Xiaomi Q3: Impressive Financial Report and Future Challenges

![]() 11/19 2024

11/19 2024

![]() 573

573

On November 18, 2024, Xiaomi Group released its financial report for the third quarter of 2024, showing total revenue of 92.5 billion yuan, a year-on-year increase of 30.5%, and adjusted net profit of 6.3 billion yuan, a year-on-year increase of 4.4%. Despite the adjusted net loss of 1.5 billion yuan in innovative businesses such as smart electric vehicles, the overall performance remained impressive.

Xiaomi's smartphone business achieved revenue of 47.5 billion yuan in Q3, a year-on-year increase of 13.9%. Shipments reached 43.1 million units, a year-on-year increase of 3.1%, maintaining the third position globally. In the domestic market, Xiaomi's smartphone shipments continued to rise, with market share increasing to 14.7%, ranking fourth.

Behind this achievement lies the preliminary success of Xiaomi's premiumization strategy. In Q3, the share of Xiaomi's premium smartphones in the domestic market reached 20.1%, a year-on-year increase of 7.9 percentage points. Globally, the average selling price (ASP) of Xiaomi smartphones increased from 997 yuan last year to 1102.2 yuan.

However, the gross profit margin of the smartphone business declined due to rising prices of core components and intensified competition, falling from 16.6% in the same period last year to 11.7%. This reflects the intense market competition and supply chain pressure that Xiaomi still faces amid stagnant growth in the global smartphone market. Nevertheless, the strong sales of Xiaomi 15 indicate huge potential in the premium market, promising higher profits in Q4.

The AIoT and consumer products business achieved revenue of 26.1 billion yuan in Q3, a year-on-year increase of 26.3%, primarily driven by strong performance in major appliances and wearable devices. Refrigerator shipments exceeded 810,000 units, a year-on-year increase of over 20%; washing machine shipments exceeded 480,000 units, a year-on-year increase of over 50%; and air conditioner shipments exceeded 1.7 million units, a year-on-year increase of over 55%. Global wearable product shipments increased by over 50% year-on-year, with record-high shipments of smartwatches and TWS earphones.

The gross profit margin of the AIoT business reached 20.8%, a record high, mainly due to the revenue growth of high-margin products such as wearable devices and major appliances. Xiaomi's brand upgrade has not only enhanced the performance of the smartphone business but also driven rapid growth in the AIoT business. The number of users with five or more AIoT devices reached 17.1 million, a year-on-year increase of 24.9%, demonstrating high user stickiness and repurchase rates in Xiaomi's ecosystem.

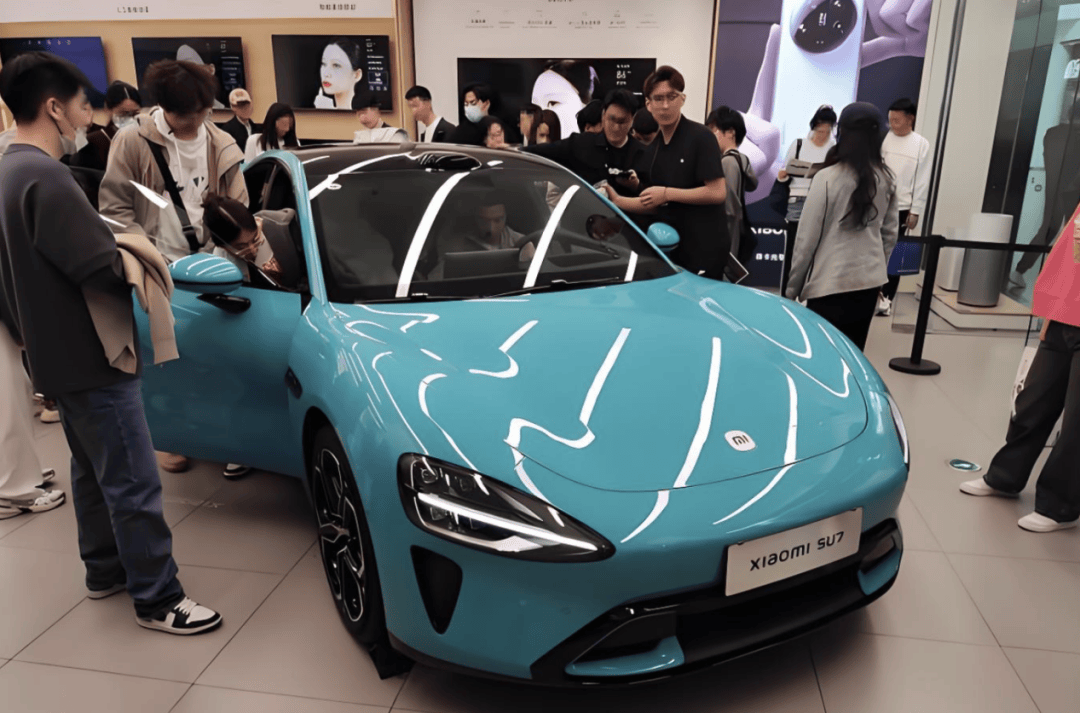

Xiaomi's smart electric vehicle business made significant progress in Q3. Xiaomi SU7 deliveries reached 39,790 units, and revenue from innovative businesses such as smart electric vehicles was 9.7 billion yuan, with a gross profit margin of 17.1%. Although the adjusted net loss was 1.5 billion yuan, it was significantly narrower than the 1.8 billion yuan loss in Q2. This is attributed to the gradual emergence of economies of scale, with the loss per vehicle decreasing from 66,000 yuan in Q2 to 37,500 yuan in Q3.

Lei Jun announced that Xiaomi's electric vehicle deliveries have exceeded 100,000 units, completing the annual target ahead of schedule, and set a new target of delivering 130,000 units annually. This means that Xiaomi SU7 will deliver over 60,000 units in the remaining time of Q4. With further capacity increases, Xiaomi's electric vehicle business is expected to achieve quarterly profitability in Q4. Xiaomi's rapid rise in the electric vehicle sector not only brings a new growth point to the company but also demonstrates its strong competitiveness in the smart electric vehicle field.

The internet business achieved revenue of 8.5 billion yuan in Q3, a year-on-year increase of 9.1%, setting a new record. The global monthly active user base reached 686 million, a year-on-year increase of 10.1%; the monthly active user base in Mainland China reached 168 million, a year-on-year increase of 10.6%; and the global monthly active user base for smart TVs reached 69.1 million, a year-on-year increase of 7.3%. The growth of the internet business is primarily driven by the expansion of the user base and the improvement of the ecosystem.

The gross profit margin of the internet business reached 77.5%, making it Xiaomi's most profitable business in the third quarter. This indicates Xiaomi's increasing monetization capabilities in advertising, gaming, finance, and other fields. With the continuous growth of user numbers, the internet business is expected to maintain its strong growth momentum.

Despite Xiaomi's impressive performance in Q3, it still faces many challenges in the future. Firstly, the growth of the global smartphone market is slowing down, and Xiaomi needs to continuously innovate and optimize its products to cope with fierce market competition. Secondly, competition in the smart electric vehicle industry is intensifying, and Xiaomi needs to accelerate capacity expansion and technological research and development to ensure its leading position in the market.

Xiaomi's 'human-vehicle-home' strategy is gradually being implemented, and the synergistic effects between various business segments are increasingly evident. With the rapid rise of Xiaomi SU7 and the continuous growth of the AIoT business, Xiaomi is expected to maintain its strong development momentum in the future. However, facing a complex and ever-changing market environment, Xiaomi still needs to remain vigilant, continuously enhancing its competitiveness and innovation capabilities to cope with various challenges ahead.