan to spin off Kunlunxin and prepare for its listing represents a trial run in this direction.

From the capital market's perspective, the current controversy surrounding Baidu does not revolve around whether its technology is leading but rather whether this leadership can be translated into predictable returns.

In the highly capital-intensive and long-return-cycle Robotaxi sector, Baidu's accelerated expansion demonstrates its capabilities in technology and execution. However, it also amplifies market concerns about the company's capital consumption, strategic sustainability, and the viability of its ultimate business model.

Therefore, the market is not denying the industrial value of autonomous driving but choosing not to pay in advance for the future. In this context, spin-offs may represent the key to unlocking value reevaluation for Baidu's innovative businesses.

Before the Robotaxi Finals, Baidu Faces a Critical Choice

In 2026, Baidu's autonomous driving business stands at a crossroads between commercialization and capital.

At the commercial level, intelligent mobility is approaching a disruptive 'iPhone moment.'

In a report from the second half of 2025, Morgan Stanley proposed that soon, purchasing a car with a steering wheel will become as absurd as buying a BlackBerry in 2006, just before the iPhone's release.

Goldman Sachs also predicts that the Robotaxi market will grow nearly 700-fold over the next decade, surpassing $47 billion, with over 25% of shared mobility capacity potentially provided by Robotaxis by then.

Despite this, Baidu, as the industry leader, has not yet seen its valuation rise in the capital markets, leading to several inferences:

It is known that Baidu needs a new narrative. The valuation logic of advertising revenue is uninspiring, and Baidu undoubtedly hopes the market will recognize its hardcore assets like AI chips and autonomous driving.

It is also known that Baidu is considering spinning off its chip business for listing. As a consumer-facing application, Robotaxi garners no less attention than AI chips and similarly benefits from tech bull markets, making independent financing likely to achieve higher valuations.

A natural question arises: Should Baidu consider spinning off its autonomous driving business?

For Baidu today, spinning off its autonomous driving business for listing would likely result in a higher valuation. Currently, Baidu's overall price-to-sales ratio stands at just 2.27 times, while Pony.ai's ratio reaches 94.39 times, and WeRide's stands at 60.67 times.

Most importantly, beyond valuation, spin-offs offer numerous benefits for the development of autonomous driving businesses.

The foremost advantage lies in financing and resource acquisition.

Autonomous driving represents a protracted 'arms race.' According to Pony.ai CEO Peng Jun's prediction, companies may need to expand their fleets beyond 50,000 vehicles before achieving positive cash flow. Spinning off and listing would allow direct access to capital markets for independent financing, providing crucial 'ammunition' for this enduring battle while reducing reliance on Baidu Group's cash flow, granting the group greater flexibility during 'cost reduction and efficiency enhancement' cycles.

More profoundly, spin-offs facilitate strategic 'risk isolation' and 'incentive focus.'

On one hand, divesting the autonomous driving business, which remains in the investment phase and is subject to technological and policy uncertainties, effectively controls its potential volatility risks to the group's overall financials and market capitalization. Additionally, Baidu can optimize its business structure and adjust its strategic focus.

On the other hand, an independent listed entity can attract and retain global top-tier technical and operational talent through more direct equity incentive mechanisms, more closely aligning team creativity with the company's long-term commercial success.

Spinning off represents a critical choice for Baidu. Having clearly shown interest in spinning off its chip business, how will Baidu decide regarding autonomous driving?

Of course, whether allowing intelligent driving to venture out independently or continuing to nurture it fully within the group, Baidu should demonstrate greater patience and focus, showing the market a far stronger determination to win. Only then can the giant ship of autonomous driving, carrying the dreams of future mobility, set sail on a prosperous voyage.

Source: Hong Kong Stocks Research Society